India: Structural Strength and the Case for a Standalone Allocation

A Bright Spot in the Global Economy

India is among the few large global economies projected to see 6%-7% real GDP growth over the next few years, driven by many factors, from digitization and favorable demographics to manufacturing and infrastructure buildouts.1 Our meetings with key policymakers, corporate leaders and startup founders at the end of 2024 highlighted wide-ranging confidence on the country’s economic trajectory and growth opportunities.

More recently, a reduction in central government capital expenditure (capex) amid elections has led to weak fixed asset investment (FAI) and a slowdown in pockets of urban demand for items like cars and other high ticket consumption items. These factors, coupled with volatile weather conditions, have contributed to a slowdown in GDP growth. Importantly, however, the path of fiscal consolidation, relatively low inflation and long-term corporate earnings growth all remain strong.

In February, India's fiscal budget focused on boosting consumption while maintaining key policy targets such as fiscal consolidation and capex growth.2 Policymakers did not reverse structural reforms, including inflation targeting, taxation reform, and the promotion of manufacturing. Large infrastructure projects like highways, regional airports, railways, and ports remain a priority. The government also set the stage for next-generation reforms in infrastructure and technologies, such as artificial intelligence and broadband connectivity. Micro, small, and medium enterprises (MSMEs), which employ 75 million Indians,3 received support through easier access to credit, tax relief, and fewer compliance hurdles.

From a monetary policy standpoint, the Reserve Bank of India (RBI) cut rates by 25bps in February,4 with consensus expectations signaling a second 25bp cut in April.5 A rate cutting cycle may support growth. The RBI also took steps to boost credit flow in the economy by reducing the risk weights on bank credit by -25% for non-banking financial companies and bank loans for the microfinance segment for consumption purposes.6 While inflation remains on a downward trajectory, it will be important to monitor weather shocks that may cause agricultural supply disruptions, interrupt the rural recovery, and cause food prices to spike.

While India is primarily a domestically driven economy, it is not immune to major geopolitical conflicts and their repercussions. Prolonged geopolitical tensions could impact commodity prices and disrupt trade. Resilient external balances and low exposure to the US by way of goods exports and geopolitical neutrality may provide India with a strong economic moat against global tariff uncertainty. Meanwhile, Prime Minister Modi's first visit to Washington D.C. in President Trump's second term showed the US and India will be working on a trade deal, with the aim of increasing US-India trade to $500 billion by 2030 from ~$120 billion in 2024.7

An Attractive Equity Market Entry Point?

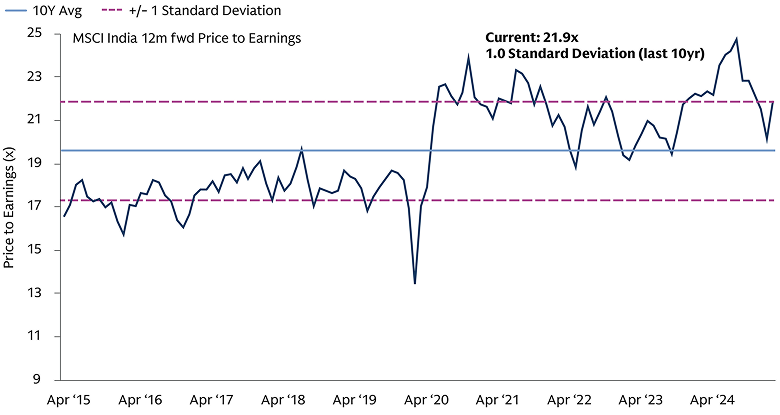

Indian equities have experienced a strong rally in recent years, outperforming broader emerging market (EM) equities. The MSCI India has delivered a 16.7% annualized rate of return over a five-year period versus 8.8% for the MSCI EM Index,8 primarily led by earnings expansion. Since September 2024, domestic stocks have pulled back due to economic softness. High starting valuations and global risk-off sentiments have also driven foreign institutional outflows, keeping markets under pressure.

