Shifting Paradigms for Portfolio Construction in 2026

This article is part of our Investment Outlook 2026: Seeking Catalysts Amid Complexity

Active ETFs

We believe the flexible solutions offered by active ETFs make them an effective vehicle for accessing a range of markets, including those where structural inefficiencies make robust risk management and security selection essential. Their combination of active management with the benefits of the ETF structure has helped drive increased investor demand, with global assets under management in active ETFs growing by 46% annually since the start of 2020.1 Looking ahead to 2026, we see continued growth potential for active ETFs, particularly in fixed income, private assets and derivative-income ETFs.

Fixed income opportunities

Active ETFs are a natural fit for fixed income investors, in our view, helping them navigate structural inefficiencies in many areas of the market as well as risks including interest-rate movements and the creditworthiness of issuers. These potential benefits have boosted demand in recent years, with active fixed income ETFs now accounting for 41% of total inflows to US-listed fixed income ETFs.2 Looking forward, we see attractive fixed income opportunities in the year ahead from both a technical and fundamental standpoint, and we think the balance of risks favors the sort of dynamic approach and rigorous bottom-up security selection that active ETFs can provide. We think income opportunities exist in harder-to-access parts of the fixed income market, including high yield and emerging market debt. Expected central bank rate cuts in the US and elsewhere over the next year should benefit fixed income, including investment-grade credit and front-end US Treasuries. In all these areas, we believe the liquidity and transparency of active ETFs allow investors to manage their fixed income positions dynamically.

Source: Bloomberg, Goldman Sachs Global FICC & Equities. Data shows US-listed active ETF values as a percentage of overall US ETF AUM. Colors assigned to differentiate two distinct phases (2010-17 and 2018-2024) with 2025 highlighted as a standalone period. As of October 16, 2025. Past performance is not indicative of future results, which may vary.

Private assets, public access

As investors prepare for 2026, the investment case for private assets remains compelling, in our view. Yet many investors have historically faced barriers to investing in private assets, including high minimum-investment requirements and complex investment structures. Access to private equity investing began to change with the arrival of open-ended funds that expanded access to a broader range of investors by lowering the bar for initial investment and simplifying the investing process. Now ETF providers are responding to investor demand with strategies that seek to deliver private equity-like returns via public equity portfolios. We believe a portion of private-equity outperformance can be captured in a public equity portfolio. This can potentially be achieved with sufficient data and an understanding of how private equity investors select companies for investment, including their use of sector and factor tilts and the use of leverage.3 Private equity performance cannot be fully captured because the level of control that comes with private ownership and the potential value creation by private company management are different than the influence wielded by shareholders in a public company. While the market in these ETFs is just getting started, it builds on the more mature market in funds that seek to approximate the returns of hedge funds through a variety of trading strategies. We see investor demand for private equity-like returns and private assets remaining robust in 2026, and we expect the ETF industry to continue innovating to meet investors’ needs.

Derivative-income ETFs

We also see further growth in the years ahead for derivative-income ETFs, which are designed to generate income from an equity portfolio with the use of options contracts. These funds have seen a surge of interest in 2025 from investors who want to remain invested in equities while seeking greater predictability of returns in uncertain markets. Inflows through the first three quarters of 2025 reached $47 billion, making derivative-income ETFs the most in-demand active ETF category in the US.4 Part of the appeal for investors is that these funds seek to pay out regular distributions, offering a source of income that is not tied to interest rates. As the European and Asian ETF markets develop, we believe investors will gradually embrace use cases now prominent in the US, including derivative-income ETFs.

Enhancing Passive Allocations

We believe Alpha Enhanced equity strategies have emerged as a portfolio construction solution heading into 2026, offering a sophisticated middle ground between traditional passive and active investing. This approach allows investors to optimize their portfolio risk budget by integrating the cost-effectiveness and predictability of passive equity strategies with the robust risk management and alpha generation potential of active management. In an environment characterized by moderating forward market-return expectations, elevated index concentration risks, and heightened uncertainty across global trade, economic growth, and inflation, purely passive exposures may not be the most efficient use of an investor's risk budget. Alpha Enhanced strategies address these challenges by closely tracking a benchmark while strategically taking active bets within pre-set tracking-error limits, typically ranging from 50 to 200 basis points. This disciplined deviation aims for alpha stability and consistency, rather than magnitude, potentially leading to more frequent positive annualized excess returns over passive peers, especially over the long term due to compounding effects.

Source: Goldman Sachs Asset Management. As of October 10, 2025. For illustrative purposes only. The illustration shows the probability of a portfolio to achieve various levels of annual excess returns for various levels of tracking error. For instance, while a portfolio with 100 bps of tracking error (in dark blue) may have an average predicted annual excess return that is lower than one with 200 bps of tracking error (in green) – seen in the horizontal midpoint of each respective bell curve, the probability of achieving that return is higher for the 100 bps portfolio – seen in the vertical height of each bell curve. Withal, a lower tracking error portfolio encompasses a much higher certainty of controlled positive return. The illustration is not related to any Goldman Sachs Asset Management product or strategy.

