Private Market Investments in Defined Contribution Plans

Private market investment has grown meaningfully over the past decade and incorporating private market strategies into defined contribution (DC) plans is an emerging trend with the potential to enhance long-term retirement outcomes.

Compared to public market investments, private market strategies can offer the potential for higher returns, higher risk and portfolio diversification through long-term commitments, active business management, and operational value creation. However, some of their potential characteristics in the areas of liquidity, pricing and investment horizons can present questions regarding structuring and implementation in the context of DC plans.

Addressing these considerations for DC plans requires innovative solutions and thoughtful plan design to ensure these strategies can be effectively and responsibly utilized, providing participants with access to a broader set of potential growth investment opportunities.

Potential for Enhanced Investment Returns

The challenges of saving and preparing for retirement are growing more complex, leading to a wide range of savings outcomes. There are three primary ways to drive success in a retirement strategy:

- Time Horizon: Saving for a longer period of time

- Saving Rate: Increasing the amount saved

- Investment Return: Increasing the long-term investment return

For many individuals, increasing savings can be particularly difficult due to competing financial priorities. According to our latest Retirement Survey & Insights Report1, over 60% of respondents believe they will need to delay retirement because of competing priorities but only 3% of retirees actually retire later than planned. In fact, 47% retire earlier than anticipated, which can be detrimental to one’s total savings.

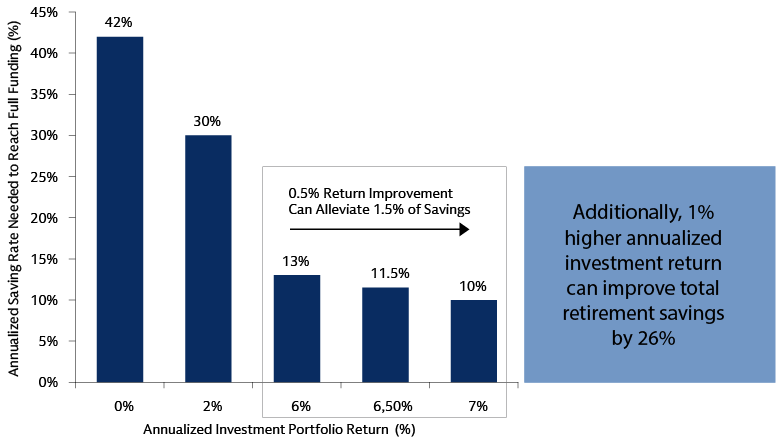

Optimizing investment returns can play a crucial role in supporting retirement savings growth. For example, a modest 0.5% increase in annual investment returns can reduce the required annual savings rate by 1.5% over the course of one’s career, underscoring the impact of return enhancements on long-term outcomes.

The chart below illustrates how much a person needs to save (i.e., annual saving rate) based on different portfolio returns over the course of their career (age 25 to 65). All saving rates and portfolio returns result in approximately the same total savings. As highlighted, a 0.5% additional annualized return from 6% to 6.5%, lowers the equivalent savings rate from 13% to 11.5%. Additionally, 1% higher annualized investment return can improve total retirement savings by 26%.

Source: Goldman Sachs Asset Management. As of January 2025. Calculation assumptions: Beginning salary is $50,000 and grows 2% per year with inflation; saving period is age 25 to 65; saving rate and investment return provided in the table. These examples are for illustrative purposes only and are not actual results. If any assumptions used do not prove to be true, results may vary substantially.

