Municipal Bonds: Navigating Easing Cycles for Enhanced Returns

The municipal credit market has faced its fair share of headwinds this year. Potential federal funding cuts, the impact of tariffs, and sector specific pressures have weighed on the asset class to a degree. However, we believe the broader strength of credit fundamentals, the buoy of a Federal Reserve (Fed) easing cycle and municipals’ track record during prior easing cycles provide plenty of reasons to be optimistic.

Riding the Cutting Wave

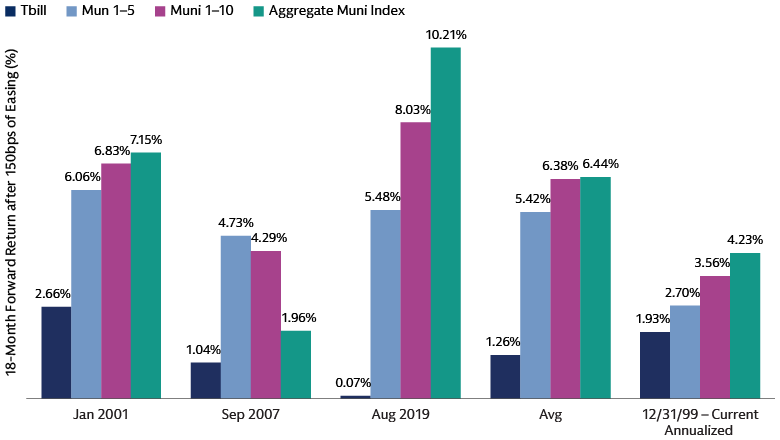

The Fed’s current easing cycle has already seen 150 basis points (bps) in rate cuts, a significant move mirrored in only three other cycles over the past 25 years: the 2000 tech bubble, the global financial crisis, and the COVID-19 pandemic. While it seems reasonable to assume the prime opportunity to capitalize on rate cuts has passed, historical precedent suggests that attractive total return opportunities may still be on the horizon.

Municipal bonds have consistently demonstrated their resilience and outperformance potential in past easing cycles, despite these typically being accompanied by economic slowdowns. The 1-10 year Municipal Bond Index, for example, has historically delivered an average annualized return of 6.38% in the 18 months following 150bps of Fed cuts. This represents a 2.82% outperformance compared with its 25-year annualized average return of 3.56%.

This pattern extends across the municipal yield curve, with the Muni 1-5yr and Muni Aggregate indices having similar outperformance relative to their long-term averages.

Source: Bloomberg, Goldman Sachs Asset Management. As of December 4, 2025.

As the Fed continues to cut rates, money market yields, which have been attractive, are expected to decline. This shift makes tax-exempt municipal bonds increasingly appealing on a relative value basis. Strategic allocations to municipal bonds have consistently outperformed cash (as measured by the T-bill Index) during every past cutting cycle.

Higher Yield Levels Offer Income Potential

The current environment offers a compelling value proposition through higher starting yields beyond the potential for capital appreciation driven by falling rates, presenting a strong entry point for investors.

The Muni Aggregate Index for example, currently has a yield of 3.60%, above its 25-year average of 3.12%. Similarly, the Muni 1- to 10-year Index yields 2.99% compared with its 25-year average of 2.45%, and the Muni 1- to 5-year Index stands at 2.78% against its 25-year average of 1.99%. This environment means that investors can anticipate attractive total returns primarily from income generation, even in a scenario where yields do not compress further.

Robust Credit Fundamentals

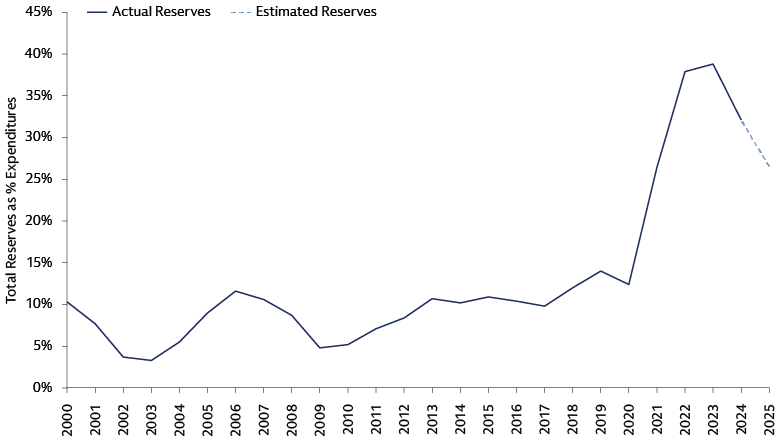

Municipal credit fundamentals remain strong with many metrics at relatively high levels. This strength was largely driven by substantial federal aid during the pandemic followed by strong economic growth. State and local revenues grew significantly during this period and conservative budgeting allowed governments to bolster reserves, reduce debt and improve pension funding. State reserve funds have grown as a percentage of overall expenditures since fiscal year 2021. Despite some recent spending down of these hefty reserves, states are estimated to end fiscal year 2025 with over double the level of reserves they had in fiscal year 2020.1 Some states have also improved controls, added protections to limit spending down rainy-day funds and introduced requirements to build up reserves when revenue growth is strong.

Source: NASBO, Goldman Sachs Asset Management. Figures for 2024 and 2025 are estimated reserves, rather than finalized.

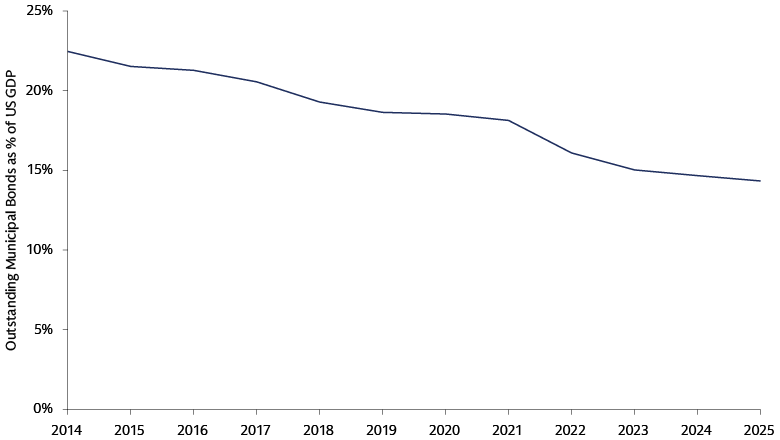

Municipal debt as a percentage of GDP has continued to decrease, indicating a healthier overall fiscal picture despite increased issuance. Additionally, states have made significant strides in improving their pension funding. The aggregate funded ratio for state and local pension plans increased to an estimated 81.4% in fiscal year 2025.2

Source: SIFMA, Federal Reserve, Goldman Sachs Asset Management. As of December 4, 2025

We believe these pillars provide a strong fiscal foundation for municipal credit, which may be entering a period of slower revenue growth. Recent positive credit trends have led to rating agency upgrades that continue to consistently outpace downgrades. Moody’s, for example, has upgraded more municipal issuers than it has downgraded for 17 consecutive quarters. Some of the more notable upgrades this year include the states of Illinois and New Jersey, as well as New York’s Metropolitan Transportation Authority.

As we navigate the ongoing easing cycle, the historical performance, compelling yields, and strong credit fundamentals of municipal bonds offer a clear roadmap to enhance portfolio returns and provide robust tax-advantaged income.

1NASBO Fall ‘25 Fiscal Survey of States

2Equable Institute, July 2025