Unlocking Tax Efficiency: A Tax-Aware Approach to Active Management

Active management's potential for higher returns can come at the cost of higher taxes. We’ve identified strategies with the goal of mitigating these tax inefficiencies while also creating capacity for a higher allocation to active management, thereby enhancing overall after-tax returns over the full lifecycle of an investor’s financial journey. We recently explored the importance of Managing Your Portfolio with After-Tax Returns in Mind and in this article we examine the tax implications of active management. Specifically, we consider potential strategies to mitigate tax inefficiencies and simultaneously retain the capacity for active investment, thereby enhancing overall after-tax returns for investors throughout a financial lifecycle.

The Compounding Advantage: Tax-Aware Choices Build Greater Wealth Over Time

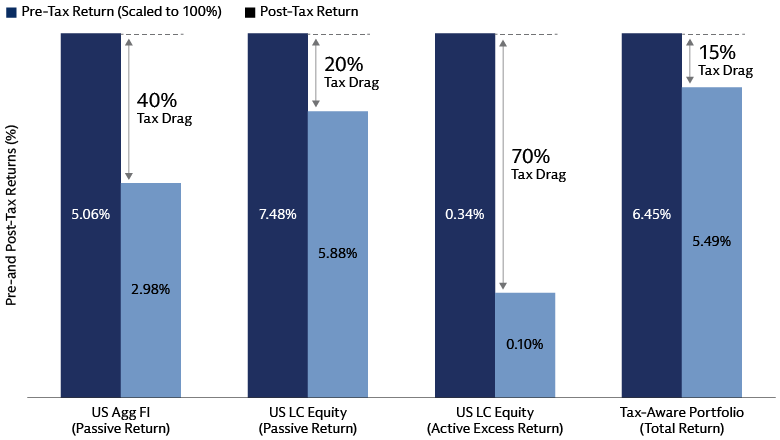

Active management, by its nature, involves more frequent buying and selling of securities. This higher portfolio turnover leads to more frequent realization of capital gains and potentially larger tax liabilities for investors compared to passive strategies. These taxes diminish net returns, creating a "tax drag." Disregarding the tax implications in active management can therefore significantly erode investment returns. Tax choices compound over time, and small annual differences can result in meaningful dollar gaps over decades. Importantly, our research shows that high tax bracket investors who prioritize after-tax returns when allocating assets and selecting products can boost expected wealth by about 15% over 30 years versus those focused on pre-tax returns.1 This approach considers tax impacts from asset allocation, active management, and tax-loss harvesting. Furthermore, portfolios that are invested with a focus on bequest or charitable contributions and therefore likely benefit from a step up in basis2 at the end of the investment horizon will experience a larger benefit of more than 30%.

Source: Goldman Sachs Asset Management. As of December 31, 2024. Illustration of post-tax wealth growth over 30 years for portfolios optimized to pre- and post-tax returns with only passive investments, optimized to post-tax returns with active managements, assuming an investor with high federal tax rates (i.e., income tax of 37%, long-term capital gain tax of 20%, net investment income tax of 3.8%), no state/local tax, with and without stepping-up cost basis after investment horizon, one-way turnover of 15% per year from equity to fixed income due to periodic portfolio rebalancing.

