A Quantitative Competitive Edge in Complex Markets

We believe that the adaptability of quantitative investing is crucial for navigating rapidly changing market environments and achieving consistent, differentiated returns. While this investing style has sometimes been perceived as rigid or overly dependent on historical data, skilled managers can leverage data and technology to proactively respond to new market dynamics. We emphasize that data-driven strategies should be anchored in strong economic intuition and supported by human oversight. Advanced analytics and technology are most effective when they enhance—rather than replace—informed decision-making.

In this article, we examine the unique advantages of quantitative investing, emphasizing its strategic use for both enhanced returns and robust risk management. We find these attributes are especially compelling given the complexities of today’s market environment.

Gaining and Maintaining an Informational Advantage

Successful active investing relies on consistently gaining and maintaining an informational edge. Quantitative investment strategies empower investors to harness vast amounts of data, enabling a more holistic understanding of companies across the global equity universe. This comprehensive perspective can serve as a powerful driver of alpha generation, directly supporting the core goal of active management: delivering returns that exceed market benchmarks through informed decision-making. In today’s environment, data and technology have become critical differentiators, providing the tools to achieve and sustain this informational advantage. With the right infrastructure, expertise, and experience, investors can leverage data to uncover compelling investment opportunities. Crucially, realizing the full potential of big data and AI also requires skilled data scientists who can develop high-quality hypotheses and generate innovative investment ideas.

Over the past decade, the global volume of information has surged at an unprecedented pace. Current estimates indicate that more data will be produced in the next three years than throughout all human history.1 At the same time, the world’s internet population continues to expand rapidly, with approximately 68% of people worldwide now online.2 This explosive growth is generating a vast and ever-increasing pool of data, placing data-driven investors with significant scale in a position to capitalize on potential opportunities. This criticality of scale applies not only to the sheer quantity of information analyzed but also to the breadth of implementation across global markets. By efficiently processing and synthesizing insights from this immense data landscape, investors can set themselves apart and secure an informational edge—an essential factor for active managers seeking to outperform the market.

Advancements in technology, such as AI and machine learning, further enhance this capability. Data analysis techniques have evolved, allowing for a more insightful understanding of larger, less structured, and more complex datasets. This evolution allows quantitative managers to leverage the power of data to identify potential investment opportunities and generate alpha, especially in large, inefficient, complex, and dispersed markets like international developed markets, emerging markets, and small caps. For instance, we find that company linkages in Europe are less obvious than the US, yielding an advantage to a quantitative, data-driven process.

Seeking Consistent and Differentiated Sources of Returns with Dynamic Risk Management

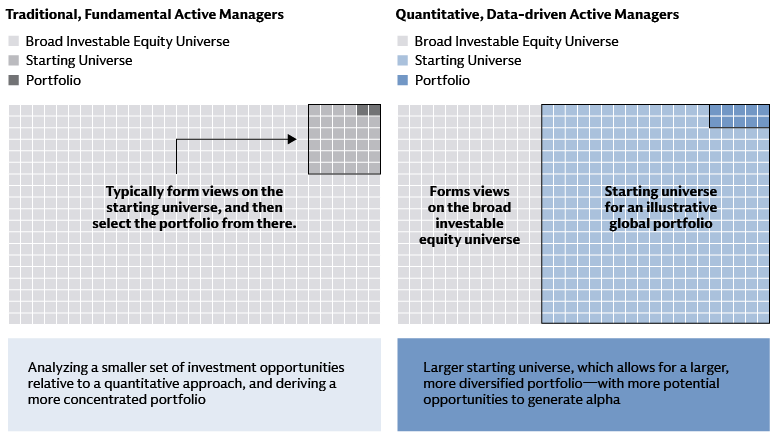

The breadth of the full global equity complex presents both opportunities and complexities. A broader portfolio that includes quantitative investment allocations may achieve more consistent and resilient returns in aggregate. The MSCI ACWI IMI (All Country World Index Investable Market Index) has over 8,000 constituents, offering a vast universe of potential investments while bringing challenges to traditional managers to fully capture the potential opportunities.3 In markets outside the US, we generally observe lower levels of analyst coverage, resulting in greater information asymmetry and lower speed of information diffusion. This can present opportunities for data-driven investors to distinguish signal from noise, inform investment decisions, and potentially construct diversified portfolios by implementing numerous, smaller active investment positions.

Source: Goldman Sachs Asset Management. For illustrative purpose only.

