Debt Ceiling Uncertainty: What Does it Mean for Money Markets?

Dealing with the Debt Ceiling

The US debt ceiling is back in focus. After being suspended in 2023—allowing the federal government to borrow as needed—the limit was restored on January 2, 2025, and set to the outstanding debt level of ∼$36.1 trillion at that date. Debt ceiling drama is primarily a US saga that plays out almost every other year and may lead to disruption. In the past, volatility and weakness in the US Treasury market has occurred over the timing for an agreement and fears of the Treasury being unable to continue paying the nation’s bills and the US defaulting.

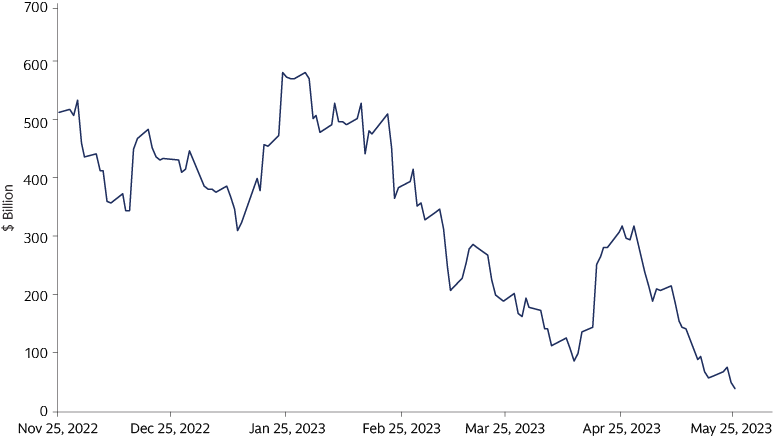

With the debt ceiling back and once again limiting additional borrowing, its reinstatement will likely cause the Treasury to utilize a series of cash-saving tools known as “extraordinary measures”. This involves drawing on a balance in the Treasury General Account (TGA) at the Federal Reserve (Fed) to fund spending, which stood at ∼$721 billion at year end 2024. However, at some point, this account will reach a so-called “X-date” if no resolution materializes—the point at which the Treasury runs out of money and enters technical default, which we believe could fall around late 2Q or 3Q 2025. In 2023, on the final day of the debt limit standoff, the TGA dwindled down to $22 billion.

In this article, we take a closer look at how money markets have typically reacted to past debt ceiling episodes. While a resolution is likely, we also examine why we believe the Treasury has the capacity and intention to prioritize principal and interest payments should we cross the “X-date” and enter technical default territory.

We’ve Been Here Before

The legal limit on the amount of money the US government can borrow has been suspended and reinstated seven times since 2013, rising from $16.7 trillion to today’s ∼$36 trillion. Despite close calls, in each of the prior instances, Congress has always acted to raise the debt limit before “extraordinary measures” and the Treasury’s cash balance were exhausted. The Treasury generally looks to target holding enough cash in the TGA to cover 5-days’ worth of outlays (a buffer currently estimated to be ∼$700 billion).

Source: Federal Reserve Bank of St. Louis, Federal Reserve Economic Data. As of December 10, 2024.

Debt Limits and Money Markets

Our observations based on prior cycles show money markets tend to experience three main stages of impact from the debt limit process:

Leading up to the “X-date” Treasury issuance declines. This generally causes a scarcity effect where the reduced supply causes the relative price of those securities to increase (yields decline). However, securities that are deemed to mature within the “X-date” window can experience the opposite effect where prices can decline (yields increase).

Treasuries that mature within the “X-date” window may continue to decline in price (yields increase) as investors avoid ownership of those issues. These price movements are generally relegated to the Treasury market as US Government Agency and front-end credit markets have historically seen limited impact.

After the debt limit is raised, impacted securities trading with dislocated prices typically revert to more normal levels quickly. This period is also often marked by a substantial increase in T-Bill supply as the Treasury works to replenish its “extraordinary measures” as well as its depleted cash balance in the TGA.

Potential Impacts, Downgrades, and Default Scenarios

Failing to increase the debt limit would not prevent the Treasury from rolling over existing debt, rather it would limit its ability to issue net new debt to the market. Historically, the US Treasury has favored maintaining the pace of coupon issuance of existing instruments at the expense of T-bill issuance. This has led to sharp pay downs in Treasury bill supply during periods of binding debt limit constraints.

Sentiment across the street suggests that should we cross the “X-date”, the Treasury could prioritize principal and interest payments. This view is informed by several data points that have come to light after previous debt ceiling episodes, but most notably from minutes of 2011 and 2013 Federal Open Market Committee (FOMC) meetings that occurred in and around respective “X-dates”. Those minutes indicated that the Treasury has the capacity and intention to prioritize principal and interest payments.

Based on statements released from credit rating agencies, it is a possibility that US debt could be downgraded in the event of a technical default. In 2011 S&P downgraded the credit rating on US debt from AAA to AA+ in response to the lack "effectiveness, stability, and predictability” from Congress in addressing the debt limit.1 In 2023, Fitch downgraded the US long-term credit rating from AAA to AA+ and Moody’s lowered its outlook on the US credit rating from “stable” to “negative.”2 Both cited the erosion of good governance and lack of policies in place to address the major drivers of debt.

When considering what a technical default might look like for US Treasuries, our view and understanding of the “Operational Plans for Various Contingencies for Treasury Debt Payments” paper from the Treasury Market Practices Group leads us to believe Treasuries would remain as liquid, transferable and marketable assets in a default scenario.3 The technical default could be viewed as a delay of payment in which maturities are rolled one day at a time until a resolution is reached by Congress. Additionally, there is no provision for cross-default among US Treasuries.

Keeping a Close Eye on Events

Based on prior debt ceiling episodes, political brinkmanship may mean a resolution is not found until the eleventh hour once again, resulting in potential market volatility. We will continue to assess the situation and scenarios as they develop, making portfolio adjustments in real-time as information presents itself. Active risk management is important in constructing and maintaining resilient portfolios should stressed scenarios ultimately arise.

1 S&P Global. As of August 11, 2011.

2 Fitch Ratings, Moody’s. As of August 1, 2023, and November 10, 2023, respectively.

3 New York Fed. Operational Plans for Various Contingencies for Treasury Debt Payments. As of December 2021.