Retirement Survey & Insights Report 2025

New Economics of Retirement: New Solutions Provide a Ray of Hope

In our annual Retirement Survey & Insights Report, we are pleased to present findings that may challenge conventional wisdom about retirement preparedness in America. While many acknowledge the looming retirement crisis, the traditional advice to simply save more may fail to account for the complex and evolving realities faced by millions of Americans.

This year’s report introduces the "new economics of retirement,” as we grapple with the question “does the retirement math still work?” The report illustrates how rising costs and competing financial priorities are fundamentally reshaping the retirement planning landscape and making affordability a central concern for savers nationwide. As these trends persist, we examine the true feasibility of achieving retirement readiness and explore actionable solutions to help individuals and families navigate these shifting dynamics.

A significant structural shift is reshaping how individuals must approach saving for retirement. This shift is largely driven by competing priorities that now consume a larger percentage of income, leading to profound lifestyle changes and creating substantial headwinds for meeting traditional retirement saving goals.

Optimism appears to be growing about retirement preparedness, buoyed by market growth and a strong economy. This optimism may, however, be tempered by the reality that many have not yet encountered the full spectrum of competing financial pressures. While confidence may be improving, planning and resilience remain essential to overcome the challenges ahead.

A key question of whether retirement is becoming unaffordable for Americans living paycheck to paycheck, who often make limited saving progress.

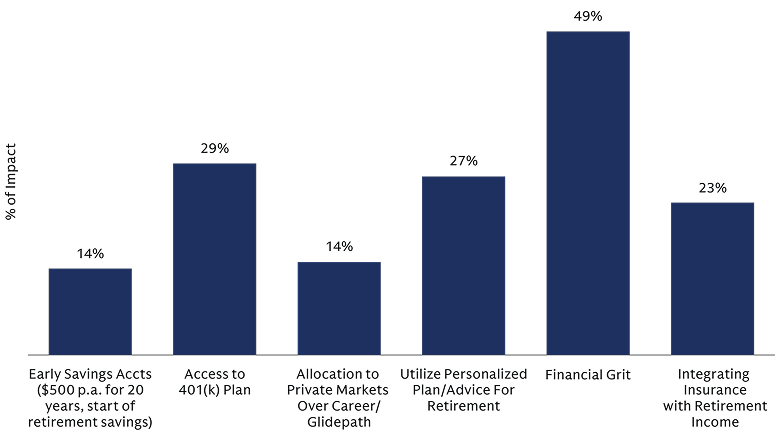

Amid mounting retirement headwinds, there’s a clear ray of hope: thoughtful plan design and policy innovations can measurably improve outcomes. We quantify both the drag from competing priorities and the lift from targeted solutions—earlier and more consistent saving, personalized advice and defaults, integration of protected lifetime income/insurance, and strengthening individual resilience through Financial Grit—that together drive materially better retirement readiness.

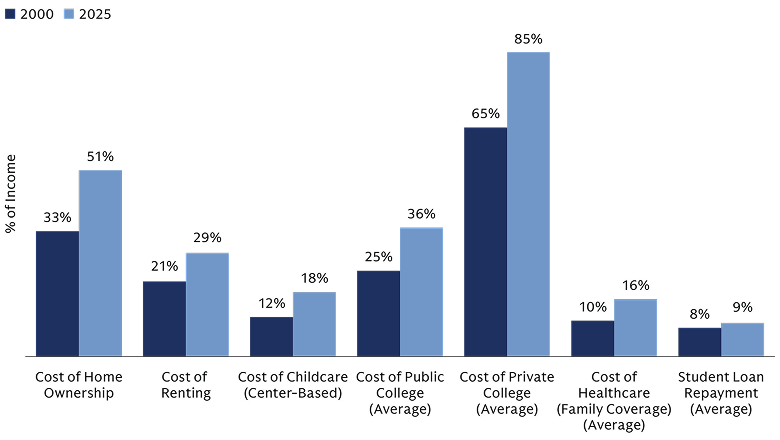

Structural Shift in the Costs of Financial Priorities Squeezing Retirement Saving

The cost of basic needs has increased dramatically since 2000, outpacing by far the median wage growth. As the cost of expenses such as housing, childcare, education and healthcare has grown, it has narrowed the gap between income and expenses, leaving little to save for retirement.

