Finding a Firmer Footing: The Case for Commercial Real Estate

Why CRE? Income and Diversification

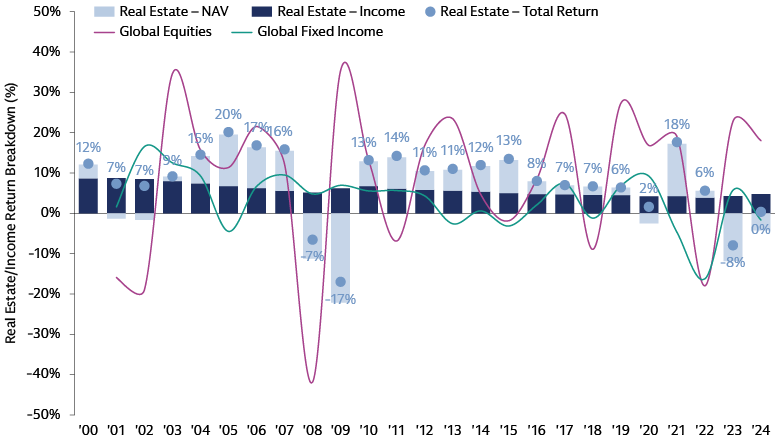

We believe real estate’s income and diversification attributes are compelling in a world of macro uncertainty.

Core real estate has historically served as a steady source of income for investors, often delivering higher yields compared to stocks and bonds. Over the long term, NCREIF Property Index (NPI) net operating income has consistently outpaced the rate of inflation,1 underscoring private real estate's role as an effective inflation hedge from an income perspective. Asset prices have also historically moved with inflation, influenced by construction costs (labor and materials) and changes in land values affecting replacement costs.

Furthermore, real estate can enhance a portfolio's risk-adjusted return by offering diverse, less correlated return streams. The unique supply and demand characteristics of real estate, along with lease structures, introduce market-, sector-, and asset-specific factors that can mitigate sensitivity to broader economic trends. These dynamics have historically reduced correlations with public equity and credit markets, particularly for private real estate.

Source: Goldman Sachs. As of December 31, 2024. Real estate (as well as income return breakdown) is represented by the NCREIF Property Index (NPI). Global Equities are represented by the MSCI ACWI Gross Total Return Index (USD). Fixed Income is represented by the BBG Barclays Global Aggregate Total Return Index (USD). Past performance does not guarantee future results, which may vary.

Value-add strategies—investing in properties with potential for improvement through active management and capital investment—and opportunistic strategies—such as development, redevelopment, or distressed acquisitions—are mainly found in private markets. These approaches provide exposures that are not easily accessible through public markets.

Publicly traded REITs have also historically provided competitive total returns through a combination of consistent dividend income and long-term capital appreciation. Daily liquidity, ease of implementation, access to non-traditional property types, and extensive diversification by geography and tenant are additional benefits. Sectors like telecom towers, colocation data centers and self-storage offer differentiated returns that can be harder to access in the private markets.

Also, we believe private real estate credit (direct lending to real estate owners and developers) presents an increasingly attractive risk-adjusted option in investors’ portfolios. The asset class offers an alternative source of strong and steady income at a more defensive basis in today’s volatile market environment. It also provides diversification due to low correlation with both traditional fixed income securities and traditional real estate equity. Additionally, structural shifts in the market are creating heightened demand for private capital.

Why Now? Potential Attractive Entry Points Opening Up

The real estate market is showing signs of recovery after a period of significant disruption and interest rate increases, presenting significant, though selective, opportunities for investors.

The NFI-ODCE Index (which tracks institutional core private real estate returns) has returned to positive territory in recent quarters, following nearly two years of negative performance. However, valuations remain below post-pandemic peaks, potentially translating to more attractive entry points for investors who can capitalize on the current valuation reset.

