Seizing Potential Opportunities with Active Fixed Income ETFs in 2025

Actively managed exchange-traded funds are on the rise. First introduced in 2008,1 active ETFs have taken off in recent years, with global assets under management surging to an all-time high of nearly $1.1 trillion in 2024, fuelled by robust inflows.2 The market is dominated by US-listed funds, though investor demand in the rest of the world has increased.3 In Europe, assets in active ETFs rose sharply last year to $56.7 billion.4

For investors, active ETFs offer all the advantages of the ETF wrapper. They are cost-effective and offer intraday trading at a known price just like stocks, as well as offering greater transparency on holdings. Unlike passive ETFs that track an index, however, the active variety are managed by investment professionals with the goal of achieving specific outcomes, including capturing market inefficiencies, targeting investment themes such as sustainability, outperforming a benchmark, and generating income.

At Goldman Sachs Asset Management, we believe the active ETF market will continue to expand, and that the active component of these funds will be critical in driving market growth. We think active ETFs offer investors a flexible, efficient way to gain exposure to key fixed income markets in the year ahead. In this market especially, an active approach can help investors seize potential opportunities and help manage risks that may arise.

Charting the Expansion of Active ETFs

ETFs have been around for more than 30 years, and during most of that time they have been associated primarily with passive investing and index-tracking funds. This is changing as investors increasingly seek to combine the potential benefits of the ETF wrapper, including liquidity, portfolio diversification and transparency, with the in-depth research and alpha potential that an active manager can bring.

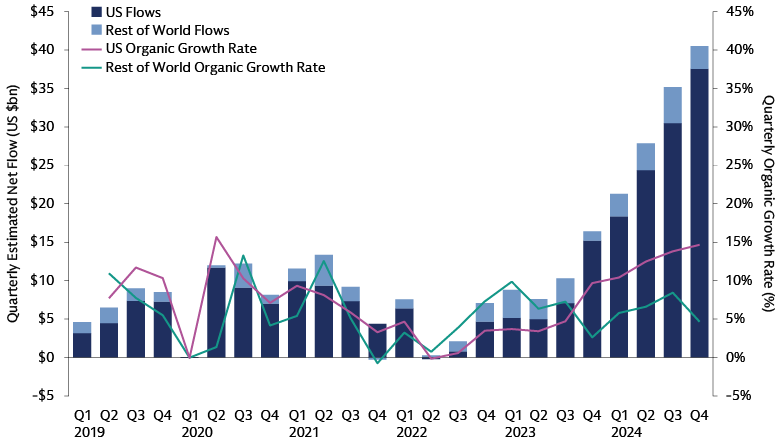

While passive funds still account for the bulk of ETF assets under management, demand for active funds are fast increasing.5 In 2024, active ETFs grew almost five times faster than passive ETFs. Flows into these products more than doubled from the previous year to $339 billion, with equity and fixed income strategies capturing 89% of active flows.6

Within the active ETF fixed income market, the US accounts for the bulk of flows and assets, but the rest of the world is making progress.7 Europe is lagging, with about $11.5 billion in assets under management in active fixed income ETFs,8 but we think it is poised for expansion as new products enter the market.

Source: Goldman Sachs Asset Management, Morningstar. For illustrative purposes only. As of December 31, 2024.

The Case for Active Fixed Income ETFs

Active investing and fixed income are a natural fit. The $141 trillion fixed income market9 is vast and expanding. It is complex, with more than 3 million unique securities outstanding across a range of types, maturities and ratings.10 That said, it can have structural inefficiencies in many areas and investors face a range of risks including interest-rate movements and the creditworthiness of issuers. In this environment, active management using rigorous data-driven, technology-led processes and thoughtful portfolio construction can help investors manage these risks and take advantage of the opportunities with the goal of outperforming relevant benchmarks.

Combining active management with the ETF wrapper can provide investors with a set of unique tools for navigating the fixed income market. Active ETFs allow managers to respond to evolving market conditions, for example by adjusting a portfolio’s sector composition and duration exposures. They provide investors with the benefits of specialist fundamental research and bottom-up security selection that can help identify issuers well-positioned for both cyclical and structural trends.