Mitigating Tax Drag in Active Management

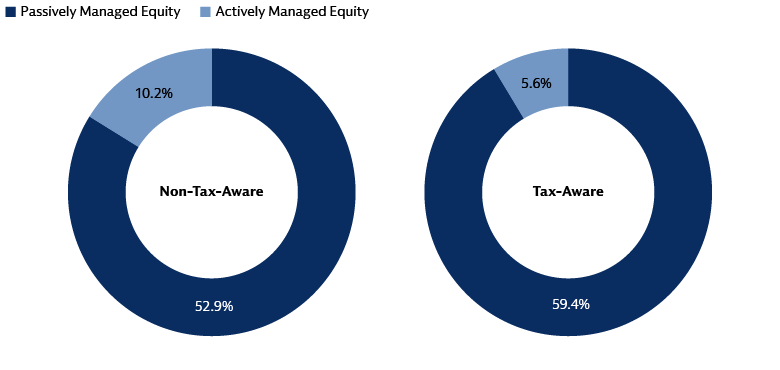

If active managers fail to consider the tax consequences of these frequent trades, the resulting tax burden for investors can be worse than if they had simply used a passive investment strategy. Our research indicates that investors in high tax brackets, employing a 60/40 portfolio with a median active turnover, may find that a significant reduction to allocations to actively managed funds—possibly by as much as 50%—is desired relative to the allocation appropriate for tax-exempt investors (see below). In other words, without tax-aware implementation, the net benefit of active can be materially reduced for taxable clients. While reducing allocations to actively managed funds might seem like a direct solution to mitigate negative tax consequences, we believe that employing specific tax-efficient strategies can help retain the potential benefits of active management. These benefits include the possibility of outperforming market benchmarks and the ability to adapt to evolving market conditions.

Source: Goldman Sachs Asset Management. As of December 31, 2024. Pre-tax risk-free rate is assumed to be 3.90%, post-tax risk-free rate is assumed to be 2.31% at high-tax bracket. Assuming a turnover ratio of 32% for active US Large-Cap Blend mutual funds (Median of the category according to Morningstar Direct, as of June 30, 2024).

Source: Goldman Sachs Asset Management. As of December 31, 2024. For illustrative purpose only.

Sensitivities and Variables Influencing Tax Drag

While the core principles of tax drag's impact on investment returns remain consistent, the precise magnitude of this effect can vary significantly based on several factors. State taxes, for instance, add another layer of complexity, as their rates and rules (e.g., how capital gains are treated) differ widely across jurisdictions, directly influencing the overall tax burden on investment portfolios. Similarly, portfolio turnover variability plays a crucial role; higher turnover typically leads to more frequent realization of capital gains, which can increase tax liabilities, especially if those gains are short-term. Conversely, lower turnover often enhances tax efficiency by deferring taxable events. Finally, gain realization patterns, influenced by investor behavior and strategies like tax-loss harvesting, also affect the timing and amount of taxes paid. It is important to note that while these variables can alter the magnitude of tax drag, they do not change the direction of its impact. Tax drag consistently reduces after-tax returns for taxable investors, making tax efficiency a critical consideration. Understanding these sensitivities allows advisors to tailor insights and strategies more effectively to their clients' specific state tax environments and portfolio characteristics.

Active ETFs and Tax-Loss Harvesting: A Complementary Approach

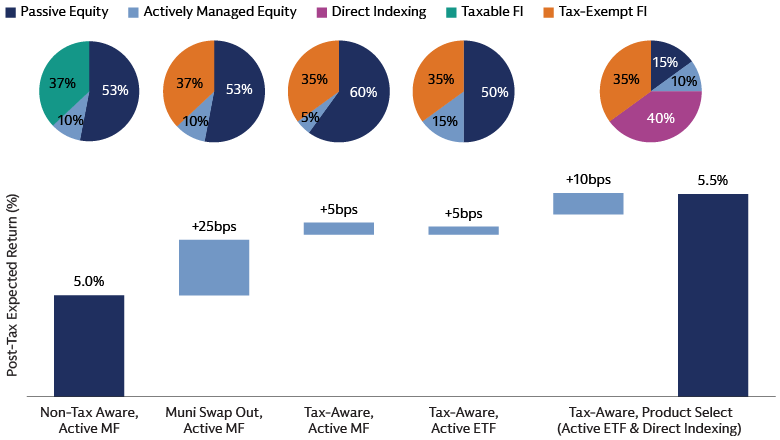

As highlighted, for high-tax-bracket investors with 60/40 portfolios and median turnover, the tax drag from tax-inefficient active vehicles, such as active mutual funds, can significantly reduce their desired allocation by as much as 50%. Fortunately, active ETFs and tax-loss harvesting strategies offer distinct yet complementary ways to effectively reintroduce active management into portfolios in a tax-efficient manner.

