Evolving Thematic Landscapes and Megatrends in 2026

This article is part of our Investment Outlook 2026: Seeking Catalysts Amid Complexity

The investment landscape is being reshaped by evolving megatrends, presenting both challenges and new opportunities for strategic capital deployment. In 2026, we expect economic security to remain a priority focus for nations and corporations. This theme is being amplified by turbulent geopolitics, a new trade order, persistent inflationary pressures, and energy-intensive artificial intelligence. Meanwhile, sustainable investing is maturing with a greater focus on performance. We favor a focus on themes including renewable energy, grids, energy storage, and companies solving critical pain points, offering cost savings, or providing essential value chain links.

Economic Security

Supply chains, resources, and national defense take center stage

After a year dominated by headlines surrounding tariffs and AI capex announcements, we believe economic security will be a prominent theme in 2026, helped by continued corporate resilience as interest rates head lower. Geopolitical flashpoints, NATO defense commitments, and renewed momentum in US and European reindustrialization efforts highlight a global imperative among economies and companies to build resilient supply chains, secure critical resources, and strengthen defense capabilities. In our view, this environment creates substantial opportunities for active managers to identify and capitalize on companies strategically positioned for this shift.

Tariffs are fundamentally reshaping global trade flows by incentivizing businesses to prioritize supply chain security, leading to a strategic shift towards shorter, more resilient, and reliable networks. This transformation is not a new phenomenon but has been accelerated by the imposition of tariffs and growing geopolitical tensions. In response to the increased costs, uncertainty, and risks associated with long-distance supply chains, companies continue to move away from a pure cost-efficiency model to one that values flexibility and risk mitigation.

Critical resources, including energy and raw materials, continue to gain heightened strategic importance. Vulnerabilities are starkly illustrated by current global dependencies: China accounts for ~60% of rare earth production.1 Similarly, ~90% of the world’s leading-edge semiconductors critical for AI’s future development are manufactured in Taiwan.2 We believe this profound concentration underscores the urgent need for resource security and resilience in global supply chains.

We also expect continued momentum in US liquefied natural gas (LNG) exports driven by European buyers seeking supply from friendly nations and Asian buyers looking to lessen their usage of dirtier power sources like coal. The burgeoning demands of the digital economy add another layer of complexity to resource security. Data centers currently consume 3% of US power and are expected to reach 8% by 2030.3 Security threats are also growing in magnitude and complexity, driving the need for significant investment in cutting-edge defense technologies and cybersecurity solutions.

Sources: $1.7 trillion in announced projects sourced from Eaton. As of January 2025. $3.3 trillion in global energy sourced from International Energy Agency. As of June 2025. +€800 billion EU defense spend sourced from European Commission. As of March 2025. For illustrative purposes only.

These trends highlight the durability of economic security among developed nations, and we maintain strong conviction in the long-term growth of companies aligned with this theme. Positive signals around ongoing capital deployment and the reaffirmation of capital expenditure plans have further strengthened the already compelling investment case. By leveraging deep expertise and rigorous research, we believe active managers are uniquely positioned to identify companies that are not only adapting to these shifts but are also poised for significant growth by providing solutions for resource security, supply chain resilience, energy independence, and national defense.

Sustainable Investing

We believe sustainable investing will continue to evolve in 2026 towards a greater focus on metrics, themes, and risks that will be performance-impacting in both public and private markets. Shifting policies and sustainable fund underperformance have, in our assessment, prompted more investor discussions on whether we are seeing a secular curtailment of sustainable investing. We do not believe so and instead see maturation occurring, with investors focused on nuances around performance linkages.

Fewer labels, more performance

To navigate the evolving investment landscape, we emphasize a focus on accelerating themes within broader growth trends, particularly in the energy transition. This involves prioritizing mature sub-themes like renewable energy, grids, and energy storage, which are seeing significant investment increases, over less mature areas such as hydrogen and carbon capture that face declining investment.

