Municipal Fixed Income Monthly

Munis Generate Positive Returns in Turbulent Month

Market Overview: Geopolitics, Federal Open Market Committee (FOMC) Rate Decision, and New Fed Chair Nominee

The municipal bond (muni) market meaningfully outperformed the Treasury market due to a combination of reinvestment and a very strong January month of demand that exceeded new issue supply, leading to a rally across the front end of the muni curve. The kinetic start to the year fueled by improving growth expectations and higher term premium pricing triggered a Treasury sell-off, which steepened the front and belly of the curve, and flattened the long end. We saw geopolitical headlines around Venezuela and Greenland during the month, the Federal (Fed) Reserve decided to keep the policy rate unchanged at 3.50-3.75%, and the nomination of Kevin Warsh as the next Fed chair.

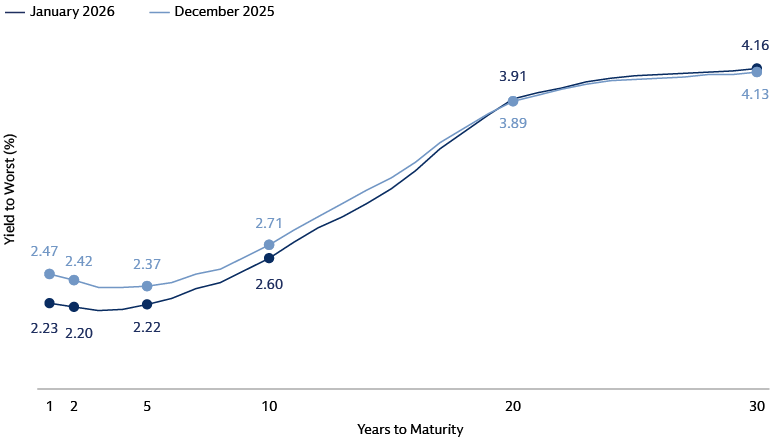

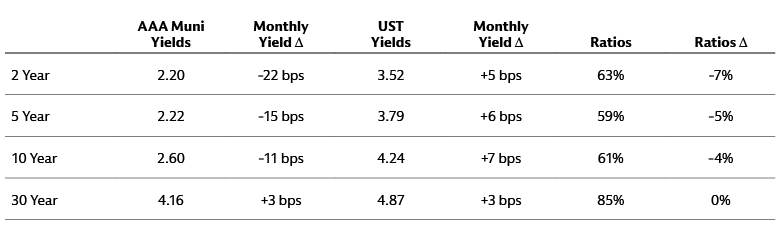

Yields & Valuations: Falling Yields

The yields in the front end and belly of the muni curve fell in January, driven by strong demand, while longer-term yields rose slightly. The difference between 1-year and 30-year muni yields widened 27 basis points (bps) to 193 bps. Muni/US Treasury ratios decreased 5/4/0%, finishing January at 59/61/85% respectively for 5/10/30 years.

Source: Goldman Sachs Asset Management. Bloomberg. As of January 31, 2026.

Source: Goldman Sachs Asset Management. Bloomberg. As of January 31, 2026.

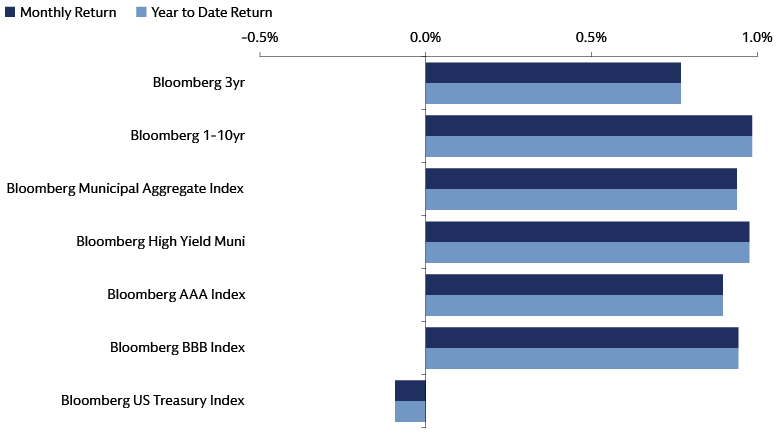

Muni Index Performance: Positive Returns

The Bloomberg Muni Index returned 0.94% in January, while the Bloomberg Muni High Yield Index increased by 0.98%. All credit ratings (AAA–BBB) saw positive performance within investment grade munis.

Source: Goldman Sachs Asset Management. Bloomberg. As of January 31, 2026.

Credit Research Spotlight

Recent cuts announced by the US Department of Health and Human Services are unlikely to be consequential to state budgets. Allegations of fraud and misuse of federal funds at various daycare facilities in Minnesota led to an announced freeze of $10 billion in federal childcare and family assistance grants for five states (California, Colorado, Illinois, Minnesota, and New York). Courts have continued to stop federal aid freezes while cases are heard. Even if these cuts are ultimately implemented, the lost revenues would be less than 1% of the combined budgets for the five states.

