2024 EMEA Investment Forum: Explore, Uncover, Apply, Reflect

While signals point to an improving macroeconomic backdrop, investors face elevated geopolitical risks and election uncertainties as we head further into 2024. Asset class dynamics are evolving too, with investors seeking new ways to uncover opportunities and capture attractive risk-adjusted returns. At our EMEA Investment Forum in London, industry leaders dived deeper into the major drivers of change across economies, the secular trends transforming the shape of public and private markets, and the strategies required for success.

Explore

This year’s Forum opened by exploring the current macroeconomic environment—including how we got here, and where economies might be heading. In the US, the story over the past year has been one of resilient growth, slowly cooling inflation, and strong equity market returns. Interest rate cuts appear to be on the horizon but ongoing stickiness in inflation remains a near-term risk. Investors also highlighted November’s US elections as another source of uncertainty, along with the growing burden of higher debt-to-GDP levels and rising debt servicing costs.

Beyond the US, European economies are experiencing a cyclical improvement having demonstrated their ability over recent quarters to adapt to an energy crisis and record rises in policy rates. As the European Central Bank begins to cut rates, investors are likely to stay focused on labor market and inflation prints across the euro area, as well as longer-term policy shifts arising out of the EU elections. In the UK, while politics has dominated headlines, market participants are awaiting the start of an interest rate easing cycle that remains dependent on inflation numbers. China’s property market, debt dynamics and aging demographics remain headwinds, although policy support across macro, housing, and capital markets has lifted sentiment lately, albeit from a low base.

Alongside the macro picture, speakers explored the advent and rapid adoption of generative artificial intelligence (AI). Despite debates around the potential opportunities and risks the technology may create, there was broad agreement that generative AI is a game-changing transformative force, and not a buzzword. A growing number of investors are recognizing the power of models and taking time to understand AI’s current limitations and risks. AI’s evolution will likely be determined by the quality of datasets. In other words, there is no AI strategy without a data strategy. Those with clean, organized and readily available data look best positioned to gain informational advantages from AI and make more informed decisions.

Uncover

As economies diverge and secular trends accelerate, speakers at the Forum discussed ways to navigate changing dynamics and uncover trends across public and private markets. Broadly, heightened market volatility and increased dispersion within and between asset classes continues to create an environment conducive to active management.

Investors acknowledged that the operating environment has become more challenging for private equity—exit activity has yet to recover, and holding periods continue to be extended. In this environment, general partners (GPs) remain focused on bottom-up efforts to identify and drive value creation at portfolio companies. In public equity markets, earnings have been solid despite macro uncertainty. Some of the largest US companies with quality attributes and strong balance sheets continue to trade at high valuations. Investors at the Forum noted opportunities to add exposure to overlooked areas—such as smaller companies, which have historically performed well as rate cutting cycles commence. Businesses operating in countries with favorable macroeconomic and geopolitical dynamics, such as India and Japan, also warrant attention.

Fixed income investors—both public and private—find themselves in a new paradigm. In public markets, yields on high-quality bonds in the US, Europe and UK are close to their highest levels in a decade and provide diversification benefits due to their low or negative correlation with other risk assets, like equities. Spreads may remain tighter-for-longer given healthy credit fundamentals and slower but positive economic growth. Active investors may be best positioned to navigate any signs of slowing earnings as well as late-cycle behaviors that could be unfriendly for credit fundamentals. In private credit, competitive pressure to deploy capital has driven spreads tighter versus last year, but yields remain attractive. In an environment of higher-for-longer funding costs, investors highlighted that underwriting, structuring discipline, robust sourcing pipelines and experience should become a greater determinant of ultimate outcomes. Changing supply and demand dynamics also continue to reshape the private credit opportunity set, with strong investor appetite for semi-liquid vehicles that aim to deploy capital quickly.

