The $100 Trillion Elephant in the Room: High Debt and Wide Deficits

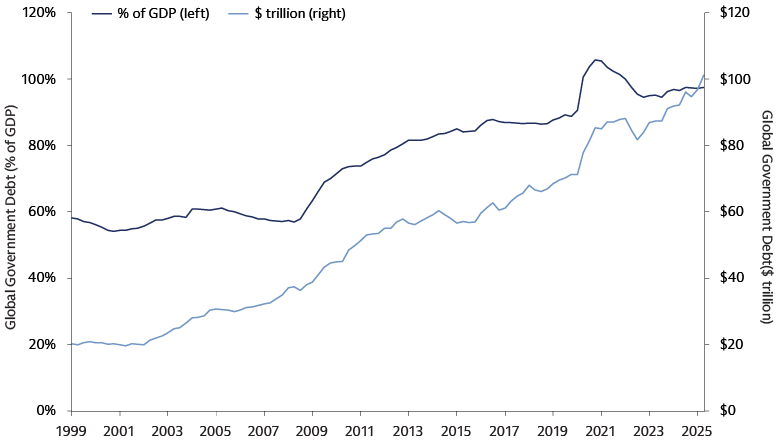

A cascade of crises—the global financial fallout, the COVID-19 pandemic, and the energy crunch following Russia’s invasion of Ukraine—has dramatically inflated public debt. Global government debt recently surpassed $100 trillion and is on course to exceed 100% of global GDP. We explore paths for governments to manage these fiscal burdens and outline key considerations for investors in a high government debt and wide fiscal deficit landscape.

Source: Institute of International Finance (IIF) Global Debt Monitor, as of September 2025. Government debt data as of June 2025.

The Debt Dilemma—No Easy Way Out

Conventional paths

Governments have three conventional routes to improve their fiscal standing: lower interest rates, higher economic growth, or fiscal consolidation. Today, each path faces obstacles.

Rate relief—limited room

While global central banks have been cautiously reducing rates for over a year, a return to the ultra-low or negative interest rate environment seen after the 2008 financial crisis is highly unlikely. This is due to persistent inflation driven by several structural factors, including geopolitical fragmentation and tensions that disrupt supply chains and trade routes, and the significant capital requirements and adjustments needed for the global energy and digital transition. Additionally, demographic shifts, such as aging populations, may also contribute to ongoing price pressures. This environment limits the ability of central banks to significantly ease the burden of government debt through lower rates.

Growth—optimistic but uncertain solution

A surge in productivity, potentially driven by the widespread adoption of AI, seeks to offer an exciting prospect for countries to grow their way out of debt. For instance, the US Congressional Budget Office (CBO) has estimated that a 0.5% increase in labor and capital productivity could lower projected US government debt as a share of GDP by over 30% by 2050.1 However, historical patterns indicate that the economy-wide benefits of new technologies often take years to fully materialize. Immigration represents another potential engine for growth, capable of boosting GDP and spreading the debt load across a larger population. Yet, this solution frequently encounters significant political opposition in most major economies. Furthermore, its long-term efficacy is questioned, as migrant populations, like native populations, will eventually age, potentially presenting similar fiscal challenges on a grander scale. That said, while it is crucial to focus on the economic implications of global population aging, including rising public sector pension costs, it is equally important to recognize that increasing life expectancy is a fundamentally positive development. People are not only living longer but also living healthier lives. A recent IMF study found that, on average, a person who was 70 in 2022 had the same cognitive ability as a 53-year-old in 2000, while the physical frailty of a 70-year-old corresponded to that of a 56-year-old in 2000.2 These trends can help counteract some of the impacts of aging by extending working lives and thereby reducing dependency ratios.

Fiscal consolidation—a politically fraught but achievable imperative

Historically, significant debt reductions have been achieved through various means, including sustained fiscal surpluses, low interest rates relative to GDP growth, high and unexpected inflation, and financial repression. The US, for instance, experienced debt reduction in the late 1990s primarily through primary surpluses, while a mix of factors, including high inflation, contributed to the post-World War II debt reduction.3 Governments are typically more inclined to reduce fiscal deficits when interest expense constitutes a larger share of GDP, when GDP is growing more rapidly, and when high domestic political fragmentation restrains spending. However, fiscal consolidations do not invariably lead to a reduction in the debt-to-GDP ratio. They can be self-defeating if they excessively curtail GDP, a phenomenon faced by Italy. Successful consolidations are more often associated with strong economic growth, central banks easing monetary policy in response to deficit reduction, and a private sector that is not highly leveraged or financially vulnerable. These conditions are currently present in the US. Successful consolidation also necessitates spending cuts supported by broad political consensus, frequently initiated by new governments with clear mandates—conditions that are largely absent in most major economies today.

