Municipal Fixed Income Outlook 2025

Let Income Lead the Way

Municipal bond yields defied most market expectations by moving higher over the course of 2024. Despite this surprising result, the municipal market still managed to provide investors with positive total returns. This dynamic not only showcased the power of income to drive performance, but also its important role as a volatility dampener.

We believe 2025 will be the year of the coupon, where income will once again be the main source of investor returns in municipals. Our view is that yields will stay elevated during the year amidst healthy economic growth, a data dependent Federal Reserve (Fed), and overall fiscal policy uncertainty. We suggest investors stay the course but also be prepared to take advantage of opportunities during periods of rate volatility.

Bond market volatility was a consistent theme for much of 2024 as shifts in economic data relating to inflation and the labor market sent mixed signals about the state of the US economy. This in turn changed Fed easing expectations considerably as the number of rate cuts was far less than originally anticipated. Ultimately, the Federal Open Market Committee (FOMC) initiated its first rate cut in over four years in September. Amidst this uncertainty, the market was also contending with the looming US Presidential election and its impact on future policy decisions.

Three themes drove municipal performance in 2024

1. Volatile Rates

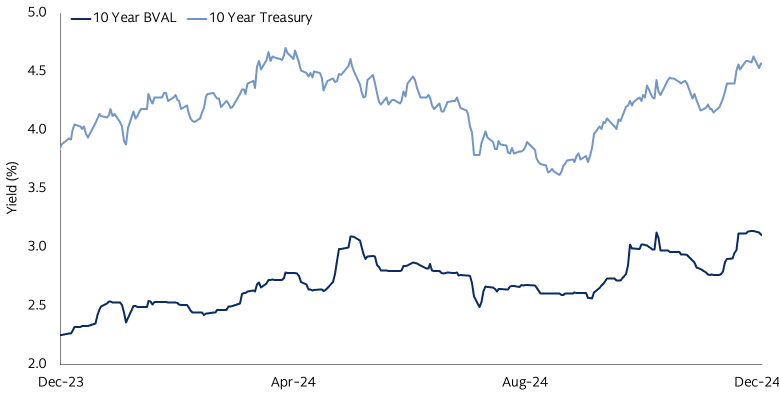

10-year municipal yields went along for the volatile macroeconomic ride by starting 2024 at 2.27%, followed by a climb to 3.11%, then to a low of 2.51%, then increasing to 3.14%, falling to 2.78%, before finally ending the year at 3.13%.

2. Record Primary Market Tax-Exempt Supply

Tax-exempt issuance related to new projects and refinancing activity surged to a record level. The aggregate issuance level of more than $500 billion was $100 billion higher than predicted by market prognosticators at the start of the year.

3. Lower-Rated Credits Significantly Outperform

A growing economy, solid credit fundamentals, and strong demand drove the BBB-rated and high yield portion of the municipal market to vastly outperform their higher rated counterparts.

With economic growth projected to be closer to normalized levels and pro-growth policy initiatives due to come out of Washington D.C., we believe the Fed will take a more measured approach to lowering the Fed Funds rate. This leads us to believe that yields will stay elevated for longer.

We expect primary market supply to maintain its record pace from last year as the need for costly infrastructure spending continues across most municipal sectors. At current yield levels, refinancing activity of previously issued debt also has the potential to rise.

Boosted by healthy reserve balances, investment grade municipal issuers remain on solid footing. This strong starting point will provide a needed cushion given a normalization in both revenues and federal aid.

Positioning for a Coupon-Clipping Environment

Investment strategy: Clip your coupon and be nimble

10-year municipal yields begin the year 100bps above their 10-year average and we expect rates to stay elevated. In our view, income will be the main driver of returns in 2025. We foresee rate volatility being prevalent throughout the year as economic data may continue to be choppy and headlines surrounding federal policy will be consistent, both creating additional uncertainty. We believe many investors have already positioned their existing municipal portfolios to be at a neutral duration over the last few years. However, given high cash levels it seems most investors may still be underweight exposure from a strategic perspective. Investors should take advantage of periods of volatility and weakness to tactically add back into the asset class. Further, given the continued stable credit backdrop, an appropriately sized allocation to lower-rated municipal credits may further enhance returns during the coming year.

Source: Bloomberg. As of December 31, 2024.

Market Dynamics Worth Watching - Supply, Demand, Valuations

Overall supply: Expecting another $500 billion

Major municipal debt underwriters are calling for $500 billion in supply on average for 2025 with tax exempt supply constituting the majority of the issuance. This strong pace of new issue supply seems appropriate as we see a continuation of infrastructure spending by state and local governments. These projects have only become more expensive given recent inflation, adding to borrowing needs. Refinancing activity should also be robust given the amount of debt that is eligible to be refinanced and current borrowing rates. Supply could surprise to the upside if certain sectors such as private activity bonds become candidates for limiting or eliminating their tax-exempt status.

