Navigating Volatility: The Strategic Advantage of Bonds

A Source of Stability Amid Volatility

Market volatility in early August highlighted the rapid shifts in sentiment in the post-pandemic era. This risk-off episode reaffirmed strategic advantage of bonds as a source of stability and diversification for risk asset exposures. Bonds rallied on expectations of central bank rate cuts, while equities weakened. A similar pattern was observed during the US regional banking crisis in 2023, which saw the largest daily drop in the US Treasury 2-year yield since 1982.

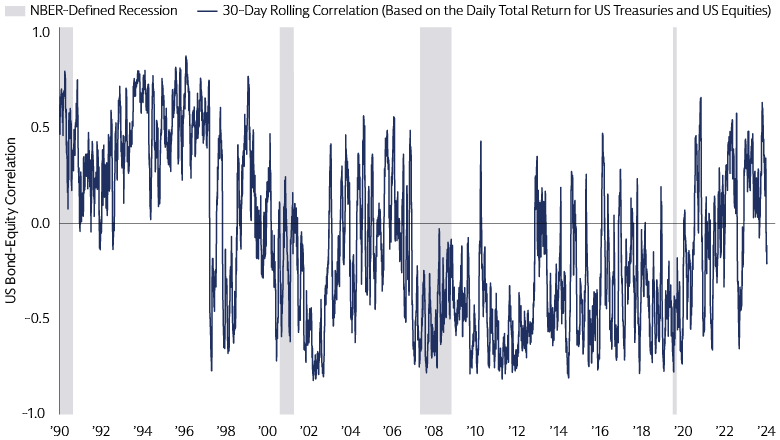

Typically, the bond-equity correlation is negative when economic growth concerns outweigh inflation risks, allowing bonds to diversify equity exposures. Although the post-pandemic period was an exception, inflation is now under control, and growth risks have risen. The bond-equity correlation has recently returned to negative territory amid downside growth concerns, reinforcing the case for restoring, initiating, or increasing allocations to core fixed income assets, such as high-quality government and corporate bonds.

Source: Macrobond, Goldman Sachs Asset Management. As of August 20, 2024. US equities: S&P 500 Index Total Return. US Treasuries: ICE BofA Merrill Lynch US Treasury & Agency Index Total Return. Past correlations are not indicative of future correlations, which may vary.

A Higher Starting Point for Yields Can Buffer Declines in Cyclical Assets

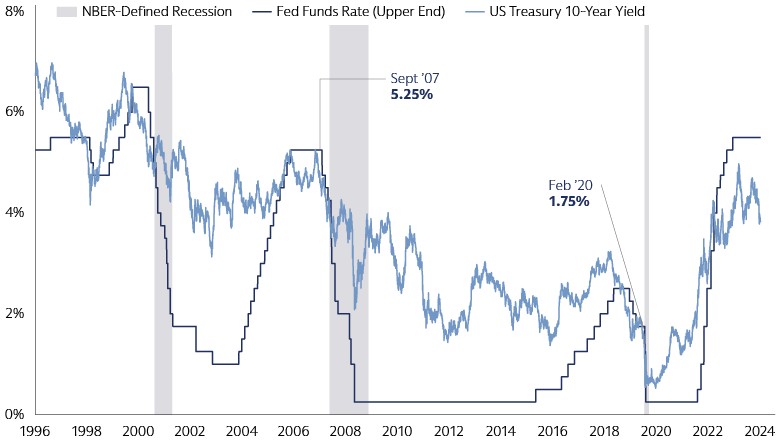

The shift to a higher rate regime allows bonds to generate attractive income and potential returns during stable periods, while also serving as a buffer for weaknesses in risk assets during economic downturns. This marks a significant change from the last cycle when bond yields were near their lower bound, limiting their ability to protect portfolios. Currently, the US Federal Reserve has 550 basis points of policy room to address economic challenges, compared to just 175 basis points at the onset of the pandemic.

Source: Macrobond, Goldman Sachs Asset Management. As of August 21, 2024.

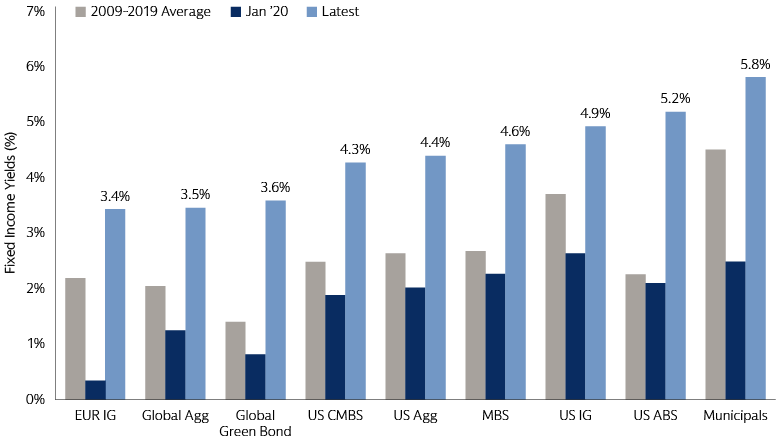

Similarly, core bond yields have ample space to fall, providing a stronger defense against economic downturns compared to the previous cycle. The Global Aggregate index, which tracks high-quality, global core fixed income bonds, yielded 1.25% in January 2020 and averaged 2% in the last cycle. Today, it yields 3.5%. As growth volatility resurfaces, cyclical assets are expected to face larger headwinds relative to core bonds. Higher yields on high-quality bonds also reduce the need to seek income and returns from riskier assets, especially during periods of negative growth shocks.

Source: Macrobond, Bloomberg, ICE BofAML. As of August 20, 2024. Abbreviations: Investment Grade (IG), commercial mortgage-backed securities (CMBS), mortgage-backed securities (MBS), asset-backed securities (ABS).

Structural Shifts Point to More Frequent Episodes of Growth-Driven Bearish Sentiment

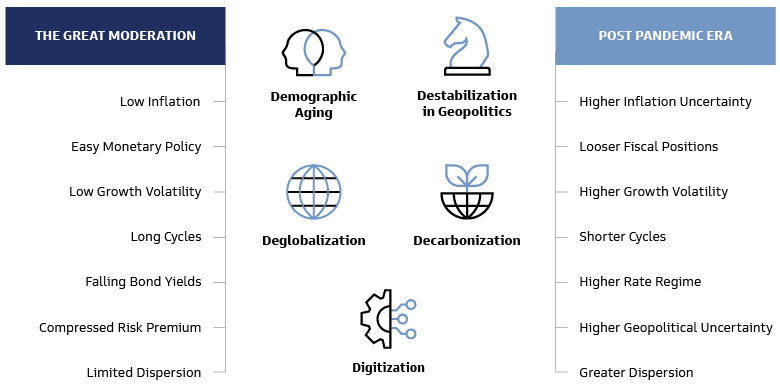

Structural changes in the global economy create diverse investment opportunities but also increase fluctuations in economic data and episodes of bearish sentiment, even without leading to outright bear markets or recessions. Growth concerns, driven by geopolitical instability, cyber threats, and climate-related challenges, underscore the need for stability in investment portfolios.

Source: Goldman Sachs Asset Management. For illustrative purposes only.

The interplay of deglobalization, geopolitical destabilization, decarbonization, disruptive technology, and demographic aging is expected to influence economies and financial assets in various ways, causing dispersion and volatility. Core fixed income allocations may help mitigate potential shocks and distortions in the economic cycle. Ultimately, active investment strategies, diversification, and strong risk management will be crucial to navigate volatile markets and generate alpha.