Growth of Private Markets

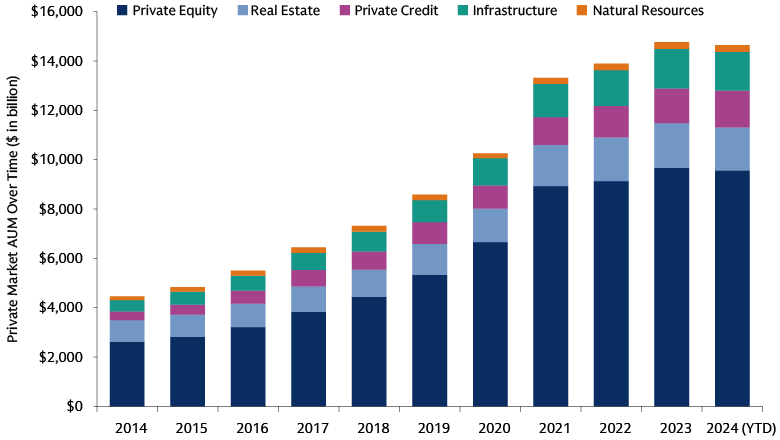

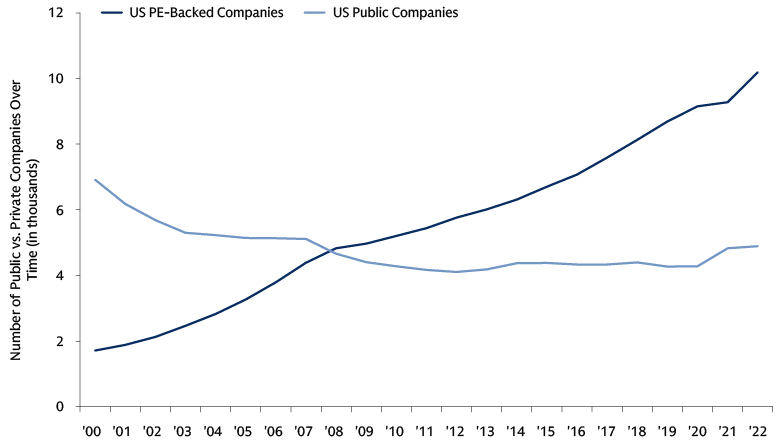

The growth of private markets over the past 10 to 20 years highlights a notable shift in the dynamics underlying capital markets. Private capital investment – including equity, credit, infrastructure and real estate – is playing an increasingly critical role in how companies finance and expand their businesses. Since 2014, the private markets have growth 3.5 times, and over the past two decades, the number of private equity-based companies has risen from 25% of the total number of public companies to more than double the number of public companies today. This represents an annualized growth rate exceeding 8%.

This shift is further evidenced by the trend of companies staying private longer before going public. As a result, the investable universe within public markets, particularly in the small-cap segment, has diminished, impacting the composition and opportunities available to investors.

Many investors base their asset allocation strategies on traditional capital markets theories, seeking broad and diversified market exposure. However, with the rapid expansion of the private market, a growing portion of the market remains inaccessible to many retirement savers, potentially limiting their opportunities for diversification and growth.

Source: Preqin and Goldman Sachs Asset Management. Data as of Q2 2024, latest available.

Source: Pitchbook and World Bank. As of December 2023.

Growth in Private Market Allocation

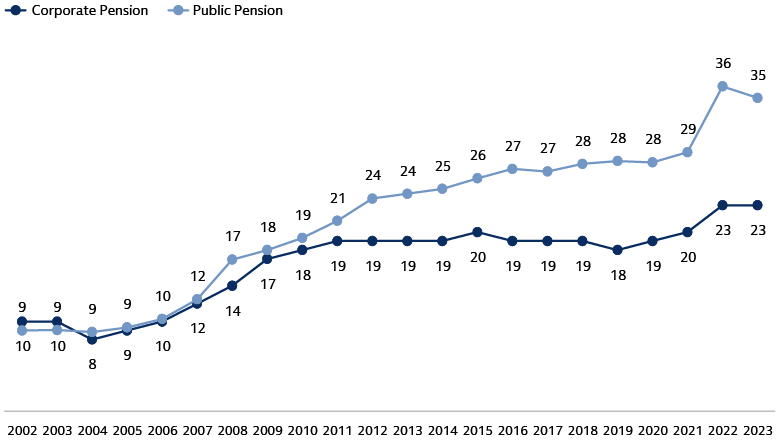

Professional asset allocators are increasingly incorporating private market investments into their portfolios to seek improved outcomes. Corporate pension plans are often frozen or “closed” to new benefit accruals and seek to leverage the enhanced performance potential offered by private market strategies. These pension plans are often managed by fiduciaries who also oversee defined contribution plans.