Lessons from past market crises underscore that successful quantitative investing hinges on true diversification and the identification of genuinely unique sources of return. As such, translating alpha potential into alpha requires constructing portfolios that are resilient to market uncertainty. This means moving beyond surface-level diversification across sectors, industries, or individual securities. Instead, a robust data-driven approach delves deeper—analyzing underlying style exposures and uncovering hidden risks that may be accumulating within the portfolio. By doing so, managers can pursue more consistent alpha over time. This deeper analysis ensures that diversification is fundamentally robust rather than merely cosmetic, reducing reliance on any single return driver and aiming to deliver performance that is less correlated with other managers.

We believe that investment ideas and unique signals driven by data and advanced technology can lead to differentiated returns. Combining many different sources of information results in insights that are less correlated with other investment approaches, improving overall portfolio resilience and diversification. For asset allocators, data-driven managers can be valuable diversifiers because they tend to have low correlation with traditional asset classes and other investment styles.

From a risk management standpoint, active data-driven investing enables managers to employ rigorous risk controls. A systematic risk model helps control tracking error, positioning, and style biases relative to the benchmark. Differentiated factors enable dynamic reactions, allowing strategies to adapt to evolving market conditions. This investment approach could objectively focus on stock-specific attributes to inform investment decisions, limiting the presence of potentially unintended biases, and supporting early detection of potential risks.

Quantitative managers can systematically monitor portfolio sensitivity to risks and control unintended exposure to common factor risks. This approach could potentially monitor the impact of all portfolio deviations from the benchmark, with the addition of daily oversight providing an extra layer of risk management. While traditional diversification has its limits, human oversight can supplement the risk management approach by accounting for geopolitical and market events that may impact stock relationships.

Frequent rebalancing driven by this approach provides more opportunities to incorporate the latest information into portfolio positioning while systematically managing transaction costs and overall market impact.

Navigating Market Complexities

Quantitative strategies can adapt by rebalancing portfolios more objectively, proving their value in dynamic and volatile environments. While there are tentative signs of investors broadening their exposures geographically and across factors, concentration risks remain elevated.

In June 2025, the MSCI ACWI Index exhibited significant concentration, with only 106 of its 2,528 constituents representing 50% of the index's market capitalization. Furthermore, roughly 20% of investor capital was concentrated in seven companies—Nvidia, Microsoft, Apple, Amazon, Alphabet, Meta, and Broadcom—whose combined weight exceeds that of the next six largest countries in the MSCI ACWI index and nearly equals the combined weight of the 42 smallest countries and 2,028 smallest constituents within the index. Similarly, the ten largest companies in the S&P 500 account for 38% of the index's total market capitalization and 30% of its earnings.4 This concentration highlights the potential benefits of geographic diversification, and a data-driven investment approach is well suited to source differentiated opportunities through both allocation and implementation.

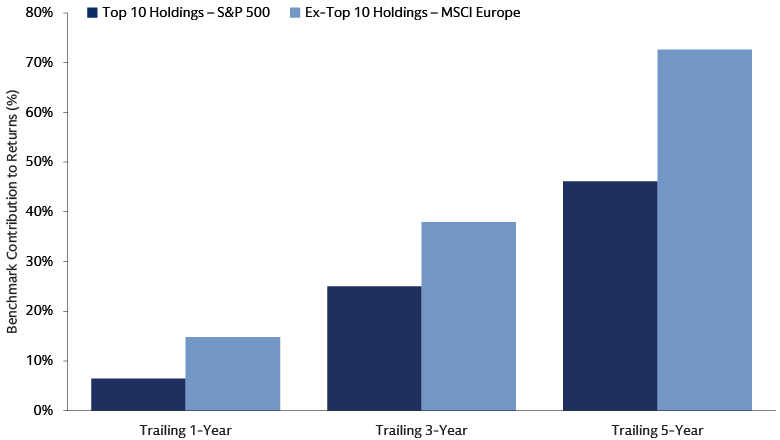

For asset allocation, we favor diversification into ex-US and small-cap markets. These markets offer less concentration and more diverse compositions. We believe strategies leveraging data and technology are particularly effective in these areas. They can exploit informational advantages across a wide range of investments and diverse opportunities. For example, considering the S&P 500 and the MSCI Europe holdings by benchmark weight, the MSCI Europe ex-top 10 holdings have outperformed the S&P 500 top 10 holdings over the trailing 1,3, and 5-year periods. This suggests that a broader investment approach, capturing opportunities beyond US mega-caps, may enhance returns.5

Source: Goldman Sachs Asset Management. Based on Brinson attribution analysis on benchmark contribution to returns for the trailing 1,3, and 5-year periods as of May 2025. Top 10 Holdings based on benchmark weight.