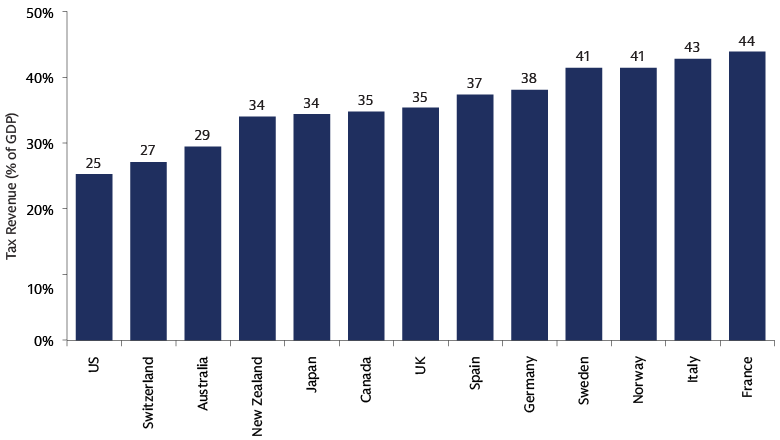

Source: Macrobond, Goldman Sachs Asset Management, OECD. Australia as of 2022. Other countries as of 2023.

The current environment is further complicated by increasing spending pressures from defense, climate initiatives, digital transitions, and aging demographics. Simultaneously, large tax increases and spending cuts face considerable electoral resistance, collectively hindering the path to fiscal consolidation. Despite these political and economic obstacles, the experiences of certain G10 economies demonstrate that fiscal consolidation is achievable. Canada's rapid deficit elimination in the 1990s, driven by a strong emphasis on expenditure reduction (with spending cuts outweighing tax increases by a 7 to 1 ratio in the 1995 budget),4 was followed by over a decade of robust economic growth. Similarly, Sweden's post-crisis consolidation in the 1990s involved both spending cuts and revenue increases, alongside institutional reforms and currency depreciation, significantly improving public finances.

Unconventional exits

With conventional paths facing challenges, less market-friendly methods to solve debt issues could enter the conversation.

Sovereign default

We believe this is highly unlikely in major developed market (DM) economies who would want to retain their ability to borrow from public debt markets and has been rare since WWII except for Greece and Cyprus in the 2010s.

Inflating away debt

Historically, governments have used inflation to erode the real value of their debt. According to research from Harvard economist Carmen Reinhart and the IMF economist Maria Belen Sbrancia, DM governments spent roughly half the time between 1945 and 1980 gaining more from inflating away debt than paying interest.5 However, this strategy requires inflation to be unexpected. With central banks still committed to inflation targets, and with inflation already expected to run higher due to structural shifts like supply chain restructuring and demographic changes, engineering a surprise inflationary surge to solve the debt problem is a difficult and risky proposition.

Financial repression

This entails government policies that channel private sector funds to the public sector to reduce national debt. These policies allow governments to borrow at low interest rates, often below inflation, transferring wealth from savers to borrowers, including the government. Key mechanisms include interest rate caps (on deposit rates or government debt), captive markets (including requirements for domestic banks and pension funds to hold government debt), capital controls, government control of financial institutions, and high reserve requirements for banks. Historically, financial repression helped reduce public debt-to-GDP ratios, especially after World War II. In the 21st century, the feasibility of financial repression is limited by open capital borders and liberalized financial markets.

In summary, the world appears poised to remain in a state of high government debt and wide fiscal deficits for the foreseeable future, which may be reinforced by the rising prevalence of unforeseen shocks including climate events or geopolitical volatility.

Investment Considerations When Seeking Resilience

For investors in government bonds, fiscal dynamics are a key part of the investment backdrop, and a critical concern that could trigger significant market volatility. Pinpointing the exact moment when fiscal anxieties will reemerge or peak is impossible, but a deep understanding of the landscape is essential. The following ten key considerations aim to help investors build a dynamic and diversified approach to their government bond exposures.

