Powering America: Investing in the Nation’s Energy Future

The US is reaching a power demand inflection point due to the rise of energy-intensive artificial intelligence (AI), the need for more AI-ready data center capacity, and the reshoring of manufacturing. In this article, we look at potential investment opportunities related to both power generation and the infrastructure needed to support it.

Soaring Power Demand

The growth in US electricity consumption is being driven by rising demand from factories to produce previously offshored critical components (such as semiconductors and EV batteries) and, crucially, AI-related data centers. The US electrical power demand is expected to rise at 2.4% compound annual growth rate (CAGR) through 2030,1 with AI-related demand comprising approximately two thirds of the incremental power demand in the country.2

Source: International Energy Agency (IEA), EuroStat, and British Department for Business - Energy & Industrial Strategy. As of December 31, 2022. The economic and market forecasts presented herein are for informational purposes as of the date of this publication. There can be no assurance that the forecasts will be achieved. Please see additional disclosures at the end.

Not only is the energy demand rising in volume, but its nature is changing, too. Continuity and reliability of electricity is mission-critical for AI-related data centers, which require continuous uptime for their operations.

Who Will Provide the Power?

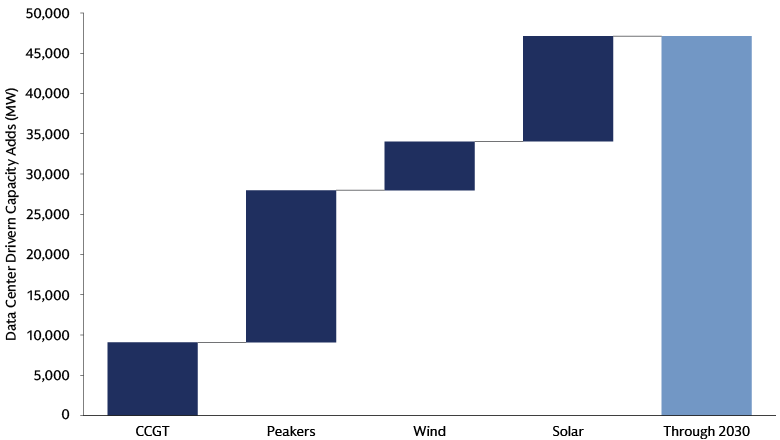

Energy sources and beneficiaries of rising demand

A combination of power generation sources will be required to meet this demand. Natural gas and renewables are expected to provide 60% and 40% respectively of the incremental generation capacity related to data center demand.3

Overall Net Capacity Additions Through 2030 by Source, “GW” refers to Gigawatt. “MW” refers to Megawatt. “CCGT” refers to combined cycle gas turbine. Source: Goldman Sachs Global Investment Research. As of January 12, 2025. The economic and market forecasts presented herein are for informational purposes as of the date of this publication. There can be no assurance that the forecasts will be achieved. Please see additional disclosures at the end.

Renewables

To meet the requirement for green electricity that matches AI-related data centers’ needs on an hourly basis, energy providers must rely on diverse power generation assets to build and manage a resilient portfolio. In this context, we view vertically integrated utilities and independent power producers (IPPs) as especially well positioned. One of the largest energy generators in the US, a Florida-based utility with an unregulated renewables subsidiary, operates a large wind and solar portfolio, as well as cutting-edge energy storage systems.4 With a large land bank and renewable energy projects already queued to be connected to the grid, it has secured a key position in the power generation and transmission nationwide.

Natural gas

Natural gas will benefit significantly from the rising electricity demand and the requirement for 24/7 uninterrupted supply. It is most flexible among all energy sources and an abundant domestic resource. Historically low current prices should stimulate demand and encourage increased production.

The primary beneficiaries are companies focused on exploration, development and production of natural gas resources, as well as owners and operators of gas pipelines. An example of an upstream beneficiary that is highly levered to the expected growth for gas demand is the largest, low-cost producer of natural gas in the Appalachian basin in the northeastern US. The company may be positioned to capture a meaningful share of the capacity increase given its advantaged cost position and inventory.

