Expecting the Unexpected: Toolkits for Tail-Risk Hedging

Investors face multiple sources of risk in the second half of 2024. Key drivers of left-tail risk—extreme downside risks—include interest rate volatility, geopolitical conflict escalation, and elections. We believe balanced portfolios of equities, fixed income, and alternatives have the potential to help investors navigate turbulence. Alongside a diverse mix of assets, an understanding of hedging strategies—including how and when to use them—can enhance the resilience of portfolios and help investors prepare for unexpected events.

To evaluate the portfolio construction merits of various hedging strategies, a helpful starting point may be to understand the different approaches and economics associated with tail-risk mitigation. An investor can broadly categorize tail-risk hedging approaches into three main camps:

Direct Hedging

Most direct hedging strategies focus on reducing portfolio exposure by employing derivatives-based overlays on risk asset underliers (e.g., purchasing equity or commodity options, credit protection). These strategies consistently have a strong negative correlation to risk assets, which effectively shield portfolios during deep drawdowns. However, they are costly and tend to negatively impact a portfolio’s upside capture. Many investors are prepared for some cost for insurance but may be surprised by the accumulated cost of structurally employing direct hedges and potential increases in premiums as markets evolve. Given these considerations, we find direct hedging strategies best utilized as one-off, tactical hedges to target specific risks over a defined period.

Indirect Hedging / Diversifying Macro Hedges

Indirect hedging, or diversifying macro strategies, tend to be effective structural hedges in long-term portfolio construction. Unlike direct hedges, which involve positions in instruments directly linked to the risk, indirect hedges take advantage of changes in risk asset correlations under different market environments (e.g., low in normal market conditions, negative in economic downturns), helping to preserve upside capture at a lower cost. They can be systematic, rules-based strategies, rather than discretionary decisions. Approaches include using derivatives to capitalize on the curvature, or convexity, of the relationship between US government bond prices and interest rates, or asymmetric methods to hedge currency exposure to cover tails of growth or geopolitical shocks.

Alternative Hedging Strategies with Distinct Return, Correlation, Carry, and Cost Profiles

Alternative strategies can provide additional sources of uncorrelated returns. Trend-following models, for instance, use technical indicators to systematically modulate portfolio exposures based on sustained upside or downside patterns, without human bias. Trend-following managers benefitted from the coordinated rise in interest rates during 2022, posting one of their strongest years on record.1 However, returns can be challenged during periods of directionless markets, and strategies may struggle to capture sudden reversals.

Taking the Sting Out of the Next Tail

Following the rapid rate hiking cycle across most developed economies, the time-lagged impacts from the monetary policy shift could be difficult to anticipate and left-tail events may appear quickly and without warning. We believe investors can consider gradually re-establishing long-term indirect tail-risk hedging strategies as the end of the rate tightening cycle approaches. The potential portfolio ballast from treasuries in a severe growth shock is elevated with policy rates at their highest levels since the global financial crisis. With rates volatility trending lower and asset class correlations moving closer to long-term relationships, long interest rate option strategies have once again become more attractive as a structural portfolio hedge.

Investors can further enhance portfolio diversification through alternative hedging strategies, such as trend-following. These strategies offer diversification potential due to their cross-asset nature and their ability to take long and short positions. Recognizing that the strategy may face immediate challenges during turning points, its dynamic ability to reposition delivers convexity, particularly during sustained downside events. It is also important to mix different trend observation windows, balancing both convexity and long-term return contributions.

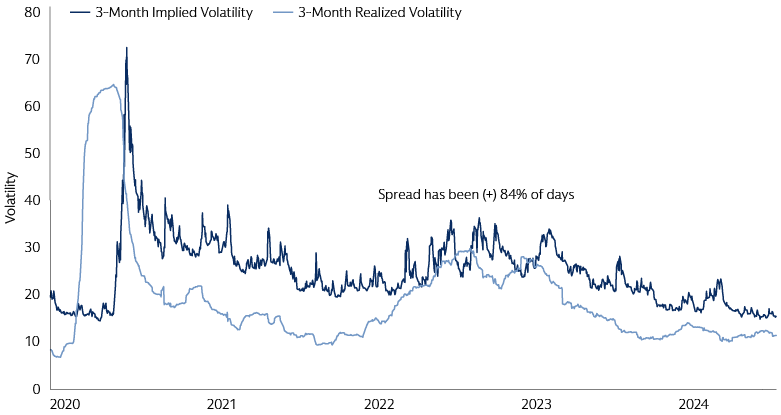

As near-term macro data continues to shift market expectations and asset class correlations, investors may also consider potential benefits of tactical exposures to direct hedges focused on specific, time-based tail risks. Pairing with carry strategies across foreign exchange assets or within equity volatility could help alleviate concerns about the costs of these direct hedges. In the context of equity index volatility carry, there is a structural gap between implied and realized volatility that such strategies can capture, but prudent portfolio construction is key to controlling for times when this spread reverts.

Source: Bloomberg, Goldman Sachs Asset Management. Data from January 1, 2020 through May 29, 2024.

Looking Ahead

In a continually changing macroeconomic environment, with elevated geopolitical risk, we think it’s important for investors to consider the range of hedging mechanisms available to prepare portfolios for unexpected events. Different techniques offer unique advantages and limitations depending on market cycles and risk environments. Although no single strategy can eliminate all risk from market shocks, each can play a meaningful role in enhancing portfolio resilience and contributing to risk mitigation. In our view, the efficacy each approach relies not only on a deep understanding of how they work but, more importantly, thoughtfulness in structuring them appropriately in the context of specific portfolio construction objectives and prevailing market environments.

1SocGen Prime Services, Bloomberg. Past performance does not guarantee future results, which may vary.