Asset Management Outlook 2025: Broader Equity Horizons

This article is part of our 2025 Outlook: Reasons to Recalibrate.

Broader Equity Horizons

At the halfway point of 2024, we highlighted some potential opportunities for investors to broaden their horizons within and across equity markets. While the breadth of stock market returns has marginally improved in the second half of the year, equity market concentration remains near historic highs.1 We expect the return structure of the stock market to broaden in 2025 against a backdrop of rate cuts and resilient economic growth, providing motivation for diversification across equity markets. Identifying undervalued and long-term opportunities in the US, internationally (both in developed and emerging markets) and across the market cap spectrum, may prove rewarding. In our view, heightened return dispersion and volatility will make an active investment approach, diversification and solid risk management essential.

US concentration risk: Getting more out of your core

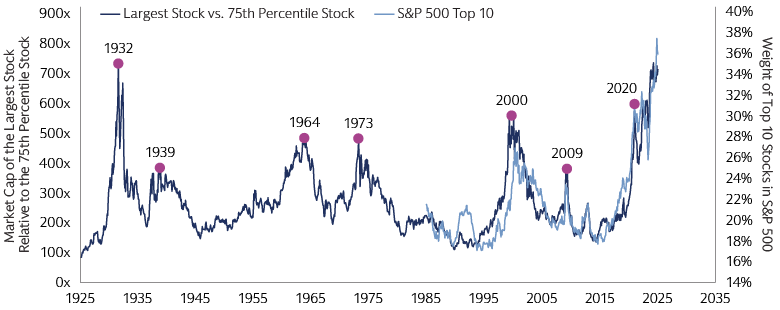

The US equity market remains near its highest level of concentration in 100 years.2 Large US tech companies have long been the most important driver of equity market returns, and for valid reasons: their earnings have outstripped those of the global market for more than a decade.3 However, since 2022, mega-cap outperformance has owed much to the hopes and aspirations about artificial intelligence (AI).4 In many cases, mega-cap fundamentals still look solid, and we believe AI is a transformational technology. In our view, the level of market dominance is not sustainable. With the performance of the S&P 500 Index strongly dependent on the prospects of a small number of stocks, passive allocations to US large cap indices may pose risks to broader portfolios.

Despite acute equity concentration risk, the US equity market remains one of the most attractive in the world due to the US’s resilient economic growth, persistent corporate earnings growth, and a strong culture of promoting innovation. If implemented, we believe lower corporate tax rates and lighter-touch regulation under a second Trump presidency would be favorable for US stocks. The need to rebuild US manufacturing capabilities also provides a tailwind for the “picks and shovels” of reindustrialization—companies designing, building and outfitting the “factories of the future”. These firms represent a large universe of investment opportunities, spanning several economic sectors.

As the market calls for broader participation, a well-rounded and differentiated approach to investing in the US large and mid-cap space in 2025 may lead to positive return outcomes. We believe active management can help identify less-obvious businesses with quality attributes of durable growth, attractive valuations, excellent management teams, and compelling financials. Rigorous stock selection combined with quantitative insights on quality, volatility and valuation metrics may help drive attractive risk-adjusted performance across sectors.

Source: FactSet, Compustat, Goldman Sachs Global Investment Research. As of September 30, 2024. Universe consists of US stocks with price, shares, and revenue data listed on the NYSE, AMEX, or NASDAQ exchanges. Series prior to 1985 estimated based on data from the Kenneth French data library, sourced from CRSP, reflecting the market cap distribution of NYSE stocks.

The case for international diversification

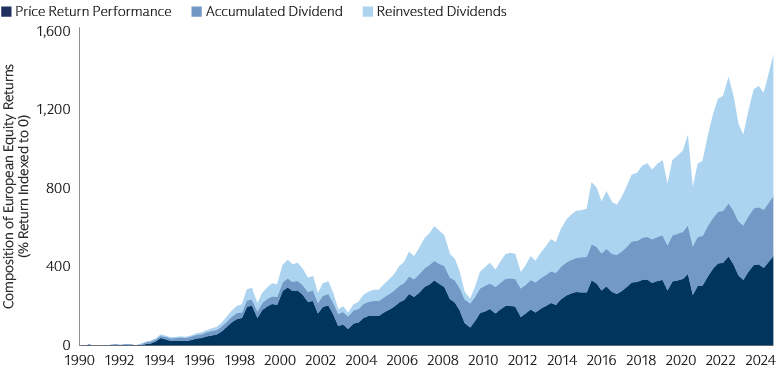

Beyond the US, developed equity markets across regions provide opportunities for differentiated exposures. For example, the technology sector accounts for a smaller proportion of equity indices covering Europe and Asia than US equity indices.5 Financials, by contrast, are better represented, including European banks which have recently outperformed the Magnificent 7. Areas of the market such as healthcare, green energy and luxury goods contain companies that either do not have a US equivalent or appear more attractively priced. Moreover, the return profile of the non-US market is quite distinct. In Europe, for example, dividends have historically been a much larger driver of the total return than in other markets. We believe there is upside potential for dividend growth given that European payout ratios remain below historical averages.6

Source: Worldscope, Datastream, Goldman Sachs Global Investment Research. As of October 31, 2024.

