Sustainable Investing in Emerging Markets: Making an Impact With Active Fixed Income ETFs

For fixed income investors, the case for allocating capital to emerging markets is compelling. With appealing valuations compared with other fixed income sectors, emerging markets offer the potential for generating attractive income and total return. Investing also has the potential to make an impact in countries that are among the most vulnerable to the combined impacts of climate change and widening economic inequality, and where the financing shortfall for sustainable development stands at $4 trillion a year.1

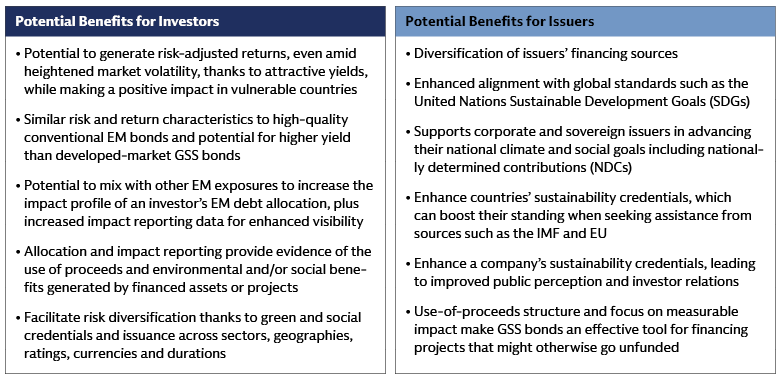

While increased sustainable investment in emerging markets is urgently needed, targeted products for financing environmental and social projects have not always been widely available. The rise of green, social and sustainability (GSS) bonds is changing that. These bonds offer investors transparency around the use of proceeds, annual impact reporting and opportunities for engagement with issuers. With financial characteristics similar to those of conventional bonds, GSS bonds can complement a portfolio’s existing emerging-market (EM) allocation and strengthen its sustainability and impact profile. For EM governments and companies, GSS bonds can diversify their sources of financing and bolster the credibility of their sustainable-development plans.

These benefits for investors and issuers have combined to drive rapid growth in EM GSS bonds, with the market topping $1 trillion in 2024 across all currencies.2 The proceeds of these bonds are being deployed to advance environmental objectives in areas such as renewable energy and sustainable water as well as social projects including building affordable housing and expanding access to healthcare.3 Issuers from developed countries account for the largest share of the global GSS bond market, but EM issuers are increasingly active and now make up about a quarter of the market.4

At Goldman Sachs Asset Management, we think this rapid growth allows investors to deploy capital in regions that face the most immediate climate threats, boosting the real-world impact of their investments. In our view, navigating the nuances of emerging markets requires an active management approach to help identify the best opportunities and manage underwriting challenges. In addition to mutual funds, the potential advantages of active management can be accessed through a growing number of exchange-traded funds that also offer intraday trading, cost-effectiveness and enhanced transparency around holdings.

Understanding the Market

For investors who know developed market GSS bonds, some aspects of the EM GSS market will be familiar, though there are important differences that could have performance implications. For example, financial firms are the largest issuers of GSS bonds in both emerging and developed markets, followed by non-financial corporates, but corporate GSS issuers account for a slightly larger share of the EM market.5 This is significant because EM corporate bonds generated a total return of 7.6% in 2024, boosted by spread tightening and attractive income that drove investor demand. They have delivered one of the strongest Sharpe ratios in fixed income since 2010.6

Emerging- and developed-market GSS bonds also differ significantly in currency composition. The euro is the most common currency of denomination in developed markets, while in emerging markets the US dollar tops the list.7 As a result, the decision to invest in local- or hard-currency bonds is a key issue, especially amid ongoing tariff tensions and market volatility. For investors concerned about currency risk, the EM GSS bond market offers expanding hard-currency opportunities, with annual issuance increasing from just over $15 billion in 2019 to $105 billion last year.8

