Diversions Ahead: Finding Resilience in the Next Chapter

The US economy remains in robust shape as the second Trump administration settles in. Reasonably steady growth and inflation moderation look plausible. Nevertheless, the new US administration and President Trump’s policy agenda signals the start of a new chapter. Multiple macroeconomic and market drivers—domestically and internationally—could cause even greater divergence by either propelling economies forward or holding them back. At this juncture, we believe it’s important for investors to consider the crosscurrents at play and seek resilience through active management and wider diversification.

Several Signposts to Watch

Our base case for the US economy sees growth outpacing developed market peers in 2025, aided by continued robust productivity growth and easy financial conditions amid some further rate cuts. Inflation moderation has continued despite some bumps in recent months. The US also remains anchored by a financially sound consumer and a looser but still healthy labor market. However, changes in trade policies, fiscal uncertainty, regulatory adjustments, and shifts in immigration laws may disrupt this healthy economic equilibrium and widen the range of potential outcomes for growth, inflation and employment.

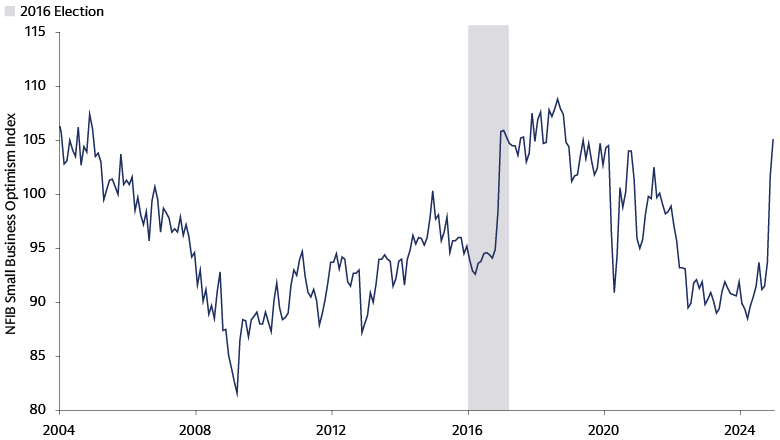

Potential tax cuts and deregulation could spur CEO confidence, drive dealmaking and foster persistently higher levels of growth in private investment over the coming quarters. “Animal spirits" sparked equity market bullishness and improved business sentiment at the end of 2024. The National Federation of Independent Business (NFIB) Small Business Optimism Index climbed from 94 in October to 105 in December, the largest 2-month increase on record.1 Capital expenditure plans among US manufacturers firmed up in January with indicators of future capex intentions climbing to levels last seen in 2021. However, capex indicators softened in February and returned to the lowest levels since August 2024.2 Whether enthusiasm over deregulation and tax cuts wanes or grows from here remains to be determined.

Source: NFIB, Goldman Sachs Global Investment Research. As of January 24, 2025.

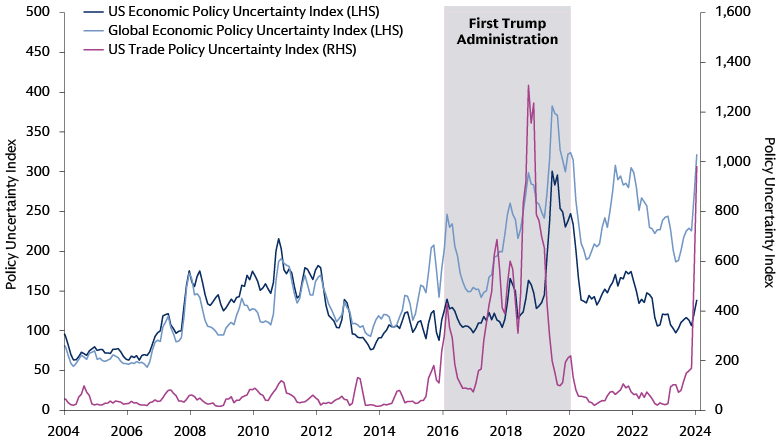

On the flip side, higher tariffs and tighter immigration policy pose downside risks to growth. Tariffs in particular are complicating the macroeconomic picture. While the S&P Global US Manufacturing PMI indicated an acceleration in the rate of US manufacturing sector expansion in February3, the US ISM manufacturing index declined by more than expected, with February’s survey respondents noting the tariff environment has created “uncertainty and volatility”.4 On February 1, President Trump signed executive orders imposing 25% tariffs on imports from Mexico and Canada (energy at 10%), and a 10% tariff on China.5 Following a month-long delay, US tariffs on Mexico and Canada went into effect on March 4. Two days later, some tariffs had already been postponed.6 Trump has also raised the prospect of levying additional tariffs on goods imported from the European Union.7 Tariff unpredictability may become a persistent theme for central banks and investors to grapple with in 2025. New trade barriers could delay—rather than derail—inflation convergence to the Federal Reserve’s (Fed) target. More aggressive tariff measures could also open the door to more market speculation on the possibility of the Fed hiking rates at some point this year.

Source: Policyuncertainty.com, Goldman Sachs Global Investment Research. As of December 31, 2024.

A Wide Range of Risks

Optimistic “animal spirits” and caution over tariffs and tighter immigration are opposing forces, but reasonably steady US growth and inflation moderation remains our base case amid these crosscurrents. That said, there are numerous tail risks that could result in a deterioration in business confidence or financial market risk sentiment.

