Late-Cycle Opportunities, Lingering Tail Risks

Five years after COVID's arrival, the US economy is moving beyond a phase that proved to be unlike any other. Significant post-pandemic inflationary forces have finally faded, the labor market has rebalanced, and the Fed has started to unwind policy after the most aggressive rate-hiking cycle in decades. We believe the economy remains in late cycle, not end cycle. However, late cycle dynamics are changing as 2025 comes into view, and investors find themselves facing an environment that is different in scope and character than recent years.

Soft Landing, Higher Risks

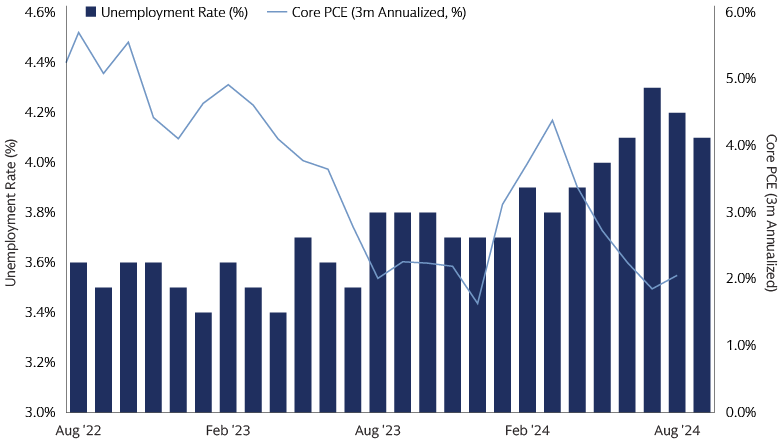

We maintain our view that the US economy is still on course for a soft landing, but acknowledge that recession risks have increased. The labor market has rebalanced and, for now, not swung too far in the other direction. Whether the job market shows more signs of stabilization or loses further steam will be a critical factor for the economy, Fed policy decisions and market direction in the months ahead. A significant part of the rebalancing in the job market year-to-date has occurred due to an increase in supply rather than significant layoffs, and the unemployment rate remains low by historical standards. Weaker jobs data in the summer contributed to market fears over the US economy’s strength, triggering the “Sahm Rule," historically a reliable recession indicator. However, in our view, the Sahm Rule applies less this time around given household and corporate balance sheets are healthy, corporate profitability is high, and the Fed is now focused on the labor market.

Alongside the trajectory of the labor market, we expect consumption patterns and savings data to be in focus among policymakers. The resilience of the US consumer has been a standout story post-pandemic, and consumer balance sheets broadly remain robust. There are signs that US consumers are becoming more choiceful with their spending. Savings rates, which soared after the arrival of the pandemic, have also recently declined. While the depletion of savings buffers—and potential efforts to rebuild them—raises concerns around the sustainability of spending, we view falling savings rates as a rational normalization given the significant rise in household net wealth that emerged post-pandemic.

The Federal Open Market Committee (FOMC) delivered a 50bps cut at its September meeting, lowering the target range for the Fed funds rate to 4.75-5%, with the key theme being a shift in focus from inflation risks to employment risks. Fed chair Powell emphasized that the FOMC is “not on any preset course” and will be making decisions “meeting by meeting.” We expect the path forward will depend on the race between job growth and labor force growth, consumption and savings trends, further progress in returning inflation to target, and possible fiscal policy changes in the aftermath of the upcoming elections.

Source: Goldman Sachs Asset Management, Haver Analytics, US Bureau of Labor Statistics, US Bureau of Economic Analysis. As of September 20, 2024.

Overall, with inflation approaching 2%, we expect a further interest rate reduction before year-end and see the possibility of additional rate cuts occurring in 2025, potentially resulting in an easing cycle that could conclude at year-end.