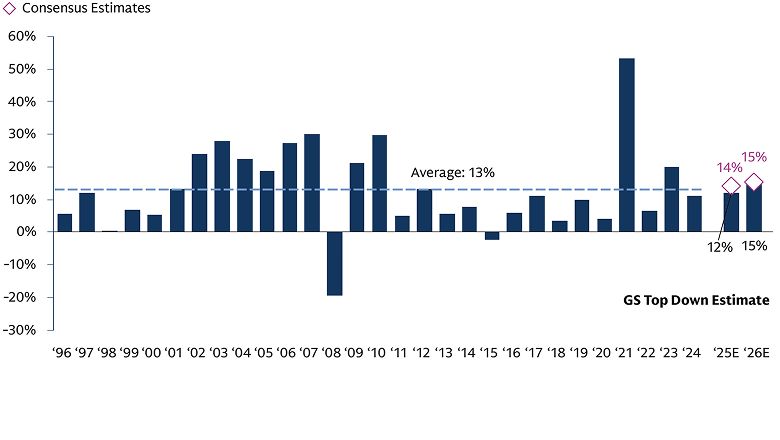

We view India’s economy and corporate sector as fundamentally strong and—with absolute valuations having cooled—believe the current environment presents an attractive entry point into one of the fastest growing major economies of the world. Consensus earnings estimates remain robust, with 2025 and 2026 earnings at 14% and 15%, respectively, which in our view should continue to support Indian markets.9

Source: Goldman Sachs Global Investment Research, Factset, MSCI. As of March 20, 2025.

Another aspect to consider is the changing nature of ownership within the Indian market. There has also been a continuous rise in domestic retail inflows via systematic investment plans (SIP), now topping ~$3 billion monthly, providing some support to the market during volatile periods.10 Ongoing financialization, or the growing influence and maturation of financial markets on the economy and rising per capita incomes have driven this trend.

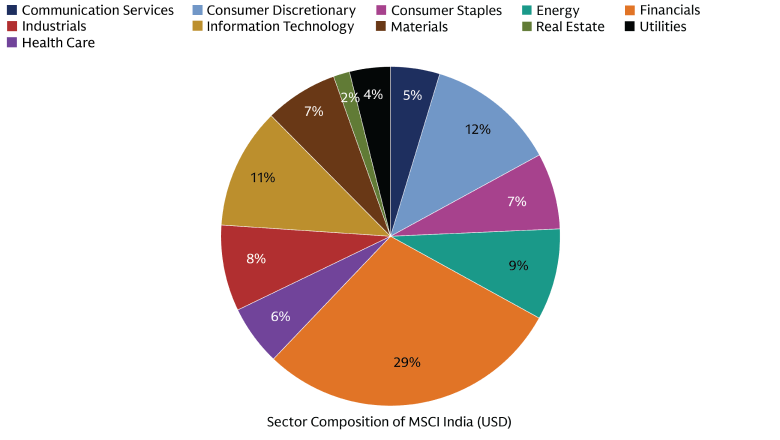

At a sector level, we see potential opportunities across the market cap spectrum, including in areas linked to premium goods and the buildout of infrastructure. The push for manufacturing is also unlocking value within high-growth areas like electronics. Founders of innovative startups we met with in 4Q 2024 were constructive on government efforts to support fledging companies operating in areas like e-commerce, fintech and IT.

Source: Goldman Sachs Global Investment Research, I/E/B/S. Bloomberg, MSCI. As of March 24, 2025.

As bottom-up investors, we refrain from predicting the outcome of macro and geopolitical variables and focus on the merits of each underlying investment. We remain focused on actively identifying companies with strong fundamentals trading at attractive valuations and are set to benefit from the long-term growth potential of India’s economy. This includes exposure to mid and small caps, as well as off-benchmark names to capture sizeable alpha.

A Standout Opportunity for a Standalone Allocation?

As the global economic landscape shifts towards potentially lower growth and greater equity market dispersion, strategic diversification becomes paramount for investors seeking higher returns. For investors willing to embrace a broader equity landscape, India presents a compelling opportunity within this context, offering a potentially attractive source of high growth, strong earnings potential, and subsequently, higher equity returns.

India’s size and scale are also important considerations. India is set to become the third largest global economy by 2030 and already has the largest population in the world, having surpassed China in 2023.11 It also has one of the youngest demographics in the world with a median age of ~28 years, ten years younger than in the US. Today, India’s weight in the MSCI EM Index is around 17%—versus 7% a decade ago—and less than 3% for the MSCI All-Country World Index.12 Alongside the country’s economic momentum—GDP is forecast to grow at an average of 6.5% between 2025 and 203013—we expect India’s weight in global benchmarks to rise in the years ahead.