The international developed market equity universe is far from homogenous. The 21 developed markets captured by the MSCI EAFE (Europe, Australasia, Far East) Index, for instance, are not driven by a defined set of macro factors or an overarching theme.7 This heightens the importance of stock selection. Across non-US developed markets, we favor dividend-paying companies with sustainable returns on invested capital, strong cash flow generation, a track record of capital discipline and consistent payout history. A focus on high-quality businesses and consistent dividend payers may help to mitigate volatility and market drawdowns, which have historically been sharper in international markets than in the US. This type of defensive value approach to international developed market equities over the coming quarters may prove rewarding, particularly in Europe, where growth risks are tilted to the downside given the possibility of renewed trade tensions under a second Trump term in the US.

Small caps in the spotlight

To complement large cap exposures, we see potential to capitalize on a small cap reversal of fortune in 2025, driven by small caps’ historically large valuation discounts relative to large caps and a supportive rate cutting environment. Historically, US small caps have often outperformed large caps following the end of rate cycles, especially in soft-landing scenarios.8 A higher share of floating debt versus large caps means smaller companies may benefit disproportionately from rate reductions in 2025 as interest payments decrease. Small caps generally have a more domestic focus making them less dependent on uncertain international trade, which continues to fragment. Relative to larger businesses, smaller companies have tended to also be more insulated from negative consequences of tariffs, given their greater domestic revenue sources and shorter supply chains. We believe the less liquid, more diverse and less thoroughly researched nature of the small cap market suits active investment strategies given the potential for higher dispersion. From a fundamental perspective, access to company management teams, including while companies are still private, can provide early opportunities to uncover hidden gems before they are broadly recognized by the market once they become public. Quantitative approaches, including the application of AI techniques, may help to capture alpha and manage risks in what is a vast and diverse investment universe.

Emerging opportunities in emerging markets

We believe EM equities will constitute a significant part of a broader equity market opportunity set in 2025. From a macro perspective, non-recessionary Fed rate cuts and easing by other EM central banks should be supportive for the asset class. Strong corporate earnings growth at fair valuations also keeps us constructive, notwithstanding potentially elevated volatility from the fallout of the US election and ongoing Middle East tensions. Risks of additional US tariffs on imports could pose headwinds to EM equities, particularly to China, and other economies with high goods revenue exposure to the US. At the same time, hopes of a stimulus-led growth revival in China bode well for EMs.

More broadly, the environment may lead more investors to reevaluate how to manage Chinese equities within the context of emerging market equity allocations. Emerging markets and China used to move in tandem, but they have started to diverge significantly post pandemic. This growth divergence may widen further in 2025, owing to more favorable demographic dynamics outside of China and a shift in supply chains towards emerging market ex-China countries.

Splitting emerging market and China allocations into dedicated allocations may introduce greater flexibility to manage active views more effectively in each universe and lean more heavily into alpha opportunities. Alongside allocation decisions, finding high-quality, attractively-valued emerging market opportunities across a diverse universe requires an informational advantage to know more, act faster and potentially capture durable long-term investment performance.

China remains a dominant economic force in the global economy with a rich and vibrant equity universe. We emphasize the need to stay bottom-up and focused on quality over the long term. Opportunities can be found tied to technology innovation, a key trend benefitting the healthcare and IT sectors, or in electric vehicle production. Outside of China, countries benefitting from favorable demographics, such as India, look compelling. Elsewhere, markets like Taiwan and South Korea contain semiconductor companies crucial to AI development. Notwithstanding tariff risks in a second Trump presidency, we expect further pressure for relocation of some supply chains (or at least final assembly) from China to Southeast Asia, India, and Mexico.

India to stay stronger-for-longer

India will remain a bright spot in 2025, in our view, given its solid economy, profitable and diverse corporate universe backed by megatrends like digitalization, growth of an affluent middle class and a reform-oriented government. India has shown limited long-term correlation to previous US interest rate easing cycles, underscoring the more domestic and earnings-driven nature of India’s growth story.9 We see India as a potential beneficiary of the Trump administration among emerging markets. The country has a more domestically-driven growth profile than many other EMs, and many companies have diversified supply chains. India is also less at risk of a fallout from global trade wars, in our view, and some export product categories may in fact benefit from the new US administration’s tougher stance towards China.

We believe elevated valuations should be looked at in the context of robust corporate earnings delivery, which are sustained by resilient macro environment. Recently we have observed secular themes in India, such as more efficiency from digitization, manufacturing competitiveness as well as a cyclical recovery in sectors such as industrials and financials. Indian bank financials remain particularly strong with improving loan growth on the back of healthy macro and credit demand. We believe domestic banks also have attractive growth potential given the under-penetration of retail and micro, small and medium enterprises (MSME) credit in India.