In an environment of higher inflation, we are also focused on companies that solve critical pain points or potentially offer substantial cost savings, moving away from growth that is reliant on subsidies. Furthermore, we believe identifying "pick-and-shovel" companies that provide essential upstream links in value chains is crucial, particularly those with technological or scale advantages.

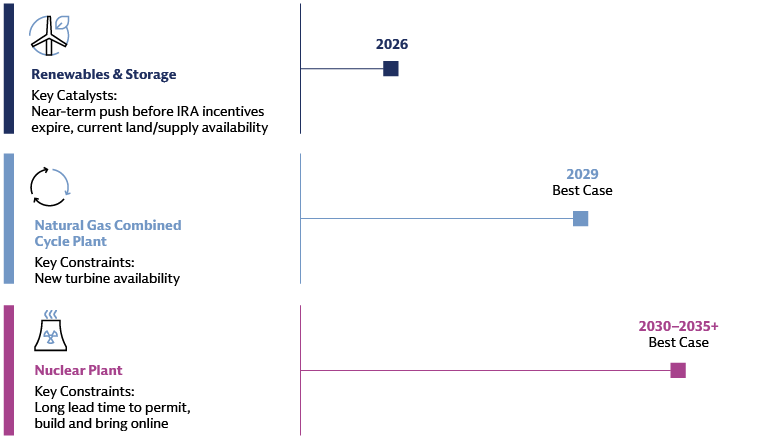

We believe the energy transition, fueled by increasing power demand, necessitates a holistic investment approach. This includes low-carbon power generation, global transport electrification, and crucial grid enhancements in both emerging and developed markets to manage rising baseload power and intermittency. As tech companies and hyperscalers race to deploy AI, we believe speed to power is paramount. This imperative is most constructive for renewables in the near term, as competing generation sources such as natural gas and nuclear are facing more immediate supply chain and logistical constraints.

Physical risk is an increasingly critical investment factor. Despite rising climate costs, such as nearly $1 trillion in US disaster recovery within a year, federal spending on prevention has decreased.4 We believe this trend drives higher secondary and tertiary costs, including business interruption and insurance premiums. Consequently, governments, investors, and businesses must develop proactive strategies for adaptation and managing disaster-related debt.

The circular economy presents opportunities given global resource depletion, supply chain vulnerabilities, and environmental stressors. This approach, focused on keeping materials in use and eliminating waste, offers strategic investments in supporting infrastructure and companies that recycle valuable materials. A significant infrastructure gap, potentially widened by projected landfill closures, underscores the urgent need for circular innovation.

Water stress is an under-appreciated and growing risk impacting diverse sectors. For instance, a third of global thermal power plants and two-thirds of new data centers are located in high water-stress regions, consuming vast amounts of water.5 Industries like food production, semiconductors, and mining are inherently exposed, and even historically water-sufficient areas are experiencing increased heat and dryness, exacerbating this challenge.

Asset Class Opportunities

Private Equity

We are constructive on sustainability-themed opportunities in the middle market, which has matured. With the heightened backdrop of inflation and financial strain, we believe investors will favor companies that provide more efficient, accessible and affordable solutions. We see an increasing number of businesses that are profitable and fast growing that offer sustainable products and services in sectors such as waste and materials, sustainable food and agriculture, ecosystem services and water, and clean energy.

Private Credit

We believe sustainable private credit offers an attractive risk-return profile due to a significant supply/demand imbalance for debt capital in the energy transition sector. Mature companies increasingly seek non-dilutive financing for surging energy demands driven by trends like reshoring, transportation, and AI/data centers. Historically, sustainable private debt capital has been sparse, with only $61 billion raised since 2014 compared to $781 billion for sustainable private equity.6 This limited availability and scarcity of specialized expertise create compelling risk-adjusted opportunities. Companies are seeking flexible debt solutions, and bespoke strategies in niche sustainable spaces are commanding higher premiums.

