Asset Management Outlook 2025: Exploring Alternative Paths

This article is part of our 2025 Outlook: Reasons to Recalibrate.

Exploring Alternative Paths

Private markets and other alternatives continue to evolve and attract a broader base of investors seeking to complement their traditional market exposures. General partners (GPs) and limited partners (LPs) are charting new routes across a dynamic landscape and we see a diverse opportunity set across private equity, private credit, real estate, infrastructure and hedge funds. A more balanced economy in 2025 could spur dealmaking and ease some valuation and liquidity pressures. However, a more constructive macro picture will not be a magic bullet, as some asset types may be better positioned than others.

As investors digest the longer-term implications of recent election results, we think it’s important to keep in mind that economic policy depends on multiple factors, not all of which are known at the moment that administrations change. Furthermore, private market investments often span multiple administrations, so over-indexing to a current administration can be an unintended source of risk. Prudence in deploying capital will be critical as economies shift and alternative investment paths emerge.

Private equity: The expectations recalibration

A stabilizing macro backdrop and a recalibration of investor expectations should act as a catalyst for a more normalized environment for private equity buyouts in 2025. We see signs that this process is already underway, positioning the industry better for exits and new capital deployment, albeit with some parts of the market looking more compelling than others.

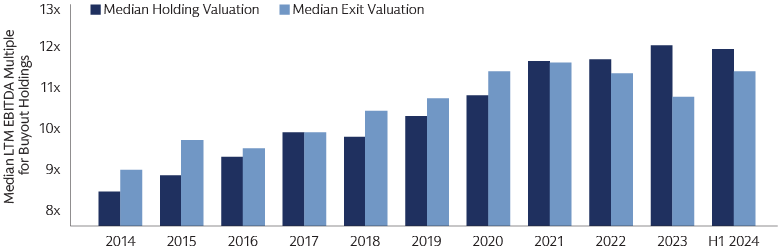

We believe a key reason for muted exit activity since 2021 has been GPs giving portfolio companies more time to grow into their target exit values, with EBITDA growth bridging the valuation gap resulting from the interest rate regime change.1 Uncertainty about the broader macroeconomic and market environment has been another reason. Today, valuations have broadly stabilized and disconnects between median holding and exit valuations have diminished. Exit valuations are off their 2023 troughs, while holding valuations have edged down from their 2023 peaks. Investor confidence is returning as uncertainty about near-term economic growth, inflation, and rate trajectories abates. As such, many portfolio companies appear better positioned for exit at or near values in line with GPs’ return targets. Practical realities, however, suggest that the pace of the rebound is unlikely to be uniform. Larger companies, which may have fewer potential strategic buyers, may find the sale process takes longer and depends more on the IPO environment.

For new capital deployment, we anticipate that a restored market balance in 2025 and a continued strengthening of the dealmaking environment will make for an attractive entry environment for the coming vintage—and, perhaps, in hindsight, for the past couple of vintages as well.

Supply / demand dynamics lead us to posit that valuations should stabilize around current levels. However, we see no obvious catalyst for a systematic upwards trajectory similar to that experienced in the last decade. Operational value creation is likely to remain the key driver of returns. Middle-market strategies may provide the most attractive balance among upside potential from active management, scalability of value creation initiatives, downside mitigation in turbulent times and a flexible, multi-dimensional exit strategy.

Source: MSCI. As of June 30, 2024.

In venture capital and growth equity, valuations and growth expectations have normalized in many parts of the market, and the muted fundraising environment of the past two years brought down the level of dry powder down from 2023 record highs. These factors make for a more constructive environment for deploying new capital in an asset class that offers access to innovative companies in their highest-growth phase.

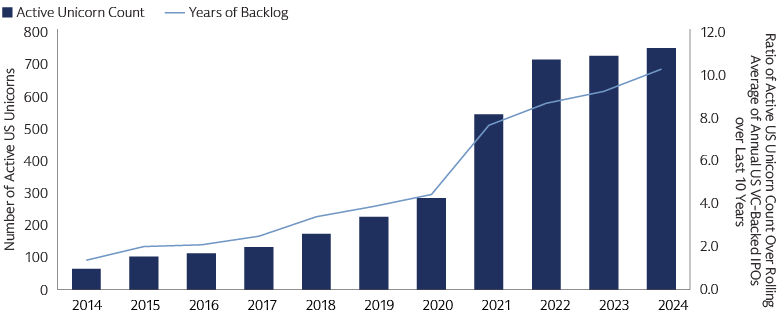

We see a growing need for growth equity capital as venture-backed companies are remaining private for longer and require additional capital to finance the next steps of their journeys. In the US, the backlog of unicorns (private companies valued at $1bn or more) stands at around 750—this represents a backlog of 10 years if they go public at the same average rate seen over the past decade. This suggests there will be greater demand for growth capital to fund the transition from late-stage venture capital to freestanding enterprises.