1. Context is key

Fiscal sustainability is a complex issue. No single debt-to-GDP ratio automatically triggers a fiscal crisis. Japan, for instance, has maintained a debt-to-GDP ratio exceeding 200% for over a decade without catastrophic outcomes, underscoring that surrounding economic, market and political conditions are also paramount. Current fiscal concerns stem from a confluence of factors, including slowing economic growth, higher interest rates, and central banks reducing large-scale bond purchases (quantitative tightening). A critical aspect of debt sustainability is the relationship between real interest rates (r) and real GDP growth (g). When r exceeds g, debt grows faster than the economy, requiring a fiscal surplus to stabilize the debt-to-GDP ratio. Conversely, when r is below g, debt is more manageable, allowing economic expansion to outpace debt accumulation. The favorable r−g dynamics of the past are no longer present, posing challenges for debt sustainability. Additional factors influencing fiscal sustainability and bond yields include institutional credibility, market condition, reserve currency status, reliance on foreign capital, and debt structure.

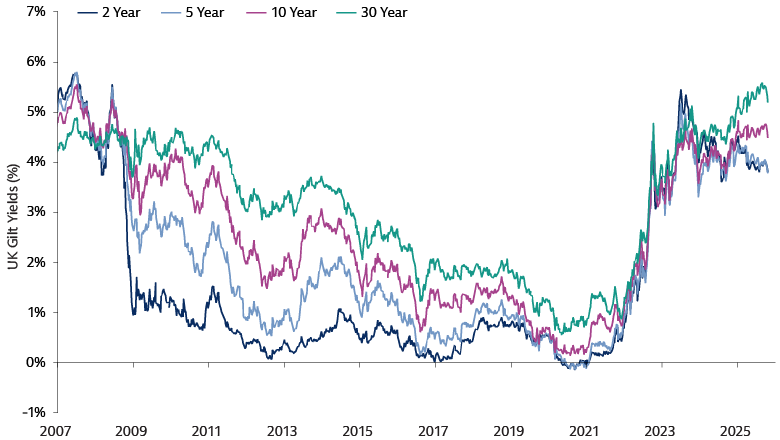

The political climate can also affect risk premiums by reducing investor expectations for credible fiscal consolidation. The UK serves as a pertinent example. Despite possessing strong fiscal institutions like the Office for Budget Responsibility, a track record of fiscal consolidation, the capacity to raise taxes relative to other European countries, and monetary sovereignty, UK gilts have exhibited an embedded risk premium since the 2022 mini-budget episode. This premium likely reflects the surrounding economic conditions, specifically the combination of high inflation and low growth, which has limited policy options to offset downside growth risks and reinforced fiscal concerns. Furthermore, the structure of UK debt is a contributing factor, characterized by a high share of inflation-linked debt, a rising portion held by foreign investors, and a shorter average maturity due to quantitative easing. These dynamics render gilts more vulnerable to inflation, rising global bond yields, and shifts in investor sentiment, thereby emphasizing the crucial role of the broader context surrounding debt metrics. Ultimately, fiscal dynamics and the conditions that surround them are fluid and necessitate constant reassessment by investors.

2. Bonds as a safe haven (with caveats)

We believe government bonds can still provide protection against downside growth risks, especially in an era of positive yields. Recent years have seen bonds rally during periods of economic uncertainty, such as the US regional banking crisis in March 2023 and in response to weak labor market data in 2024 and 2025, as well as during periods of heightened geopolitical risk. However, investors must dynamically adjust their allocation between risk assets and government bonds. The correlation between bonds and risk assets can shift from negative to positive, especially if inflation or fiscal concerns intensify, potentially diminishing bonds' hedging effectiveness. As such, strategic positioning along the yield curve is crucial for effective hedging. Front-end yields, being more sensitive to central bank policy, tend to offer superior counter-cyclical properties and act as a better hedge during economic weakness. Conversely, long-end yields are more susceptible to fiscal concerns, which can drive them higher, leading to curve steepening. Understanding these dynamics allows investors to exploit yield curve views to optimize their portfolio's defensive characteristics.