Infrastructure

The infrastructure asset class requires significant capital for essential service projects driven by megatrends like AI, energy transition, and circular economy efficiency. As governments and corporates withdraw, private investors can find opportunities. We view middle-market value-add infrastructure as particularly attractive. While mega-projects face competitive pricing, the value-add middle market may offer better-priced deals, negotiation flexibility, and strong exit optionality.

Green Bonds

For fixed income investors, we believe an allocation to green bonds can help provide significant portfolio diversification without sacrificing liquidity or returns. Investors can benefit from an allocation to green bonds from a traditional risk management perspective as well as by increasing sustainability exposure. While we believe the green bond market will continue to grow and diversify in the years ahead, we think some differences with the conventional fixed income market will remain, for example in terms of sector composition. As a result, we believe that adding a standalone green bond allocation will continue to provide portfolio-diversification benefits for investors.

Source: Goldman Sachs Global Investment Research. As of August 2025.

Power demand and the demographic dilemma

The US and European power industries face a critical demographic dilemma: over 750,000 new workers are needed by 2030 amidst an aging workforce and limited skilled labor.7 We expect this acute demand, especially for complex roles in electricity transmission and interconnections, will drive accelerated adoption of grid optimization and automation solutions. Renewable sources of power are more than 2.5x labor-intensive than fossil fuels on average across the lifecycle from the manufacturing stage, construction and installation stage, and during operations and maintenance.8 Access to talent and labor is set to become a key competitive advantage. Consequently, we believe larger companies with robust training programs and advanced productivity solutions are poised for competitive advantage and revenue consolidation.

Three Key Questions

Looking ahead to 2026, here are three key questions for investors on the evolving thematic landscape:

1. Besides economic security and energy transition, what other themes should investors monitor?

We expect investors to broaden their focus into areas such as the circular economy (waste & materials), sustainable food & agriculture, and ecosystem services & water. We believe these themes will gain prominence as businesses prioritize efficiency and cost savings, for example, by converting organic waste into biomethane and fertilizer, using sensors for water efficiency, or implementing compliance systems for environmental and food/agricultural end markets.

2. Do climate-related investment opportunities still exist despite unwinding US climate policy incentives?

We believe a disconnect exists between the narrative and reality. We observe increased power demand from both developed and emerging markets. This is driving prices and catalyzing investment across asset classes. Backlogs and rising natural gas turbine prices make renewables attractive due to their cost-competitiveness and shorter deployment timelines. In the first five months of 2025, over 90% of new US power generation capacity came from renewable sources,9 creating demand for debt financing for projects and for renewable parts providers in the value chain.

3. What specific dimensions of physical climate risk will be paramount for investors in 2026?

Rising and more volatile temperatures and extreme weather events will become a key focus, in our view, as investors concentrate on physical risk and adaptation. On the risk side, increased insurance costs and higher infrastructure capex to enhance resilience are expected to be key considerations in financial analysis. On the opportunity side, we believe investors will increasingly focus on companies providing adaptation solutions. This may include businesses that can capitalize on higher spending for heating, ventilation, and air conditioning, water and power infrastructure, coastal defense, food production, and disaster risk management.

1 International Energy Agency (IEA). As of October 2025.

2 Boston Consulting Group, Semiconductor Industry Association. As of November 2023.

3 Goldman Sachs Global Investment Research. As of October 2024.

4 Bloomberg. As of June 17, 2025.

5 Bloomberg. As of May 8, 2025.

6 Sustainable strategies include PitchBook categories: Agriculture; Air; Biodiversity & Ecosystems; Climate; Energy; Infrastructure; Land; Oceans and Coastal Zones; Pollution; Waste; Water. Private equity funds include private equity, venture capital, and infrastructure. As of October 21, 2025.

7 Goldman Sachs Global Investment Research. As of June 30, 2025.

8 Goldman Sachs Global Investment Research. As of June 30, 2025.

9 Federal Energy Regulatory Commission. As of May 2025.