Climate Transition and Your Total Portfolio: Key Considerations for CIOs

Understanding and managing investment implications of the climate and energy transition is a complex challenge on multiple fronts. It is an emerging and complex issue with global implications at a security, sector, asset class and total portfolio level. In this article we outline key questions for chief investment officers (CIOs) and boards to consider as they seek to navigate this topic holistically across whole portfolios. We also share our investment observations based on our own proprietary analysis and experience managing across asset classes in partnership with clients and as an outsourced chief investment officer (OCIO).

Determining Goals, Demands, and Considerations

Many of our clients have identified a secular trend towards a low-carbon economy as material to their portfolio performance. The primary focus for those clients is investment-driven – even in the absence of external demands, they believe managing their portfolios’ climate risk exposures and capturing opportunities from potential beneficiaries of the transition are critical for positive long-term investment outcomes. This is a purely financially driven lens on risks and opportunities and how to capture them effectively. On top of that, some clients also have to navigate a range of external demands and stakeholder considerations, such as requests from regulators, beneficiaries, and boards on topics such as setting portfolio decarbonization targets and pathways, underweighting or divesting from certain sectors, conducting climate stress testing, and meeting transparency and disclosure requirements. Although prompted by stakeholder requests, the lens then is how to implement them in a way that is fully aligned with their long-term financial interests. When attempting to meet these goals, demands and considerations, while there are challenges within an asset class, there are particular challenges for CIOs and boards in navigating it holistically across the whole portfolio. We believe it is beneficial for CIOs and boards crafting their approaches to these issues to begin by thinking through some fundamental questions.

Where Should I Start? Is There an Asset Class to Focus on First?

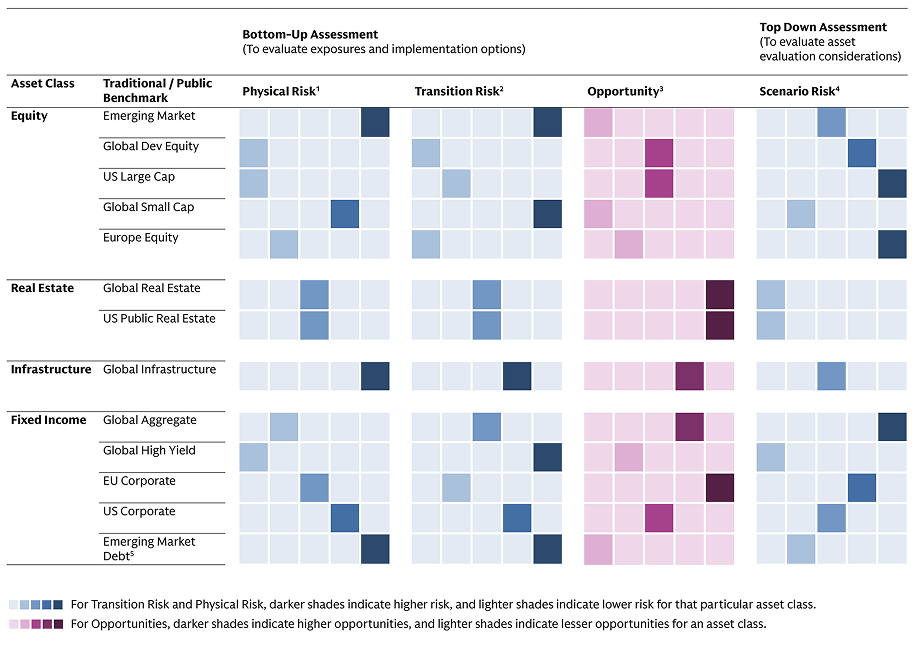

Understanding climate-related risks and opportunities unique to each asset class gives a roadmap on where to focus efforts – start with where there is high risk exposure, robust opportunity to capture upside, or both.