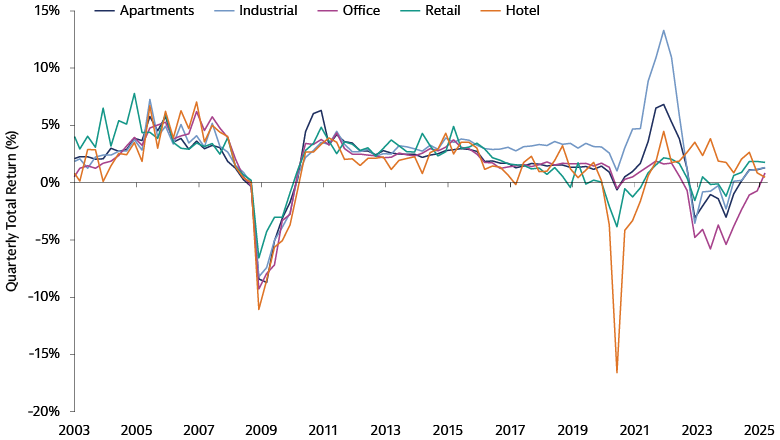

Source: NCREIF Property Index (NPI). US Only. As of March 2025.

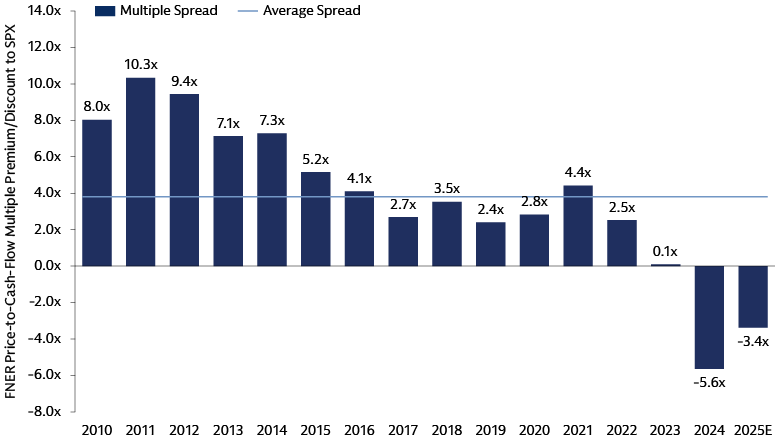

In the public markets, listed US equity REITs finished the first half of 2025 trading at a median 19% discount to consensus net asset value (NAV) per share estimates.2 Compared to the broader US equity market, REIT valuations are well below their historical median, indicating they may be undervalued relative to the overall stock market.

Source: Goldman Sachs Asset Management, Bloomberg, and Greenstreet. Data as of December 31, 2024. Public REITs represented through Goldman Sachs Asset Management’s defined REITs universe. REITs multiples represented through price-to-FFO, while public equity multiples represented through price-to-earning. Past performance does not guarantee future results, which may vary. For illustrative purposes only. Universe is defined by Goldman Sachs Asset Management’s public real estate security coverage universe.

Although the improvement in the interest rate environment may be slower than initially anticipated, short term interest rates are expected to be on a declining path, helping to mitigate further downside risk in the real estate market. Liquidity and financing conditions have improved, marked by increased transaction volumes and bank lending. However, tariff uncertainty, which escalated in April 2025, has created some hesitation in the capital markets.

