Navigating the Nuances Across Public Markets in 2026

This article is part of our Investment Outlook 2026: Seeking Catalysts Amid Complexity

Equities in a Multipolar World

The global economic and geopolitical environment is adopting a more multipolar structure, in our view, resulting in greater fragmentation and a broader array of opportunities for equity investors.

The US stock market continues to be driven by advancements in and investor sentiment towards AI, with leading companies harnessing technology and scale to achieve remarkable growth. In Europe, a renewed focus on national and economic security is resulting in increased investment in infrastructure and defense capabilities. Political developments across markets, including in France and Japan, add to a complex backdrop.

We believe maximizing equity diversification and managing risk effectively is essential given the investment backdrop. In our view, this can be achieved through active exposure, a global presence, and regional expertise; combined with a strategic blend of fundamental and quantitative equity strategies.

The big are getting bigger

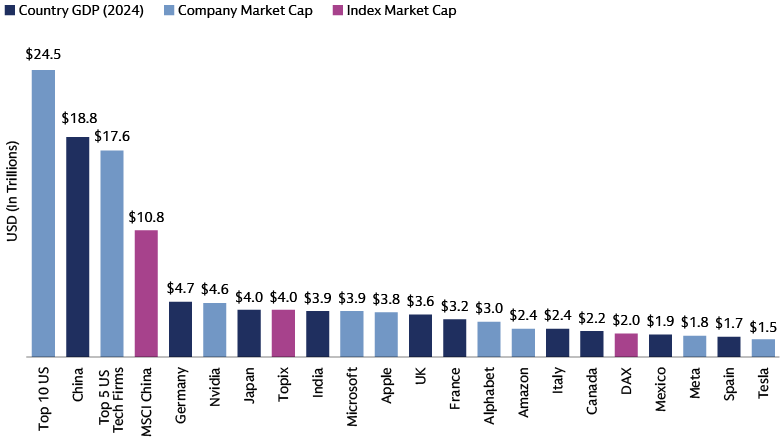

The biggest 10 US stocks (8 of which are technology-related) account for nearly 25% of the global equity market, and are worth almost $25 trillion.1 The top 10 companies in the S&P 500 now account for a substantial portion of the index’s market capitalization (~40%) and earnings (~30%).2 The five largest AI hyperscalers—Amazon, Google, Meta, Microsoft and Oracle—are alone responsible for ~27% of S&P 500 capex.3

Source: Compustat, IBES, FactSet, Goldman Sachs Global Investment Research. As of October 8, 2025.

The Magnificent 7 continue to expand their market share through strong core businesses and strategic reinvestment. In our view, the strong earnings power of these large companies may set the stage for further gains. We believe hyperscalers’ AI capex will extend into 2026, and we continue to monitor associated AI infrastructure spending, as well as AI application build-out and monetization. However, we see some signs of homogeneity in performance among these large players evolving into greater dispersion.

We're observing a similar trend of increasing scale across other market segments. In retail, for instance, Walmart and Costco have captured a significant share of sales growth, benefiting from strong value offerings, operational leverage, and effective supplier negotiations.4 Financials is another area in which this trend is clear.

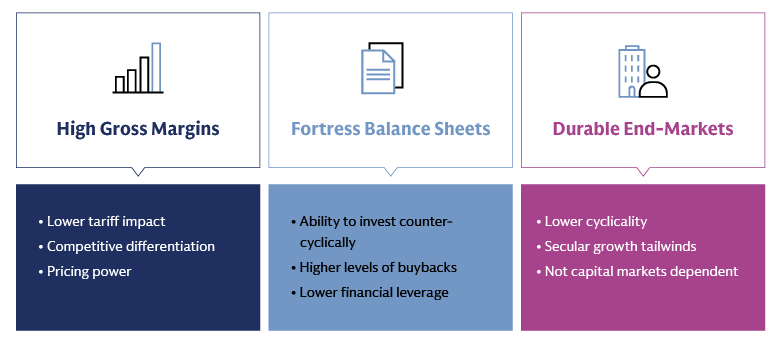

Substantial investment by well-resourced entities positions them to capitalize on transformative technologies and market dynamics. Our focus remains on companies exhibiting high gross margins, fortress balance sheets, and durable end markets. While some smaller counterparts may struggle for competitive footing, we also see pockets of opportunity across the small and mid-cap segment.

Source: Goldman Sachs Asset Management. For illustrative purposes only.