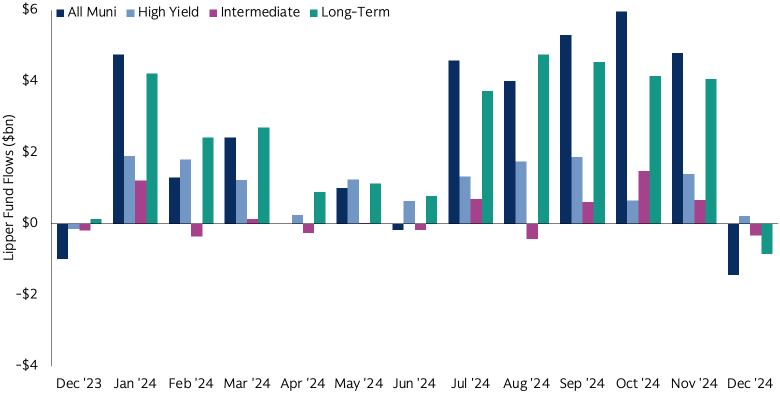

Demand should remain robust

Given our constructive and income-focused view on muni returns in 2025, we believe aggregate demand for municipals will be positive. If yields stay elevated, we believe all investment vehicles will benefit as investors look to take advantage of the tax-free income available. With recent innovations, there have never been more options for investors to access the municipal market across SMAs, Mutual Funds and ETFs.

We believe demand from individuals may materially increase, particularly if money market fund and short-term Treasury yields decrease significantly as the Fed lowers its benchmark rate. We think bank demand will remain constrained with the corporate tax rate remaining at 21% given President-elect Trump’s comments during the campaign, possibly moving lower. Additionally, non-traditional buyers of municipal debt such as insurance companies and foreign investors will continue to be driven by relative valuations versus other fixed income asset classes.

Source: Lipper Global Fund Flows as of December 31, 2024.

Municipal Credit Normalization - Stability will be a Key Theme

Municipal credit fundamentals remained positive overall during 2024. Improved revenues and conservative budgets allowed most state and local governments to end the fiscal year with surpluses, while we saw liabilities such as debt and pension lessen. We believe revenue growth will continue at a slower pace in 2025, and governments will be able to keep their budgets balanced. However, we do expect to see an increase in headlines, especially with any discussion of major policy changes.

Below we will discuss federal support of municipalities and potential policy impacts with a focus on state and local governments. We also go through some of the main sectors in our market and what we expect from 2025.

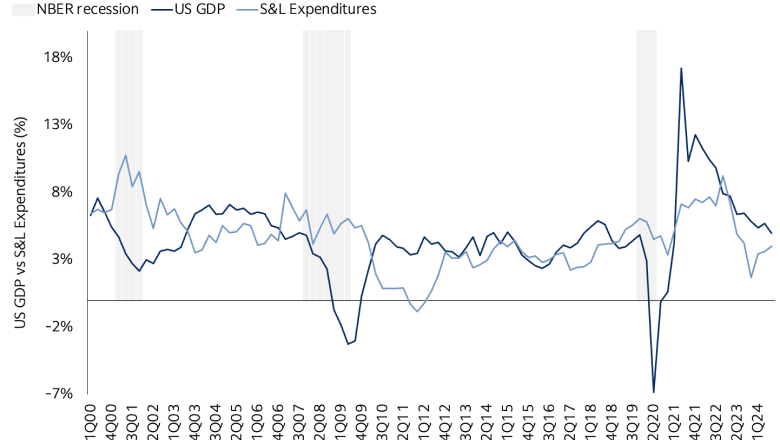

States and localities have strong budget discipline through economic cycles

Over 40 states have a “balanced budget requirement” and many localities have similar requirements. These requirements along with decades of budgetary discipline are the bulwark for municipal credit. States and localities have broad based revenue sources to rely upon should the need arise to raise revenue to meet increased expenses.

State revenues have continued to grow, although the rate of growth has slowed. Even with the slowdown, conservative budgeting helped most states to beat revenue estimates for fiscal year 2024. For states, increasing sales taxes have continued to grow and help to limit any weakness in personal income taxes.

For localities, property taxes often are the primary revenue source and tend to perform well throughout economic cycles. Although we have seen a lot of headlines about commercial real estate and high vacancy rates, property taxes have mostly increased due to residential properties that make up the majority of the tax revenues. In addition, most local governments, including school districts, maintain autonomy to raise the property tax rate to offset a soft real estate market.