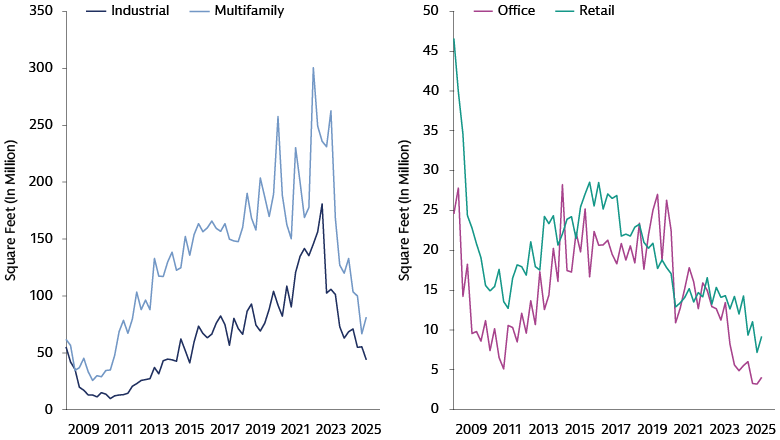

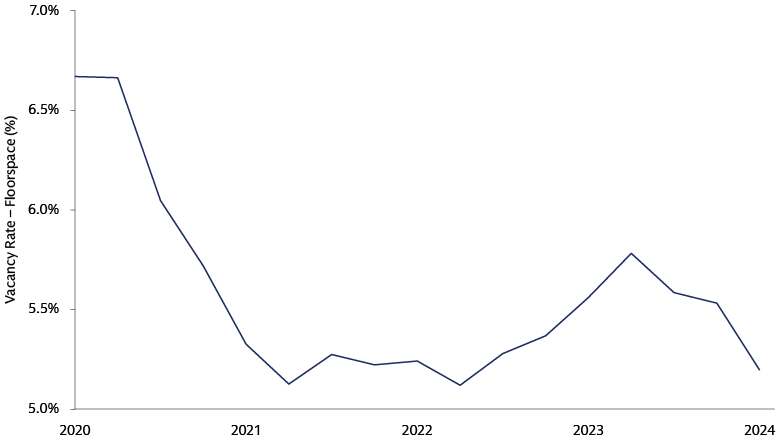

It is still too early to fully assess the impact of increased tariffs. However, tariffs could raise material and construction costs, as well as delay project completion times for different types of properties. This may help support the values of existing assets. Liquidity and financing conditions have improved, and supply-demand fundamentals remain strong. Over the past three years, limited new construction and steady demand in most sectors have led to lower vacancy rates across regions and property types—except for offices. A drop in construction starts, especially in multifamily and industrial sectors, has reduced supply. This supply contraction may boost rent growth and support property valuations in the future.

Source: CoStar, Goldman Sachs Global Investment Research. As of May 29, 2025.

Source: MSCI Global Quarterly Property Index" (based on 19,972 property investments globally, with a total capital value of $820 billion. All sectors excluding offices.

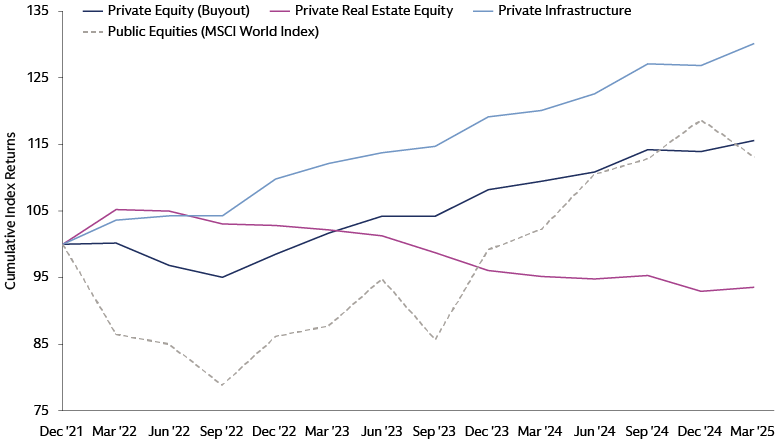

Improving sentiment, valuations, liquidity and positive supply/demand fundamentals point to attractive entry points and relative value opportunities in real estate, including private real estate which has underperformed other asset classes like private equity, infrastructure, and credit markets over the last three years.

Source: MSCI. As of 1Q 2025. Based on MSCI Global Private Equity Closed-End Fund Index, MSCI Global Private Real Asset Closed-End Fund Index. And MSCI World Index.

However, despite rising real estate optimism, several considerations warrant caution. Macroeconomic disruption, stemming from events like fluctuations in interest rates and inflation, geopolitical tensions, and evolving macroeconomic policies, remains an ongoing feature of the real estate landscape. This uncertainty has kept core buyers on the sidelines and redemption queues elevated, tempering expectations of a rapid V-shaped recovery.