A flexible portfolio management platform enables the delivery of various risk-return profiles, providing asset owners with a toolkit to express evolving objectives as the market changes. We highlight below three different types of implementation considerations, depending on investment objectives and preferences:

1. Enhanced Equity Solution: By running a portfolio tighter to the benchmark (with low tracking error), quantitative managers can diversify across active weights more efficiently, leading to more consistent performance and higher risk-adjusted outperformance. This approach allows for tailored risk management based on client objectives.

2. ETF Wrapper: The accessibility of an ETF wrapper is advantageous, in our view, especially for low tracking error implementation, opening the door to investors seeking stable alpha while remaining "benchmark-aware."

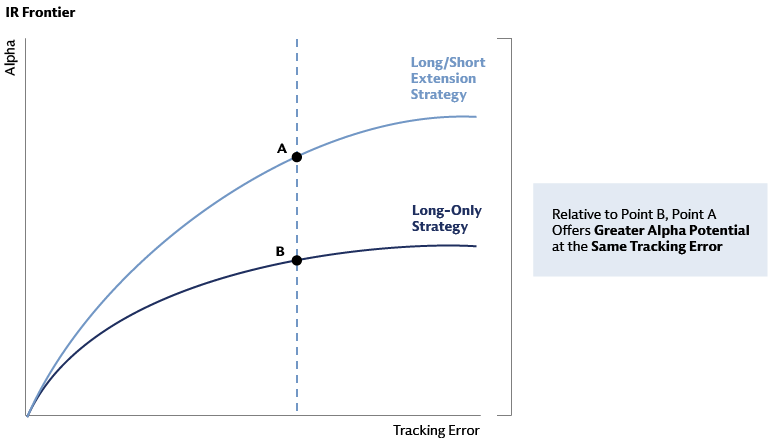

3. Extension Strategies: For investors seeking higher returns, long/short extension strategies offer flexibility to underweight names beyond their absolute benchmark weight and offer, on average, a cleaner expression of a manager’s negative views. Data-driven managers can balance risk and return expectations by maximizing return per unit of active risk as part of quantitative portfolio construction.

Source: Goldman Sachs Asset Management. For illustrative purpose only.

As the investment landscape evolves and investment objectives shift, the need for customized solutions has never been greater. A flexible portfolio management platform enables the creation of tailor-made solutions to meet a variety of client objectives and address concerns. This includes managing portfolios according to a client’s specific risk budgets (e.g., tracking error), implementing targeted regional exposures and exclusions, and potentially employing extension strategies.

Spotlight on sustainability

Recent performance trends have demonstrated that passively replicating sustainable indices can potentially lead to underperformance in the short to medium term. To address this, a more active approach offers a potential solution for enhancing returns and managing risk. One such strategy involves a two-step optimization process: first, rigorously identifying and selecting companies that meet specific sustainability criteria; and second, employing a bottom-up stock selection process via a quantitative approach, while adhering to a defined tracking error budget. This alpha-enhanced approach to sustainable investing can provide the added benefits of transparency across the two-steps and flexibility with accommodating diverse investor preferences and sustainability objectives.

Staying Ahead

In summary, navigating complex markets demands a competitive edge, which quantitative investment approaches can provide by leveraging data, technology, and continuous research to know more, see better, and act faster. We expect these strategies, enhanced by human oversight, to offer consistent yet differentiated returns, early risk detection, and to play an increasingly important role in investors’ portfolios. Nimble, risk-managed portfolios with flexible platforms are best suited for evolving markets. Continuous technological advancements will drive quantitative investing, emphasizing the importance of human oversight. Importantly, we believe advanced technology and analytics should be used to inform, not dictate, investment decisions, enabling innovation to be balanced with risk management, transparency, and interpretability.

1AVANT by Avison Young, IDC Global DataSphere Forecast (2022–2026), Hinrich Foundation. As of 11 March, 2025.

2Statista. As of February 2025.

3MSCI. As of June 2025.

4Goldman Sachs Asset Management, Goldman Sachs Global Investment Research. As of June 2025.

5Goldman Sachs Asset Management. Based on Brinson attribution analysis on benchmark contribution to returns for the trailing 1,3, and 5-year periods as of May 2025.