What are the Key Themes for Munis in 2026?

Coupons Matter, More So When They Are Tax-Exempt

Market volatility is anticipated to persist in 2026, primarily influenced by the selection of a new Federal Reserve Chair, the ongoing impact of evolving economic data, and increasing policy unpredictability. Critical questions throughout the year will revolve around the timing and magnitude of Federal Reserve interest rate adjustments. A steady focus on tax-free income and active management of yield curve positioning will help investors navigate the potential choppy waters of the year ahead.

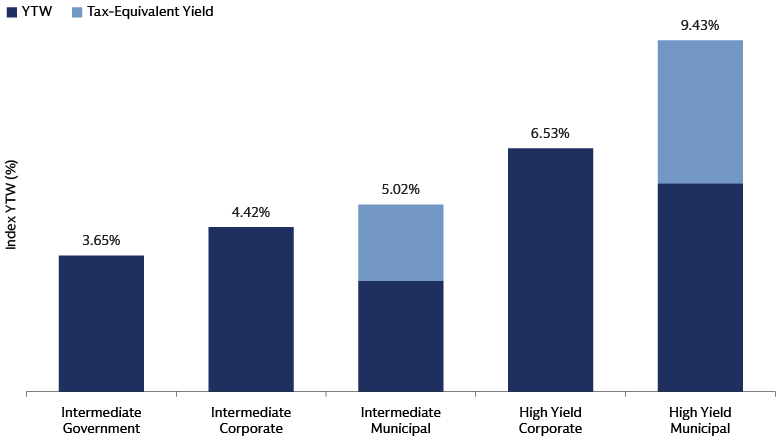

Municipal bond yields are currently offering investors portfolio stability, with both investment-grade and high-yield segments presenting attractive absolute and relative valuations. For 2026, income generation is anticipated to be a key return driver, as elevated starting yields provide a substantial buffer against interest rate and credit market volatility. In addition, municipals carry the added benefit of tax-exemption, which makes municipal yields a compelling option on a relative basis compared to other fixed income products.

Source: Bloomberg. As of December 31, 2025. Tax-Equivalent Yield assumes 40.8% tax rate (37% Federal + 3.8% ACA surcharge on investment income).

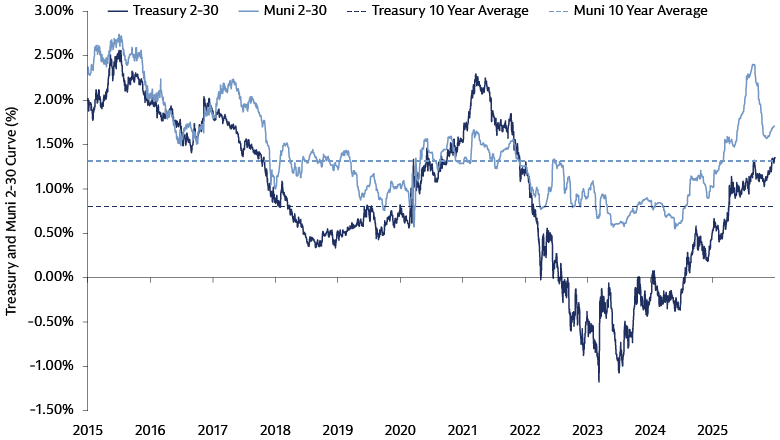

Portfolio construction will require municipal investors to be active and flexible with their yield curve allocation throughout the year. The front end of the municipal yield curve should remain well bid and tethered to the front end of the treasury yield curve, given expectations for continued Fed rate cuts and persistent strong demand for short duration municipal bonds.

The current steep municipal yield curve compensates investors for taking on additional duration risk in longer-maturity allocations. With the yield differential between 2-year and 30-year municipals currently above ten-year average levels, adding longer duration municipals opportunistically during the year may be a compelling lever for investors to consider pulling to potentially increase return. We believe an active approach to yield curve positioning will be necessary given the potential market volatility in the upcoming year.

Source: Bloomberg. As of December 31, 2025.

