Social Bonds Bounce Back as New Issuers Strengthen Global Market Momentum

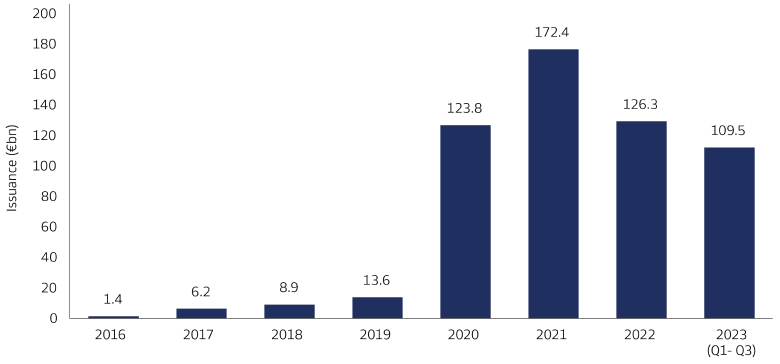

When governments around the world began winding down the emergency spending that had helped companies and individuals weather COVID-19, social bond investors were left wondering what would drive future market growth. Social bond issuance had surged during the first two years of the pandemic as governments tapped the market to finance economic support programs and the public health response.1 Many of these programs came to an end in 2022, however, and issuance dropped off in a tough year for fixed income generally.2

The post-COVID future of social bonds has started to come into focus in 2023. Issuance in the first nine months of the year amounted to €110 billion, up by 20% from the same period a year earlier.3 This increase outpaced all other sustainable debt asset classes including green bonds.4 Issuers who had postponed social bond sales in 2022 returned to the market as conditions improved, buoyed by the expectation that interest rates were nearing their peak. Yet issuance remained below the level seen in the first nine months of 2021.5

Goldman Sachs Asset Management’s Green, Social and Impact Bonds team views 2021, which was fueled by pandemic-related issuance, as an outlier in the development of the social bond market. The year-on-year rise in issuance in the first nine months of 2023 signals a return to a more stable path of market expansion based on resilient investor demand, continued growth in established markets and the potential for increased issuance in emerging markets and corporate sectors such as utilities and industrial companies.

The pace of growth in the social bond market will depend in the near term on the broader fixed income climate, where concerns include higher-for-longer interest rates, the impact of disinflation and downbeat economic signals from Europe and China.6 The social bond market also faces specific challenges, such as the need for improved data quality and the wider adoption of common standards and definitions – the same issues that had to be overcome in the expansion of the green bond market. Recent progress includes an update of the Social Bond Principles, which set out best-practice guidelines for issuers.7

Source: Goldman Sachs Asset Management, Bloomberg. As of September 30, 2023.

Conventional bonds with social goals

Social bonds are fixed income securities with a social objective. Their financial characteristics such as structure, risk and return are similar to those of conventional bonds. The main difference is that the legal documentation of social bonds spells out how their proceeds will be used, with the goal of financing only projects with clear social benefits such as building affordable housing, creating jobs and expanding access to education and healthcare. Most social bonds are also intended to make a positive impact on a specific population, such as the unemployed, undereducated and people living below the poverty line.

The first formal social bond was issued in 2015.8 Issuance was sparse at first, but began to pick up in 2017 with the first edition of the Social Bond Principles.9 These guidelines for issuers have helped the market become more standardized, facilitating tradability and supporting the development of social bonds as a distinct segment of the fixed income market. By the end of the third quarter of 2023, social bonds had developed into a €552 billion market,10 nearly a third the size of the green bond market, which debuted eight years earlier.11

Growth built on investor demand

A key factor driving the expansion of the social bond market is the strength of investor appetite. In a recent survey of European professional investors conducted for Goldman Sachs Asset Management, almost two thirds of respondents said they had already invested in social bonds or were interested in adding them to their fixed income allocations. Of these respondents, nearly nine in 10 planned to maintain or increase their holdings during the next 12 months.12

This demand for social bonds has proven resilient despite the challenges of 2022 and looks likely to increase in the years ahead. The strength of demand can be seen in the growth of the six social bond funds launched since 2020. In less than four years, these funds have accumulated €670 million in assets under management.13

Evidence of this demand can also be found in the order books of many social bond issues. For example, the European Union (EU) held a two-part sale in late 2020 that raised €17 billion.14 The issue was more than 13 times oversubscribed, drawing demand of more than €233 billion.15 In early 2023, CADES – a French state agency and the largest issuer in the social bond market – sold a €5 billion social bond that remains the largest issue of the year to date.16 The order book for this issue totaled more than €31 billion, then a record level of interest in a bond issued by the agency.17

While demand has proven resilient, the relatively small number of dedicated social impact fixed income investment funds is constraining social bond market growth. This can be seen in our social bond investor survey, where respondents identified the limited range of available investment strategies as the biggest barrier to social bond allocation.18 As the number of social bond funds increases, we expect a further increase in demand.