Unlocking potential in small and mid-caps

In the small and mid-cap space, we see potential opportunities among enablers, so-called "picks and shovels” of the AI boom, including companies on the front line of AI innovation. We also believe small caps in the US and internationally offer compelling opportunities driven by anticipated rate cuts and accelerating earnings. A pick-up in dealmaking could also generate optimism and investor interest in the broad small-cap market. While these beta tailwinds are strong, we believe actively seeking small-cap alpha is key to turning these tailwinds into superior returns and avoiding potential pitfalls. The "meme stock" phenomenon, where social media and retail trading drive extreme volatility, highlights the need for active oversight beyond traditional financial analysis.

Maintaining broader horizons

European equities and the region’s paradigm shift

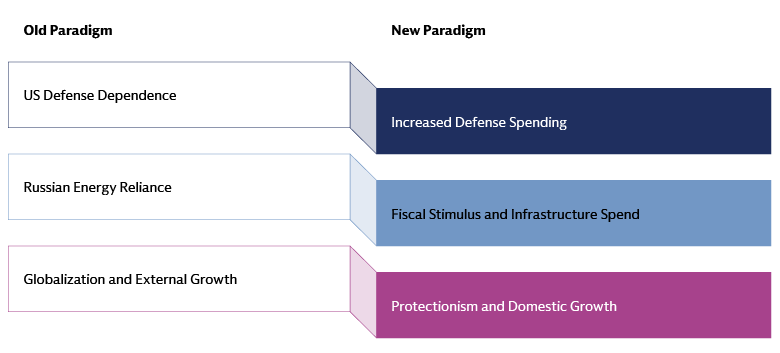

European equity markets experienced two distinct phases in 2025, initially outperforming the US market due to hopes of economic recovery and uncertainty surrounding US policy, with US technology underperforming. However, following the new US tariff regime on April 2, the US market reasserted its leadership through an AI-driven surge, causing the S&P 500 to move ahead of the MSCI Europe in local currency terms by September, though both indices achieved double-digit returns.5 A significant depreciation of the US dollar, driven by US policy uncertainty and an increasing budget deficit, introduced FX risks for non-USD investors, creating a divergence in Euro terms not seen in over two decades.

Value stocks led by financials, defense, and utilities outperformed growth and quality sectors. European bank valuations have consistently traded below their long-term averages since the global financial crisis. Despite positive performance in 2025, they remain below long-term averages heading into 2026, indicating potential for further re-rating supported by stronger capital positions and attractive dividend yields.6 Across sectors, European equities broadly remain at a deep discount to US stocks, even when adjusted for sector exposure or different growth expectations.7

Many leading European-based global companies, including those with exposure to secular tailwinds like energy transition and sustainable consumption, have a proven track record of successfully adapting to changing environments. We believe the underperformance observed among high-quality businesses in 2025 may present an opportunity to selectively add exposures, particularly with Europe’s economy at an inflection point.

We expect increased fiscal flexibility (e.g., Germany's easing of the debt brake for defense and infrastructure) and reindustrialization (initiatives like the EU's Clean Industrial Deal and European Defence Industry Programme) to contribute to European economic growth in 2026 and beyond, narrowing the GDP growth gap with the US. In our view, Europe's diverse equity market also provides fertile ground for quantitative investment approaches that can process complex information to identify subtle market inefficiencies and structural dynamics.

Source: Goldman Sachs Asset Management. As of November 2025.

Japanese equities: Tailwinds into a Takaichi administration

We believe Japanese equities are supported by positive tailwinds heading into 2026. These include moderating inflation,8 stable monetary policy, and the potential for increased fiscal support from a Takaichi-led government. We expect robust corporate capex and consumer spending, fueled by wage growth, to drive earnings in 2026. A weaker yen may benefit exporters, while rising inbound tourism may support domestic-focused companies. We expect corporate governance reforms to continue unlocking shareholder value, leading to increased dividends and share buybacks. Although valuations are above historical averages, we believe earnings growth and corporate reforms justify continued optimism. In our view, Takaichi's fiscal stance may benefit defense, nuclear energy, and technology sectors, given pledged investments in AI, semiconductors, quantum computing, space, advanced medicine, and cybersecurity.9

Japanese investors, who have traditionally preferred holding cash, are now gradually shifting towards riskier assets.10 A significant driver of this behavioral shift is the expanded Nippon Individual Savings Account (NISA) program, which offers enhanced tax-free investment limits and particularly appeals to younger, financially informed investors. In our view, this behavioral change, coupled with corporate reforms, further strengthens the asset class. The Japanese stock market also has unique characteristics, including fewer research analysts covering each company compared to other developed markets,11 language differences, and valuable data that is hard to access. We believe these conditions create potential opportunities for quantitative investors who use data to find and profit from information.

