More Predictable Outcomes in Unpredictable Markets: The Investment Case for Buffer ETFs

Faced with elevated volatility in financial markets, many investors are looking for protection. The whipsawing of equity markets in response to the US administration’s evolving tariff policy underscores the challenge for investors in a period of heightened policy and macroeconomic uncertainty. This challenge was compounded in April by a simultaneous sell-off in Treasuries, which investors have long viewed as an alternative source of income and returns during equity-market downturns.

In response, many investors are turning to defined-outcome exchange-traded funds (ETFs) in search of greater stability. These products, also known as buffer ETFs, are a relatively recent innovation that offers equity-market exposure and aims to provide downside protection in exchange for a cap on gains. Their popularity has surged in the US amid this year’s market turmoil, with net inflows of $5.7 billion in the four months through the end of April, compared with just over $10 billion of inflows in the whole of last year.1

The tariff shock in global markets indicates rising dispersion and highlights the importance of portfolio diversification, in our view. Buffer ETFs can contribute to diversification when it is most useful – during equity drawdowns such as we have seen in recent months. Their unique alternative return profile can complement fixed income, particularly when stocks and bonds are highly correlated.

How They Work

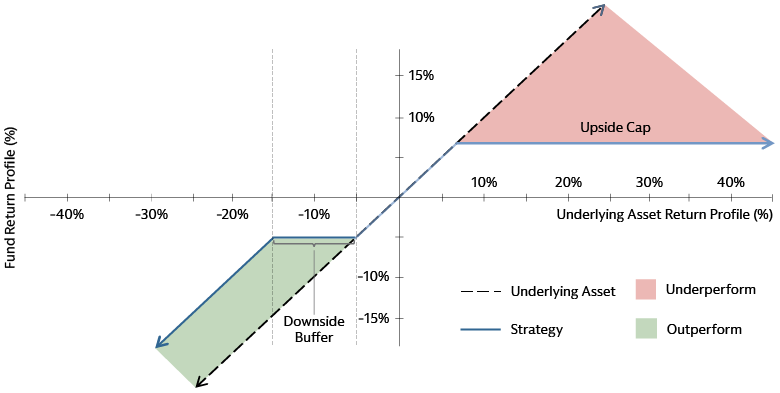

Buffer ETFs seek to deliver a pre-defined range of outcomes over a set period, and we think this increased predictability helps explain the spike in investor demand for these funds this year. The structure of a buffer ETF typically begins with establishing a one-to-one exposure to a reference asset, often an underlying ETF, for a defined period. This is often a year, though some funds reduce this with the goal of increasing upside potential through a more dynamic, adaptive approach.

The next step is to install the downside buffer. This is done by buying a put option at the top of the protected range, for example when the price declines by 5%. This gives the fund the right to sell the underlying asset at this predetermined level, known as the strike price. The bottom of the protected range is set by selling a put option, for example at -15%. Between these limits, a buffer, known as a put spread, shields investors from further losses.

The fund then sells a call option to cover the cost of creating this downside buffer. The strike price of this call option, which obligates the fund to sell the underlying asset at this price, determines the upside cap or the maximum gain the fund can earn over the full outcome period.

Source: Goldman Sachs Asset Management. As of February 4, 2024. For illustrative purposes only. There is no guarantee that objectives will be met.

The Investment Case

The long-term impact of tariffs announced or temporarily postponed by the US, and retaliatory measures initiated by other countries, remains uncertain. The impact of current trade tensions will depend on the outcome of negotiations between the US and its trading partners, and any further measures taken by both sides. This uncertainty may erode confidence, investment and spending, in our view.

In this environment, we think defined-outcome strategies may offer added resilience and diversification benefits to a portfolio. In our conversations with investors, we find that many want to maintain exposure to equity markets to participate in any potential upside, though we are also seeing an increased focus on downside protection. This combination of factors has driven inflows into defined-outcome ETFs.