Corporate issuance set for expansion

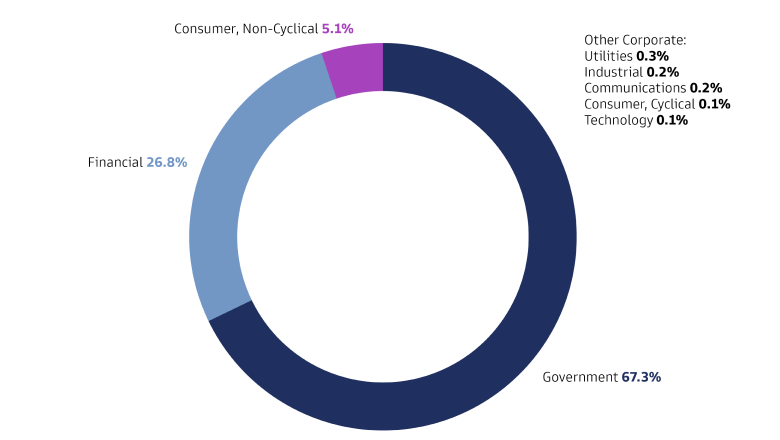

In our view, another key factor driving the expansion of the social bond market in the years ahead will be the entrance of new issuers, especially on the corporate side. The government-related sector, which includes multinational issuers such as the EU and national agencies such as CADES, accounts for 67% of this young market. Financial services firms, primarily banks, claim a 27% market share. The remaining 6% covers a wide range of corporate issuers led by non-cyclical consumer companies19 in sectors such as biotechnology, commercial services, food and healthcare.20

An example of corporate issuers turning to the social bond market is UK-based Motability Operations Group, which provides financing for the acquisition of vehicles for disabled people.21 In September 2023, the company issued its latest social bond, raising £250 million.22 Under its Social Bond Framework, the proceeds of these bonds are used to fund its existing fleet of vehicles as well as new vehicles.23

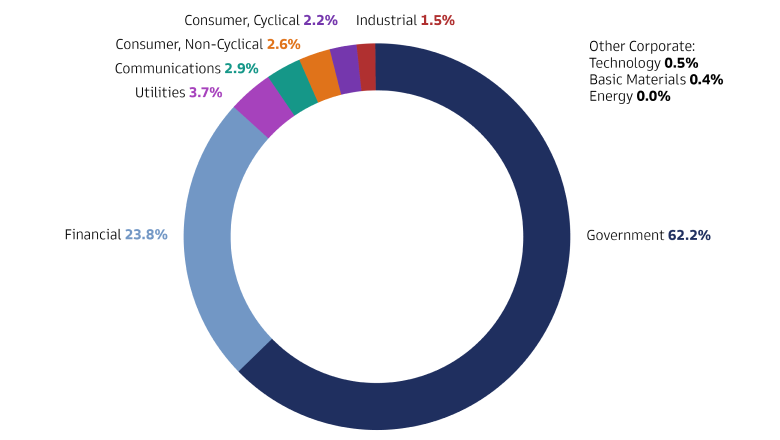

The potential for increasing corporate issuance of social bonds can also be seen by comparing them with the related market in sustainability bonds. These have the same use-of-proceeds feature as green and social bonds, meaning their legal documentation spells out how proceeds will be used. The difference is that sustainability bonds are used to finance a combination of environmental and social projects.

As the charts below show, the government-related and financial sectors are the top two in both the social and sustainability markets, though their weightings in the social bond market are slightly greater. By contrast, corporate issuers account for a larger share of the sustainability bond market, and the range of sectors represented is broader, extending to basic materials, energy and cyclical consumer products such as vehicles. The sustainability bond market is also slightly larger at €637 billion.24

Source: Goldman Sachs Asset Management, Bloomberg. As of September 30, 2023.

Source: Goldman Sachs Asset Management, Bloomberg. As of September 30, 2023.

In the corporate segment of the sustainability bond market tracked by our Green, Social and Impact Bonds team, issuers on average allocate 58% of proceeds to social projects and 42% to green projects.25 This evidence of corporate social ambitions extends to sectors where we currently see few social bonds.