The Investment Case

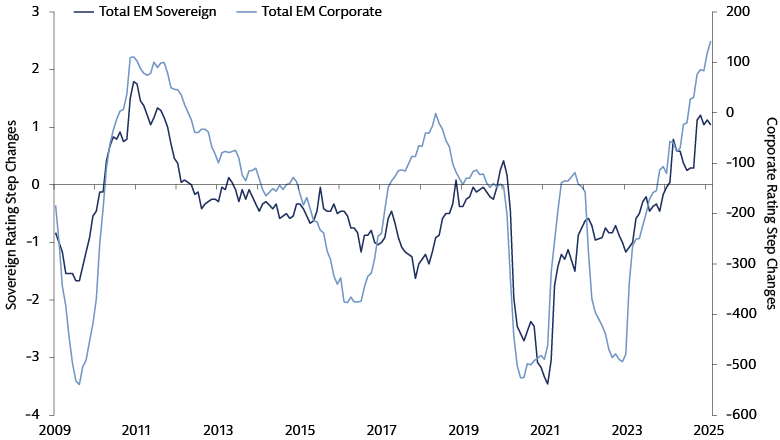

The case for investing in EM GSS bonds has strengthened in recent years as the quality of EM bonds generally has improved. Ratings have been on the rise, especially in corporate issuance, as the following chart shows.

Source: Goldman Sachs Global Investment Research, J.P. Morgan Markets. As of February 28, 2025.

We think this reflects improvement in fundamentals, also evidenced in key credit metrics. Net leverage has remained at cycle lows, for example, demonstrating financial discipline. Profit margins have increased, driven by sales growth and easing cost pressures, which has boosted the financial standing of EM companies.

As a result of these improvements, default rates are trending lower.9 In our view, robust fundamentals and improved credit trends will allow EM companies to withstand external headwinds including risks from US tariffs and elevated trade-policy uncertainty.

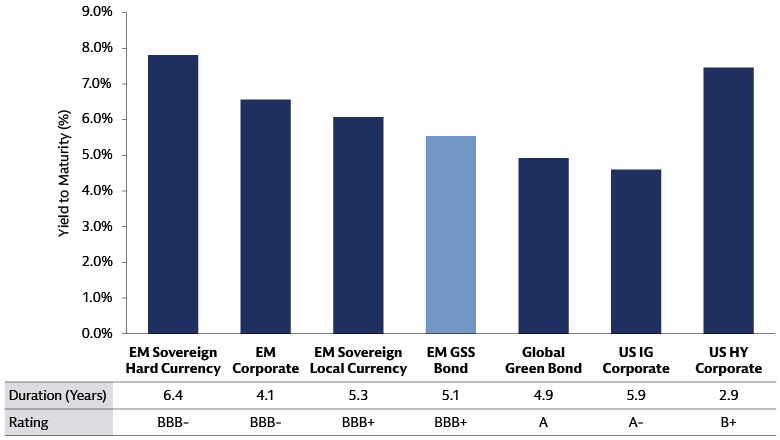

The case for investing in EM GSS bonds can be seen by comparing the hard-currency EM GSS benchmark with other relevant benchmark indices in emerging and developed markets. EM GSS bonds offer higher average quality than the aggregate EM sovereign and corporate bond hard-currency indices (BBB+ compared with BBB-) while still offering a higher yield than the global green bond index.

Source: J.P. Morgan (for EM GSS Bond), Bloomberg (for remaining indexes). As of May 30, 2025. All indexes are in USD or hedged to USD.

Note: The values for average yield, rating and duration refer to the following indexes: JPMorgan EMBI Global Diversified Index (EM Sovereign Hard Currency), J.P. Morgan CEMBI Broad Diversified Core Index (EM Corporate), JP Morgan GBI-EM Global Diversified Index (EM Sovereign Local Currency), JPMorgan EM Credit Green, Social and Sustainability Bond Diversified Index (EM GSS Bond), Bloomberg MSCI US Green Bond Index (Global Green Bond), Global Aggregate Corporate Index (US Corporate IG), Bloomberg US Corporate High Yield Index (US Corporate HY).

EM GSS bonds offer a range of potential benefits to investors and issuer that are summarized in the following tables:

Importance of Active

The emerging-market GSS bond universe is extremely diverse, encompassing investment-grade, high-yield and distressed credit. To generate returns we think it is critical to have a robust green, social and credit underwriting process together with dynamic portfolio construction. Active credit selection begins with the issuer’s GSS framework, which should explain the alignment of their bond-issuance program with leading industry standards.10 Issuance should also align with the issuer’s own sustainability strategy.