Elevated Supply, Here to Stay

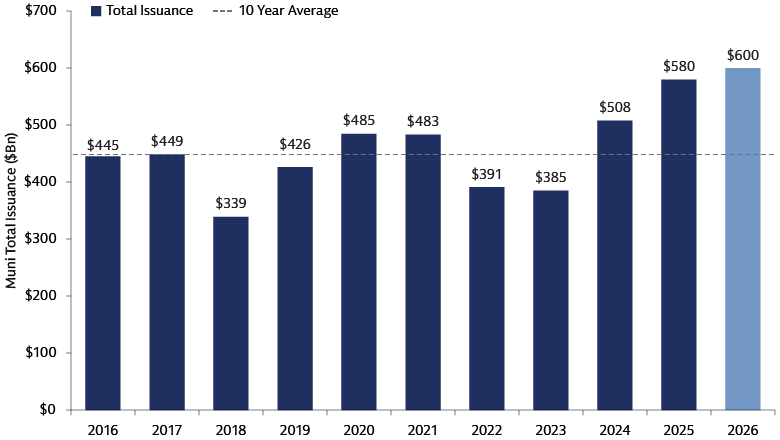

We expect the recent increase in primary market supply to continue in 2026, as continued investment in new and updated infrastructure, the expiration of Covid related federal funding, and the greater inflationary pressure of the past few years have led to this supply surge. While the muni market has been able to handle the heavier supply, it has added increased volatility in the asset class. We expect a similar set up for 2026 and believe that the increase in volatility will provide interesting opportunities for active managers.

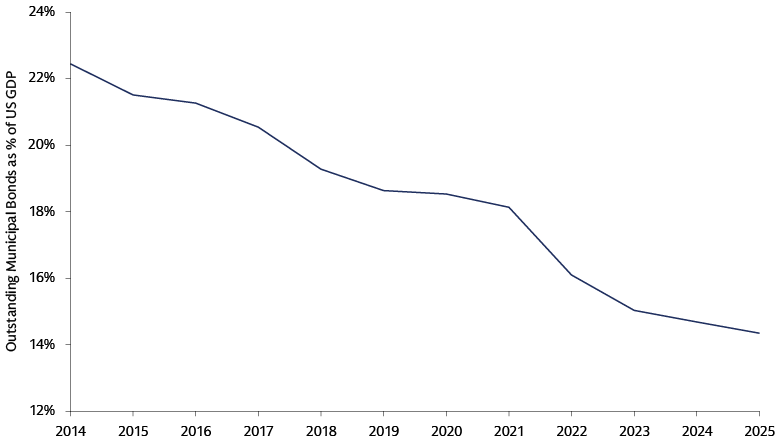

The municipal market's overall size experienced modest growth, increasing from $4 trillion in 2010 to $4.1 trillion by 2023.1 In stark contrast, the outstanding US Treasuries market grew three-fold, and US Corporate bonds increased by 50% over the same period.2 Major municipal debt underwriters are forecasting approximately $600 billion of supply on average for 2026, beating 2025’s record issuance of roughly $580 billion.3 Increased issuance is anticipated for both tax-exempt and taxable municipal bonds, with tax-exempt offerings making up the majority of the overall supply. Issuances for debt refundings should also see an increase due to an expectation for lower rates providing better opportunities for refinancing.

Source: BondBuyer. As of December 31, 2025.

