Asset Management Outlook 2025: A New Equilibrium

This article is part of our 2025 Outlook: Reasons to Recalibrate.

Balancing Act

After the past couple of years of high inflation and interest rates, macroeconomic imbalances have diminished. Inflation has fallen without a global recession occurring, and central bank easing cycles are underway. We expect rate cuts to progress across most developed and emerging markets in 2025—albeit following different timelines—before eventually settling at a higher level than the low-rate world of the last cycle.

We remain cautiously optimistic that major economies can achieve a new equilibrium of sustained growth as central banks gradually ease policy, but tail risks could knock things off balance. Markets are weighing up the potential policy and portfolio implications of Donald Trump’s legislative agenda, which is yet to become clear. There is potential for looser fiscal policy and pro-growth measures, including lower corporate taxes and lighter touch regulation, but also the possibility of trade protectionism which could act as a drag on growth and cause temporarily higher inflation. Fluctuations in economic data may spark growth-driven bearish episodes like August's volatility. Conflict in Eastern Europe and the Middle East has a high humanitarian cost, above all else, but further escalation could also disrupt trade routes and commodity prices.

In our view, the current environment provides reasons for investors to recalibrate their portfolios. Using a broad, diverse and global toolkit across both public and private markets may help to deliver positive outcomes and navigate risk over the coming quarters. We see reasons to land on bonds, broaden equity horizons, explore alternative paths and pinpoint opportunities amid disruption. Before diving deeper, here are our views on the potential roads ahead for economies.

US soft landing remains our base case

The US economy remains resilient heading into 2025. Inflation is almost back to the Federal Reserve’s (Fed) 2% target and tight labor market conditions have eased. We lean toward a soft landing as our base-case scenario against a backdrop of late-cycle opportunities and lingering tail risks. The Fed made its first cut of 50bps in the cycle in September and this was followed by a 25bps cut in November, resulting in the federal funds rate falling to 4.5-4.75%.1 We expect additional cuts throughout 2025—provided inflation continues to cool—potentially resulting in an easing cycle that could conclude by the end of the year.

A second Trump presidency involves upside inflation risks due to the prospect of tariffs, raising the prospect of a Fed pause and a slower pace of cuts. However, we believe a resumption of rate hikes is unlikely as long as inflation expectations remain anchored. While post-election policy will be in focus, we expect the labor market and the health of the consumer to be critical factors for the economy, Fed policy decisions and market direction in the months ahead. Like central banks, we remain data-dependent and alert to various potential paths from here. A hard landing, or recession, is not our base case, but the risk of such a scenario would rise in the event of severe disruptions to global trade. We also anticipate greater focus on widening US deficits and the sustainability of rising government interest costs.

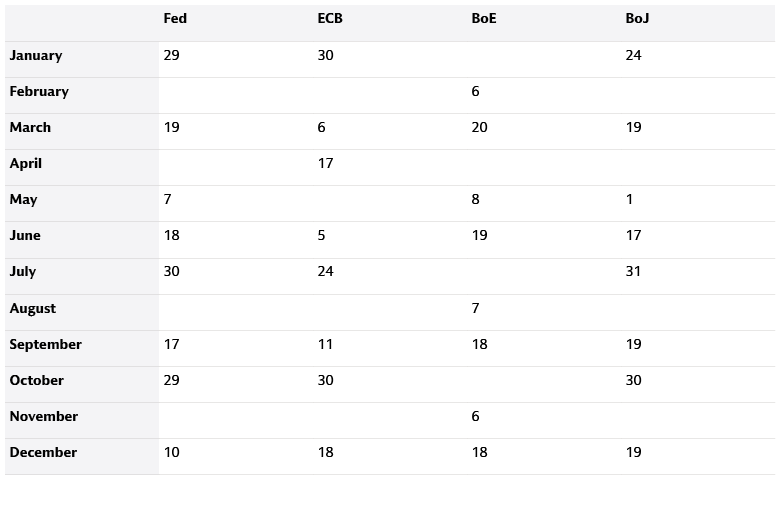

Source: Goldman Sachs Asset Management. US Federal Reserve, European Central Bank, Bank of England, Bank of Japan. As of November 1, 2024.

