Beyond the Beta: Actively Seeking Small-Cap Alpha

Beta Boost Momentum

Beta in small-cap markets is currently being influenced by several key factors, meaning these stocks are more sensitive to market changes and can see outsized gains as conditions improve—especially with rate cuts, earnings growth, attractive valuations, and increased dealmaking supporting their outlook.

A supportive macroeconomic environment

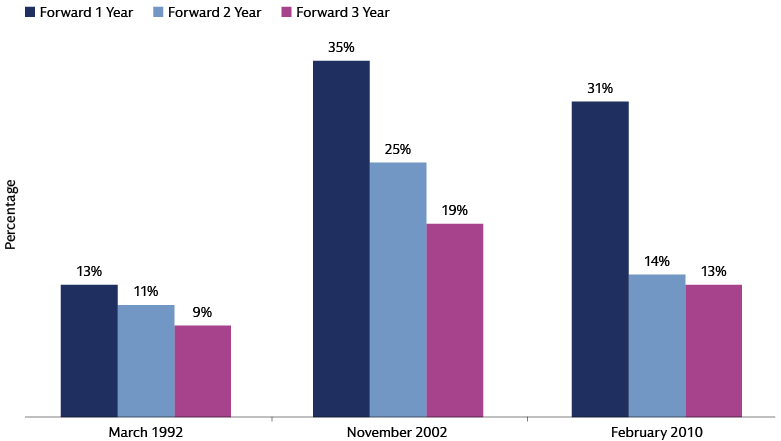

With over twice the leverage of large caps and a much higher share of floating rate debt (32% for the Russell 2000 vs 6% for the S&P 500),1 small caps are especially sensitive to interest rate changes and stand to benefit more from rate cuts. Given that US small caps represent over 60% of the global small-cap market,2 the anticipated US rate cutting cycle is poised to meaningfully influence small-cap performance globally. Historically, US small caps have often outperformed the S&P 500 following periods of rate cuts.

Source: Goldman Sachs Asset Management & FactSet. Starting dates are the dates of the respective FOMC meetings for illustrative purposes only. Past performance does not predict future returns and does not guarantee future results, which may vary.

A more normalized rate environment in Europe is also supportive of the region’s equity market; the European Central Bank (ECB) having lowered rates by 200bps between June 2024 and June 2025. Commitments to more fiscal spending in Germany and increased defense spending across the region, coupled with a stronger euro, may further benefit European small caps. Elsewhere, Japan’s economy is being revitalized by broadening wage growth, higher inflation, and corporate governance reforms, which are boosting domestic capital expenditure and consumption. As real wages turn positive and the yen strengthens, Japanese small and mid-cap stocks are poised to benefit from increased consumer purchasing power and limited tariff exposure.

Positive earnings momentum and compelling valuations

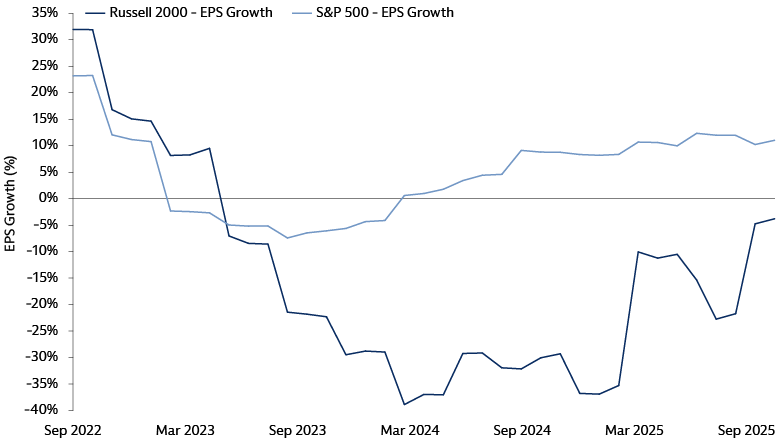

US small-cap earnings are showing signs of a strong rebound. In the second quarter of 2025, they recorded their first positive earnings, fueled by improving sales and margins. Notably, 25% of Russell 2000 companies have reported at least two consecutive quarters of accelerating earnings. This momentum is expected to extend into 2026, enabling small-cap earnings to catch up with—and potentially surpass—large caps.3

Source: Goldman Sachs Asset Management & FactSet. As of September 18, 2025. Past performance does not predict future returns and does not guarantee future results, which may vary.