We see interesting opportunities among high-quality midstream companies that operate large-scale gas infrastructure in key geographies and provide logistics solutions such as field gathering, processing, mainline long-haul expansions, greenfield long-haul additions, and storage and marketing services.

A local utility in Virginia is a transmission-levered player that benefits from its location supplying the state’s famous “data center alley”, the largest hub in the US. The data center power demand in the company’s service territory is forecast to increase by 109% by 2030.

Nuclear

Nuclear energy has bipartisan support, and a new bill aimed at growing the country’s nuclear capabilities was signed into law in July 2024.5 It supports re-starting mothballed plants, delaying decommission and willingness to consider new large-scale nuclear reactors by some utilities. Power companies already operating nuclear capacity are prime beneficiaries of hyperscalers’ interest in this energy source. Frontier technologies are behind small nuclear reactors (SMRs), which are being designed for modular manufacturing, portability and scalable deployment onsite.6

While promising in the long-term, project lead times, potentially high costs and execution risks means it is unlikely that nuclear power generation capacity will be impactful until the 2030s.7

Some existing players may benefit sooner by combining natural gas and nuclear capabilities and adding to their portfolio of renewable sources. January 2025 brought an announcement of a landmark acquisition by the biggest US nuclear plant operator of a privately held natural gas and geothermal company. The combined company will become the largest US independent power provider8 and stands to benefit from the rising all-in power demand.

Who Will Provide Support?

Grid infrastructure, power generation equipment and electrical components

The US infrastructure needs to be updated to accommodate the unprecedented growth of electricity demand. More than $700 billion of grid investment is expected in the country through 2030.9 Construction work for power plant new builds and distribution systems is handled by grid services providers such as a company based in Houston, Texas—in our view one of the most attractive datacenter hubs in the country.

Furthermore, the development of large gas-fired power plants requires turbines and other components, as well as services, from diversified power technology providers. A company headquartered in Massachusetts, is a key player in this market; its installed base of turbines (gas, steam, nuclear, wind and hydro) helps generate ~30% of the world’s electricity.

As for electrical components, key beneficiaries include companies such as an Ohio-based power management company that leads in electrical distribution and backup power equipment, including transformers, switchboards, panelboards and voltage assembly products.

Strong power demand generating opportunities across public equities

Underinvestment over the last decade has led to compelling opportunities across multiple sectors of public equities addressing power demand and aging grid infrastructure. We believe that while certain parts of the energy system may be more attractive than others at various times, it will take several types of energy sources to meet incredibly strong demand. In our view, we are still in the early stages of strong, durable power demand due to structural tailwinds from AI to supply chain reshoring. Many of these sectors account for small portions of market-cap weighted benchmarks, making active management critical when trying to gain access to these compelling opportunities.

For more on the drivers of power demand and the energy sources and infrastructure to support it, download our extended version of Powering America: Investing in the Nation’s Energy Future. Reach out to your Goldman Sachs representative to learn more about where we see potential investment opportunities related to the theme of economic security across supply chains, resources and national security.

1 Goldman Sachs Global Investment Research, “The push for the “Green” data center and investment implications”. As of November 3, 2024.

2 Raymond James. “Energy: Can US generate enough electricity for the AI boom?” As of April 24, 2024.

3 Goldman Sachs Global Investment Research. “AI/data centers' global power surge: five drivers of upside/downside and the Reliability investment tailwind”. As of January 12, 2025.

4 Company investor presentation, June 2024, data as of March 31, 2024.

5 The Advanced Nuclear for Clean Energy (ADVANCE) Act, announcement by the US Department of Energy. As of July 2024.

6 The NEA SMR Dashboard, Second Edition. As of February 2024.

7 Goldman Sachs Global Investment Research, “The push for the “Green” data center and investment implications”. As of November 3, 2024.

8 Reuters. As of January 10, 2025.

9 GS Global Investment Research, “Americas Utilities: Power: Energy, Clean Tech & Utilities Conference — Key Takeaways on Power/Utilities”. As of January 8, 2025.