Apply

Breakout sessions at this year’s Forum provided opportunities for industry leaders to dive deeper into multiple areas, identify what it takes to win, and find ways to turn strategies into action. Sessions covered the role of private markets, and how some of the obstacles that have made it challenging for individual investors to access them are gradually disappearing. The expansion of the green, social, and sustainability bond universe across developed and marketing markets was another theme in focus. Speakers also spotlighted the drivers behind a growing number of large and complex organizations seeking outsourced solutions for the management of their portfolios—including cost savings, and greater access to resources, insights, and investment capabilities.

Geopolitical instability remains a constant theme—one that is unlikely to dissipate as we move further into this active political year. Participants at the Forum noted the need to combine macroeconomic and geopolitical experience with thoughtful investment strategies to navigate risks. There are also opportunities to lean into areas that may benefit from an increasingly fractured world, including rising demand for security solutions across supply chains, resources, and national defence.

Reflect

The world of investing has always required resilience. The ability to withstand market volatility—without losing confidence or giving up on long-term goals—is even more important today. To find potential long-term winners in the transition to a more sustainable, inclusive economy, investors agreed that there is a need to cut through the noise to find signals of actual change. This will likely require constant dialogue with corporate management teams, accurate measurement of carbon efficiency and inclusivity at the company level, and potentially greater use of generative AI to separate noise from value.

Speakers noted how opportunities and risks tied to decarbonization are not siloed. Instead, they overlap with technology advancements, demographic shifts and deglobalization trends. Navigating these dynamics requires forward-looking planning and analysis, as well as deep understanding of how market themes intersect. Many companies now transitioning their business models may be high-emitting industrial businesses in capital-intensive sectors, and this evolution is where investors can unlock potential value. More opportunities are emerging to build a more inclusive economy through education, financial services, and healthcare. Ultimately, a successful transition to a sustainable, inclusive economies requires businesses that provide innovative solutions.

Looking ahead, investment success across asset classes, industries and themes is likely to look a lot different than the past. Characteristics of resilience, resourcefulness, and responsibility that featured at this year’s EMEA Investment Forum are set to be pivotal going forward as investors seek to capitalize on opportunities in a changing world.

Wisdom of the Crowd

Opportunities in Public Equities: At Goldman Sachs Asset Management’s 2024 EMEA Investment Forum, we invited an audience of investment leaders to share their views on equity market opportunities in a session titled “Wisdom of the Crowd”. Luke Barrs, Global Head of Client Portfolio Management, Fundamental Equity and Hania Schmidt, Global Co-Head of Client Portfolio Management, Quantitative Investment Strategies, reflect on the responses and provide investment views on potential areas of opportunity in the second half of 2024. We polled investors at the 2024 EMEA Investment Forum on where they expect the best equity market returns to come from in the second half of the year. Sentiment remains optimistic overall, despite widespread concern over geopolitical risk. Those surveyed appear more evenly balanced on style and market capitalization preferences. Artificial intelligence is viewed by most respondents as a game-changing technology—not hype—signalling AI-related investment is likely to grow as new tools alter economies and industries.

Based on 158 responses at the EMEA Investment Forum, May 22, 2024.

To gauge sentiment among attendees at this year’s Forum, we asked audience members gathered in London to state whether they are “bullish”, “neutral”, or “bearish” on stocks. The majority have a positive outlook, although close to 40% of respondents are “neutral”. At the highest level, these views broadly align our cautiously optimistic view on the global equity landscape heading into the second half of 2024. Our Fundamental Equity and Quantitative Investment Strategies teams see a wide opportunity set across regions and sectors. We expect high-quality companies with improving business fundamentals to benefit from a gradually improving growth backdrop, and the start of interest rate cutting cycles across developed markets. Active management will be critical, in our view, given complex and evolving macroeconomic and geopolitical conditions.

Based on 162 responses at the EMEA Investment Forum, May 22, 2024.

