Fixed Income Outlook 3Q 2024

Sound Fundamentals, Narrow Margins

In recent earnings calls, leaders from consumer goods companies have noted a shift towards more value-conscious and selective spending among consumers. As we pass the halfway point of 2024, a year on from the peak in the federal funds rate, our investment approach mirrors this trend. We observe sound economic and corporate fundamentals, yet we approach the investment landscape with a value-oriented lens due to tight fixed income sector spreads and a rise in political uncertainty which creates a narrow margin for error.

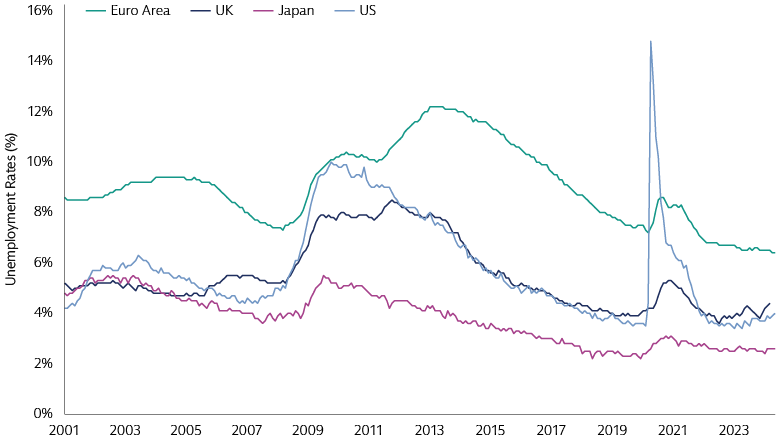

The good news is that disinflation appears to be back on track after setbacks earlier this year. Stable inflation expectations and labour market rebalancing portend further inflation progress. Low unemployment and real income growth continues to support steady consumer spending, particularly on experiences. However, as noted, there's a discernible shift towards value in consumer goods purchases, likely a response to the residual impact of past inflation and the erosion of excess savings.

Favorable market conditions have allowed companies to issue new debt, reducing refinancing risks. The robust issuance of bonds and loans this year has been met with an enthusiastic response from investors drawn to historically high yields. The private sector's financial health is evident in the contained rates of delinquencies, downgrades, and defaults, laying a strong foundation for debt servicing capabilities. This is a positive sign for the return prospects on corporate bonds and securitized sectors like collateralized loan obligations (CLOs) and commercial mortgage-backed securities (CMBS).

Major central banks are either easing or soon to begin cutting rates, setting the stage for a supportive environment for fixed income assets.

However, the Fed’s cautious approach, coupled with upside inflation risks from weaker currencies, has prompted a slower pace of easing in some emerging market (EM) economies. Meanwhile, the BoJ is set to steadily progress with its policy normalization. These divergent monetary policies warrant a dynamic approach to duration management and offer distinct opportunities for cross-market interest rate exposures.

The coming months will likely reinforce the importance of diversification to mitigate risks, active bond selection to identify strong corporate and sovereign balance sheets, and strategies to enhance portfolio resilience. Leaning into the US dollar's carry advantage and perceived safe-haven status amidst political volatility is one strategic way to enhance resilience.

What We’re Watching

Inflation

The path to disinflation may stay bumpy. We're vigilant about factors like commodity prices and shipping costs. Although firm, their inflationary impact is less widespread than during the pandemic, with cost increases in the supply chain being isolated rather than universal. A critical area of focus is services inflation, especially related to consumer spending on experiences. For instance, the economic impact of a concert tour could introduce a new "Taylor Rule" of sorts, where central bank policy is influenced by strong spending on tickets, merchandise, and hospitality, contributing to services inflation. The term "Swiftanomics," coined from Taylor Swift's economic impact on spending and inflation, encapsulates this phenomenon. The big question is whether this spending surge is a temporary blip leading central banks to 'shake it off,' or if it's a sign of more persistent services inflation.

Policy & Politics

As investors, we are focused on the fiscal and broader policy outlook rather than predicting election outcomes. Globally, no political developments suggest imminent fiscal consolidation, aligning with our expectations for sovereign yield curves to steepen as longer-dated bond yields incorporate a higher term premium. Trade and immigration policies are also areas of close observation, as they could influence the economic trajectory in the US, which currently favors a soft landing. Trade policy uncertainty in the US is at its highest since the 2018-2019 US-China trade war, potentially dampening business investment. However, investments in long-term themes like generative AI and decarbonization may remain resilient despite political shifts. Political uncertainty reinforces the importance of diversification, active bond selection, and strategies to enhance portfolio resilience. This includes balancing risk asset exposures with interest rates, leveraging the US dollar's safe-haven appeal, and employing currency options to navigate potential rises in currency volatility from current low levels.

The Consumer

Consumer spending remains a pivotal driver of economic growth. However, rising delinquency rates in credit card and auto loans suggest that some borrowers are facing difficulties, likely exacerbated by high vehicle costs and the resumption of student loan payments.

Source: Macrobond. As of May 2024 except for the UK which is as of April 2024.

Despite this, it's important to note that credit constitutes a small portion of overall consumer spending, and overall delinquency rates remain below pre-pandemic levels. We also note that wealth gains and interest income are predominantly concentrated among higher-income households, who traditionally exhibit a lower propensity to consume. Recent company commentary has indicated a growing caution regarding lower-income consumers. Additionally, consumer sentiment is subdued, despite the labor market's strength. Potential disruptions to gasoline supplies during the hurricane season could further inflate fuel costs and dampen consumer confidence. These factors underscore the dynamic nature of today's economy, highlighting the importance of monitoring these evolving trends.

Navigating the Fixed Income Landscape: Income, Total Return, and Cautious Optimism

While we recognize sound economic and corporate fundamentals, we remain vigilant due to stretched valuations and political uncertainties. Our strategy is to be selective, focusing on generating attractive income in a higher yield environment and being ready to seize risk premiums to generate total returns in our clients’ portfolios as opportunities arise.