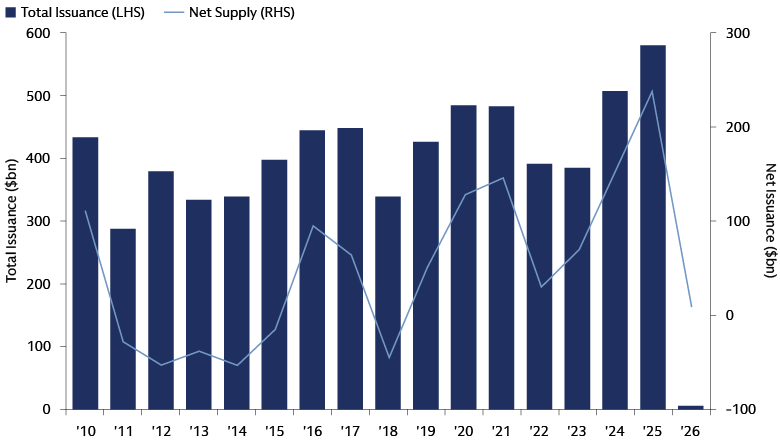

We expect new issue supply to have another record year given costly infrastructure projects need funding. There should be consistent demand as investors continue extending their duration as the Fed resumes an easing cycle.

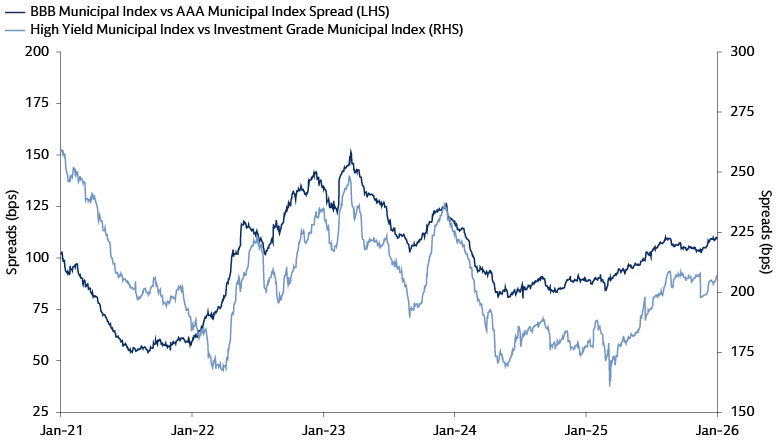

Current valuations of both investment grade and high yield municipals appear reasonable based on stable credit fundamentals and attractive absolute yields.

Credit selectivity remains a critical driver of outperformance with spreads near their five-year average. The strong economy and healthy reserve balances have credit well positioned to withstand idiosyncratic events.

Supply: Strong Issuance

January new issue supply amounted to $34 billion ($32 billion tax-exempt and $2 billion taxable). This was 7% lower than January 2025 volumes and 15% lower than last month.

Weekly new issuance volumes in January ranged from $4 billion to $12 billion. Notable deals include $1.6 billion Commonwealth of Pennsylvania, $1.5 billion New York City Transitional Finance Authority, and $968 million University of Texas. Supply fell in the last week of the month due to the FOMC meeting.

Source: Goldman Sachs Asset Management. The Bond Buyer, Barclays. As of January 31, 2026.

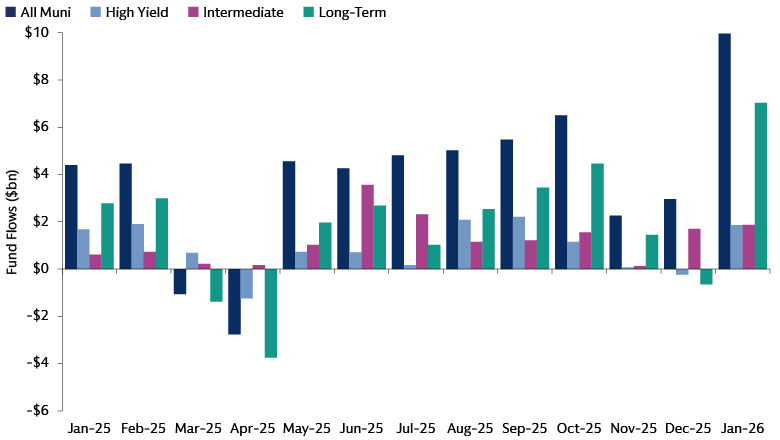

Demand: Positive Flows

January had positive weekly inflows for all four weeks. On average, each week had $1.5 billion worth of inflows based on weekly reporters’ data.

January saw strong demand for investment grade and longer duration munis. Year-to-date fund inflows have totaled $9.9 billion, with most of those inflows to ETFs and investment grade munis.

Source: Goldman Sachs Asset Management. Refinitiv. As of January 31, 2026.

Spreads: Moved Wider

Both investment grade spreads and high yield spreads drifted wider in January. Investment grade spreads increased 4 bps to 109 bps and high yield spreads increased 8 bps to 207 bps.

Within high yield, all sectors showed positive performance. Puerto Rico and tobacco were the biggest gainers, up 2.18% and 1.61% respectively.

Source: Goldman Sachs Asset Management, Bloomberg. As of January 31, 2026.