Source: PitchBook, Prof. Jay Ritter. US Unicorn backlog is measured as the ratio of active US unicorn count over rolling average of annual US VC-backed IPOs over last 10 years.

Private credit: The supply / demand normalization

Supply / demand factors have also been driving dynamics in private credit. Spreads have tightened in recent quarters as investors sought greater exposure to floating-rate credit, across both syndicated and private markets against a backdrop of depressed new-origination activity. Many borrowers refinanced, in some cases switching between public and private sources, and in others, repricing loans with their existing lenders. Around 80% of loan activity in 2024 was refinancings, repricings and extensions.2

Some market participants have observed loosening lender protections as lenders compete on both price and terms. This may ultimately make lenders more vulnerable if companies experience stress.

Falling rates may therefore paradoxically prove constructive to private credit, mitigating the supply / demand imbalance and normalizing spreads. An equilibrium between demand for public and private credit should arise as well, in which companies will choose between the lower cost of capital available in public markets versus a more tailored capital structure and financing solution in private markets.

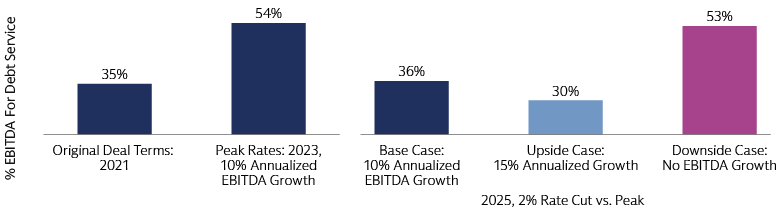

Lower rates can also help support debt serviceability and mitigate stress. So far, defaults have been muted, as robust earnings growth has helped support debt servicing even as higher rates have driven meaningful increases in interest expense costs. A back-of-the-envelope analysis suggests that for a company that was underwritten on market-average terms in 2021 and that has since achieved market-median EBITDA growth, a 2% decline in rates may bring its debt service capacity back toward levels at which the deal was underwritten. Above-median operational growth rates would lower the relative cost of debt service further, allowing the company to incur and service additional debt where prudent. However, a company whose fundamentals have not kept up would see little relief from lower rates and would come under strain by any additional debt financing. Dispersion in fundamentals will therefore drive dispersion in ultimate outcomes.

Source: Goldman Sachs Asset Management. For illustrative purposes only. Original deal term reflects aggregate LBO industry statistics as of 2021 for EBITDA multiples, leverage used and secured overnight funding rate (SOFR) floor amounts (source: LCD) and a spread on private credit sourced from the KBRA database. Impact of rising rates reflects maximum SOFR in 2023 (source: Federal Reserve Bank of New York) and spreads sourced from the KBRA database. Past performance is not indicative of future results.

This dispersion will be amplified as recent recapitalization and refinancing activity comes to its ultimate conclusions. Record levels of amend-and-extend and pay-in-kind activity over the past three years will have helped companies manage their cash interest expenses and prudently support growth initiatives in some cases and have forestalled inevitable defaults in others.

Overall, we anticipate ongoing interest in private credit—many institutional investors indicate being under-allocated to private credit.3 We expect interest to expand across areas, such as directly-originated investment-grade credit, real asset (real estate and infrastructure) credit as well as asset finance, which encompasses lending against assets as varied as consumer loans, industrial machinery, and private market fund LP commitments. These are expanding opportunities for private credit, given the contracting supply of credit from traditional lenders and continued demand from borrowers.

We also see opportunities in hybrid capital—flexible financing solutions that can meet a range of needs—including reoptimizing balance sheets to better support business operations, bolstering strategic transactions while redirecting cash towards operational uses, and optimizing a sponsor-backed company’s balance sheet until a successful exit.

With its expanding purview, private credit offers attractive opportunities to build a diversified portfolio that can be customized across the spectrum of risk and return, borrower type, seniority, duration, and macroeconomic sensitivity, complementing public credit exposure in a variety of ways.

Real estate: The rates-based revitalization?