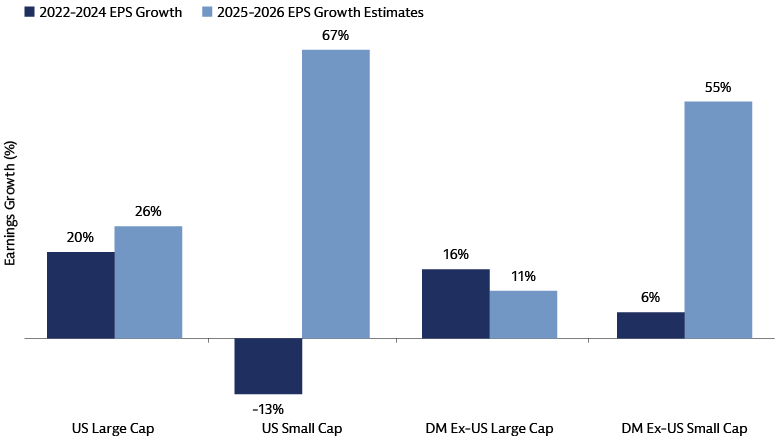

Outside of the US, European small-cap earnings are also set for strong growth, with estimates suggesting a notable upgrade versus flat expectations for large caps. In Japan, small- and mid-caps have recently outperformed larger peers, driven by stronger earnings, better governance, and resilient domestic demand. As Japanese interest rates rise, high-quality, profitable companies are likely to be favored. While the valuation gap with large caps has narrowed, we find that select firms with solid fundamentals still offer attractive opportunities.

Source: Bloomberg and Goldman Sachs Asset Management. As of August 14, 2025. Chart Shows earnings per share (EPS) growth for calendar years 2022-2024, and the Bloomberg Consensus Estimate for EPS growth for calendar years 2025 and 2026.