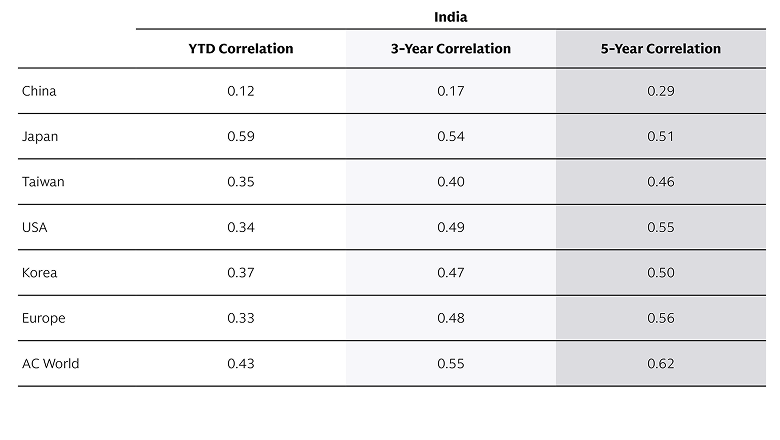

Low volatility of corporate earnings and low correlation to other emerging and developed markets are overlooked strengths within India’s equity market, in our view. Earnings have only declined two times on an absolute basis in the last 30 years and have been correlated to nominal GDP growth over time. This has resulted in India having a low beta to the broader EM complex, alongside lower correlations. For instance, when compared to China, India has a lower beta to emerging markets and Asia ex-Japan. By increasing the allocation to India within an Emerging Markets portfolio, we find that there can be potential enhancements to the information ratio by achieving higher annualized excess returns without significantly increasing return volatility.

Source: Goldman Sachs Asset Management, FactSet, and Morningstar. As of February 28, 2025. Past performance does not predict future returns and does not guarantee future results, which may vary. For illustrative purposes only. Performance may not add to 100% due to rounding.

Source: FactSet, MSCI, Goldman Sachs Global Investment Research. For illustrative purposes only. As of March 20, 2025.

India’s equity universe is also deep and diverse, with over 2,500 companies listed on the National Stock Exchange14 (NSE) and ~5,000 on the Bombay Stock Exchange (BSE),15 with diversity across sectors. Unlike regional or global portfolios, which may only provide large cap exposure, a standalone allocation to India across the market cap spectrum, including to small and-mid (SMID) caps, may lead to strong alpha generation. SMID caps have broadly outpaced large caps over the last 5 years on an annualized basis (USD). Greater market inefficiencies within SMID caps provide strong alpha potential for disciplined, on-the-ground investment teams to uncover.

Today, SMID caps in India cover a range of segments, including chemicals, pharma, automobile components, capital goods, IT services, financial services, software as well as early-stage enterprises in technology hardware. Multiple sectors provide exposure to thematic trends including digitalization, India’s affluent consumer, financialization of household savings, and rising manufacturing. India also has a buoyant IPO market, with proceeds tripling from $5.5 billion in 2023 to $19.2 billion, far outpacing other regional markets.16 Over the past five years India has seen 650+ IPOs driven by the broadening of markets, financialization of its economy, and positive investor sentiment as private companies see the benefits of public market multiples.

Staying Stronger for Longer

While India’s economy and equity market has faced a soft patch recently, we believe it’s important to put cyclical speedbumps and structural tailwinds into context. We continue to see an environment of ongoing macroeconomic stability and corporate confidence. A policy easing cycle could potentially uplift growth and earnings over coming quarters. Meanwhile, we remain focused on India’s unique combination of long-term growth, scale, and visibility of corporate earnings. Potential opportunities exist across the market cap spectrum, earnings estimates remain strong, and the recent market correction has also helped cool valuations from their peaks. India's equity market, with its low correlation to other emerging and developed markets, diverse equity universe, and structural drivers, also presents a compelling case for standalone asset allocation.

1 Goldman Sachs Global Investment Research. As of December 10, 2024.

2 Government of India, Union Budget 2025-26. Goldman Sachs Global Investment Research. As of February 2, 2025.

3 Government of India, Union Budget 2025-26. As of February 1, 2025.

4 Reserve Bank of India. As of February 7, 2025.

5 Business Standard. As of March 4, 2025.

6 Goldman Sachs Global Investment Research. As of February 26, 2025.

7 The White House, Goldman Sachs Global Investment Research. As of February 18, 2025.

8 MSCI. As of February 28, 2025.

9 Goldman Sachs Global Investment Research, I/E/B/S. Bloomberg, MSCI. As of March 24, 2025.

10 Association of Mutual Funds in India. Data compiled by Goldman Sachs Global Investment Research. As of January 2025.

11 United Nations. As of June 2023.

12 MSCI. MSCI Emerging Markets Index (USD). MSCI All Country World Index. As of February 2025.

13 Goldman Sachs Global Investment Research. As of December 10, 2024.

14 National Stock Exchange FY 2024 Annual Report. As of August 2024.

15 Bombay Stock Exchange. As of March 17, 2025.

16 AngelOne. As of January 27, 2025.