Praemia Healthcare, a French real estate development and investment company, is one of the companies opting for sustainability bonds to finance its social projects. Praemia, which owns, operates and manages healthcare facilities, issued a debut sustainability bond in September 2023, raising €500 million.26 Social projects eligible for financing under the company’s Sustainability Financing Framework consist of medical and elderly care facilities.27 These projects expand access to essential health services in line with the Sustainability Bond Guidelines, which set out best practices for issuers.28

We also see potential for growth of social bond issuance in corporate sectors such as utilities, which account for less than 1% of outstanding social bonds but nearly 4% of sustainability bonds, indicating the potential for expansion.29 Communications companies are another source of potential issuance, which could be used to provide low-income households with cable and internet access, for example. Non-cyclical consumer companies, which sell staple products and services, are relatively well represented in the social bond market, but we believe cyclical consumer firms that sell products such as cars could also turn to the market to finance social projects.30

One reason some companies choose to issue sustainability rather than social bonds has to do with the size of their asset pool. When a company seeks to finance a relatively small number of eligible social projects, it may elect to combine its green and social projects to create a benchmark-size issuance capable of attracting interest from the broadest possible range of investors.

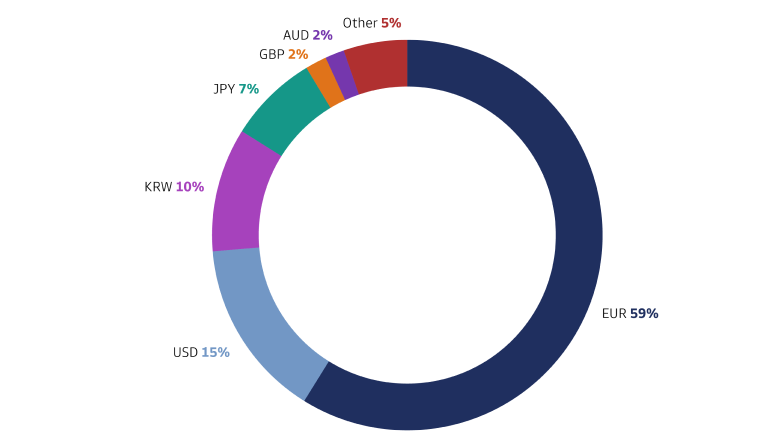

Sources of growth beyond Europe

Europe is the main driving force in the social bond market, and its leading role is reflected in the volume of euro-denominated social bonds, which account for 59% of outstanding issuance.31 Yet the market is diversifying, with sources of expansion arising in other regions, notably Asia. South Korea is the third-largest social bond market thanks to issuers such as Korea Housing Finance Corp. (KHFC), which has the equivalent of nearly €18 billion in outstanding issuance used to finance affordable housing projects.32 Japan ranks fourth, powered by issuers such as Japan Expressway Holding and Debt Repayment Agency.33 As a result of this activity, social bonds denominated in South Korean won and Japanese yen make up nearly 18% of the global market.

While social bond issuance has come primarily from developed economies, we see potential for an increase in emerging markets, where some sovereign issuers are tapping the market to finance social programs. Chile is a notable example, with €10.5 billion in outstanding issuance.34 Colombia issued its inaugural social bond in November 2023, raising $2.5 billion in a sale that was more than five times oversubscribed.35

Multilateral institutions in emerging markets such as the African Development Bank Group (AfDB) have also established track records as social bond issuers.36 We believe this issuance from sovereigns and supranational institutions shows the need for social projects in these regions as well as their availability, paving the way for corporate issuers as well as more sovereigns, supranationals and agencies to tap the market.

Source: Goldman Sachs Asset Management, Bloomberg. As of July 1, 2023.

Challenges facing social bonds

In our view, accelerating the expansion of the social bond market will require wider adoption of issuer standards as well as agreement on detailed definitions of project categories and target populations, and the increased availability of reliable data reported in standard formats. The social bond market has made strides toward increasing transparency around the use of proceeds and project impact. The Social Bond Principles, most recently updated in June 2023, have been instrumental in driving this process. The International Capital Market Association, which administers these guidelines, has also published a framework for reporting on the impact of social bonds.37

Increased corporate issuance and the growth of social bonds in emerging markets will help address investor concerns about the level of market diversification. In our survey, this issue ranked second among the barriers investors see to allocating to social bonds.38 This situation resembles the early years of the green bond market, which has since achieved greater sector diversity. We believe the social bond market is on track for similar development, and that diversity will improve over time.

These challenges reflect the reality of a market in development. The social bond market has grown rapidly in the past four years. We believe that investor concerns will be alleviated as the social bond market continues to expand, encouraging the development of more strategies offering exposure to the market and increased issuance across an expanding range of sectors.

1 Social bond issuance in 2019, just before the outbreak, amounted to €14 billion. In 2020, issuance soared to €124 billion, and rose again in 2021 to €172 billion. Goldman Sachs Asset Management, Bloomberg. Calculated on August 28, 2023.