The level and trajectory of interest rates naturally matters most for strategies with relatively high and long-term leverage, such as real estate. There is optimism that lower rates will be a stabilizing force to values and act as a catalyst to close bid-ask spreads. However, the ultimate path of yields will determine the trajectory. Overall, we expect lower rates to facilitate greater transaction activity, as lower cost of financing makes deal economics more attractive. This dynamic may have the most immediate impact in core / core-plus strategies, where the spread between the return on assets and the cost of debt is lower, but will ultimately benefit strategies across the risk-return spectrum.

A rebound in transactions can help to quantify where fair value is. In our view, the discounts to net asset value at which REITs are currently trading are an indication of where investors anticipate fair value may ultimately land, although REIT discounts may be overly punitive and not reflect what private asset sales can achieve.4 This adjustment process may prove painful to some assets; however, we view it as a necessary step on the way to broader market recovery and greater confidence in the asset class.

As is the case for other asset classes, asset fundamentals drive real estate returns through market cycles. The fundamental dynamics observed in real estate today are driven by the evolution of the market. We continue to expect secular trends to impact fundamentals. Demographics, technology and the drive towards sustainability should continue shaping global real estate demand. The attractiveness of assets with respect to these themes will differ by region and individual asset quality.

At the sector level, in the US multifamily and industrial markets are contending with peak supply deliveries, which have softened pricing power. However, new construction pipelines are decreasing, indicating better supply / demand balance ahead—especially when considered alongside structural factors. Office bifurcation continues, with growing stress for lower quality assets. Meanwhile, attractive retail locations may be benefiting from a combination of healthier demand and stretched supply due to years of low new construction as the sector went through its own adjustment period.

In Europe, there is a greater focus on uplifting assets and improving energy efficiency. In Japan, a confluence of macro tailwinds and ongoing structural changes have opened opportunities across several sectors, including logistics, hospitality, and residential.

While much focus remains on distress, this is primarily the case for lower-quality assets (older, less sustainable, in less favorable locations) that may have trouble getting financing. These assets may offer attractive opportunities to redevelop and reposition the assets, providing an attractive entry point.

Overall, we believe current market dynamics present opportunities to acquire select assets at attractive prices and grow net operating income through active management and accretive capital programs. There is also scope to develop, redevelop or reposition assets to cater to changing demands for space.

Infrastructure: The asset class reconfiguration

Infrastructure has performed well amid recent high inflation, in-line with historical experience. However, moderating inflation and heightened geopolitical issues present headwinds to future cash flow upside for assets whose revenue growth comes primarily from inflation sensitivity. This may put pressure on upside growth potential, particularly in core strategies. Limited relief from the interest rate environment may also pressure core returns. We believe fundamental asset growth will become more critical to attractive upside generation.

Asset owners with the ability to pull operational levers to drive fundamentals are likely to be best positioned in 2025. We believe value-add strategies are well positioned in this regard as their business model derives more of its return from operational value creation initiatives in cash flow-generating assets. The key risk is execution skill, but this can be mitigated via careful manager selection.

Much like in private equity, we believe the middle market offers an attractive balance of potential value creation from systematic operational initiatives and a flexible exit strategy, amplified by recent fundraising trends. The industry is evolving, with large funds accounting for a bigger share of fundraising, which we believe will lead to greater competition to deploy capital at the upper end of the market. However, this presents attractive exit opportunities for mid-cap funds that can grow their investments during their holding periods. Competition for new assets in the large-cap market could also widen the existing valuation spread between middle market and large-cap assets, amplifying multiple expansion tailwinds for mid-market assets from entry to exit.

Given the market dynamics linked to asset size, access points for infrastructure may bifurcate. Large core assets could increasingly become within the scope of evergreen structures, which provide more flexibility for long hold times without the need to exit the investment. Returns would come largely from yield, reducing the reliance on transactions to generate cash flows. Opportunistic assets may continue to be held primarily in drawdown funds, a structure that can provide discipline to sell the asset and realize proceeds. Value-add strategies can lend themselves to either structure, given their mix of yield and capital appreciation return drivers and greater exit and realization flexibility.

More broadly, while structural change is always subject to some degree of uncertainty, we expect thematic opportunities to remain in focus in 2025 as infrastructure evolves. The shift towards more sustainable energy consumption is driving investments across renewable energy storage and electrified transport. AI’s accelerating adoption is another structural force; data center investment is poised to more than double by 2030, driven by AI. Trade fragmentation represents another structural change for the asset class, as companies reconfigure supply chains for resiliency and evolving geopolitical realities. This is impacting transport and logistics requirements to support changing locations of manufacturing and storage facilities, and trade routes to deliver goods to customers. Aging populations may also contribute to growing demand for private infrastructure funding, as public budget priorities in societies with aging populations shift to support retirees’ income and healthcare needs and leave less public money available for public works spending.

