Beyond the Index: Active Fixed Income Investing in Turbulent Times

In unsettled markets, it’s more important than ever to know what you own. For fixed income investors seeking to recalibrate their portfolios amid global trade tensions, policy uncertainty and central bank easing, this means taking a hard look at the benchmarks that underlie most mutual and exchange-traded fixed income funds. The composition of key benchmarks has changed over the past decade, potentially affecting the long-term performance of fixed income funds and portfolios.

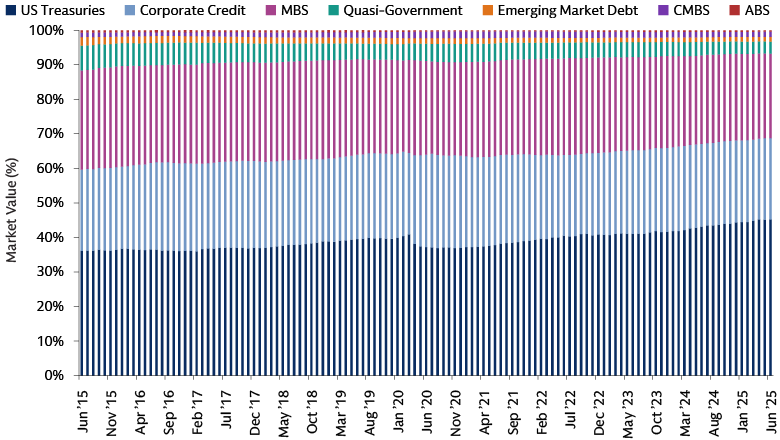

We analyzed the investment implications of benchmark evolution based on the Bloomberg US Aggregate Bond Index, a widely used measure of performance for US dollar-denominated, investment-grade (IG) fixed income securities. The headline finding is that the weight of Treasuries in the index has risen by 9% since 2015 to 45.2%. This increase has come at the expense of other sectors, most notably mortgage-backed securities (MBS), whose share of the index has declined by 4% over the 10-year period.1

In our view, this shift underscores the importance of an active, multi-sector approach for investors seeking attractive income and risk-adjusted returns in IG fixed income. Sectors that have proven more resilient during recent market turmoil, including some structured products, may now be underrepresented in passive, index-tracking products. We think it’s critical for investors to broaden their scope and explore corners of the market that potentially offer a compelling value proposition, but are often overlooked by index-oriented strategies.

Breaking Down the Index

The composition of the Bloomberg US Aggregate Bond Index has shifted considerably since 2015. The weight of Treasuries in the index has increased, making the index more sensitive to US monetary policy. The weight of three key sectors has decreased: in addition to MBS, government-related securities have slipped by 3.9% and emerging-market debt by 1.1%. Three other sectors – corporate credit, commercial mortgage-backed securities (CMBS) and asset-based securities (ABS) – are little changed.2 This evolution over time is shown in the following chart.

Source: Bloomberg, Goldman Sachs Asset Management. As of June 30, 2025.

The result of this evolution is that nearly half of the index is now allocated to government and government-related debt. For investors, this means that index-tracking products may lag the returns of more credit-intensive sectors of the bond market that can offer additional yield and spread pick-up.

Other key aspects have also changed over time, altering the bond math that drives the index. For example, the effective duration of the index now stands at six years, well above its long-term average of just over five years. The yield of the index has risen to 4.7%, slightly higher than the historical average.3 The upshot is that investors are now compensated more than they were previously, thanks to the higher yield, but the elevated duration means the index carries greater interest-rate risk.

Considering all these changes, we think investors should take a hard look at their strategies to determine which remain viable in today’s environment and whether the components of the benchmark are positioned to deliver the diversification they seek from fixed income.

The Case for Structured Products

Many fixed income benchmarks have not evolved to reflect the importance of structured products that potentially offer attractive performance and the benefits of diversification in fixed income portfolios. For example, collateralized loan obligations (CLOs) and CMBS have delivered resilient risk-adjusted returns and attractive income amid recent market turbulence. Index-focused strategies may miss out on opportunities such as the following:

- CMBS often bundle together a number of commercial properties (conduit) or reference a single asset or borrower (SASB). As a result, their performance is highly dependent on the performance of those specific properties. We find value in multi-family properties, which have demonstrated resilience, thanks largely to sustained demand for rental units which has supported occupancy rates and rental income. Factors such as rising home prices, higher mortgage rates, and limited housing supply contribute to this trend. Robust security selection is critical in this sector, particularly in the office sector, where we focus on CMBS backed by recently originated loans on high-quality office buildings.

- CLO pricing dynamics are often influenced by technicals in the market driven by who the buyers are – increasingly exchange-traded funds. This can create price dislocations and opportunities for active investors. We favor CLOs with AAA ratings; these offer the lowest yield but provide the highest level of credit protection. The credit curve has been flat, so we have been focusing on select up-in-quality opportunities.

- ABS are generally more sensitive to credit risks as well as broader macroeconomic factors, particularly those that affect consumers. Concerns about consumer health should be a primary consideration when evaluating ABS. Subprime ABS are particularly susceptible to economic downturns due to the weaker credit profiles of their borrowers, though senior ABS offer better protection against these risks.

We expect increased dispersion within and across spread sectors, making individual asset selection crucial. External shocks will inevitably affect sectors and industries differently, underscoring the need for active management.

Stay Nimble in Fast-Moving Markets

The first half of 2025 has seen markets whipsaw in response to policy announcements, notably on US tariffs. Market events such as the Moody’s downgrade of US sovereign debt have added to investor concerns despite having little impact on markets. In this dynamic environment, we think fixed income investors should adopt a flexible approach that looks beyond indexes to consider a broader global opportunity set. Given higher rates in most bond markets compared with cash and core bonds, a dynamic approach that integrates sector rotation, focuses on income, and considers the relative value among spread sectors may be a sensible way to capture income and offer better diversification to risk assets.

1 Bloomberg. As of June 30, 2025.

2 Bloomberg. As of June 30, 2025.

3 Barclays Live. As of May 31, 2025.