The options-based strategies these funds employ have been used by investors for decades. Packaging these strategies in an ETF wrapper makes them convenient and accessible to a variety of investors. Buffer ETFs can vary widely in the specifics of the downside buffer and upside cap and the length of the outcome period. The fees and expenses charged to investors also vary.

Buffer ETFs offer a range of benefits in portfolio construction. The downside protection built into buffer ETFs provides investors with an equity-based hedge against portfolio volatility that can complement other defensive strategies. By allowing investors to participate in price gains up to a pre-defined cap, these funds help mitigate the risk of selling the dip and missing out on a potential rebound in equity markets.

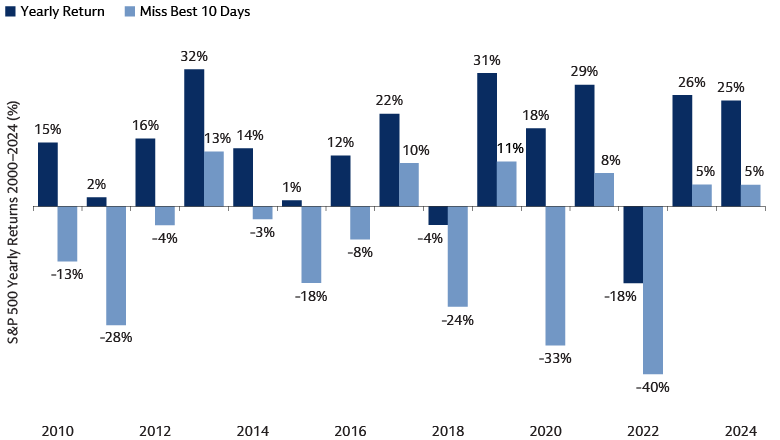

History suggests that staying invested is the best strategy. For a start, exceptional highs and lows in equity markets tend to cluster, with just two to eight days often separating the worst day in a drawdown and the best day of the subsequent recovery, analysis by Goldman Sachs Asset Management shows.2 This makes timing the market very difficult. What’s more, annual returns can differ widely for investors who stay invested and those who miss out on the best 10 days of a given year, as the following chart shows.

Source: Bloomberg, Goldman Sachs Asset Management. As of December 31, 2024. For illustrative purposes only. Past performance does not predict future returns and does not guarantee future results, which may vary.

Things to Consider

When considering an allocation to buffer ETFs, we believe investors should keep a few key things in mind. These funds are designed to deliver a defined outcome over a specific period, so it is critical to be invested on day one and remain invested until the end of the period to achieve the defined outcome. Trading the funds during this period could result in a different investment outcome.

It is also important for investors to understand how the buffer strategy works and the risks. It does not provide blanket protection. Investors are exposed to losses before the buffer’s upper limit is reached, and again if the reference asset price slides beyond the buffer’s lower limit.

Investors should also consider the costs associated with buffer ETFs. On average, investors are paying about 0.77% of the value of their investment in fees and expenses, which is more than they would pay for many lower-cost allocation funds, according to Morningstar. 3

Focus on Risk

With increased uncertainty and volatility in global markets, we think this is a good time for investors to take a hard look at portfolio risk. Some may have become overly comfortable with risk during the long period of central-bank support and low rates following the 2008 financial crisis that helped drive a prolonged bull market in US equities. Those same investors may now be tempted to reduce their exposure, foregoing potential upside in any future recovery. Buffer ETF strategies may help shore up investors’ confidence to stay the course and remain invested in equities, which has proven historically to be a more effective strategy than attempting to time the market.

1 Morningstar, Goldman Sachs Asset Management. Data as of April 30, 2025. Ex funds of funds and feeders.

2 Bloomberg, Goldman Sachs Asset Management. As of April 30, 2025.

3 “Buffer ETFs Have Worked for Investors (So Far),” Morningstar. As of April 7, 2025.