Emerging market equities: Pillars of potential opportunity

We observed how a softening US dollar, declining oil prices, easing inflation, and a more dovish stance from the US Federal Reserve (Fed) created a supportive backdrop for emerging market equities in 2025. We see potential for continued positive performance in 2026. On a one-year forward price-to-earnings (P/E) basis, emerging market equities trade at ~40% discount to US equities, below the long-term average.12 We see potential for this discount to narrow given strong corporate earnings profiles across emerging markets. In India, for instance, we believe sustained GDP growth can continue to fuel solid corporate earnings. We are focused on finding fundamentally strong, domestically-oriented opportunities in the country.

Recent stimulus to boost consumption and tech innovation are enhancing China’s appeal, in our view, but stock selection is key to seek out real earnings growth and avoid policy risks. We are focused on emerging themes: advanced manufacturing, technology innovation (AI, robotics, EVs and clean energy, biotech and fintech), resilient consumption, and defensive companies paying high dividends.

Strong GDP growth is driving steady corporate earnings. The volume of digital payments in India has surged, expanding threefold since June 2021.13 Favorable demographics and domestic consumption trends underscore India’s investment appeal. 65% of India’s population is below 35 years of age. The country has a median age of 28, roughly ten years younger than the US and China, respectively.14

We believe economic reforms, alongside diversification beyond oil, are generating new investment opportunities across Gulf Cooperation Council (GCC) countries. Themes like digitalization and infrastructure investment may help to underpin corporate earnings. The Gaza conflict and Red Sea tensions have heightened risks to trade and tourism, but Saudi Arabia, Qatar, and the UAE have remained largely unaffected.

Emerging markets are leading in AI and chip innovation—China, India, South Korea, and Taiwan all have standout companies driving global tech growth. Taiwan’s TSMC, as one example, dominates manufacturing of sub-10 nanometers chips used in used in AI and 5G.15 The company intends to invest ~$165 billion in advanced semiconductor manufacturing operations in the US.16

A Quantitative Edge in Multipolar Markets

The relentless expansion of data and the transformative power of AI is also driving new investment opportunities. As data continues to explode, much of it remains untapped by traditional investors. We believe quantitative strategies equipped with advanced computing and AI are uniquely positioned to synthesize this complex, unstructured information, extracting meaningful insights and patterns at scale. This capability provides a critical informational advantage in our view, allowing data-driven managers to understand market nuances and act faster than others, thereby capitalizing on opportunities before they are fully priced in.

Alongside data growth, market inefficiencies in Europe, small caps and emerging economies are becoming increasingly pronounced, creating fertile ground for active management. We believe the rise of passive investing, while offering broad market exposure, paradoxically contributes to mispricings as a growing portion of trading becomes indifferent to fundamental values. Coupled with a more fragmented mix of market participants and elevated return dispersion, these conditions amplify the potential for stock-picking.

We believe quantitative investment approaches also offer structural advantages that are critical for 2026 and beyond. Their systematic nature allows for continuous adaptation to market shifts, while their focus on stock-specific attributes minimizes macro biases, along with robust control of style, geographical or sectorial tilts. By constructing highly diversified portfolios with numerous smaller positions, we believe quant strategies can generate strong excess returns without taking on excessive active risk. This versatility, coupled with their ability to serve as powerful diversifiers, makes increased allocation to data-driven, systematic strategies an imperative for investors seeking to play both offense and defense.

An unprecedented degree of equity market concentration, coupled with higher correlations between equities and fixed income, has made traditional 60/40 investing riskier. We observe a growing interest in long/short beta-1 strategies that may offer investors a dynamic path to potentially enhanced investment outcomes. However, there are complexities that allocators must carefully consider, including correlation risks, capacity constraints and cost considerations.

Three Questions on Equities

Looking ahead to 2026, here are three key questions for equity investors focused on the Mag 7, small cap stocks, and China.

1. What is the outlook for the Mag 7's performance?

Historically, the Mag 7 stocks have largely exhibited homogenous stock price performance. However, key points of debate are now emerging that are expected to drive dispersion among these companies. These include questions surrounding whether their core businesses are genuinely enhanced or possibly cannibalized by AI, and whether AI investment is driven by strengthening existing market leadership or the need to find new markets. We are closely monitoring corporate fundamentals, such as free cash flow and potential return on investment, to assess the sustainability of their growth and to identify potential shifts in market leadership.