Fundamental analysis of cashflows and balance sheet are needed to determine the issuer’s forward trajectory. Issuers on an improving trajectory can provide an opportunity to generate returns through spread compression.11 High-quality issuers with stable macroeconomic backdrops are a source of income for the portfolio, while those with idiosyncratic stories provide risk uncorrelated to market returns. Finally, deteriorating credits are best avoided for capital preservation.

While the quality of disclosures from emerging-market issuers has improved, they can still vary widely in terms of transparency and the level of detail provided. As a result, another critical aspect of active management involves targeted dialogue with issuers to share industry best practices and push for improved data disclosure. This dialogue can also provide essential information for the assessment of bonds for potential investment.

For years, investors seeking the benefits of active management turned to mutual funds. More recently, however, the rise of actively managed exchange-traded funds has offered an alternative. ETFs provide an efficient way to gain exposure to emerging fixed income markets, where the variety of issuers and structural inefficiencies make specialist research and rigorous bottom-up security selection essential. These investment vehicles also offer the flexibility and liquidity of intraday trading on exchanges at a known price. For investors concerned about currency risk, these vehicles often offer hedged share classes in specific currencies.

Sovereign Case Study: Indonesia

In 2018, the government of Indonesia issued the first sovereign green sukuk,12 expanding the sustainable fixed-income market for investors in instruments that comply with Islamic religious law, known as sharia.13 Since that debut, Indonesia has become one of the largest emerging-market GSS issuers, with the equivalent of nearly $9.5 billion in securities outstanding. The Ministry of Finance has built out a full yield curve that includes euro-denominated sustainability bonds and green sukuk in both US dollars and Indonesian rupiah.14 The country’s GSS frameworks clearly define the use of proceeds, set out the process for project evaluation and selection, and provide for allocation and impact reporting.15

Indonesia’s issuance of GSS instruments is aligned with its national program to advance the UN’s Sustainable Development Goals. On the environmental side, this includes projects in renewable energy, sustainable water and waste management. Social priorities include job creation, food security and improving the quality of healthcare.16 Projects that have received financing under the GSS program include the construction of dry dams as part of a flood-prevention program in and around the capital, Jakarta. On Sulawesi Island, the government is using GSS proceeds to help build a 2,000-kilometer railway network that will connect the island‘s provincial capitals. For a country composed entirely of islands, projects aimed at managing and preserving the marine environment are a priority. Examples of projects eligible for financing with GSS instruments include rebuilding fish stocks, rehabilitating coral reefs and replanting mangrove forests and seagrass meadows.17

Corporate Case Study: Cemex

Cemex, based in Mexico, is a multinational producer of cement, ready-mixed concrete and aggregates for use in construction, a key sector in the global effort to reduce greenhouse-gas (GHG) emissions.18 The manufacture of cement alone is responsible for about 6% of global GHG emissions, and emissions from the sector today are higher than they were in 2015.19 In response, Cemex has committed to reduce its emissions to net zero by 2050, becoming one of the first companies in the cement industry to have its net zero road map validated by the Science-Based Targets initiative.20 The company has reduced its Scope 1 specific cardon-dioxide emissions by 13% since 2020.21

Cemex issued its first green bond in 202322 and allocated the majority of proceeds toward projects in renewable energy and pollution prevention and control. These include the acquisition of clean energy required for its cement operations, thereby contributing to the company’s target of meeting 65% of its electricity needs for cement operations with clean energy by 2030. Cemex also plans to reduce carbon-dioxide emissions from “clinker,” an intermediate product in the manufacture of cement. Clinker typically consists of limestone and clay, which are processed at high temperatures in a kiln. During this process, the limestone releases carbon dioxide. Clinker production accounts for at least 60% of emissions in the cement industry. Cemex is addressing this by using limestone alternatives known as decarbonated raw materials.23

Agile and Active

For sustainable investors, the rapid expansion of green, social and sustainability bonds in emerging markets offers an opportunity to support some of the world’s most vulnerable countries as they respond to climate change and social challenges. Identifying opportunities for potential returns and real impact in this diverse market requires an active approach underpinned by robust credit, green and social underwriting. The rise of active ETFs provides investors with a flexible way to gain exposure to EM GSS bonds, combining the potential advantages of active management with the benefits of the ETF wrapper.