3. US fiscal dynamics—enduring strengths vs. mounting concerns

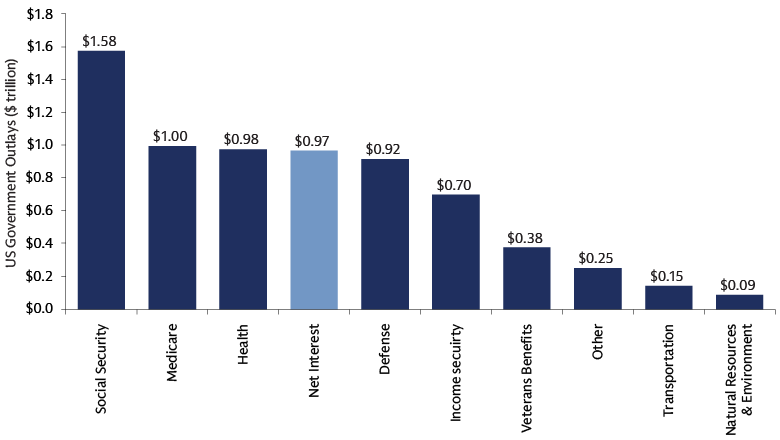

The US benefits from significant economic strengths that support its debt sustainability relative to its peers. As the world’s largest economy, it boasts high GDP per capita, strong labor productivity, and substantial innovation intensity and R&D spending.6 Household wealth stands at over $176 trillion, equivalent to more than 570% of GDP or 780% of disposable income.7 For context, total public government debt outstanding is around $38 trillion.8 Further contributing to its economic resilience and dynamism are diversified corporate profits, abundant natural resources, and a leading position in global oil and natural gas production. Crucially, the US remains the primary destination for global savings, with the US dollar’s dominant reserve role underpinning structural demand for US Treasuries (USTs). Despite these enduring strengths, the US faces mounting fiscal pressures. Large deficits outside recessions, higher real interest rates lifting interest costs (which have exceeded defense outlays), and structural imbalances from mandatory spending programs (Social Security, Medicare, Medicaid) contribute to these pressures.

Source: US Treasury, Goldman Sachs Asset Management, Macrobond. As of September 2025.

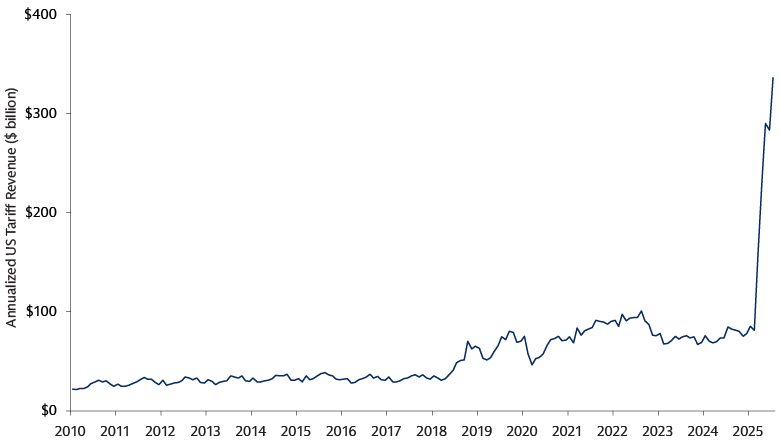

The political climate introduces additional uncertainty regarding the commitment to fiscal sustainability. While efforts by the Trump administration to increase revenue through tariffs have generated income, they also pose potential risks to economic growth, particularly if increased trade costs are passed on to consumers. The future of these tariff revenues is uncertain due to an ongoing US Supreme Court case challenging the legality of tariffs imposed under the International Emergency Economic Powers Act (IEEPA). Other proposed measures, such as significantly raising H-1B visa fees or streamlining government operations, have unclear long-term fiscal impacts.

Source: US Treasury, Macrobond, Goldman Sachs Asset Management. As of July 2025.

4. US market dynamics—pre-eminence prevails, but reform and Federal Reserve independence are crucial

The UST market’s unparalleled size, depth, and liquidity continues to attract global demand despite the concerns over the fiscal trajectory. Additionally, the Treasury’s ability to tilt issuance toward short maturities can harness easing cycles, albeit with greater rollover risk.9 Furthermore, regulatory measures have been designed to enhance demand for USTs. For example, the GENIUS Act mandates stablecoin issuers maintain reserves primarily in US dollars and USTs.10 Proposed changes to supplementary leverage ratios (SLR) for US banks could unlock significant balance sheet capacity for UST purchases, with Goldman Sachs Global Investment Research estimating an increase of $5.5 trillion to $7.2 trillion in bank balance sheet capacity.11 While these measures offer some support, they are not a substitute for comprehensive fiscal reform.