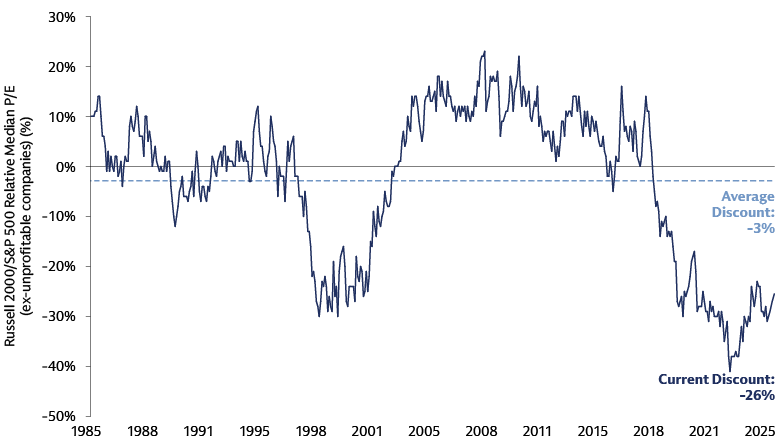

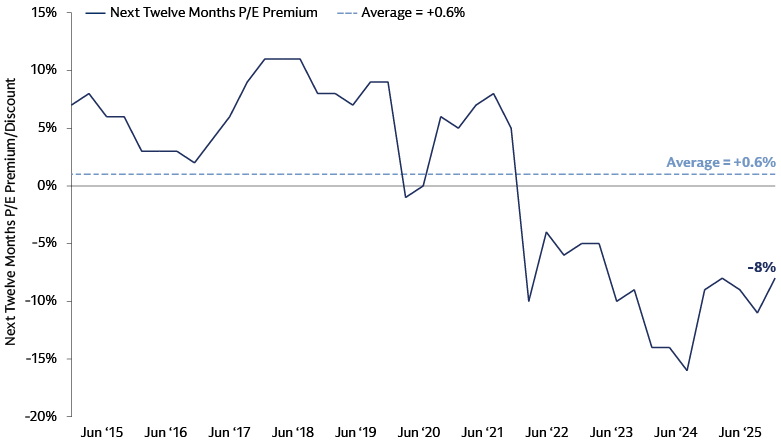

We believe small-cap valuations are highly attractive given the outlook for earnings. In the US, small caps trade at a 26% discount to large caps (excluding unprofitable firms), near historic lows. Outside the US, international small caps, which typically trade at a premium, are now at an 8% discount to international large caps despite offering higher forward earnings growth. This suggests the market may be undervaluing small-cap upside potential, creating a compelling entry point for long-term investors. In Europe, the small-cap discount in 2025 has been as sharp as levels seen in global financial crisis when economies were in severe recession, highlighting the opportunity.4

Source: Furey Research Partners and FactSet as of September 30, 2025. For illustrative purposes only. Past performance does not predict future returns and does not guarantee future results, which may vary. Small Caps are defined using the Russell 2000 Index. Large Caps are defined using the S&P 500. Based on total returns. The content on this slide does not represent Goldman performance/products. Valuation is defined by LTM P/E excluding unprofitable companies.

Source: FactSet, as of June 30, 2025. International Small Caps represented by the MSCI EAFE Small-Cap Index. International Large Caps represented by the MSCI EAFE Index.

Capital markets activity could boost small caps

We believe a pickup in M&A activity and IPOs can generate optimism for the broader market, increase investor risk appetites, and draw greater interest to the small-cap space. Small caps are often the target of consolidation: in the US, 9 out of every 10 public M&A targets are small caps.5 We believe we are currently at the start of a new cycle in the capital markets: in the US, deal activity has picked up, with announced M&A (dollar volumes) +22% year over year, with smaller deals (<$5 billion) +7%.6 A decline in interest rates may further spur deal-making by lowering the cost of capital and improving financing conditions, giving buyers more flexibility for acquisitions. With small caps trading at attractive valuations, they may increasingly become bid targets as firms seek bolt-on acquisitions or industry consolidation plays.

Source: Furey Research Partners “New M&A Cycle Can Help Power Small-caps (and What’s Working)”, FactSet. As of October 31, 2024. Periods greater than one year are annualized.

In recent years, subdued IPO activity has limited the flow of new companies into the public small-cap universe. We believe that the IPO market is beginning to rebound, with 46 US IPOs exceeding $25 million completed so far in 2025, raising a combined total of $24 billion year-to-date. This marks an 18% rise in the number of IPOs compared to the same period last year, setting 2025 on track to be the most active year for IPOs since 2021.7

There has been discussion about companies increasingly choosing to stay private for longer. Last year, we observed a spike in the median age of a company at IPO to 14 years (from 10 in 2023). Some companies go from private markets straight into mid- and large-cap indices as a result. However, this is not unusual in historical terms. In previous cycles, the median age of companies at IPO also reached 14-15 years but then subsided. We note that as of May 2025, the median market value of an IPO at first close was still small-cap at $1.2bn (adjusted for inflation).8

We believe there may be benefits to businesses remaining private for longer, as it gives them time to refine their models and emerge as more mature, yet fast-growing, public companies. Looking ahead, we believe the small-cap universe will continue to be revitalized by high-quality new entrants, many of which have been supported by private equity in their formative years.