2. Will secular growth in small caps, driven by opportunistic and idiosyncratic factors, be rewarded as it has been in previous cycles?

We anticipate that secular growth will be met with outsized multiple expansion. Given that the growth rates of the average company may not be particularly impressive, businesses demonstrating consistent, above-trend-line growth could be poised to benefit significantly. While the specific sectors driving this trend may differ from previous cycles—with semiconductors potentially experiencing continued multiple expansion (as opposed to software), and aerospace and defense taking precedence over housing-related industries—we expect secular growth narratives to flourish as interest rates begin to retreat. A data-driven investment approach may help to identify alpha opportunities and manage risks effectively across a diverse small-cap universe.

3. Is the rally in Chinese equities sustainable in 2026?

We believe recent support for China’s equity market stems from abundant liquidity, increasing retail participation, and limited alternative investment options. Policymakers have been focused on boosting consumption via direct stimulus (consumption vouchers for services) and indirect support to property and employment markets. Long-term equity market outperformance, in our view, hinges on translating this liquidity into durable earnings growth. We consider valuations attractive relative to global market peers, and light global investor positioning leaves room for potential inflows into Chinese stocks. Risks include potential re-escalation in tariff rhetoric and possible policy or regulatory shocks, which have historically triggered sharp reversals in China's flow-driven rallies.