On the other side of the equation, for most states and local governments expense controls keep spending in check. This is certainly not true for all, however over the last 20 years spending has grown more slowly than GDP overall during expansionary periods evidencing spending discipline. Spending is expected to slow dramatically for fiscal year 2025, with state spending expected to be up 1% for the year.

Source: US Bureau of Economic Analysis - National Income and Product Accounts, National Bureau of Economic Research - Business Cycle dating. As of October 7, 2024

Discipline around municipal debt is a powerful support to credit stability

There are two key aspects of municipal debt practices that are important catalysts for strong municipal credit fundamentals. State and local government debt is amortized and is issued for capital needs and not to balance the budget. Consequently, with debt issuance generally flat over the last few years, until 2024, muni debt burden has decreased in relative terms. Over the last 15 years municipal debt has contracted relative to GDP, revenue and spending. The exhibit below evidences a significant decline in debt from 2.7% of income to 2%, or a 25% decline in debt burden. With a lower debt burden, municipals have increased capacity should the need arise to self-fund more capital projects including for transportation and electric energy resources.

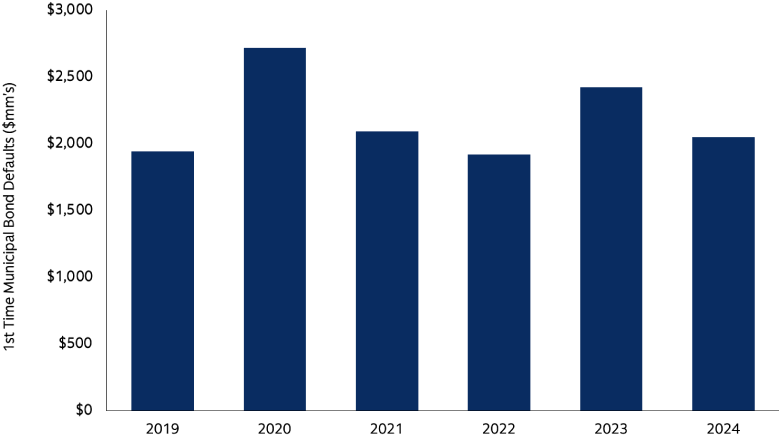

Muni high yield performance and default update

High yield municipal bonds returned 6.32% in 2024, materially outperforming their investment grade counterparts by more than 525bps. On the credit fundamentals front, the par amount of first-time municipal bond defaults totaled just over $2 billion in 2024 which was down more than -15% year-over-year. Senior living credits once again accounted for the largest percentage of the newly-defaulted universe as management teams navigate post-pandemic occupancy volatility and a higher labor cost environment. The second largest group of first-time defaults consisted of “project finance” transactions which tend to be relatively sizable and carry construction, technology and operational risk. Notably, higher education and charter school defaults ticked up in 2024 as both sectors have been grappling with the exhaustion of pandemic-related federal monetary support while less selective universities have generally faced enrollment declines.

Source: Bloomberg, BAML As of December 31, 2024.

While some sector-wide challenges have begun to take shape, we continue to believe that the majority of distressed situations will remain one-off in nature given the idiosyncratic nature of municipal credit. Credit selectivity will be pivotal to portfolio outperformance particularly given the expectation that high yield issuance increases again in 2025 after 2024’s sizable jump.

The Way Forward

As we reflect on what we have seen over the last year, our team is looking ahead on how income may lead the way in 2025.

Legislation has the potential to re-shape many corners of the economy and will likely have an impact on both the municipal and broader bond market.

The supply surge was a major story in 2024 and will likely remain elevated in 2025. In addition, demand for municipal bonds is expected to remain robust across SMAs, Mutual Funds and ETFs.

While negative credit headlines may creep up, we continue to see the stabilization of municipal credit as a key positive theme for the asset class in 2025.

Strategy for 2025

- Tax-equivalent yields are compelling across both investment grade and high yield munis, and income will be a powerful source of return as it may help cushion portfolios from rate volatility.

- Despite relatively tight spreads, credit will remain a key driver of returns, although careful monitoring of names and sectors remains critical across SMAs, Mutual Funds & ETFs.

- As the municipal yield curve continues to normalize, portfolio construction will play a key role in optimizing carry and roll in portfolios.

- An active approach to portfolio management remains imperative across SMAs, Mutual Funds and ETFs to help guide investors and manage portfolios through uncertain times.

For a more in-depth review of our Municipal Outlook for 2025: Let Income Lead the Way, download our full report. Reach out to your Goldman Sachs representative to learn more about how our decades of experience equips our dedicated Municipals Fixed Income team to make informed investment decisions in the complex municipal bond market.