Given the complexity of the issue, investors often wonder which part of their portfolio to focus on. We think understanding of potential climate-related opportunities and risks for each asset class is a helpful starting point. This helps inform two questions – one, are there asset allocation adjustments to be made? And two, are there high risk or opportunity asset class to consider different implementation options for? For top-down asset allocation decisions, we leverage our work in climate-aware capital market assumptions (CMA) to evaluate each asset class’s return impact under various climate transition scenarios (see more on our climate-aware CMA work here). For implementation decisions on specific asset classes, we leverage bottom-up assessment of potential opportunities and risks, including exposure to physical climate risk, transition risk, and opportunity (e.g. climate solution revenues).

There is a growing range of implementation tools across asset classes for investors who want to position their portfolios for the risks and opportunities from a low-carbon transition. In public markets, from the early days of exclusion-based strategies, the industry broadly now has increasingly sophisticated strategies across systematic, fundamental space that are designed to deliver for a variety of objectives (e.g. to capture pure play low-carbon solutions, heavy emitters with credible transition plans). In private markets, there are energy transition themed funds across a full spectrum of asset classes e.g. private equity, real asset, private credit, etc.

Given that, where do we start? A helpful starting point may be to evaluate the asset classes where there is either high risk exposure, robust opportunity to capture upside, or both. For instance, the inherently large-scale, capex-heavy, and long-horizon characteristics of infrastructure assets mean there is rising threat of asset damage and operational disruption from physical risks. The transition to a low-carbon economy is also likely to trigger transition risks from policy and technological changes. At the same time, we believe infrastructure contains some of the most compelling opportunities with tailwind for clean infrastructure. We are entering a new era of demand growth for electricity to meet rising demand from data centers and broad electrification trends from transport to domestic manufacturing. US power demand is expected to grow at 2.4% CAGR through 2030 after a decade of no growth.1 To meet that demand, we expect growth to continue for clean energy technologies based on cost and speed of deployment considerations, even with the backdrop of recent US policy volatility.2

Source: MSCI, Goldman Sachs Asset Management. As of December 31, 2024. 1. Physical risk: 3°C Aggregated Physical Risk Company Climate Value-at-Risk. 2. Transition risk: Percentage of underlying companies as “Aligned”, “Aligning”, “Committed to Aligning” under GSAM proprietary Net Zero alignment methodology. 3. Opportunity: Revenue percentage from climate change related themes. 4. Scenario risk: Volatility-adjusted return difference between capital market assumption (CMA) under Net Zero scenario vs. the original CMA. 5. Emerging market debt assessment has a large proportion of sovereign debt. Given data availability considerations, assessments for emerging market debt for physical risk, transition risk are done qualitatively.

How Can I Evaluate Various Implementation Options Holistically Across a Portfolio?

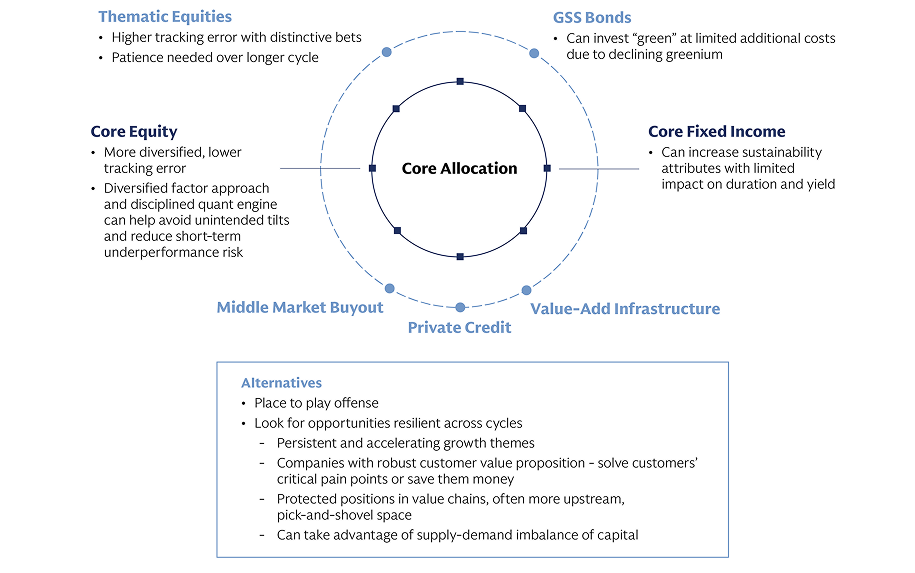

For different parts of a portfolio (e.g. core vs. satellite), we believe using the right tool to improve efficiency and effectiveness of tracking error budgets across passive, active, and thematic options can lead to a well-allocated and risk appropriate portfolio.