We believe the core proposition of Alpha Enhanced strategies lies in their ability to deliver alpha efficiency and balance risk. By making smaller, diversified active bets across market caps, sectors, and geographies, these strategies seek to limit concentration and avoid unintended risk exposures, maintaining a composition close to the benchmark. This systematic, data-driven framework offers significant flexibility and transparency, allowing for customized portfolios aligned with specific objectives, including financial and non-financial goals like sustainability. Furthermore, the costs associated with Alpha Enhanced strategies tend to be lower than traditional active approaches, with expense ratios only slightly higher than passive funds, often offset by the potential for alpha generation.5 The high alpha efficiency at lower tracking-error levels translates to lower marginal costs, making these strategies increasingly accessible to a broader investor base. We believe this balanced and more flexible approach provides professional risk management and the potential to outperform the market, making it a compelling theme for optimizing core equity allocations in 2026, helping integrate investor goals across the dimensions of risk, return, cost and in some cases, sustainability.

Tail-Risk Hedging

Tail-risk hedging is a critical tool for multi-asset investing, but we think its true value lies beyond simply shielding portfolios from downside risks. When implemented effectively, tail-risk hedging can enable investors to increase their exposure to core risk assets, such as equities, potentially boosting overall returns while providing convex-payouts during risk events. Essentially, we believe downside convexity allows for portfolios to take excess risk to positive risk premia factors without substantially increasing downside. Furthermore, traditional portfolio hedges rely on two assumptions that are somewhat challenged in the current environment: negative equity-rates correlations amid stress events and USD behaving like a perceived safe-haven currency. We believe that investors now need a broader set of hedging instruments to potentially deliver intended objectives. In addition to tail-risk hedging, we intend to diversify and broaden our exposure to offensive alternative risk premia, expanding beyond broad-based trend and carry. This adds another lever to potentially generate returns and offset the negative carry of tail-risk hedging strategies.

Broadening Access to Alternatives

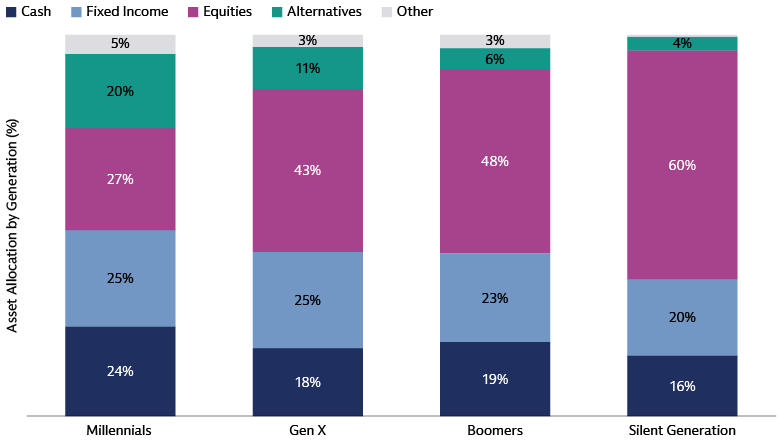

The private market landscape is undergoing a significant transformation, and we observe individual investors increasingly opening the door to alternatives. Our survey of 1,000 high net worth investors revealed Millennials are at the forefront of this evolving investment behavior, demonstrating greater familiarity and higher allocations to alternatives compared to older generations.6 We believe private assets offer compelling opportunities for portfolio enhancement through strong risk-adjusted returns and diversification. The scope of private markets has broadened as companies have stayed private for longer. There are far fewer publicly listed companies than has historically been the case, which has driven appetite from the retail segment as individual investors look to access opportunities that can only be found in private markets.

Source: Goldman Sachs Alternatives. As of August 8, 2025.

We believe the integration of private markets into traditional portfolios can lead to meaningful long-term wealth accumulation. However, successful implementation requires thoughtful planning and liquidity management. Newer private evergreen funds are designed to make things easier by allowing ongoing subscriptions and redemptions, helping to smooth out some of the liquidity issues (although it is important to remember that redemptions may be limited if overall redemptions exceed a predetermined level (5% of fund assets is a typical minimum), in which case it can take several quarters to redeem. By taking a holistic approach to managing public-private exposures, we believe investors can build resilient portfolios that reflect strategic goals and market realities.

1 Morningstar. As of September 30, 2025. Reference is to the compound annual growth rate (CAGR).

2 Morningstar. 2025 year-to-date data as of September 30, 2025.

3 MSCI, “Tracking Private Equity: Closing the Performance Gap,” . As of September 30, 2025.

4 Morningstar. As of September 30, 2025.

5 For a more detailed insight on this topic, please see “ Boosting the Efficiency of Core Equity Allocations with an Alpha Enhanced Approach” on am.gs.com.

6 Survey conducted by Goldman Sachs Asset Management and 8 Acre Perspective. Data collection took place between July 18 and August 8, 2025. Participants met qualifying criteria: +$1 million in investable assets, serving as the primary financial decision-maker for their household, and being aged 25 or older.