2 Social bond issuance in 2022 totaled €126 billion. Goldman Sachs Asset Management, Bloomberg. Calculated on August 28, 2023.

3 Goldman Sachs Asset Management, Bloomberg. Calculated on November 1, 2023.

4 Green bond issuance in the first nine months of 2023 was 12% higher than in the same period a year earlier. Goldman Sachs Asset Management, Bloomberg. Calculated on October 17, 2023.

5 Social bond issuance in the first nine months of 2021 totaled €149 billion. Goldman Sachs Asset Management, Bloomberg. Calculated on November 1, 2023.

6 For more on the fixed income climate, see Goldman Sachs Asset Management’s “Fixed Income Outlook | Q4 2023: Turning Cautious.” As of October 11, 2023.

7 “Social Bond Principles: Voluntary Process Guidelines for Issuing Social Bonds,” International Capital Market Association (ICMA). As of June 2023.

8 “Spanish Government Bank Attracts ESG Investors to New €1bn ‘Social Bond,’” Responsible Investor. As of January 30, 2015.

9 “Green Bond Principles evolve to encourage new categories of issuers and embrace Social & Sustainability Bond market participants,” ICMA press release. As of June 14, 2017.

10 Goldman Sachs Asset Management, Bloomberg. Calculated on November 1, 2023.

11 The amount outstanding in the green bond market stood at €1.9 trillion as of September 30, 2023. Goldman Sachs Asset Management, Bloomberg. Calculated on November 3, 2023.

12 “Investing in Inclusive Growth,” Goldman Sachs Asset Management. As of May 16, 2023.

13 Bloomberg data. As of November 6, 2023. These funds vary in the level of social bonds they hold as a percentage of total holdings.

14 “EU’s Social Bonds Draw $275 Billion to Set Global Demand Record,” Bloomberg News. As of October 20, 2020.

15 Ibid.

16 Bloomberg data. As of September 30, 2023. CADES (an acronym for the Caisse d’amortissement de la dette sociale) had €115 billion of social bonds outstanding, accounting for nearly 21% of the market. CADES was established by government order to redeem French social debt. See “Mission and Operation” on the CADES website.

17 “The Newsletter,” Number 46. CADES. As of February 2023.

18 “Investing in Inclusive Growth,” Goldman Sachs Asset Management. As of May 16, 2023.

19 Non-cyclical consumer companies sell staple products and services such as food and clothing that are in demand regardless of economic trends.

20 Goldman Sachs Asset Management, Bloomberg. Calculated on November 1, 2023.

21 Motability Operations Group runs the Motability Scheme, which allows disabled people to exchange their qualifying mobility allowance for a new car, wheelchair accessible vehicle (WAV), scooter or powered wheelchair. It is governed by the Motability Foundation, the charity which sets the Scheme’s strategic direction and oversees performance. See “All about us” on the Motability Operations Group website.

22 Refinitiv data. As of November 7, 2023.

23 “Social Bond Framework,” Motability Operations Group. As of July 2020.

24 Goldman Sachs Asset Management, Bloomberg. Calculated on November 1, 2023.

25 Ibid.

26 “Successful Launch of Praemia Healthcare’s Inaugural Sustainable Bond Issue,” Praemia press release. As of September 13, 2023.

27 “Sustainability Financing Framework,” Praemia Healthcare. As of August 2023.

28 “Sustainability Bond Guidelines,” ICMA. As of June 2021.

29 Goldman Sachs Asset Management, Bloomberg. Calculated on November 1, 2023.

30 Communications companies account for 0.2% of outstanding social bonds and 2.9% of sustainability bonds. Cyclical consumer companies make up 0.1% of the social bond market compared with 2.2% of sustainability bonds. Goldman Sachs Asset Management, Bloomberg. Calculated on November 1, 2023.

31 Goldman Sachs Asset Management, Bloomberg. As of July 1, 2023.

32 Goldman Sachs Asset Management, Bloomberg. As of September 30, 2023. For eligible social project categories, see KHFC’s “Sustainable Financing Framework.” As of September 2023.

33 Goldman Sachs Asset Management, Bloomberg. As of September 30, 2023. Japan Expressway Holding and Debt Repayment Agency is an independent administrative agency owned by the Japanese government.

34 Ibid.

35 “Colombia issues $2.5 bln in first ‘social’ bonds,” Reuters. As of November 8, 2023.

36 AfDB issued its first social bond in 2017. See “Sustainable Bond Program” on the AfDB website. As of November 9, 2023.

37 “Harmonised Framework for Impact Reporting for Social Bonds,” ICMA. As of June 2022.

38 “Investing in Inclusive Growth,” Goldman Sachs Asset Management. As of May 16, 2023.