Riding the Tide: The Strengthening Case for Emerging Markets Debt

The Factors Setting the Table for EMD

Emerging markets, like many other asset classes, have benefited this year from a broad diversification away from US assets given growing uncertainty over US tariffs and fiscal policy. EMFX has appreciated against the dollar by 7.4% year-to-date.1 The dollar concluded its worst first half of a year in over half a century, for example, and even fell during risk-off periods, such as in June (-2.5%), when geopolitical tensions in the Middle East were rising.

The potential for more US dollar weakness, coupled with the prospect of lower US interest rates, could constitute a tailwind for EMD across the board for a number of reasons; a weaker dollar could support EM local rates and currencies as well as improve debt servicing for EM sovereigns and corporates, for example. Stability in EMFX and/or strength also provides space for EM central banks to cut without concerns around financial stability, which eases financial conditions in emerging markets. A weakening dollar could also prompt investors to diversify their holdings internationally, driving portfolio and foreign direct investment into emerging markets, which in turn stimulates EM growth and strengthens EM currencies.

Faster-growing EMs can offer investors an opportunity to diversify their portfolios away from slower growing developments, particularly if they deem that US exceptionalism is coming to an end. The IMF projects the growth differential versus developed markets (DMs) to expand to 2.6% for the full year 2025, up from 2.5% in 2024.2 This dispersion in economic paths renders the global bond opportunity set richer than it has been in a long time.

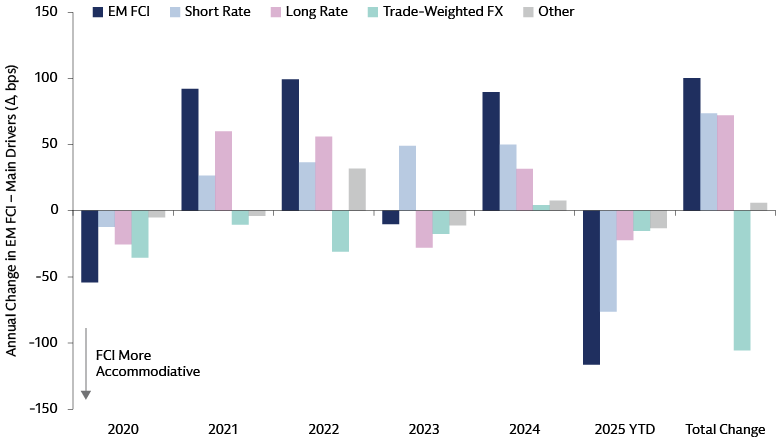

High real rates and FX stability/appreciation support plenty of room for EM central banks to cut rates and EM stand to benefit from Fed easing. Historically, US rate cutting cycles have often led to EM outperformance. The ongoing easing cycle has also driven a significant easing of financial conditions in emerging markets this year. Further cuts and ongoing US dollar weakness could further ease conditions, which provides a positive impulse to growth.

Source: Goldman Sachs Asset Management, Goldman Sachs Global Investment Research, as of end August 2025. ”Other” contains Equities, Credit Spread, and Debt-weighted FX.