Public pension plans, on the other hand, are typically “open” to new benefit accruals for plan participants. As a result, they tend to prioritize long-term growth, aligning closely with the investment objectives of defined contribution plan participants. Here, private market allocation has grown to 35% of overall asset allocation.

The growing allocation to private markets by professional asset allocators mirrors the broader expansion of private markets themselves, highlighting a consistent trend in investment strategy and market evolution.

Source: NACUBO-TIAA Study of Endowments (NTSE), Boston College Center for Retirement Research, and Goldman Sachs Asset Management. As of FY 2023. 1. The study features an analysis of the financial, investment, and governance policies and practices of the nation’s higher education endowments and affiliated foundations. The 2023 study reflects the responses of 688 institutions representing $839 billion in endowment assets and covers the fiscal year July 1, 2022, to June 30, 2023. Data reflects endowments with over $1 billion in assets prior to 2023 and endowments with over $5 billion in assets in 2023.

Growth in Product Development

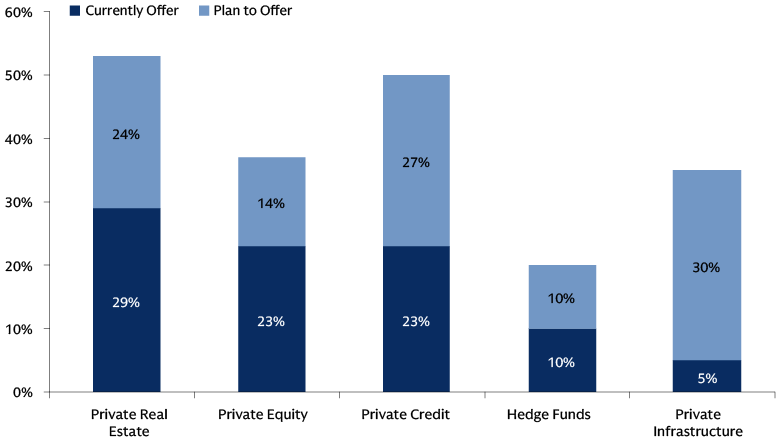

As private markets continue to evolve and asset allocators seek to enhance investment performance, many asset managers are responding by expanding their offerings through innovative product development. According to data from Cerulli, growth in private market strategies tailored for the DC market is expected to grow across all investment categories. Private real estate has been the first point of entry for asset allocators, however, private credit (27%) and private infrastructure (30%) are expected to experience the most significant new development tailored specifically to the defined contribution market.

Source: Cerulli Retirement Report, 2024

Potential Considerations for Plan Sponsors

Private market investments differ fundamentally from public market investments. Investing in private companies typically involves longer-term commitments, as these investments are not traded on public exchanges or priced daily. Unlike public companies, private firms are not generally required to produce quarterly reports for shareholders, allowing management teams to focus on strategic growth. Additionally, private investments often involve direct business consulting and operational support, which may help drive business growth and create value for investors. These unique characteristics potentially contribute to enhanced returns and diversification benefits within an investment portfolio.

