Active Fixed Income ETFs: Seizing Potential Opportunities in the US

As we mentioned earlier this year, actively managed exchange-traded funds (ETF) have been on the rise. First introduced in 2008,1 active ETFs have taken off in recent years, with assets under management in the US surging to a total of over $1 trillion in 2025, fueled by robust inflows.2

For investors, active ETFs offer all the potential advantages of the ETF wrapper. They are typically cost-effective and offer intraday trading at a known price just like stocks, as well as offering greater transparency on holdings. Unlike passive ETFs that track an index, however, active ETFs are managed by investment professionals with the goal of achieving specific outcomes such as capturing market inefficiencies, outperforming a benchmark, or generating income.

At Goldman Sachs Asset Management, we believe the active ETF market will continue to expand, and that the active component of these funds will be critical in driving market growth. We think active ETFs offer a flexible, efficient way to gain exposure to key fixed income markets, helping investors seize potential opportunities and manage risk.

Charting the Expansion of Active ETFs

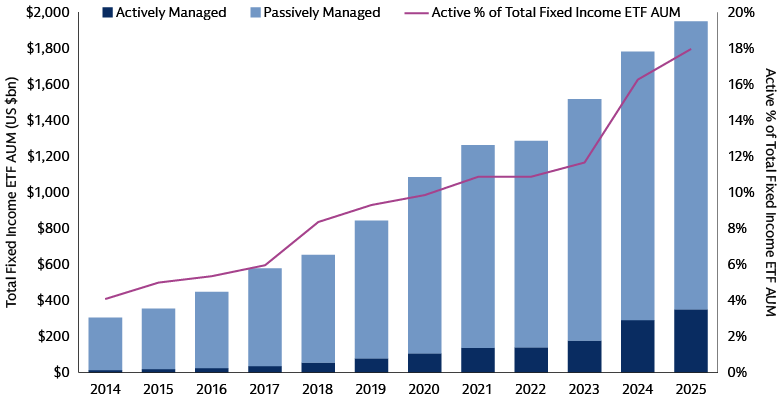

ETFs have been around for more than 30 years, and during most of that time they have been associated primarily with passive investing and index-tracking funds. This is changing, as many investors increasingly seek to combine the potential benefits of the ETF wrapper, including liquidity, portfolio diversification and transparency, with the in-depth research and alpha potential that an active manager can bring.

While passive funds still account for the bulk of ETF assets under management, demand for active funds has been fast increasing.2 In 2025, active ETFs have grown more than five times faster than passive ETFs. Flows into these products have reached $354 billion year to date, which is almost double the total for the same period last year, with equity and fixed income strategies capturing 93% of active flows.2

The Case for Active Fixed Income ETFs

We believe active investing and fixed income are a natural fit. The $142 trillion fixed income market3 is vast and has been expanding. It is complex, with more than 3 million unique securities outstanding, across a range of types, maturities and ratings.2 That said, it can have structural inefficiencies in many areas and investors face a range of risks including interest-rate movements and the creditworthiness of issuers. In this environment, active management using rigorous data-driven, technology-led processes and thoughtful portfolio construction can help investors manage these risks and take advantage of potential opportunities with the goal of outperforming relevant benchmarks.

Source: Morningstar as of May 31, 2025.

Combining active management with the ETF wrapper can provide investors with a set of unique tools for navigating the fixed income market. Active ETFs allow managers to respond to evolving market conditions, for example by adjusting a portfolio’s sector composition and duration exposures. They provide investors with the potential benefits of specialist fundamental research and bottom-up security selection that can help identify issuers well-positioned for both cyclical and structural trends.

The ETF wrapper provides other benefits, including:

- Tax efficiency

Most ETF trading occurs on the secondary market and secondary market transactions do not impact other shareholders. ETFs can create and redeem shares ‘in-kind’, which can reduce taxable events and minimize capital gains distributions for investors. - Enhanced transparency

Daily portfolio disclosure improves transparency and can help investors manage their allocations more effectively. - Trading flexibility

Intraday trading on exchanges or over the counter gives investors greater control and flexibility. The creation and redemption process allows investors to buy and sell ETFs regardless of the ETF’s size or secondary-market volumes. - Potential for lower costs

Structural differences give ETFs a cost advantage over other investment vehicles. Active ETFs typically have lower expense ratios than active mutual funds, allowing investors to keep more of their returns. - Insulation from trading costs related to client activity

Trading costs related to a creation or redemption are borne by the investors of the flows rather than other shareholders.

We believe these levers can help deliver enhanced returns by capturing potential opportunities within a risk-managed framework, while exploiting potential execution alpha from trading practices and cost-efficient implementation.

The Future Is Active

Active ETFs are changing the way investors look at the fixed income market. This relatively recent innovation is allowing investors to access the dynamic management and security selection of active funds along with the tradability, liquidity and cost-effectiveness of ETFs. This unique combination has attracted strong investor demand, and we think active ETFs will continue to grow in the years ahead, expanding the solutions they offer to investors along the way.

1 “Bear Stearns Begins Trading of First Actively Managed ETF,” Global Custodian. As of March 25, 2008.

2 Morningstar as of May 31, 2025.

3 “Capital Markets Fact Book, 2025,” Securities Industry and Financial Markets Association. Data as of 2Q24.