Seeking Alpha Opportunities

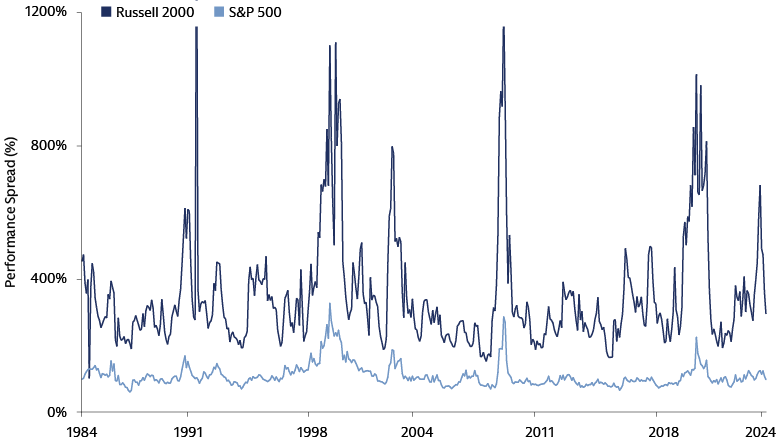

We believe the small-cap market demands a more nuanced investment approach than a beta play due to significant inefficiencies and idiosyncratic risks. Active management is particularly effective in the small-cap market due to its inherent inefficiencies. This segment is characterized by less analyst coverage and greater dispersion of returns compared to large-cap stocks, creating opportunities for skilled managers to identify mispriced securities and uncover hidden gems while also steering clear of potential pitfalls that may exist in the universe. This can be achieved through traditional bottom-up stock selection, involving in-depth fundamental research to find attractively valued, high-quality companies early in their lifecycle, or through a quantitative approach utilizing data-driven models and cutting-edge technology to derive insights from vast amounts of signals.

Source: BofA Global Research. As of December 31, 2024. Past performance does not predict future returns and does not guarantee future results, which may vary. Please see disclosures for additional information.

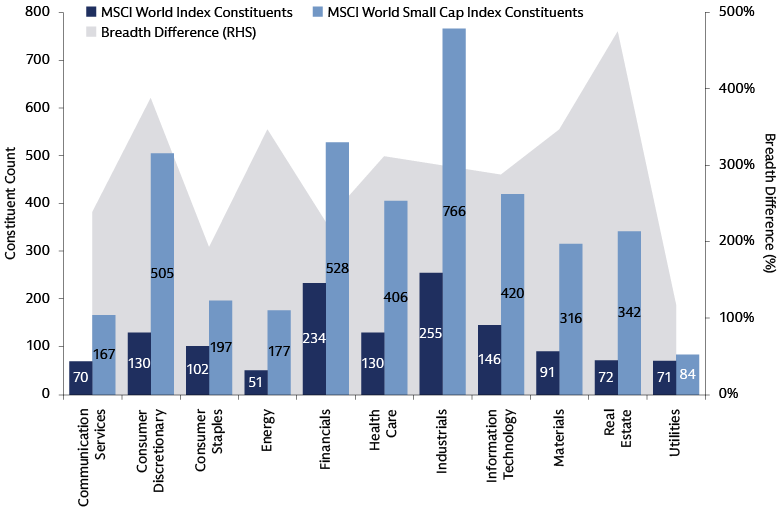

The small-cap universe is vast and diverse, with the MSCI World Small-Cap's investable universe being almost three times larger than the MSCI World's. This breadth is spread in a balanced manner across all sectors, industries, and countries, where small-cap equities represent a diverse group of stocks with varying liquidity profiles and profitability characteristics. This wider market breadth enables a greater variety of opportunities for active managers across the index compared to the higher concentrated large-cap space.

Source: Goldman Sachs Asset Management. As of March 31, 2025. Represents total number of holdings in the benchmark universe.

We anticipate that consumer, defense, and tech sectors within the small-cap universe will present areas of compelling growth opportunities.