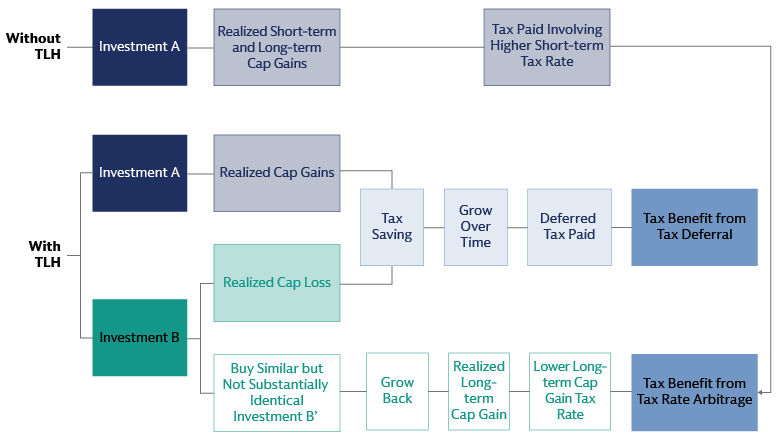

What is tax-loss harvesting?

Simply put, tax-loss harvesting3 is a strategy designed to potentially reduce your overall tax bill so you can keep more of what you earn from your investments. It works by selling investments at a loss and using those losses to offset some, or possibly all, of the capital gains from investments that you sold at a profit. For example, if an investor buys a stock at $400 and sells it for $500, they realize a capital gain of $100. This will trigger a capital gains tax (the amount will depend on variables such as the investor’s marginal tax rate, state and local tax rates and how long they held the stock). However, if the investor sells another security at a $100 loss, they can use that realized loss to offset the gain from the sale of the other stock. As a result, the net realized gain is reduced and the investor’s overall tax bill may be lowered.

Our research indicates that, for a high-tax-bracket investor, implementing a tax-loss-harvesting strategy specifically targeting US large-cap equities within a 60/40 portfolio has the potential to increase after-tax expected returns for the portfolio by 10 bps (0.10%) per year. The after-tax benefit of integrating tax-loss harvesting into the portfolio construction would bring a benefit of 35bps per year for portfolios invested with an objective of taking advantage of a step up in cost basis at the end of the investment horizon. Therefore, by strategically implementing tax-loss harvesting, investors may be able to maintain a greater allocation to actively managed investments while simultaneously enhancing overall after-tax portfolio returns. This approach suggests that tax-efficient strategies can offset the adverse tax implications often associated with active management, enabling investors to potentially capture higher returns without compromising tax efficiency.

We see value in utilizing both strategies: active ETFs can provide ongoing tax-efficient alpha due to their structure, while tax-loss harvesting, often combined with direct indexing, can be employed to harvest losses at the individual investor level, further reducing overall tax liability. This combined approach can lead to higher after-tax wealth outcomes by leveraging the inherent tax efficiency of active ETFs and the proactive tax management benefits of tax-loss harvesting.

Source: Goldman Sachs Asset Management. For illustrative purpose only.

Source: Goldman Sachs Asset Management. As of December 31, 2024. Assuming an investor with high federal tax rates (i.e., income tax of 37%, long-term capital gain tax of 20%, net investment income tax of 3.8%), no state/local tax, with and without stepping-up cost basis after investment horizon, one-way turnover of 15% per year from equity to fixed income due to periodic portfolio rebalancing.

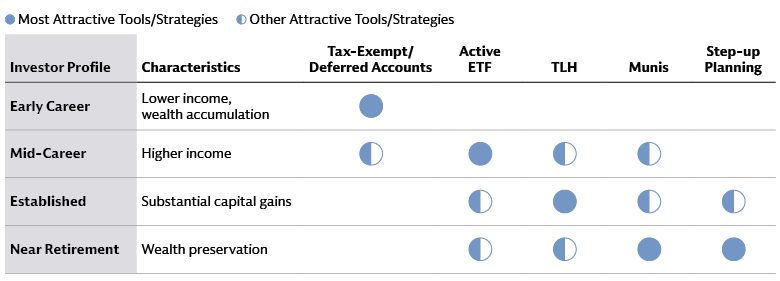

Tailoring Tax Strategies Along the Wealth Journey

Financial advisors have the potential to significantly improve clients' after-tax experience and investment outcomes by tailoring asset allocation and investment strategies to their evolving financial situations. This involves integrating tax-efficient strategies, such as active ETFs and tax-loss harvesting through separate accounts, as income and wealth increase and as investment objectives shift from wealth accumulation to estate planning, as summarized in the table below.