1 “Financing for Sustainable Development Report 2024: Financing for Development at a Crossroads,” United Nations Inter-agency Task Force on Financing for Development. As of April 9, 2024.

2 Bloomberg, Goldman Sachs Asset Management. As of December 31, 2024. Excluding supranational issuers.

3 GSS bonds are known as use-of-proceeds bonds because the funds they raise are earmarked for projects that are deemed to have environmental and social benefits. This transparency of purpose has been instrumental in establishing the credibility of GSS bonds, contributing to their growth. Green bonds are used to finance projects or activities with a clear environmental purpose. A list of eligible project categories is contained in the Green Bond Principles, a set of voluntary industry standards published by the International Capital Market Association. See “Green Bond Principles: Voluntary Process Guidelines for Issuing Green Bonds,” ICMA. As of June 2022. Social bonds can be used to finance a wide range of projects with social benefits. For eligible project categories, see “Social Bond Principles: Voluntary Process Guidelines for Issuing Social Bonds,” ICMA. As of June 2023. Sustainability bonds are used to finance both green and social projects. See “Sustainability Bond Guidelines,” ICMA. As of June 2021.

4 Bloomberg, Goldman Sachs Asset Management. As of December 31, 2024. Excluding supranational issuers.

5 Bloomberg, Goldman Sachs Asset Management. As of December 31, 2024.

6 For returns, JPMorgan CEMBI Broda Diversified Index as of end-2024. Sharpe ratio based on annualized weekly returns as of February 14, 2025.

7 Bloomberg, Goldman Sachs Asset Management. As of December 31, 2024.

8 Bloomberg, Goldman Sachs Asset Management. As of December 31, 2024. In this case, the term “hard currency” refers to issuance in three currencies: US dollar, euro and pound sterling.

9 Source: JPMorgan, based on the CEMBI Broad Composite Index. As of December 2024.

10 The Green Bond Principles, Social Bond Principles and Sustainability Bond Guidelines, published by the International Capital Market Association, are the most widely adopted standards in the industry.

11 Spread compression refers to the narrowing of the difference in yield of two types of bonds, typically a riskier type such as a corporate bond and a less risky type such as a Treasury bond.

12 ”Indonesia’s Green Bond & Sukuk Initiative,” United Nations Development Programme. As of October 16, 2018. A sukuk is a financial instrument similar to a bond that complies with sharia law, which forbids the payment of interest. Instead, sukuk proceeds are used to purchase an asset, which the investor partially owns. Investors receive a share of the profits generated by the asset in place of interest payments, and the issuer buys back the asset at par value when the term of the sukuk expires.

13 The first corporate green sukuk was issued in 2017 by Tadau Energy, a Malaysian renewable energy group, with the proceeds used to finance a solar power plant. See ”Solar Energy Firm Tadau Raises RM250m via Malaysia’s First Green Sukuk,” Tadau Energy press release. As of July 28, 2017.

14 Bloomberg, Goldman Sachs Asset Management. As of December 31, 2024.

15 ”SDGs Government Securities Framework,” Republic of Indonesia. As of August 2021. In 2018-2021 (prior to the publication of the SDGs framework), green bonds and sukuk were issued under the ”Green Bond and Green Sukuk Framework,” Ministry of Finance. As of January 2018.

16 ”SDGs Government Securities Framework,” Republic of Indonesia. As of August 2021.

17 Ibid.

18 “The Global Cement Challenge,” Rhodium Group. As of March 21, 2024.

19 “The Breakthrough Agenda Report 2024,” International Energy Agency. As of September 27, 2024.

20“CEMEX 2050 Net-zero Roadmap Validated by SBTi,” CEMEX press release. As of December 8, 2022.

21 “2023 Cemex Green Financing Instruments Report,” Cemex. As of February 2, 2023. For accounting and reporting purposes, many companies break their emissions into three “scopes” defined in the Greenhouse Gas Protocol. Scope 1 covers direct GHG emissions from sources owned or controlled by the company.

22 “CEMEX announces pricing of U.S.$1.0 billion of green subordinated notes with no fixed maturity,” CEMEX press release. As of March 9, 2023.

23 “2023 Cemex Green Financing Instruments Report,” Cemex. As of February 2, 2023.