We anticipate that the nature of the real estate recovery will diverge from the post-global financial crisis (GFC) experience. We are now operating in an environment defined by structurally higher interest rates and inflation. Therefore, we expect a larger share of total return in the future to come from income growth rather than cap-rate compression. Investors must also navigate divergence across regions.

The US CRE market, the world’s largest, experienced sentiment shifts in the first half of 2025. CRE transaction volumes climbed in 1Q 2025 until tariff-driven volatility and uncertainty on growth and the Fed’s rate path impeded private market CRE activity. In the public markets, US REITs showed resilience in the first half of 2025, including in early April, as concerns over tariffs, economic growth, inflation and the fiscal outlook led to volatile US equity market performance.

In Europe, easing monetary policy coupled with improved financing conditions and increased liquidity have boosted investor confidence in real estate. Access to financing in Europe is also increasing across various asset classes, partially driven by the successful fundraising environment for real estate credit funds over the past three years. Elsewhere, Japan's CRE market has remained resilient, with investment volumes reaching a 10-year high in 2024.3 The market is benefiting from stable interest rates, emerging inflation, corporate governance reforms, and robust liquidity.

Access Points Across Public and Private Markets

To construct a resilient portfolio in the face of ongoing uncertainty and macro disruption, we believe strategic asset allocation and active management are critical. The ability to identify and actively manage assets to create durable and growing cash flows is also essential. Blending public and private market CRE opportunities across debt and equity instruments can help capture opportunities and optimize risk-adjusted returns, especially for investors without dedicated teams to manage diverse asset classes. In our view, investment managers with broad origination capabilities, the agility to operate across sectors and geographies, and to offer equity, credit and secondaries strategies, are well positioned to capitalize on relative value opportunities.

- Private Real Estate Equity: We believe the asset class can provide income diversification, a hedge against inflation, and the potential for enhanced value through active management. In private real estate equity, current conditions may present opportunities to acquire select assets at attractive prices. There is also the potential for enhanced value through active management by developing, redeveloping, or repositioning assets to cater to changing space demands. Similar to their private equity counterparts, private RE funds have seen distributions dry up as transaction activity remains muted. As a result, many GPs are actively seeking ways to both generate liquidity and support assets that may be held longer-than-expected, resulting in opportunities in the secondary market.

- Public Equity (REITs): For investors prioritizing liquidity and access to a broader mix of property types across regions, listed REITs may be a suitable option, where sectors like self-storage, cell towers, data centers and single-family rentals offer exposure not easily accessible through private investments. Over the past 15 years, these sectors have become a much larger part of the public real estate markets and have generated total returns significantly higher than traditional real estate. The REIT market also continues to expand globally, presenting new investment opportunities in Europe and Asia; regions experiencing the largest growth since 2020, with Europe adding 77 REITs (39% growth) and Asia adding 73 REITs (36% growth).4