Having gained a deeper understanding of different asset classes’ unique attributes, we believe an important next step is to holistically evaluate different implementation options. We have learned a lot of lessons from the ups and downs of sustainable investing performance over the past few years. In our view, the performance of sustainable funds and portfolios was often driven by implementation of sustainability rather than anything intrinsic to sustainability itself. Many sustainable funds often had heavy style and sector tilts that performed well during certain periods and then reversed when market dynamics shifted.3

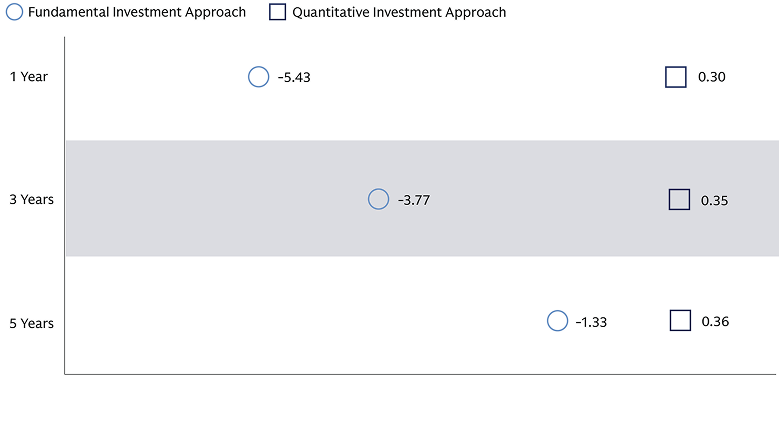

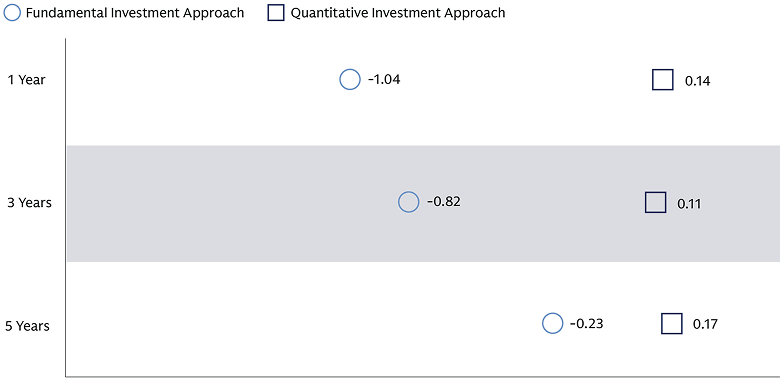

We believe thoughtful considerations on efficiency of tracking error budget across core and satellite allocations can lead to a well-allocated and risk appropriate portfolio. When considering core allocations within public equities for example, we find that a disciplined, risk-aware quantitative engine can be an effective way to capture potential alpha from sustainability factors. This approach also lends well to robust portfolio construction with less sector and style tilts, which helps to mitigate short-term underperformance risk. For instance, a diversified factor approach could help avoid unintended style and sector biases often seen in typical sustainability/climate approaches. We can also complement longer-term climate factors with diversifying shorter-term alpha drivers to support both near-term and long-term performance. On average, sustainable quantitative strategies have outperformed fundamental strategies, partly from having more diversified exposures.

Source: Goldman Sachs Asset Management. Underlying universe – eVestment “Equity ESG Focused” category, with MSCI World-ND as benchmark, as of December 31, 2024.

For core fixed income and green bonds, we find that it is possible to increase sustainability attributes (e.g. environmental benefits, climate transition alignment) with limited impact on the portfolio in terms of duration and yield. For green bonds, the corporate green bond premium has declined to just 1 basis point,4 meaning that investors can invest “green” at modest additional costs.