November’s US election remains a complicating factor for policymakers and portfolios, with a range of potential implications linked to key policy areas, such as fiscal, corporate tax and regulation, and trade policy. In the near-term, corporates are delaying some investment decisions until after the election given uncertainty about the eventual outcome. “Sweep” scenarios—where one party controls the House, Senate, and White House—could lead to the most substantial legislative changes, prolonging policy uncertainty and potentially heightening market volatility. Sweeping changes are less likely in a divided government scenario given greater potential for bipartisan outcomes or legislative gridlock.

Beyond the US policy and politics, the direction for rates in Europe is on a declining path as key European Central Bank (ECB) officials expressed higher confidence in achieving inflation target and acknowledged that the economy’s recovery is facing headwinds. Political uncertainty is also likely to remain high in Germany, where a general election is scheduled to take place in September 2025. Elsewhere, China’s economy is back in focus. We are monitoring the growth implications of September’s sizable dose of fiscal policy measures and any potential impacts on global commodity demand. Despite significant stimulus, China still faces many deep-rooted challenges including a prolonged property downturn, subdued inflation, and weak consumer confidence. Meanwhile, we believe tensions between China and the US look likely to stay elevated, irrespective of the US election result.

Navigating a New Phase

We believe active investment strategies, effective diversification, and strong risk management can help investors navigate the path ahead. In the final months of 2024, investors will be questioning if the strong year-to-date performance for equities can continue and extend into 2025, or if there is more bumpiness ahead and greater risk of drawdowns. Although we believe an outright bear market is unlikely, further upside at the broad index level may be limited, making selectivity in equities even more important over the coming quarters.

As Fed easing commences, the S&P 500 is near its all-time high, with a forward price-to-earnings ratio of 21.4x, well above the 20-year average of 16.3x. However, while valuations are stretched, we do not believe they are extreme. A more nuanced picture emerges when looking at the market without the so-called Magnificent 7 names driven by artificial intelligence (AI) innovation. Beyond this mega-cap cohort, the forward price-to-earnings ratio for the S&P 493 currently stands at 17.3x which is largely in line with its long-term average (16.3x).1 This small premium looks justified, in our view, given we expect earnings growth for the overall market to drive equity prices in the months ahead.

Advances in AI continue to capture the imagination of investors, but like macro cycles, no tech cycle runs in a linear fashion. While the advancement of AI as a technology is clear, the monetization and its implications for equity markets is not. We expect scrutiny of AI strategies, returns on investments, and profitability to heighten in 2025 as corporate AI spending grows, underscoring the need for careful security selection and active management in the US equity market. Beyond the US, signs of an economic rebound are likely to influence stock market dynamics in Europe and China respectively.

Equity-bond correlations have recently returned to negative territory amid downside growth concerns, reinforcing the case for diversification—specifically, restoring, initiating, or increasing allocations to core fixed income assets, such as high-quality government and corporate bonds. In rates, there is downward pressure on front-end US Treasury yields as the start of Fed easing gets underway. Outside of the US, the start date, pace, and likely destination of rates across economies differ, presenting potential relative-value opportunities. In the corporate bond market, balance sheets broadly look robust, but current spread levels offer limited room for further tightening; we believe a selective approach may prove rewarding in 2025.

Staying Vigilant and Flexible

As US rate cuts get underway, focus is shifting from inflation risks to employment risks. We believe the next phase of the cycle will depend on the incoming data, the evolving outlook, and the balance of risks. We maintain our view that the US economy remains resilient overall and on course for a soft landing. Tail risks include a sharper slowdown in the labor market, and steeper declines in consumption and spending patterns. For investors, the dialing back of restrictive monetary policy presents opportunities in equities and bonds. In the equity market, we believe earnings growth will be consequential for US stocks in the months ahead, making selectivity key. We believe the return of the negative equity-bond correlation also allows bonds to fulfill their strategic role as a source of income and diversification in the event of further downside growth risks. Overall, we remain vigilant and flexible as 2025 comes into view, favoring strategies that can enhance portfolios’ resilience, while being nimble enough to capture opportunities as conditions change.

1LSEG Datastream, Goldman Sachs Asset Management. As of September 24, 2024.