New tariffs and immigration policy have the potential to amplify the frequency and magnitude of supply shocks. An inflation uptick would increase the risk of stocks and bonds falling in tandem again. The US equity market appears vulnerable to earnings growth disappointments due to acute levels of concentration. A sustained rise in bond yields could tighten financial conditions and pose downside growth risks. Meanwhile, fiscal policy and soaring levels of US debt may pose upside risks to term premium and long-term yields. Tax cuts and federal spending patterns in the context of already large deficits will need to be closely monitored.

Geopolitical developments in the Middle East, the war in Ukraine and cross-Strait tensions will likely remain in focus throughout the year with varying implications for risk assets. From a currency perspective, tariff implementation together with US economic outperformance and largely stable rate differentials may be sufficient to deliver more Dollar strength in the near term, while any moderation in US growth outperformance and Fed easing could weigh on the USD in the medium term.

Economic sentiment in the Euro area had been subdued ahead of the new US administration’s arrival. A notable feature of this cycle in Europe has been muted consumption growth relative to the improvement in real income growth as negative sentiment caused savings rates to rise. An unprecedented fiscal package in Germany—announced on March 4 following the country’s recent election—has altered the economic picture and presents potential upside risks to growth, as well as deficits and debt.

Elsewhere, in China, the property market is likely to remain a drag on the economy in 2025. Risks posed by tariffs appear elevated, given the high probability of US tariffs on Chinese imports. Chinese policymakers may offset tariff risks with further policy easing and measures targeting higher levels of domestic consumption-driven growth. More broadly, the external backdrop for emerging markets in general has shifted in recent months. A soft-landing pro-risk environment and pricing of non-recessionary Fed cuts has given way to concerns around tariff risks, higher US rates and a strong US dollar that have put pressure on EM assets and set the stage for a more complex environment in 2025.

Reaching for Resilience

All things considered; we think it’s a good time to build resilience into portfolios by focusing on active management and diversification.

We maintain a broadly constructive outlook for global equities driven by resilient economic activity data and rate cuts. In the US, solid macro indicators and further Fed rate cuts would be positive for stocks. The potential for lower tax rates and deregulation is supportive too, although earnings and the Trump administration’s ultimate policy mix will be key market drivers. Active management will be key given the potential for earnings and policy surprises.

Outperformance of the Magnificent 7 was the most defining feature of the US equity market in 2024. Opportunities may arise across the more moderately valued "S&P 493" in 2025, away from heavily concentrated high-growth areas. Further episodes of technology-related market turbulence may arise due to the evolving competitive landscape around artificial intelligence (AI), resulting in a sharper focus on the scale and timeline for returns on investment (ROI) linked to AI-related capex.

In Europe, the prospects of a large German fiscal package and the potential for increased Europe-wide defense budgets may be supportive for European equities in the near-term, offsetting tariff uncertainty. Further interest rate cuts by the European Central Bank (ECB) would also be supportive. An early resolution of global tariff uncertainty and developments in Ukraine could further lift sentiment across the region. In Japan, we expect solid macro momentum (monetary policy normalization, domestic reflation) and positive structural reforms (corporate governance) to present alpha opportunities for stock pickers. Escaping secular stagnation is a positive for nominal sales, margins and earnings growth for Japanese corporates. In emerging markets, we believe dynamics around potential Chinese stimulus and US tariff will influence equity performance going forward. India continues to be supported by strong corporate balance sheets and resilient growth.

Inflation and interest rate volatility remain risks for multi-asset portfolios in a world of policy-driven uncertainty. This may continue to shift market expectations and asset class correlations, potentially disrupting the balance of 60/40 portfolios. In our view, active management and diversification can help mitigate this risk. For instance, thoughtful exposure to a variety of income-generating investments less correlated with traditional markets may help deliver a smoother ride through market cycles. Alongside steady income streams, an understanding of hedging strategies and how to use them may enhance the resilience of portfolios and help investors prepare for unexpected events.

The ability to select alternative investments with low correlation to public markets can also provide resilience in environments of uncertainty. We believe private credit can be a powerful complement to traditional fixed income strategies, offering the potential for return enhancement and risk mitigation. The variety of opportunities across the capital structure and borrower type can enable diversification of exposures and return sources.

A World Full of Risks and Opportunities

While the macro set up remains resilient for now, the precise nature of US policy remains unclear. Changes to tariffs, taxes, immigration policy and deregulation open a wide range of outcomes for policymakers and investors to contend with. There is also potential for more technology-driven volatility as uncertainty surrounding AI adoption and competition grows. Regardless of whether “animal spirits” fade or spill over into the corporate and investor decision-making, economic, political and technological change opens new opportunities as well as vulnerabilities. In our view, active investing, diversification and disciplined risk management beyond traditional equities and bonds and across regions can help portfolios stay resilient in a new and uncertain chapter.

1NFIB, Goldman Sachs, Global Investment Research. As of January 24, 2025.

2Federal Reserve Bank of Philadelphia. Manufacturing Business Outlook Survey. As of February 20, 2025.

3S&P Global US Manufacturing PMI. As of March 3, 2025.

4Goldman Sachs Global Investment Research. As of March 3, 2025.

5The White House (.gov). As of February 1, 2025.

6Goldman Sachs Global Investment Research. As of March 6, 2025.

7Financial Times. As of January 31, 2025.