EM Well Positioned with Solid Underpinnings

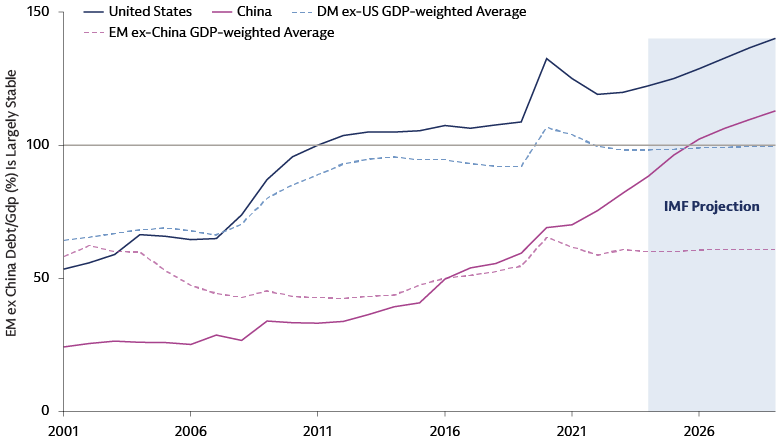

Both sovereign and corporate issuers in EM also stand on solid financial footings, which we believe puts them in a good position to capitalize on this more favorable macroeconomic backdrop. General government gross debt as a percentage of GDP is 76.6% and 60% in EMs and EM ex-China, respectively, compared with 110.4% for DMs, and EM ex-China debt-to-GDP has remained relatively stable since the global financial crisis.3 We acknowledge, however, that some countries face idiosyncratic fiscal risks and believe active management and a bottom-up research approach are particularly important to identify pockets of concern at an early stage.

This prudent debt management has also been evident among EM corporates. Net leverage for investment grade global EM corporates fell to around 1.0x in 2024 from more than 1.5x in 2013. By contrast, European and US investment grade corporate net leverage has increased from the same level to almost 3.0x over the same period.4

Source: Goldman Sachs Asset Management, IMF World Economic Outlook (October 2025).

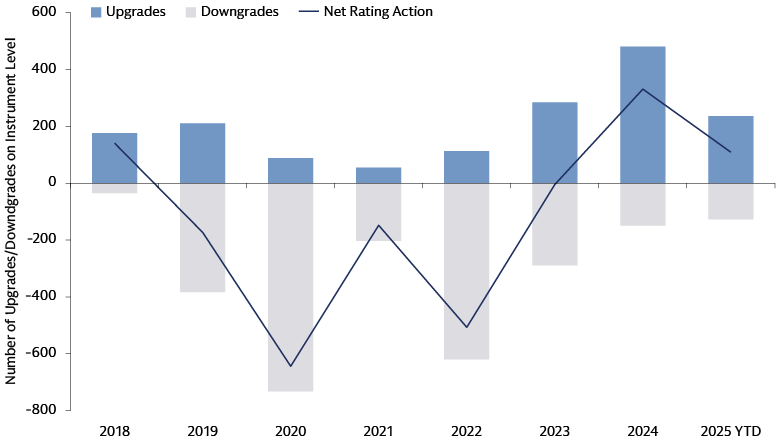

The improving picture for EM sovereign issuers, in particular, is reflected in the increased occurrence of credit rating upgrades rather than downgrades. Net rating actions on EM sovereign instruments turned positive in 2023 to upgrades, the number of which increased significantly in 2024 with Paraguay, Azerbaijan, Oman and Serbia all obtaining investment grade ratings. We believe that this momentum in creating ‘rising stars’ can continue, particularly if potential policy easing on the horizon gives EMs the chance to refinance their debt burdens at lower interest rates.

Source: Goldman Sachs Asset Management, JP Morgan. As of 31 August 2025. On instrument level.

A Diverse Opportunity Set for Active Investors

EMD has also evolved from a niche asset class to a core component of the fixed income opportunity set with 100 investible countries, compared with only eight when the Emerging Markets Bond Index launched in 1995. The universe ranges from high-quality countries characterized by sound macroeconomic platforms, institutional stability, and depth of financial markets close to G10 economies, to distressed economies engaging in debt restructuring efforts. Regional growth drivers differ significantly as well, with CEE economies potentially benefitting from Germany’s fiscal expansion whilst Asian economies have a strong domestic consumer base.

The outlook of the asset class remains strongly anchored in the carry it offers: a more dovish Fed outlook, a potentially weaker USD and spread tightening potential on the back of fundamental strength evidenced by rating upgrades. Given EMD’s breadth and low correlations to other asset classes, we think that it could be an effective strategic allocation within a global portfolio, particularly as diversification away from US assets continues.

1Source: EMFX gains versus the dollar are measured by the FX component of the USD YTD Returns of the GBI-EM Global Diversified local currency index. As of 24 October 2025.

2Source: International Monetary Fund, World Economic Outlook. As of October 2025.

3Source: International Monetary Fund, World Economic Outlook. As of October 2025.

4Source: JP Morgan. As of end August 2025.