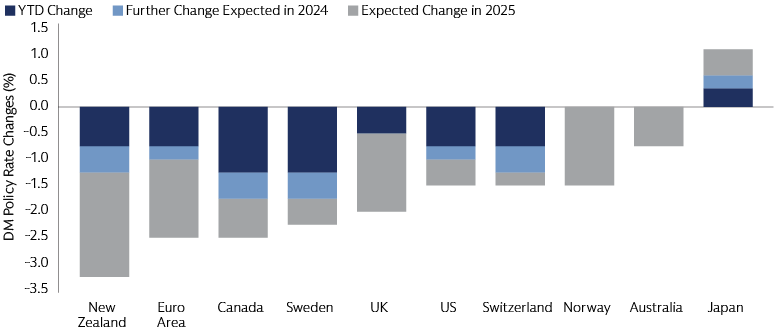

We expect more cuts across developed markets

In the Euro Area, a loss of economic momentum and a sharper slowdown of inflation pressures resulted in the European Central Bank (ECB) easing policy for the third time in the cycle in November, following its previous moves in June and September.2 If they are implemented, more expansive, universal US tariffs may act as a drag on European economic growth, leading to faster and deeper rate cuts by the ECB if incoming data is worse than expected. Donald Trump’s re-election may also result in renewed defense spending and security pressures for Europe, adding to fiscal challenges. In the UK, inflation has continued to decelerate, undershooting expectations in September.3 After its first rate cut in August, the Bank of England (BoE) delivered its second rate cut this cycle in November, lowering the policy rate from 5.00% to 4.75% due to reduced risks of inflation proving persistent. The pace of rate cuts could accelerate throughout 2025 if the economic growth impact of the UK Budget is less significant than expected and if domestic inflation pressures continue to normalize. Other central banks, including the Bank of Canada and Sweden’s Riksbank, are also moving in a dovish direction. Japan remains an economic outlier, however. Strong underlying wage-price dynamics suggest further policy normalization by the Bank of Japan (BoJ), and we anticipate gradual upward rate adjustments in 2025 as election uncertainty subsides.

Source: Macrobond, Goldman Sachs Asset Management. Year-to-date (YTD) change as of November 13, 2024. Forecasts as of November 9, 2024.

China introduced policies to stabilize its property sector and revive domestic demand at the end of 3Q 2024. This sparked a swift and forceful financial market response, which tapered off in 4Q 2024.4 The stimulatory measures indicated that policymakers have honed in on growth targets with conviction, largely in response to persistent cyclical and structural economic challenges. It remains to be seen exactly how much additional fiscal stimulus will be announced in the coming months, and how effectively stimulus measures will be implemented. The policy easing measures announced at the conclusion of China’s National People’s Congress standing committee meeting in November disappointed elevated expectations,5 but the central government has considerable scope for debt financing and deficit increases in 2025. Donald Trump’s re-election and heightened tariff risks may put additional pressure on Chinese policymakers to support growth. At the same time, a harsher export environment could force them to focus on boosting domestic consumption as China's key economic growth engine. We continue to monitor macro catalysts for China ahead of the “Two Sessions” meetings in March 2025.

Emerging market easing to extend

A more dovish Fed opened the door to easing across emerging markets (EM) in the second half of 2024, and central banks walked through. In Asia, markets sensitive to the Fed cycle, such as South Korea and Thailand, cut rates in 4Q 2024.6 Elsewhere, rates have been cut in South Africa and Mexico in recent months. We expect EM rate-cutting cycles to extend in 2025. Overall, EM growth has remained relatively resilient, and inflation is well below 2022 peaks. However, a stronger US dollar following a Republican sweep, which strengthens the possibility of higher tariffs, may encourage monetary policymakers in Asian EMs to be more cautious about cutting rates given their preference for relatively stable currencies versus the US dollar. Fiscal policy is a concern in some EMs, including Brazil, where inflation is still hot and monetary policy is diverging. However, the overall fiscal performance in EMs has been less expansionary than in developed markets (DM) in recent years, including during the pandemic. Meanwhile, EM central banks continue to drive demand for gold as a hedge against geopolitical and financial shocks.7

Signposts to Watch

1. Consumer health and labor markets

Consumers are currently benefiting from tight labor markets, strong household balance sheets and recovering confidence. Falling inflation and high employment are also supporting real income growth. However, there are variations across countries. Debt service ratios remain low in Japan, the US and the Euro Area, but have increased in Australia, Canada and the UK due to these countries’ higher share of shorter-term fixed-rate mortgages. Overall, consumers are still spending but are becoming more selective.

2. Trump’s first 100 days

As investors consider what post-election policy shifts may mean for their portfolios, we expect the first 100 days of the Trump administration to be critical for assessing legislative priorities. If implemented, tariffs may impact growth and inflation through a variety of direct and indirect channels. Targeted tariffs on China may only have a limited inflationary impact. More expansive, universal tariffs across regions, including Europe, may amplify these effects, acting as a drag on growth. Trump’s re-election may also result in renewed spending on defense and national security for Europe, adding to fiscal challenges. The international response and retaliation to higher tariffs remains difficult to predict.

3. Direction of the dollar

The US dollar tends to appreciate when the US economy is strong and growing faster than other economies. Our current activity indicator continues to show above-trend US growth, whereas growth in other major economies is trending close to or below trend. If tariffs feature prominently in the new Trump administration, combined with modest additional tax cuts, more federal spending and lighter-touch regulation, we expect to see continued dollar strength. Given the dollar also tends to appreciate when global risk conditions worsen, heightened uncertainty about trade policy in a second Trump presidency may support the dollar, in our view.

For more of our 2025 investment views explore Landing on Bonds, Broader Equity Horizons, Exploring Alternative Paths and Disruption from All Angles and the potential sources of attractive returns they could create.

1 US Federal Reserve. As of November 7, 2024.

2 European Central Bank, Bloomberg. As of October 17, 2024.

3 Bank of England, Bloomberg. As of October 16, 2024.

4 Bloomberg, Goldman Sachs Asset Management. As of October 7, 2024.

5 Goldman Sachs Global Investment Research. As of November 8, 2024.

6 Reuters. As of October 28, 2024.

7 Goldman Sachs Global Investment Research. As of September 30, 2024.