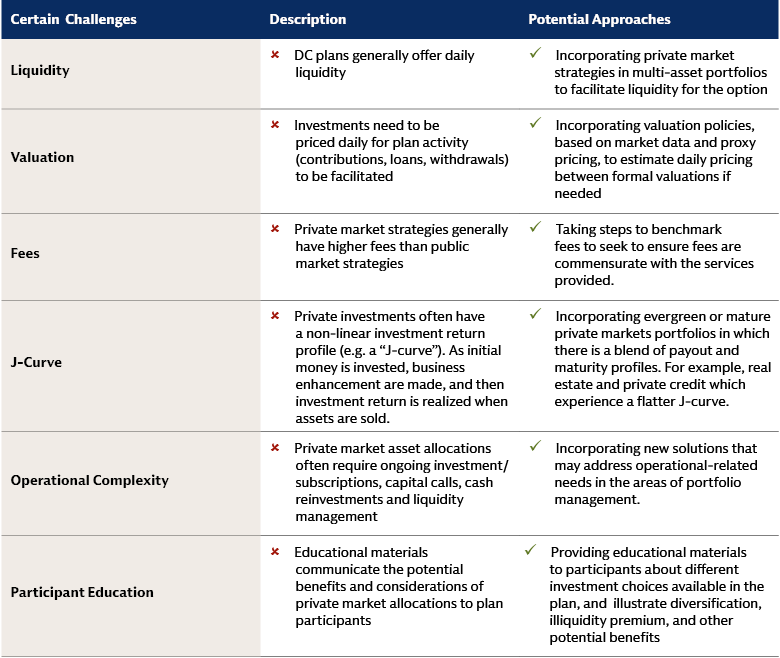

Rather than altering these attributes – since they underpin the value creation investors seek – the focus has shifted to designing processes that enable these investments to be integrated into defined contribution plans. Below are some potential considerations for plan sponsors and emerging approaches that may help facilitate the inclusion of private market investments in DC plans.

Plan Design Potential Considerations

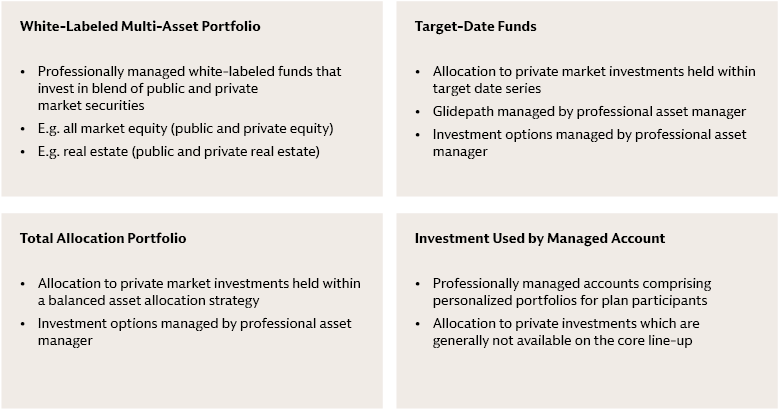

When plan sponsors explore incorporating private market strategies into their plans, the process should begin with a clear understanding of investment objectives before identifying the most effective implementation options. Potential objectives for retirement investors may include the following:

- Enhanced investment return

- Enhanced market exposure

- Enhanced income for retirement income strategies

- Enhanced portfolio diversification

The four illustrative plan design considerations outlined below offer actionable ways for plan sponsors to integrate private market strategies in light of these investor objectives.

ERISA considerations apply. See, e.g., DOL Information Letter dated June 3, 2020 and Supplemental Statement related thereto. This is not a recommendation or advice relating to any of the above illustrations. Plan sponsors should consult their own advisers and counsel regarding an offering of private market assets as part of an investment menu.

This article was originally published as part of the 1Q 2025 issue of Defined Contribution Quarterly: Private Markets in Defined Contribution Plans.

1 Goldman Sachs Asset Management. As of September 2024. The Retirement Survey & Insights Report was conducted by Goldman Sachs Asset Management and Qualtrics Experience Management between June 27, 2024–July 21, 2024. Findings were from 4,874 individuals, including 3,280 working and 1,594 retired individuals. Views expressed are those of survey respondents.