The US small-cap consumer sector is exhibiting pockets of significant strength in select companies within the apparel industry that are demonstrating the ability to thrive even amid broader industry challenges by catering to specific market niches or leveraging strong brand equity. We also seek to understand consumer behavior by analyzing timely, differentiated datasets, such as credit card transaction data as well as web and app traffic, to inform bottom-up stock selection and identify attractive opportunities.

The industry continues to experience robust growth globally, and within small caps, we see opportunities in specialized areas. For instance, companies involved in cutting-edge technologies like unmanned vehicles and advanced weapons, or those providing critical "building blocks" for significant growth areas like naval defense, are well-positioned. Firms with allocations in aerospace and defense and small defense plane contractors also represent strong prospects. A data-driven approach, including leveraging information in news reports and company statements, enables investors to identify direct and indirect beneficiaries of a rise in defense expenditures with precision, including potential beneficiaries across the entire supply chain.

While the semiconductor industry has faced some cyclical volatility, select names with clear catalysts and specialized offerings are performing exceptionally well. Beyond semiconductors, other areas rich in opportunities include cloud infrastructure providers, the rapidly evolving field of Agentic AI in cybersecurity, and data protection solutions. Thematic hardware focus remains on semiconductors and systems, while thematic software centers on Agentic AI and broader enterprise software solutions, reflecting the ongoing digital transformation across industries and enabling scalable adoption of these technologies. Small and mid-cap biotech companies drive healthcare innovation, contribute to Medtech advancements (wearables, hospital systems) and the GLP-1 anti-obesity drug market (convenient treatments). We see accelerating M&A activity in this space.

In these and other small-cap sectors globally, we see opportunities to leverage data—such as information contained in news reports, earnings statements, patent filings and company announcements—to understand global linkages between companies. As such, we seek to identify further beneficiaries of these broader themes and understand how various companies may be interconnected across supply chains.

Steering Through Market Risks

Small-cap investing offers significant alpha potential due to its diverse and often under-researched universe, but it also comes with unique challenges. Small caps are also more sensitive to market sentiment, leading to sharper price swings and wider bid-ask spreads, which can make trading costly and difficult—especially during periods of market stress. The "meme stock" phenomenon, where social media and retail trading drive extreme volatility, highlights the need for active oversight beyond traditional financial analysis. Additionally, while many small-cap companies are unprofitable, some possess disruptive potential and a credible path to profitability. For example, the S&P 600 index, which screens for profitability, has outperformed the broader Russell 2000 over the past decade, but not consistently in recent years. This underscores the importance of active management to distinguish between high-risk and high-potential opportunities in the small-cap space.

Source: Goldman Sachs Asset Management. As of September 30, 2025

Stage Set for Small Caps

Small-cap markets are set for a promising cycle, driven by expected rate cuts, attractive valuations—in the US and especially internationally—rising earnings, and increased dealmaking. Historically, small caps often outperform large caps following a rate cutting cycle. However, their diversity and inefficiencies mean active management is crucial to identify mispriced opportunities and avoid pitfalls. Sectors like defense, technology, consumer niches and biotech offer notable growth potential. Still, small caps carry higher risks, including volatility and liquidity challenges, often amplified by social media and retail trading trends. We believe active management is essential to navigate these risks and find innovative companies with a path to profitability.

1 Global Investment Research, Weekly Kickstart, May 16, 2025.

2 Measured by the MSCI World Small Cap Index. As of August 2025.

3 Furey Research Partners, FactSet. As of October 14, 2025.

4 Goldman Sachs Global Investment Research. As of July 11, 2025.

5 Furey Research Partners, FactSet. As of October 2024.

6 Goldman Sachs Global Investment Research. As of September 16, 2025.

7 Goldman Sachs Global Investment Research. As of September 26, 2025.

8 Jay R. Ritter, Eugene F. Brigham Department of Finance, Insurance, and Real Estate, Warrington College of Business, University of Florida. Initial Public Offerings: Updated Statistics As of July 2, 2025.