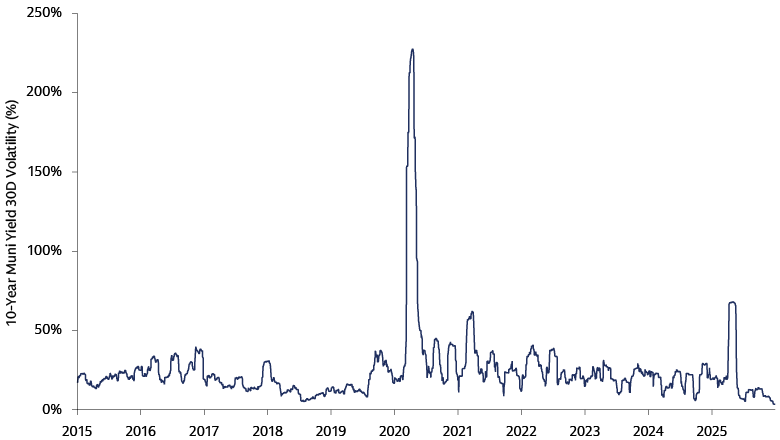

The new supply dynamic has significantly contributed to recent market volatility, underscoring the need for active portfolio management. We are also observing that these periods of volatility no longer consistently align with historical seasonal patterns in the municipal market. This shift, or "regime change," is further influenced by factors such as the involvement of crossover investors, an increase in geopolitical events, and a reduction in dealer balance sheets. We anticipate that this heightened volatility and uncertainty will create tactical opportunities for investors to capitalize on market dislocations throughout the year.

Source: Bloomberg. As of December 31, 2025.

Municipal Credit Selectivity Will Matter More

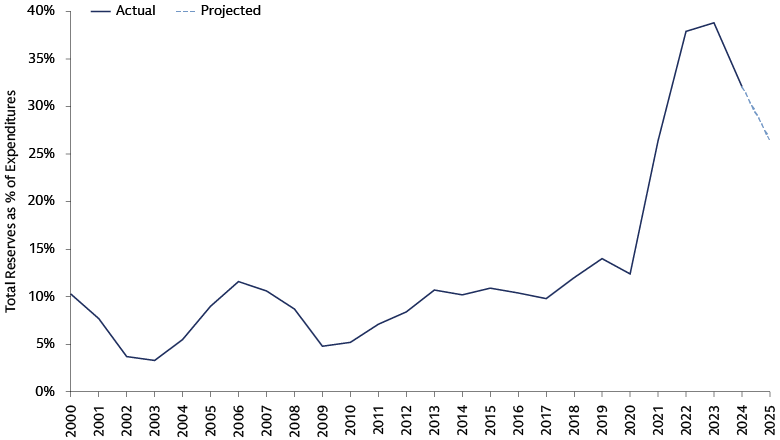

Municipal credit continued to display its resilience in 2025, and we believe this will carry forward into 2026. High grade municipal credit held in well both from credit and performance perspective, despite some potential shocks from Los Angeles wildfires to policy uncertainty emanating from the federal government. Our base case for steady state and local government credit quality in 2026 is buoyed by the strong national economy and healthy reserve balances.

Source: National Association of State Budget Officers (NASBO). As of Fall 2025.

We believe the expected record level of new issuance is necessary to meet the deferred infrastructure needs of the country and that municipal finances can accommodate the increased burden. Municipal debt has grown considerably slower over the last two decades compared to economic indicators like GDP, revenue, and income, and it now accounts for a smaller share of budgets than in previous decades. As such, the debt affordability for states and local municipalities is far better today than heading into the 2008-09 downturn. Furthermore, current reserve levels are substantially higher, which is expected to support another generally favorable budget cycle this Spring.

Source: Securities Industry and Financial Markets Association (SIFMA). As of March 31, 2025.

From a sector outlook perspective, we remain selective on universities and particularly cautious on those struggling with enrollment and modest endowments that may be challenged to maintain financial stability in 2026. The prepay natural gas sector is garnering considerable attention, particularly following a significant increase in issuance late in 2025. Although supported by sound financial institutions, we perceive the sector as exhibiting comparatively weak diversification attributes. The team continues to see opportunities within the residential backed land secured sector while we remain highly cautious in the large commercial and data center-specific projects.

The increased risk of idiosyncratic credit challenges such as the Brightline debt complex will likely increase in the current environment. While we do not anticipate a broad decline in the overall quality of high yield creditors or a material increase in defaults, we expect credit selectivity to remain a critical driver of outperformance in 2026.

1SIFMA. As of December 31, 2025.

2SIFMA. As of December 31, 2025.

3BondBuyer. As of December 31, 2025.