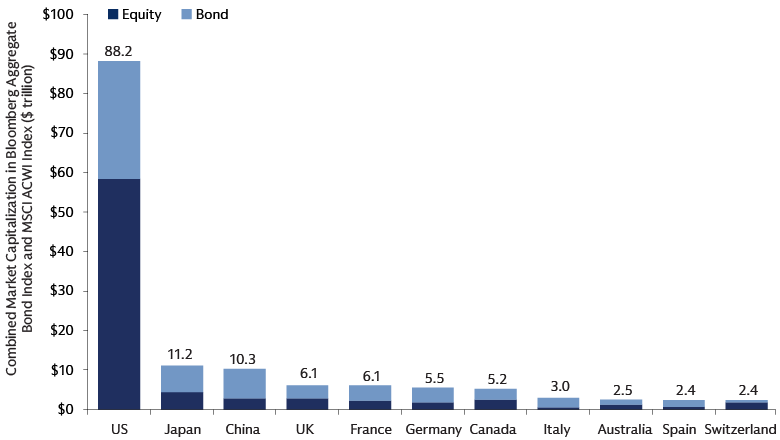

Source: Investment Strategy Group, Bloomberg, DataStream. Based on the MSCI ACWI Index for equities and Bloomberg Global Aggregate Bond Index for bonds. As of October 2025.

A critical risk to future demand for USTs is the potential erosion of Fed independence. Although such political interference is unprecedented in the 21st century, historical examples exist during the Nixon, Ford, and Carter administrations. The independence of the Fed is essential for keeping inflation expectations anchored, and therefore, risks to independence should not be taken lightly. Our view is that the structure of the Federal Open Market Committee (FOMC), which includes both presidentially appointed governors and regional Federal Reserve Bank presidents, provides a degree of diversification in perspectives, potentially limiting the dominance of any single political faction. We also anticipate that Senate-confirmed officials will uphold the Fed's independence; while interpretations of data may vary, economics, rather than politics, is expected to ultimately guide FOMC voting behavior and policy decisions.

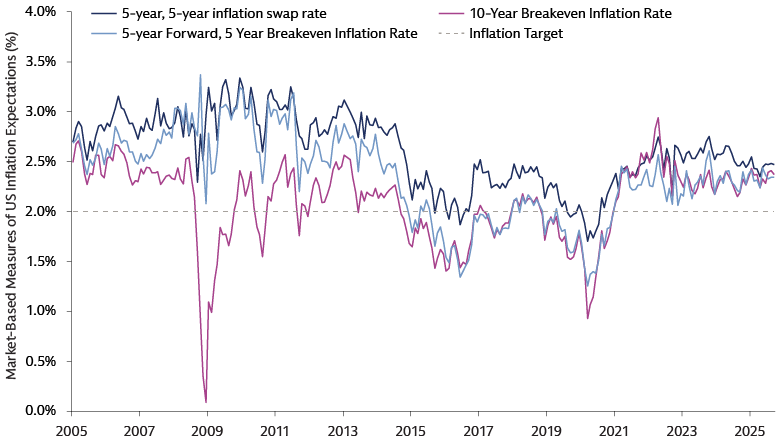

Source: Bloomberg, Federal Reserve. Monthly data. As of September 2025. The 5-year, 5-year forward inflation swap rate is used by central banks and investors to look at the market's future inflation expectations. The breakeven inflation rate is calculated by subtracting the real yield of the inflation linked maturity curve from the yield of the closest nominal Treasury maturity.

Currently, asset prices do not indicate widespread alarm regarding a decline in the institutional strength of the US. A less independent Fed would likely lead to increased inflation, higher long-term interest rates, lower stock prices, and a weaker currency. However, the rise in long-term UST yields in 2025 has been a global phenomenon, not exclusive to the US. In addition, USTs have rallied during periods of global risk aversion, US equity prices continue to reach new all-time highs, and the US dollar has recently stabilized after weakening earlier this year. Furthermore, we view the increase in gold prices as a reflection of heightened uncertainty and concerns over financial repression, rather than fears of uncontrolled inflation, given that market-based measures of inflation expectations remain contained. Nevertheless, these market dynamics are not static; intensifying concerns over fiscal dominance could lead to greater volatility in USTs than investors are accustomed to, potentially also creating higher risk premiums in inflation-linked bonds.