The ETF wrapper provides other benefits, including:

- Enhanced transparency

Daily portfolio disclosure improves transparency, facilitates performance attribution and helps investors manage their allocations more effectively. - Trading flexibility

Intraday trading on exchanges or over the counter gives investors greater flexibility. The ability of authorized participants (APs) to tap the primary market facilitates large block trades independent of the initial assets or amount of secondary trading in the ETF. - Potential for lower costs

Secondary-market volumes have the potential to lower costs for clients by limiting primary market activity, while the ability to transact in-kind has the potential to reduce clients’ trading costs through a more efficient primary market process. - Insulation from trading costs related to client activity

Trading costs related to a creation or redemption are born by the investors of the flows rather than other shareholders. - Consistent portfolio exposure and liquidity in stressed markets

The unique features of ETFs allow managers to maintain the liquidity profile of a strategy by limiting the bonds that must be traded in the market to fund outflows in a stressed scenario. - Portfolio diversification

Investors can invest or liquidate small or large positions, which can help them manage asset allocation and maintain diversification in their portfolios.

We believe these levers can help deliver enhanced returns by capturing potential opportunities within a risk-managed framework, while exploiting potential execution alpha from trading practices and cost-efficient implementation.

Fixed Income Outlook

Against a backdrop of continued global expansion, led by the US, normalizing inflation, and monetary easing, we believe the outlook for fixed income is favorable. Despite high policy uncertainty, we remain focused on healthy fundamentals while staying alert to tail risks.

Core fixed income stands to benefit from the broadening of central bank easing cycles, with rate relief also supporting high yield credit and emerging market debt. The strength of company balance sheets underpins income potential across fixed income spread sectors, including investment grade credit and securitized sectors. We believe investment grade bonds stand out as an anchor that have provided a steady stream of income, while offering historical protection against economic downturns and preserving capital during market volatility.

Spreads are tight compared to the period following the 2008 global financial crisis, reflecting a supportive fundamental and technical backdrop. At the same time, yields are near their highest levels in a decade, offering attractive potential for income-driven returns. We believe improvements in credit quality in sectors like the US high yield credit market along with changes in sector composition, suggest that certain bond spreads may narrow further. In our view, these dynamics highlight the importance of bottom-up security selection to identify issuers well-positioned for both cyclical and structural trends.

To capitalize on opportunities, we believe it will be vital for investors to understand the intricacies of each fixed income segment while also navigating macro, market, and policy crosscurrents, with particular attention on potential changes in US trade, fiscal, regulatory, and immigration policy.

The Future Is Active

Active ETFs are changing the way investors look at the fixed income market. This relatively recent innovation is allowing investors to access the dynamic management and security selection of active funds along with the tradability, liquidity and cost-effectiveness of an ETF. This unique combination has attracted strong investor demand, and we think active ETFs will continue to grow in the years ahead, expanding the solutions they offer to investors along the way.

1 “Bear Stearns Begins Trading of First Actively Managed ETF,” Global Custodian. As of March 25, 2008.

2 “Global ETF Flows 2025,” Morningstar. Data as of December 31, 2024.

3 “Global ETF Flows 2025,” Morningstar. Data as of December 31, 2024

4 “European ETF & ETC Asset Flows: Q4 2024,” Morningstar Manager Research. Data as of December 31, 2024. The USD figure given here is a conversion of EUR 54.4 billion in the Morningstar report as of December 31, 2024.

5 “Global ETF Flows 2025,” Morningstar. Data as of December 31, 2024.

6 “Global ETF Flows 2025,” Morningstar. Data as of December 31, 2024.

7 “Global ETF Flows Q3 2024,” Morningstar. Data as of September 30, 2024.

8 “European ETF & ETC Asset Flows: Q4 2024,” Morningstar Manager Research. Data as of December 31, 2024. The USD figure given here is a conversion of EUR 11 billion in the Morningstar report as of December 31, 2024.

9 “Capital Markets Fact Book, 2024,” Securities Industry and Financial Markets Association. July 30, 2024. Data as of end-2023.

10 Bloomberg data as of January 20, 2025.