Many sector-leading companies can be found in India’s small and mid-cap space due to the still-early stage of India’s economic development. Buoyant IPO markets have allowed many small and medium high-quality companies to go public, providing opportunities to bottom-up stock pickers. Overall, when investing in Indian equities, it is important to remember that India’s growth story is a marathon and not a sprint. We stay focused on companies with strong fundamentals that are trading at attractive valuations, which will be key to capitalize on India’s stronger-for-longer growth story.

Japan’s structural story remains intact

Since 2022 Japan’s equity market has been driven by strong earnings, corporate governance momentum and a shift to an inflationary environment.10 More recently, the market has faced some headwinds. Japanese stocks and the yen were whipsawed amid August volatility. Political change in Japan has added to uncertainty. Our constructive stance on Japan’s economy and equity market remains intact. New prime minister Shigeru Ishiba has indicated that he will continue the Kishida administration's economic policies.11 We believe this suggests further progress in corporate governance reforms. Wages in Japan continue to grow steadily,12 suggesting that the Bank of Japan's aim of a virtuous cycle of wage growth and inflation is on track, although rising labor costs could be a headwind for some companies. Following the US election result, Japanese stocks posted strong returns, led by financials and global cyclical sectors.13 We see Japan continuing to play a key role as a US defense partner and benefiting from friend-shoring trends. We favor active exposure to structural growth winners and select value opportunities. We remain focused on identifying high-quality Japanese businesses with robust fundamentals, backed by shareholder-friendly management teams with improving governance practices.

Three Key Questions

1. Can company earnings stay resilient in 2025?

We maintain our cautious optimism on the earnings outlook for 2025 and expect earnings growth to broaden beyond the Magnificent 7, beyond the US and beyond large-cap stocks. We are watching the ability of companies to protect margins on the back of continued wage pressures and lower capacity to increase prices as inflation returns to normal levels. In the US, S&P 500 margins have been a direct beneficiary of declining corporate tax rates. An extension of the previous Trump administration’s tax cuts beyond 2025 is a possibility, as is reinstatement of some expired business investment incentives. This could potentially boost S&P 500 earnings per share by as much as 4%. Overall, we continue to favor quality businesses with unique competitive advantages in their respective markets.

2. Where might opportunities emerge as AI broadens out?

Our outlook for technology is positive in 2025. We see fundamentals improving across the tech ecosystem, and easing interest rates provides additional support. In our view, some AI investment opportunities have yet to be fully recognized. We see exciting risk reward potential among “enablers” (semiconductors and semi-cap equipment providers) and “hyperscalers” (cloud providers that AI workloads run on). We also see potential opportunities related to data & security (including software companies that finetune huge amounts of data to be stored in the cloud for AI models) and applications (software and enterprises across sectors that will leverage AI broadly).

3. What strategies may help combine the benefits of both active and passive equity approaches?

For investors looking to capture the benefits of active management while preserving main features of passive investing (such as low costs and transparency to monitor risk and returns), we believe that alpha enhanced indexing approaches may provide an answer in equity markets. These approaches can be driven by systematic, data-driven techniques, coupled with enhanced risk management and the ability to integrate investor preferences to arrive at a customized portfolio. In particular, active ETFs continue to grow in popularity, providing potential cost benefits and transparent ways for investors to blend passive index exposure and active security selection.14 We believe having the right engines to power these vehicles is critical to deliver positive investment outcomes.

For more of our 2025 investment views explore A New Equilibrium, Landing on Bonds, Exploring Alternative Paths and Disruption from All Angles and the potential sources of attractive returns they could create.

1 Goldman Sachs Global Investment Research. As of October 25, 2024.

2 Goldman Sachs Global Investment Research. As of October 18, 2024.

3 Goldman Sachs Global Investment Research. As of September 5, 2024.

4 Goldman Sachs Global Investment Research. As of September 5, 2024.

5 MSCI EAFE Index. As of September 2024.

6 Goldman Sachs Global Investment Research. EURO STOXX 50. As of June 20, 2024.

7 MSCI. As of September 30, 2024.

8 FactSet, Goldman Sachs Asset Management. As of September 30, 2024. End of rate cutting cycles, starting January 1996, November 1998, June 2003, December 2008, March 2020.

9 FactSet, MSCI, Goldman Sachs GIR, Goldman Sachs Asset Management. As of August 2024.

10 Goldman Sachs Asset Management. As of October 31, 2023.

11 Goldman Sachs Global Investment Research. As of October 4, 2024.

12 Ministry of Health, Labor and Welfare (Japan), Goldman Sachs GIR. As of October 9, 2024.

13 Goldman Sachs Global Investment Research. As of November 10, 2024.

14 Reuters. As of September 27, 2024.