5. The UK: No longer “gilt-y” of fiscal irresponsibility?

UK gilts experienced significant volatility in 2022 due to both domestic and global factors. Domestically, unfunded tax cuts alarmed investors, leading to a rapid selloff. The UK's twin deficits (fiscal and current account) make it sensitive to global financial conditions and investor demand. High energy price uncertainty following Russia's invasion of Ukraine and the Fed's aggressive rate hikes exacerbated gilt volatility. This created issues for Liability-Driven Investment (LDI) funds, leading to forced selling and a "doom loop" in the gilt market.12 The episode highlighted the interconnectedness of global economic conditions, domestic policy decisions, and specific financial structures in the UK. It also underscored the importance of fiscal credibility and market confidence. However, we believe this episode should not permanently impact the gilt market. Today, easing inflation, a relatively weak labor market and potential tax hikes could allow the BoE to cut rates further, potentially supporting UK gilts. However, we recognize that fiscal uncertainty has increased.

Source: Macrobond, Goldman Sachs Asset Management. As of October 20, 2025.

6. Europe's new fault line—France

In Europe, fiscal concerns have shifted from peripheral nations to the core, with France now seen as a weak spot. Italy’s debt issues are well known, but an improving fiscal position and the European Recovery Fund have helped allay investor concerns in recent years. Spain has also seen fiscal improvements amid recent growth. Conversely, persistent political instability in France following the 2024 snap elections has created a fragmented parliament, making meaningful fiscal reform incredibly difficult. This has sharpened investor focus on France's deteriorating fiscal outlook ahead of the 2027 presidential elections, with 10-year French government bond yields now matching those in Italy.13 Germany’s fiscal path remains the most sustainable despite fiscal expansion. The "€1 trillion fiscal package" mandated in March 2025 is projected to result in a prolonged period of primary deficit, with debt potentially reaching 75% of GDP by 2030. However, Germany is expected to return to a primary surplus in early 2030, reflecting a preference for fiscal prudence. While debt servicing costs should rise slowly and modestly, fiscal risks could grow over time due to low structural growth. Competition from China in key exports and demographic challenges, including labor shortages, may hinder the effectiveness of fiscal spending.

7. Mind the term premium—positioning for steeper curves

A key implication of deteriorating fiscal dynamics is a higher term premium—the extra yield investors demand for holding longer-dated bonds. This supports positioning for steeper yield curves in economies like the US and Europe. In Europe, this trend is reinforced by technical factors, such as Dutch pension reforms that have reduced demand for long-dated bonds. In contrast, above-target inflation is informing the Bank of Japan’s gradual shift away from its ultra-loose monetary policy. Combined with improvements in Japanese fiscal metrics due to strong nominal GDP growth and higher tax revenues, this argues for a flatter Japanese yield curve.

8. Don't paint all markets with the same brush

Global trends can sometimes overshadow local fundamentals. For instance, in October 2025, the Japanese 30-year bond yield reached a record high, driven more by a global sell-off and technical factors—such as reduced insurer demand—than by a fundamental deterioration in Japan's fiscal position. It is also important to acknowledge that Japan's deep domestic investor base and its capacity to remain self-funded are seen as anchoring long-term stability for Japanese government bonds. These episodes highlight the importance of distinguishing between broad market trends and country-specific dynamics.

9. Emerging markets—a story of prudence

In a stark contrast to major DM economies, many emerging market (EM) sovereigns have demonstrated impressive fiscal prudence in recent years. General government gross debt in EMs is significantly lower than in DMs, and the debt-to-GDP ratio for EM ex-China has increased only modestly since before 2008. Countries like Indonesia, Vietnam, and South Korea maintain debt and deficit levels that would be the envy of their DM peers, suggesting EMs could warrant a long-term strategic allocation in portfolios.