As this gap closes, and discretionary income decreases, many wonder how they will be able to save for and afford life in retirement. For those workers who responded to our survey, a significant portion said that these priorities affect their ability to save for retirement.

Please see endnotes for various sources for the chart above.

New Solutions Can Improve Retirement Outcomes

A range of innovative financial solutions are emerging that can help individuals counteract the pressures that often undermine long-term retirement planning. Collectively, these solutions as further outlined in the report on page 24 can empower individuals to "push back" against financial headwinds, improve retirement readiness, and build greater resilience for the future.

Source: Goldman Sachs Asset Management. The chart above is for illustrative purposes only based on certain assumptions, hypothetical information, estimates, projections and statements regarding certain life events of a hypothetical retirement saver. This does not reflect results of any Goldman Sachs product. If any assumptions used do not prove to be true, results may vary substantially. Please refer to page 34 in the end notes for additional disclosure.

Methodology & Respondents

Our findings are from 5,102 individuals surveyed in July 2025 and provide insights from a diverse set of perspectives, including (i) working individuals (3,588 working individuals across generations), and (ii) retired individuals (1,514 retired individuals ages 45-75).

To better understand how people make retirement savings and advice decisions in the face of many competing priorities, we engaged behavioral economics firm, Escalent. Escalent helped develop key questions in our survey to analyze Financial Grit among other behavioral characteristics discussed in this report.

We also partnered with Escalent to survey 250 plan sponsors who work for an organization that offers a 401(k) or 403(b) plan to employees and have at least $300M in plan assets (44% of our plan sponsor sample had above $1B in plan assets). The plan sponsors were senior level decision-makers that were responsible for plan design and/or administration or for selecting and/or evaluating plan providers.

Notes related to Cost of Basic Needs Chart

· Median Household Income (after-tax): 2000: Median household income is $42,148 and assume effective tax rate is 18%; 2025: Median household income is $83,730 and assume effective tax rate is 18%; Source: US Census Bureau Median Household Income, Goldman Sachs Asset Management

· Cost of Home Ownership: 2000: Median home price: $119,600, 8% mortgage rate, 20% down payment, Insurance estimate - $500, annual maintenance cost 1% of home value, taxes 1.1% of home value; 2025: Median home price: $410,800, 6.5% mortgage rate, 20% down payment, Insurance estimate - $1500, annual maintenance cost 1% of home value, taxes 1.1% of home value: Sources: “https://fred.stlouisfed.org/series/MSPUS” Federal Reserve Bank of St. Louis, US Census Bureau, Goldman Sachs Asset Management

· Cost of Renting: 2000: Median gross rent: $602 monthly; 2025:Median gross rent: $1638 monthly: Source: US Census data, Goldman Sachs Asset Management

· Cost of Child Care (Center-based): 2000: Median cost center-based childcare: $4,000 annually; 2025: Median cost center-based childcare: $12,500 annually; Source: Child Care Aware, Goldman Sachs Asset Management

· Cost of Public College: 2000: Average tuition $3,510; average room and board $4,960. 2025: Average tuition $11,610; average room and board $13,300; Source: College Board, Goldman Sachs Asset Management

· Cost of Private College: 2000: Average tuition $16,332; average room and board $6,209. 2025: Average tuition $43,350; average room and board $15,250; Source: College Board, Goldman Sachs Asset Management

· Cost of Student Loan: 2000: Average federal loan balance $16,530; Interest rate assumption 6.9%, loan term assumption 10 years. 2025: Average federal loan balance $39,075; Interest rate assumption 6.4%, loan term assumption 10 years. Source: National Association of Colleges and Employers, Goldman Sachs Asset Management

· Cost of Healthcare: 2000: average employee paid healthcare premiums $1,715; estimated out of pocket expense $1,776 (assume three family members). 2025: average employee paid healthcare premiums $6,269; estimated out of pocket expense $4,542 (assumes three family members). Source: Kaiser Family Foundation, Goldman Sachs Asset Management