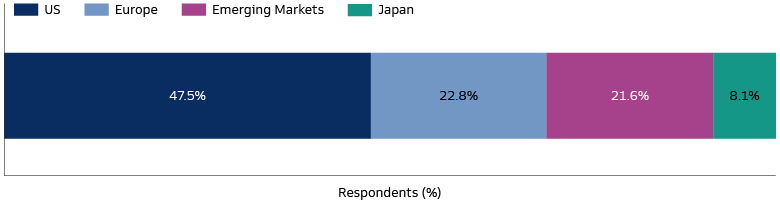

Close to half of those polled selected the US as the market providing the best potential return opportunities. Europe and Emerging Markets each received around 20% of the vote, followed by Japan in single digits. A preference for US equities is understandable, in our view, given that recent earnings seasons in the US have been better-than-expected. Most of the S&P 500 earnings growth continues to be driven by the “Magnificent 7”, though performance dispersion within the group has widened. We think the second half of 2024 will present opportunities for investors to broaden their equity horizons beyond the largest US names, and across regions. For instance, Japan’s equity market still looks compelling given stable inflation, improving wage dynamics and corporate reform momentum. Within the emerging market universe, we expect the trajectory of India’s equity market performance to remain positive despite near-term, election-related volatility. India’s macroeconomic growth and stability, helped by secular tailwinds like digitization and favourable demographics, provide long-term opportunities for active stock pickers.

Based on 162 responses at the EMEA Investment Forum, May 22, 2024.

Most investors polled believe growth stocks will outperform their value counterparts in months ahead. However, the 60/40 vote split suggests market participants see opportunities in both areas. This makes sense, in our view, given the high frequency of style oscillations over recent quarters—with growth and value each taking turns to dominate the market. Given these dynamics, we think it’s best to take a holistic look at what drives alpha for a given company’s stock. We see opportunities to invest in high-quality growth stocks and in traditional value cyclicals operating in resilient industries. Crucially, an active investment approach can help investors avoid overpriced areas on the growth side while steering clear of redundant business models in the value space.

Based on 130 responses at the EMEA Investment Forum, May 22, 2024.

Audience members were also split 60/40 on market capitalization preferences. The majority expect large cap stocks to deliver the best performance going forward, while the remainder favor small caps. We expect falling interest rates to benefit equities broadly, both large caps and smaller names. In particular, the benefits of lower rates could feed in faster for companies with shorter refinancing cycles and larger proportions of floating debt rate, like small cap equities. On average, US small caps have historically outperformed large caps in 12-month periods post interest rate peaks. Current valuations are also attractive relative to fundamentals. Across a vast, diversified, and under-researched small cap universe, active management can help to capture alpha opportunities while effectively managing risks.

Based on 96 responses at the EMEA Investment Forum, May 22, 2024.

Most investors cited geopolitical risk as their major concern. This is unsurprising given the potential for conflict escalation in Ukraine and the Middle East. Political uncertainty is also high in this mega-election year, and November’s US Presidential election is coming into focus. Incorporating scenario analysis and hedging strategies alongside long-term portfolio construction decisions can potentially reduce vulnerability to large event shocks. There are also areas of long-term opportunity to lean into as geopolitical dynamics reshape trade patterns and government priorities. We believe the theme of security, for instance, is set on an irreversible course as governments and corporations focus on ensuring long-term supply chain, resource, and national security.

Based on 131 responses at the EMEA Investment Forum, May 22, 2024.

We agree with the majority view among voters that artificial intelligence is a game changing technology. In the first half of 2024, our Fundamental and Quantitative Investment Strategies teams highlighted that a combination of investing in and with artificial intelligence—two distinct but interrelated approaches—may drive long-term outperformance. Revenues continue to grow among companies building the necessary AI infrastructure, such as cloud providers and semiconductor manufacturers. Over the coming quarters, we expect investment opportunities to emerge among businesses helping corporate management teams effectively protect and derive meaningful insights from their data to train AI models. More broadly, while many software companies have ambitions to improve their products and services with AI, most firms have yet to turn ambitions into action. Scrutiny of AI strategies, returns on investments, and profitability is likely to heighten as corporate AI spending grows.