Alternatives are one area in particular where we believe investors can play offense in targeting this thematic explicitly. Private markets can offer a vast opportunity set to capture companies well positioned to drive value from the transition. Private funds’ longer holding periods of assets also give room to optimize operations and maximize exit valuations to capitalize on a longer-term secular trend. Of course, investors would need to balance private asset allocation with their liquidity needs and risk tolerance.

Source: Goldman Sachs Asset Management. For Illustrative purposes only. GSS refers to the asset class of green, social and sustainable bonds and is not specific to any Goldman Sachs products.

How do I Consider the Aggregate Effects on my Overall Portfolio?

We believe top-down asset allocation tools can complement bottom-up implementation tools especially for risk management and offer a case study of strategic asset allocation analysis to improve portfolios’ climate resilience.

In addition to understanding specific asset class attributes, we find top-down asset allocation tools can be an additional tool to help improve overall portfolio’s climate resilience. When factoring climate risks into strategic asset allocation (SAA), investors often run into the challenge of having low confidence on which climate scenario will play out, making it a challenge to build an SAA based on outperformance potential in any given scenario.

Here, we present a case study of analysis for several large US pensions. Instead of focusing on a specific climate scenario, we optimize the SAA for resilience across various scenarios. This approach ensures that the expected portfolio performance would be less sensitive regardless of which scenario we are in, thereby reducing cross-scenario uncertainty in the portfolio's expected returns.

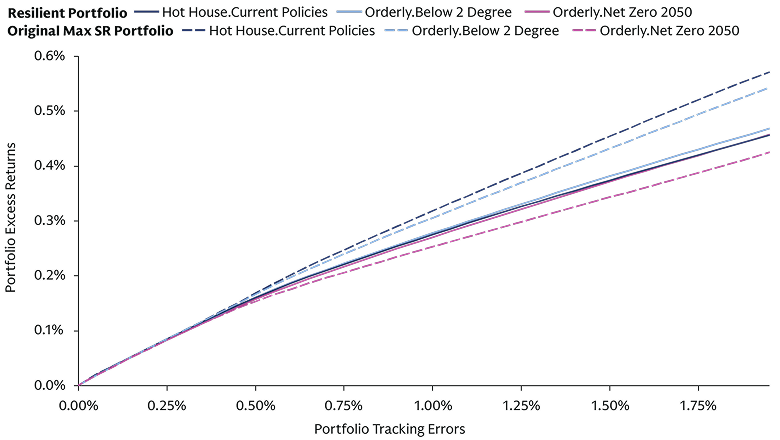

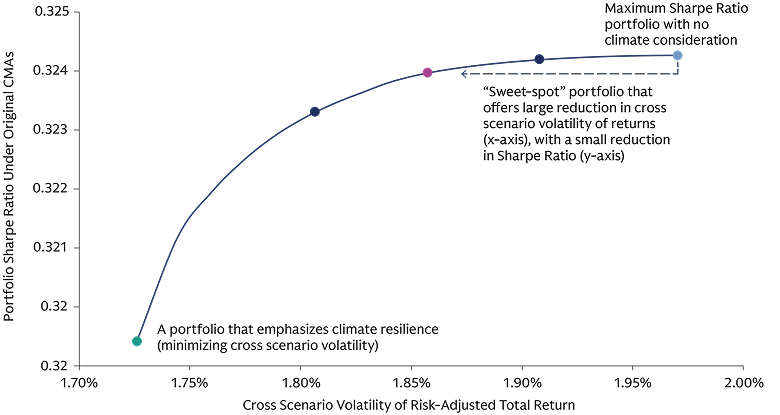

Source: Goldman Sachs Asset Management. The results shown above is sourced from MAS Climate CMAs based on a dummy 60/40 portfolio as of March 2025, based on June 2024 assumptions. Please note we only include passive assumptions, active assumptions on private investments are not included in these results. Expected returns are estimates of hypothetical average returns of economic asset classes derived from statistical models. There can be no assurance that these returns can be achieved. Actual returns are likely to vary.