10. Stay alert to the policy toolkit

Investors may benefit from policy interventions designed to manage bond market stability. These can range from adjustments in debt issuance strategies, as seen in Japan and UK, to the deployment of powerful central bank tools. The Bank of England's swift intervention during the 2022 gilt crisis and the European Central Bank's Transmission Protection Instrument (TPI)—a tool designed to counter disorderly market dynamics—are prime examples.14 The TPI has not yet been used, but a potential flare-up in French spreads could put it to the test. It is also not implausible to expect that other central banks, including the Fed, would resume quantitative easing if financial conditions were to tighten dramatically for exogenous reasons not linked to domestic policy actions.

Looking Ahead

The evolving fiscal landscape, characterized by high government debt and persistent deficits, presents a complex environment for government bond investors. While government bonds can still offer diversification and protection against growth risks, particularly front-end yields sensitive to central bank policy, their effectiveness as a hedge can diminish if inflation or fiscal concerns intensify. The US, despite its inherent economic strengths, faces mounting fiscal pressures, while Europe sees new fault lines emerging in countries like France. Certain emerging markets, in contrast, demonstrate fiscal prudence. A higher term premium and steeper yield curves are key implications of deteriorating fiscal dynamics in many developed markets. Ultimately, a dynamic and diversified approach, coupled with a keen awareness of policy interventions and country-specific fundamentals, is essential for optimizing government bond exposures in this uncertain era.

1 Congressional Budget Office. The Long-Term Budget Outlook Under Alternative Scenarios for the Economy and the Budget. As of May 2025.

2 IMF. World Economic Outlook. As of April 22, 2025.

3 Goldman Sachs Global Investment Research: The Challenge of Fiscal Sustainability with Higher Interest Rates. As of May 22, 2024.

4 Reuters: How Canada tamed its budget crisis. As of November 21, 2011.

5 National Bureau of Economic Research, The Liquidation of Government Debt (March 2011).

6 Investment Strategy Group, Goldman Sachs Private Wealth Management: Keep On Truckin’. January 15, 2025.

7 Macrobond, Goldman Sachs Asset Management, Macrobond, Federal Reserve. As of 2Q 2025.

8 US Treasury Debt to the Penny Dataset. As of October 23, 2025.

9 Rollover risk refers to the risk that a government will be unable to refinance its maturing debt or will only be able to do so at an unusually high cost. This risk is particularly relevant when a significant portion of a government's debt is concentrated on specific maturity dates or has a short average maturity, requiring frequent refinancing.

10 The Guiding and Establishing National Innovation for US Stablecoins Act, or "GENIUS Act," was signed into law on July 18, 2025. Stablecoins are a type of cryptocurrency designed to maintain a stable value by pegging their market price to an external reference asset, such as a fiat currency (like the US dollar), a commodity (like gold), or a basket of assets. Key uses cases for stablecoins include cross-border payments and remittances, facilitating cryptocurrency trading, corporate treasury management, and everyday payments.

11SNL Financial, Company data, Goldman Sachs Global Investment Research Americas Banks: Assessing the impact of the SLR proposal for large banks. As of June 25, 2025).

12 LDI strategies help defined benefit pension schemes match their assets with future liabilities, like pension payouts, by investing in long-term gilts and using derivatives to hedge against interest rate and inflation changes. These strategies often use leverage, borrowing money to amplify investment positions with gilts as collateral. In September 2022, a sharp rise in gilt yields caused gilt prices to drop, reducing the value of LDI funds' collateral and triggering margin calls. Unable to meet these calls, many pension funds sold liquid assets, including gilts, further depressing prices and increasing yields, which threatened the solvency of pension funds and the UK financial system. The Bank of England intervened with an emergency bond-buying program to stabilize the market, and the Pensions Regulator later required larger cash buffers and better liquidity management.

13 Macrobond. As of October 23, 2025.

14 The ECB also has other tools: the PEPP allowed it to skew reinvestments towards certain countries if needed, although it was intended for addressing risks to policy transmission “related to the pandemic.” Another tool is Outright Monetary Transactions (OMTs), announced in August 2012, which allow the ECB to make potentially unlimited secondary-market purchases of government bonds with maturities between one and three years. However, OMTs’ potential firepower is much smaller than the TPI, and a country must be in a programme with the European Stability Mechanism (ESM) and adhere to all the conditions attached to that programme to receive OMTs. After the sovereign debt crisis, it is unlikely that a government would approach the ESM for support unless it were truly a last resort, making the TPI the most likely tool for keeping bond markets under control.