Asset Management Outlook 2025: Landing on Bonds

This article is part of our 2025 Outlook: Reasons to Recalibrate.

Landing on Bonds

As major economies adjust into a new equilibrium, the balance of risks has changed for fixed income investors. Substantial progress in terms of returning inflation to target levels and rebalancing the labor market has led the Federal Reserve (Fed) to join other central banks in cutting interest rates. Economies remain broadly resilient heading into 2025, and we expect the Fed to continue easing policy towards neutral. However, there is a wide range of possible macroeconomic outcomes. Potential changes to US policy governing tax, trade, fiscal issues and regulation are creating new uncertainties about inflation, growth, and international trade. Overall, we think asset allocation decisions that land on bonds will prove rewarding in 2025. Specifically, we believe the current backdrop is creating opportunities to ride the interest rate easing cycle, capture income across corporate and securitized credit, and use a dynamic investment approach across sectors and regions.

To fully capitalize on the opportunities available, we believe it will be vital for investors to understand the context and intricacies of each fixed income segment. An active investment approach, diversification and strong risk management will be paramount. We remain vigilant and focused on fundamentals, ready to capture opportunities as they arise.

Source: Goldman Sachs Asset Management. As of October 15, 2024. For illustrative purposes only.

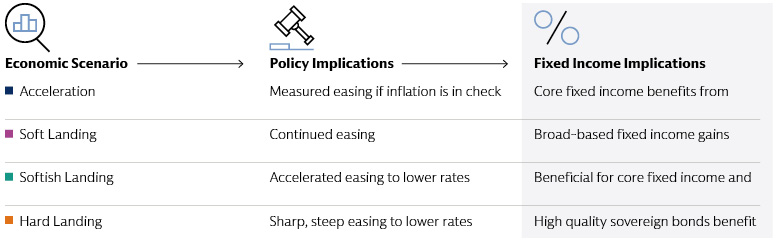

Fixed income for all seasons

Our outlook for fixed income is favorable across different macroeconomic conditions—including scenarios of accelerating or contracting growth. As we highlighted in our 4Q Fixed Income Outlook, we believe bonds have a role to play in portfolios either way the economy lands. In a soft-landing scenario, with moderate labor market weakness and growth staying slightly above trend, continued positive inflation would enable central banks to keep cutting rates, allowing bonds to potentially rally further. A “softish” landing, with below-trend but still-positive growth, could result in faster and steeper rate cuts, which would still create a supportive environment for fixed income.

An acceleration in US economic activity is also a possibility, given the potential for pro-growth policies, lower corporate taxes and lighter-touch regulation in a second Trump administration, and bonds could continue to benefit from ongoing monetary policy normalization. The main risk to fixed income is renewed inflation resulting from potential tariffs, which could slow down the pace of easing. Meanwhile, significant geopolitical shocks could lead to a hard landing, or recession. This could result in either dovish (due to downside growth risks) or hawkish (due to inflation risks) policy. If inflation expectations remain stable, high-quality core fixed income, such as sovereign bonds and investment-grade credit, could benefit. If growth risks dominate in a scenario of recession, this may favor a focus on sovereign bonds and reduced exposure to risk assets.

Ride the easing cycle

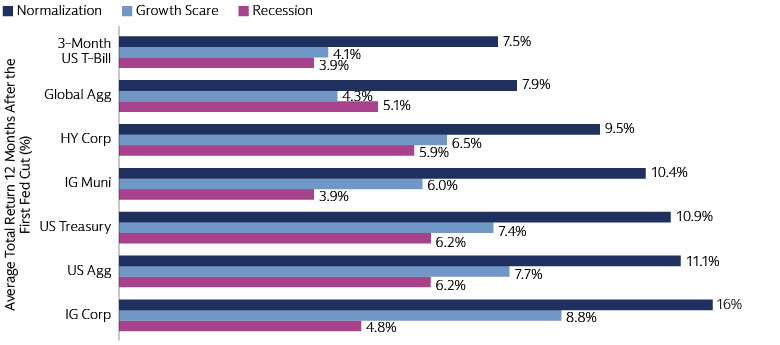

In recent years, high inflation led to rising policy rates, lifting bond yields and impacting longer-duration assets. However, as we enter 2025, the environment looks remarkably different. Central bank easing cycles are underway and set to continue, given ongoing progress on disinflation. In our view, this global monetary easing strengthens the case for rotating from cash into fixed-income assets. Historically, the bond market has outperformed cash in the year following the start of the Fed’s easing cycle.