As illustrated above, the more resilient climate-aware portfolio’s return is less sensitive across different climate scenarios, compared to the optimal maximum Sharpe Ratio portfolio (illustrated by the smaller range of excess returns from the solid lines vs. dotted lines, top chart). Additionally, we explored the efficient frontier from a maximum Sharpe Ratio portfolio with no climate resilience consideration (light blue dot, bottom chart) to a portfolio that emphasizes on improving climate resilience (green dot, bottom chart). This examined whether a “sweet-spot” existed offering the greatest gain in resilience across scenarios (x-axis) while incurring the smallest decrease in Sharpe Ratio (y-axis). This “sweet-spot” portfolio (pink dot, bottom chart) has limited changes on allocations, which we believe provides investors with a solid reference benchmark as an additional input when building their SAA.

What Should I Consider When Setting Up Governance and Processes?

We believe governance should be set up with the appropriate structure, people, processes, and metrics that align with the "North Star” of driving long-term risk-adjusted returns.

Climate change and energy transition are major themes that cut across teams and do not fit within an existing organizational bucket. We believe it is key to thoughtfully navigate governance, as well as the investment implementation processes.

Starting with a Good Governance Foundation that Anchors on Three Elements

- Knowing why you are doing it: If in addition to purely fiduciary considerations, there are stakeholder considerations or legislative mandates. It is important to have clarity on what they are, and how to address them in a way that does not distort or distract from core fiduciary objectives.

- Knowing your own organization: How to start and where to start depends on what the team looks like now. Existing considerations (e.g., funding ratios, target return, liquidity, among others) should factor into the plan.

- Knowing the market: Understand the underlying themes and the broad investment universe expands the opportunity set (the energy transition is not just about renewables). Good investment in these themes as like others require insights, active sourcing, and robust diligence.

As an investor, it is about long-term risk-adjusted returns. If there are other considerations, it is important to know what they are and meet them efficiently. It could be about meeting regulatory requirements (e.g., conducting climate stress test on portfolios), meeting stakeholder expectations (e.g., selective divestments, lowering portfolio emissions), or proactively allocating to climate solutions to position the portfolio in capturing upsides from a key secular theme.

What success looks like drives the “degree of lean” and level of incremental effort in an organization. For some, it is about getting organizational support to open the opportunity funnel, or taking stock of how much exposure to this theme there is today. These may not necessarily require changes to investment policy statements. While for others, it is about setting new top-level targets or policies to help align effort and drive progress, which is a bigger uplift.

Cross-cutting themes like sustainability, climate change, and the energy transition do not fit neatly into a bucket. We have also seen teams consider integrating sustainable investment professionals in existing teams, creating a dedicated team of specialists, or a hybrid of the two, each with its benefits and drawbacks.

There have been significant learnings on how to measure progress and on the consequences on doing it inadequately (see our piece on climate metrics 2.0). We have seen asset owners’ target-setting and reporting practices evolve from purely carbon emission reduction to climate solution investment amount, engagement level, and portfolios’ forward-looking alignment level with climate objectives. We believe a robust reporting toolkit should integrate with the broader portfolio management platform and processes, and ultimately support insights generation from investment-driven standpoints.

Embracing A Holistic Approach

Despite a growing set of options for investors seeking to manage risks and opportunities from the climate transition, we believe more discussions and development are necessary to help investors approach a multi-dimensional theme in a holistic manner. We believe understanding the full range of toolkits available to CIOs from top-down asset allocation to bottom-up implementation tools, and even more importantly, their roles for an efficient portfolio is key for a more integrated approach.

1 Goldman Sachs Global Investment Research. Generational Growth: AI, data centers and the coming US power demand surge. April 2024.

2 The economic and market analysis and forecasts presented herein are current as end of February 2025 and may be subject to change.

3 Goldman Sachs Global Investment Research, Morningstar. As of December 31, 2024. Period referred to include 2019 – 2024.

4 Barclays FICC Research. Greenium declines to 2020 levels. 25 October 2024.