Step 1: Building the Foundation – Early Career & Wealth Accumulation: For clients just beginning their wealth journey or with lower incomes, the initial focus is on maximizing contributions to tax-exempt and tax-deferred accounts, such as 401(k)s, IRAs, Roth IRAs, and Health Savings Accounts (HSAs). These accounts allow investments to grow tax-free or tax-deferred, leveraging the power of compounding without immediate tax drag. Prioritizing pre-tax asset allocation in these vehicles is crucial for building a strong financial foundation and accumulating wealth efficiently.

Step 2: Growing Wealth – Higher Income & Strategic Taxable Investing: As clients achieve higher incomes, while a significant portion of their assets may still reside in tax-exempt accounts, taxable accounts begin to play a more prominent role. For these growing taxable accounts, active ETFs are often a practical and tax-efficient choice. Active ETFs generally offer embedded tax efficiency due to their unique "in-kind" creation and redemption mechanisms, which can limit capital gains distributions to shareholders. At this stage, strategic After-Tax Asset Allocation (SAA) becomes crucial to optimize returns across all account types.

Step 3: Optimizing Substantial Wealth – Integrating Separate Accounts & Advanced Tax-Loss Harvesting: Once wealth becomes substantial, integrating separate accounts, particularly for tax-loss harvesting, becomes highly beneficial. Direct indexing, a form of separate account, offers granular control over individual securities, allowing for more precise and frequent tax-loss harvesting opportunities than traditional ETFs. These harvested losses can be used to offset capital gains and, with any excess losses carried forward to future tax years, maximizing portable losses and enhancing wrapper efficiency.

Step 4: Preserving Legacy – Nearing Retirement & Estate Planning: For clients nearing or in retirement with significant assets in taxable accounts, the focus shifts towards wealth preservation, income generation, and legacy planning. This stage may involve incorporating income-oriented separate accounts, such as municipal bonds, which offer tax-exempt interest, particularly beneficial for those in higher tax brackets. Emphasis is placed on strategies that benefit from the "step-up in basis" provision, which adjusts the cost basis of inherited assets to their fair market value on the date of the previous owner's death. This effectively reduces or eliminates capital gains tax for heirs on appreciated assets. Strategic charitable donations of appreciated assets can also be integrated to reduce tax liabilities while fulfilling philanthropic goals.

Source: Goldman Sachs Asset Management.

Unlocking Tax Efficiency

Tax-aware investment strategies are crucial for maximizing wealth over time, as even small annual tax differences can lead to significant long-term gains. While active management can incur higher tax liabilities due to increased turnover, these tax drag effects can be mitigated through strategic choices. Active ETFs and tax-loss harvesting are complementary tools that enhance tax efficiency; active ETFs offer structural tax-efficient alpha, and tax-loss harvesting can further reduce tax burdens and potentially increase after-tax expected returns. Financial advisors play a key role in customizing these tax strategies throughout a client's financial journey, from wealth accumulation to estate planning, ensuring optimal after-tax outcomes at every stage.

Goldman Sachs Asset Management’s Multi Asset Solutions (MAS) team helps RIAs enhance their portfolio construction and management to help provide customized solutions at scale, leverage our decades of asset allocation experience on behalf of our clients.

1 Analysis based on wealth differential from compounding portfolio returns at the pre- vs. post-tax rates. Refer to appendix for details on portfolio and asset class assumptions used. Refer to appendix for details on wealth increase due to compound growth improvement from tax-aware investing.

2 "Step-up in basis" is a tax provision that reset the cost basis of an inherited asset to its fair market value at the time of inheritance. From a tax standpoint, it is as if the investor purchases the asset at the time of inheritance, which reduces the tax burden on prior unrealized capital gains.

3 Please refer to disclosure section of the full PDF available in the download for a review of pertinent information regarding the strategy.