Hedge funds: A different dimension to diversification

Markets proved volatile in 2024 with a tumultuous period in August in particular seeing sharp risk-off moves. Hedge funds navigated this period well and ended the third quarter in positive territory, highlighting their important role in diversifying a portfolio and reducing both equity and fixed income market beta. Today’s post-quantitative easing environment is supportive to both hedge fund demand and returns. Lower beta/market return expectations and unstable correlations between fixed income and equity have made uncorrelated hedge fund returns more valuable to asset allocators.5 Volatility and dispersion have also made positive hedge fund returns more possible. Consequently, there has been a resurgence of interest in hedge funds and liquid alternatives and, as part of this, the return of portable alpha and extension strategies (extending long-only approaches to include limited short exposure) as a means to implement.

The hedge fund and liquid alternatives industry has also evolved. Dispersion has gotten wider, making manager selection matter even more; more so than most other asset classes. At the same time hedge funds have gotten even tougher to access and assess. The landscape has evolved to become more binary between platform hedge funds vs specialized hedge funds, and more expansive where skill can now be better accessed via not just funds but also separately managed accounts (SMAs) and co-invests. The lines are also more “blurred” between platform hedge funds vs funds of hedge funds, proprietary vs external, and hedge funds vs liquid alternatives that are designed to deliver the returns and risk of the hedge fund industry in a systematic and transparent way, without directly investing in individual managers.

Three Key Questions

1. How should investors assess different private market vehicle structures?

We believe there is a role for both closed-end drawdown funds and evergreen vehicles in private markets. Four key dimensions may drive the vehicle decision: liquidity and investor control; program complexity; performance impact from fund structure; and product availability. Evergreen funds are advantaged on the first two dimensions, while drawdown funds are advantaged on the latter two. The ultimate choice—whether one structure or a combination—should consider the investor’s time horizon, relative importance of the four key dimensions, and resources to implement the program.

2. What is a GP’s distribution quality?

With fewer exits, private equity GPs have turned to creative liquidity solutions, such as dividend recapitalizations, net asset value (NAV) financing, and continuation vehicles (CVs). While these solutions help create distributions and lock in value (albeit sometimes subject to clawbacks), they may ultimately increase the range of outcomes. In aggregate, dividend recapitalizations have been used prudently and increased the average deal’s internal rate of return (IRR), but assets can be vulnerable if the underlying company is not well-selected for the transaction.6 NAV financing adds leverage, cross-collateralizing portfolio assets and creating potential to magnify returns on the upside and downside. Continuation vehicles let GPs keep creating value, giving the company time to recover from a temporary dislocation and avoiding having to sell a prized asset to a competitor. However, in some cases maintaining a strong growth trajectory calls for a different operational value creation plan, that may be better executed by a different GP. Over time, the quality of a GP’s distribution will become apparent.

3. Is AI becoming “crowded”?

We believe the AI investment theme is underlined by secular trends but should be addressed thoughtfully. In venture capital, the difference in investor enthusiasm for AI vs other sectors is becoming apparent in valuations and investment terms. In real assets, while AI-driven data center demand should remain a strong theme, the market’s ultimate size will depend on demand, the ways in which technological progress influences space requirements for hardware and cooling solutions, and power availability. With data centers in scope for both real estate and infrastructure managers, assets may see demand from both investor types. Some attractive opportunities may come in the form of providing more efficient energy and water services. Holistic, creative solutions (e.g., incorporating the physical space along with power generation and/or cooling) may be well positioned.

For more of our 2025 investment views explore A New Equilibrium, Landing on Bonds, Broader Equity Horizons and Disruption from All Angles and the potential sources of attractive returns they could create.

1 Burgiss, Goldman Sachs Asset Management. As of October 22, 2024.

2 LCD. As of September 30, 2024.

3 Goldman Sachs 2024 Private Markets Diagnostic Survey. As of October 2024.

4 Nareit, Goldman Sachs Asset Management. As of October 31, 2024.

5 MSCI, Barclays, Goldman Sachs Asset Management. As of June 30, 2024.

6 Leveraged payouts: how using new debt to pay returns in private equity affects firms, employees, creditors, and investors. Authors: Abhishek Bhardwaj, Abhinav Gupta, Sabrina T. Howell. As of July 1, 2024.