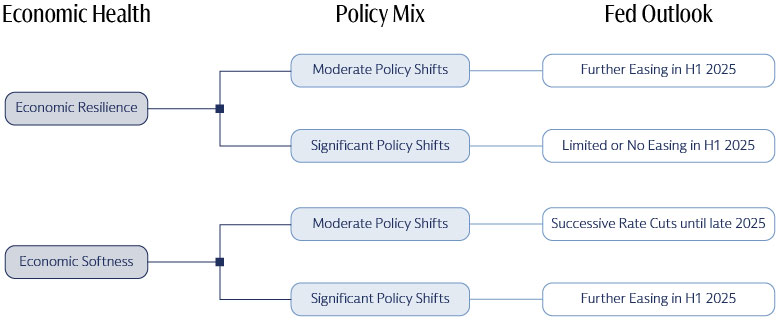

While the US election outcome has widened the range of possible economic outcomes, we still expect the Fed to cut rates again in December and early 2025. The path thereafter will depend on the policy agenda enacted by the new administration. In Europe, the policy path appears less uncertain. A slowdown in growth momentum and decreasing inflation prompt us to anticipate a series of 0.25% rate cuts until the policy rate reaches 1.5%. The pace and extent of these rate cuts could accelerate if the US imposes tariffs on European auto exports, further impacting growth. Meanwhile, in the UK, the market expects a slow and limited BoE cutting cycle, considering potential upside risks to growth from fiscal measures unveiled in the Autumn Budget. We believe the growth and inflation impact of the Budget will be smaller than anticipated, with businesses more likely to pull back employment in response to higher wage costs and a rise in national insurance contributions, rather than raise prices. This may necessitate a switch to rate cuts at consecutive meetings.

Source: Goldman Sachs Asset Management. As of November 12, 2024. For illustrative purposes only.

Other central banks, including the Bank of Canada and Sweden’s Riksbank, are also moving in a dovish direction, while central banks in Australia and Norway may join the easing pack next year. More broadly, if inflation stays under control—with anchored inflation expectations and moderating wage rises—we expect central banks to remain willing to accelerate easing in the face of any growth weakness, benefiting bonds and steepening yield curves. Overall, rate cuts are set to continue into 2025, and bonds stand to benefit. We believe an active approach that captures global and relative value opportunities is how investors can gain from riding the easing cycles.

Source: Morningstar and Goldman Sachs Asset Management. The analysis considers ten Federal Reserve rate-cutting cycles starting in 1984. Four of these cycles were associated with recessions (1990, 2001, 2020), three with growth scares (1987, 1998, 2019), and three with policy normalization (1984, 1989, 1995). Abbreviations: 3-month US T-Bill: 3-Month portion of the Bellwethers U.S. Treasury Index; US Agg: Bloomberg US Aggregate Index; IG Corporate: Bloomberg Global Aggregate Index (returns based on cycles after 1989 due to data availability). Past performance does not predict future returns and does not guarantee future results, which may vary.

Income essentials

We believe the combination of a return of yield relative to the last cycle, sound corporate fundamentals, and a Fed committed to extending the US economy’s expansion, could enable investors to earn attractive income across fixed income spread sectors like corporate and securitized credit.

Investment grade bonds stand out as an option for enhancing portfolio returns in 2025, in our view, striking a balance between earning income and risk management. The resilience of investment grade credit in downside growth scenarios and capital preservation in market phases characterized by higher growth volatility are especially relevant in the current market environment. The combination of healthy credit fundamentals and strong demand for attractive yields suggests that credit spreads could remain tighter-for-longer. Pro-growth policies, such as tax cuts and deregulation, have the potential to boost corporate earnings, which is favorable for US corporate credit fundamentals. Regulatory changes are likely to have sector-specific impacts, highlighting the importance of active bond selection. From a sector perspective, we see value in counter-cyclical companies that can withstand a potential slowdown in nominal growth, such as large healthcare companies. We also favor companies in sectors with strong growth potential and a stable customer base, including technology companies benefiting from the surging demand for artificial intelligence.