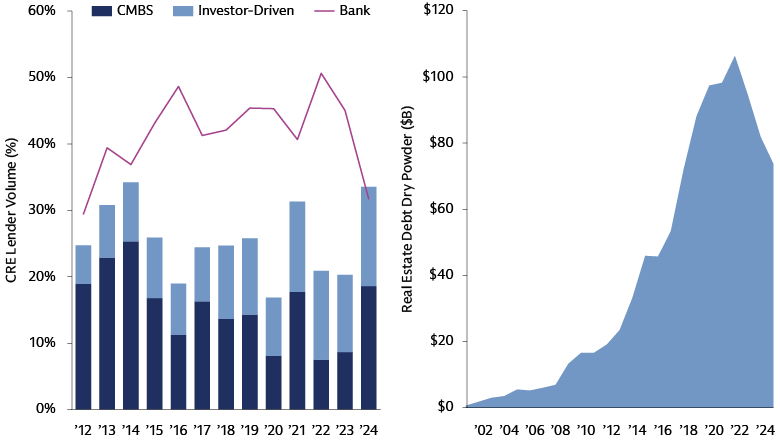

- Private Real Estate Credit: Private real estate credit can offer attractive current yields on a more defensive basis, enhancing portfolio resilience, similar to how corporate debt complements equity holdings. While Commercial Mortgage-Backed Securities (CMBS) issuance is recovering, the market remains underserved for longer-term financing, creating demand for private credit solutions that offer attractive yields and customized deal structures. The relatively limited growth of dedicated real estate debt funds, coupled with declining dry powder, further amplifies the opportunity for private credit to provide crucial capital. However, successful portfolio construction requires deep market access through a broad network of borrower relationships, coupled with structuring expertise, strong real estate knowledge and credit underwriting skills. Moreover, proactive loan asset management, coupled with close lender-borrower collaboration, is critical for early detection of potential challenges. By selecting managers in private real estate credit with these skillsets, investors have the opportunity to generate durable yield, mitigate risk and complement other income-oriented strategies in their portfolios.

Source: Left chart: MSCI RCA. As of March 26, 2025. Right chart: Preqin, data through December 31, 2024. Latest available.

Megatrends Matter

In this environment, sector and asset selection become paramount, given the potential for significant dispersion in both sector and asset quality performance. Megatrends such as demographics, technological advancements, and sustainability initiatives are creating demand tailwinds that reflect broader trends in the real economy. This leads to dispersion in sector performance, with some sectors benefiting more than others. Additionally, a flight to quality is driving dispersion in asset quality performance, meaning that higher-quality assets are likely to outperform lower-quality ones.

Demographics

Demographics have a profound influence on housing preferences and demand, particularly in the US multifamily market. US home prices, coupled with significantly increased mortgage rates, mean Millennials and Gen Z are choosing to rent apartments with modern amenities versus purchasing a home outright. Aging baby boomers also signal higher demand for senior housing in the years ahead. We believe these trends put the rental housing market on a firm long-term footing, particularly when coupled with cooling construction pipelines. Moreover, properties providing necessity-based retail to serve these populations, such as grocery anchored centers, look set to benefit. Elsewhere, Japan's aging population and deflationary history are offset by growing wages, tight labor markets, and population growth in major cities like Tokyo and Osaka (3.3% and 1.8% growth respectively over the past five years), with most of the expansion coming from younger, working-age cohorts. More open immigration policies have also helped in this regard, with the annual net increase in foreign workers rising to levels comparable with the US. This migration, coupled with relative affordability, is boosting demand for residential real estate, while supply has remained constrained.

Deglobalization

Deglobalization and a shift toward regional supply chains is driving long-term demand for industrial properties like warehouses and logistics hubs in new locations. However, the imposition of tariffs introduces complexity to the outlook. In the US, while global trade remains integral to the logistics ecosystem, not all logistics hubs will be equally vulnerable to trade volatility: assets serving end-consumption may be more insulated, while those tied to trade flows are likely to be more exposed to disruption. Meanwhile, efforts to localize defense supply chains will require additional warehousing and logistics centers. In Europe, Germany’s fiscal reindustrialization and increased EU defense spending could also lead to higher demand for key logistics and specialized manufacturing facilities in the years ahead. As a result of the shifting geopolitical landscape, the Japan government has announced several policy initiatives to encourage domestic manufacturing in strategic sectors and exports more broadly. These initiatives include subsidies to encourage advanced manufacturing and a significant increase in fiscal budget allocation to defense.