Securitized credit throughout most of 2024 was characterized by spreads tightening across collateral types and the capital structure, and we expect this to continue into 2025. We find commercial mortgage-backed securities (CMBS) the most compelling securitized credit sector, with spreads of both AAA- and BBB-rated securities appearing attractive relative to our fair value assessment. This suggests there is potential for spread compression, especially from Fed easing.

Income opportunities can also be found in the green bond market, one of the fastest-growing segments of the fixed income universe. In recent years, green bonds have undergone a major transformation from a niche impact segment to a potential opportunity for every fixed income investor. Green bonds currently provide investors with the opportunity to capitalize on higher yields, with investment-grade green bonds yielding attractive returns ahead of further central bank rate cuts.1 We see growing opportunities as issuers from more sectors and countries access the market for financing. The diminishing green premium means investors no longer need to compromise on income or return potential by going green.

The case for a dynamic approach

This is an era of opportunity for fixed income investors, in what is a phase of economic change, new geopolitical alliances, post-election policy shifts and megatrends. We believe dynamic investment strategies have the potential to serve as a strategic complement to core bond allocations in 2025.

With spreads tight, taking an agile approach can enable investors to pinpoint the most compelling risk-adjusted returns. The varying timelines, pace and scales of central bank actions will create different opportunities across different interest rate markets. High political uncertainty and structural shifts, such as geopolitical instability, digitization, and decarbonization, combined with the potential for a new post-election policy paradigm, provide additional reasons to dynamically adjust sector, rating, and duration allocations. We favor agile strategies with seamless sector, geographical, and issuer rotation in response to market opportunities, underpinned by fundamental and quantitative research.

Three Key Questions

1. Where will interest rates settle?

Rate cuts are underway, and investors are now focusing on the timing, tempo and eventual end point of easing cycles. In the US, we anticipate the Fed to deliver an additional cut in December followed by a series of adjustments to a neutral rate of 3-3.25%. However, we remain cautious as any unexpected increases in inflation could prompt the Fed to pause. In Europe, we expect consecutive cuts from the ECB until the terminal rate reaches 1.5%. However, increasing downside growth risks could lead to larger cuts or a terminal rate below neutral.

2. Will fiscal sustainability shift into focus?

In the last cycle, there was a focus on the "effective lower bounds" on interest rates. In the current cycle, more attention is being paid to the "effective upper bounds" on debt levels. We expect investors’ focus to shift toward debt sustainability and the ways that economies are addressing the debt legacy of the pandemic and their responses to energy crises. In the US, markets are nervous about further fiscal expansion. Conditions for a fiscal consolidation to succeed are in place, but there is little political momentum for deficit reduction. In Europe, we expect fiscal consolidation as fiscal rules have been reinstated but the process is likely to be gradual and uneven between countries.

3. How will potential policy shifts impact credit fundamentals and supply dynamics?

Our analysis suggests that companies in the investment grade credit market can remain resilient in 2025, much like their resilience to higher rates in recent years. This reflects a healthy starting point for credit metrics and the ability to be more selective about new investments or M&A activity. We are closely monitoring supply trends. In 2020, record bond issuance was driven by companies refinancing existing debt at low rates, reducing refinancing risks, and taking advantage of the Fed’s corporate bond purchases.2 In 2025, we will watch for a potential rise in bond supply driven by elevated 'animal spirits' leading to debt-funded corporate activities like aggressive buybacks or M&A, which could impact the current strong credit metrics. In the current cycle, elevated rates, equity valuations and slower growth are instilling more financial discipline. We expect most companies to remain disciplined regarding debt expansion to maintain their investment grade ratings.

For more of our 2025 investment views explore A New Equilibrium, Broader Equity Horizons, Exploring Alternative Paths and Disruption from All Angles and the potential sources of attractive returns they could create.

1Bloomberg. As of August 30, 2024. MSCI Euro Corp Green Bond Index vs Bloomberg Euro Agg Corp Bond Index.

2Bloomberg, Barclays, Goldman Sachs GIR. As of December 16, 2020.