Digitization

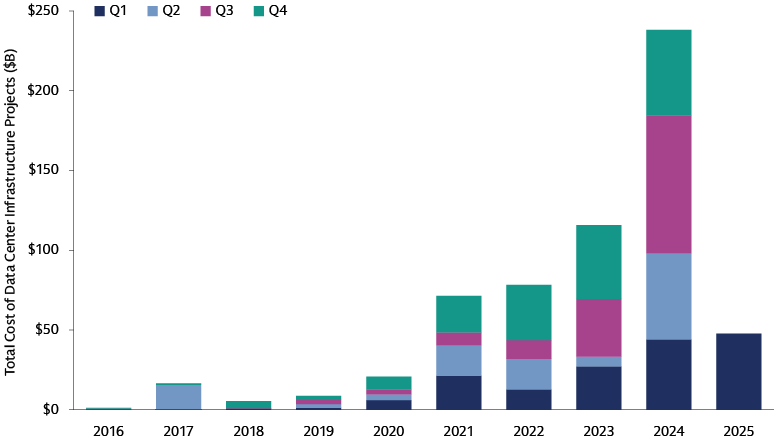

Digital infrastructure and real estate are becoming more closely intertwined, driven by the rise of data centers, 5G technology, and AI. Goldman Sachs Global Investment Research analysts expect a 165% increase in power demand through the rest of the decade, driven by both accelerating adoption of AI and non-AI technological needs.5 AI usage is not only driving significant power load requirements (for instance, a single ChatGPT search consumes 6-10x the power of a traditional Google search),6 but also increased demand for water and cooling technologies. While ongoing digitization brings durable growth opportunities to the data center space, obsolescence and potential overbuilding risks remain. Mature markets like Virginia (US), Beijing, and London continue to dominate pipeline growth given their scalability and power integration, but rising land costs and regulatory restrictions are opening doors for other regions poised to redefine the global data center map.7 Recent announcements with US AI companies in the Middle East also highlight diversifying regional demand for AI infrastructure.8 Technology is also changing our means of communication, driving increased demand for fiber and wireless networks. Telecom infrastructure like cell towers, which are structured as REITs in the US, should continue to benefit from this trend.

Source: Refinitiv. As of April 23, 2025. Data on data center infrastructure projects excluding those that have been canceled.

Sustainability

Given that real estate significantly contributes to carbon emissions, sustainability is a crucial consideration for all property assets, from data centers to offices. The operations of buildings overall account for 30% of global final energy consumption and 26% of global energy-related emissions (8% being direct emissions in buildings and 18% indirect emissions from the production of electricity and heat used in buildings).9 Minimum performance standards and building energy codes are increasing in scope and stringency across countries, and the use of efficient and renewable buildings technologies is accelerating. In the office sector, for instance, sustainability credentials are now critical determinants of office occupancy performance, alongside property age and renovation status. Buildings with higher LEED ratings (Leadership in Energy and Environmental Design) are demonstrating superior performance compared to lower-rated or non-rated office spaces. Rental growth for prime office space, which have LEED certification as a key attribute, accelerated in the first quarter of 2025 in cities like Dubai, Frankfurt, Paris and London.10 Logistics real estate investors are also willing to pay nearly 20% more for European warehouses with high sustainability credentials over assets rated below that benchmark, supported by higher rents and more favorable financing terms.11 Government policy is also increasing the drive towards sustainability, for instance, in the UK the efficiency standards require commercial landlords to improve the energy efficiency of buildings to let them, with the requirement of efficiency increasing over time.12

Finding a Firmer Footing

As CRE turns a corner, we believe income and diversification qualities, alongside improving valuations and supply/demand, position the asset class as a compelling long-term investment opportunity, particularly in a world of macroeconomic uncertainty. In our view, it remains crucial to recognize that not all real estate will perform equally, making a strong case for active management. By focusing on sectors driven by persistent and accelerating growth themes, and by constructing a diversified portfolio across public and private markets, experienced investors with local expertise can capitalize on emerging opportunities, with CRE helping to enhance portfolio resilience.

1 FRED, NCREIF Property Index (NPI); As of March 31, 2025. CPI refers to Consumer Price Index for All Urban Consumers: All Items Less Food and Energy. Past performance does not guarantee future results, which may vary

2S&P Global. As of July 3, 2025.

3CBRE. As of February 3, 2025.

4Nareit. As of June 2, 2025.

5Goldman Sachs Global Investment Research. As of February 2025.

6Goldman Sachs Global Investment Research. As of May 2025.

7Cushman & Wakefield. As of May 7, 2025.

8Reuters. As of May 14, 2025.

9IEA. As of June 2025.

10Savills. As of April 29, 2025.

11Cushman & Wakefield. As of September 12, 2024.

12Gov.uk. Department for Energy Security & Net Zero. As of June 30, 2025.