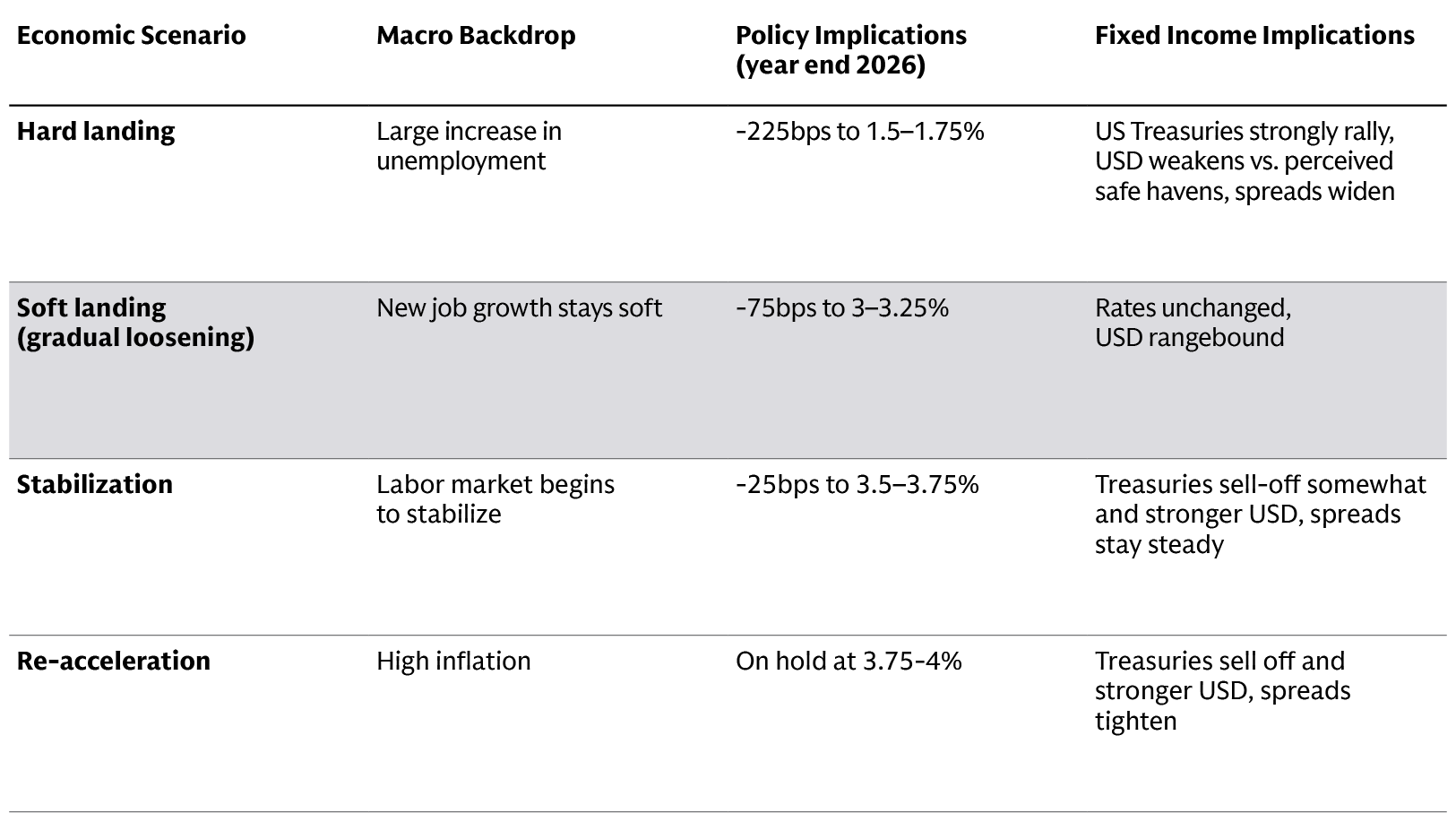

Fixed Income: Balancing with Bonds

Heading into 2026, investors face a delicate balancing act. Rising uncertainty regarding the US economy's fiscal health must be weighed against the growth potential from the AI capex boom and increased government spending. Federal Reserve policymakers appear more finely balanced between dovish and hawkish stances, adding uncertainty to the near-term outlook. A backlog of data releases following the end of the US government shutdown has complicated the picture for policymakers and markets alike.

A bifurcated investment landscape, however, presents opportunities for active fixed income investors to dynamically manage their allocations. This includes strategic curve positioning to reflect fiscal perceptions and capitalize on divergent central bank policies, alongside diverse asset selection—such as securitized credit, high yield credit and emerging market debt—to potentially secure attractive income streams.

Overall, the fixed income opportunity set remains appealing from both a technical and fundamental perspective. Nevertheless, we believe the fine balance of risks necessitates an active approach, combining diverse portfolio construction with robust risk management, and the flexibility to adapt to evolving market conditions.

Navigating mixed macro signals

We are neutral to US rates, although we see potential for Treasuries to rally should labor market weakness become more pronounced. Curve positioning is also key to capturing additional value, and we continue to hold steepening biases to the US and Europe considering long-term structural trends. In Europe, prospective fiscal expansion contrasts with potential near-term inflation undershooting. These conflicting dynamics favor an active approach and an ability to express views across the curve.

Source: Goldman Sachs Asset Management. This represents the views of Goldman Sachs Asset Management Fixed Income and Liquidity Solutions. These are hypothetical scenarios for federal funds rate through year-end 2026. Our base case is the ‘soft landing’ scenario. As of October 31, 2025. The economic and market forecasts presented herein are for informational purposes. There can be no assurance that the forecasts will be achieved. Please see additional disclosures at the end of this presentation.

Several factors could reshape our views in the months ahead. US labor market weakness is a key Fed focus, with further deterioration in employment metrics potentially accelerating the easing cycle. The health of the US consumer, particularly amid ongoing tariff cost passthrough, is a bellwether for US growth expectations. Additionally, the trajectory and sustainability of AI capex spending remain top of mind.

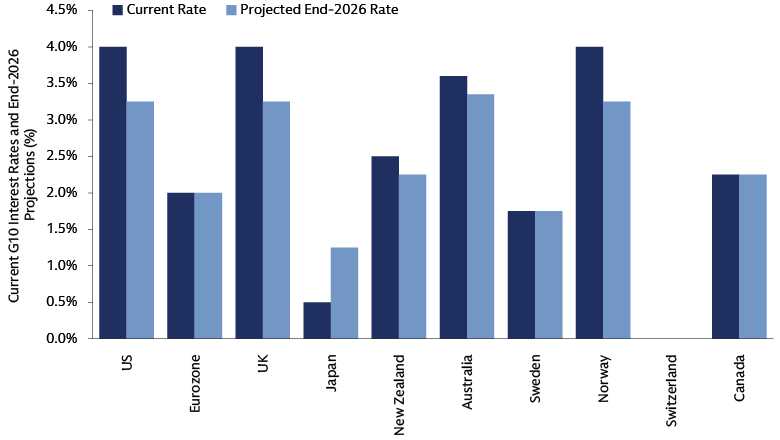

Source: Macrobond. As of October 31, 2025. This represents the views of Goldman Sachs Asset Management Fixed Income and Liquidity Solutions.

Global inflation and growth dynamics have diverged, leading to increasingly diverse central bank policies. In the US, we lean towards a December rate cut given the Fed’s continued focus on labor market weakness. We see potential for two further cuts in 2026. However, we acknowledge near-term uncertainty stemming from pent-up data releases following the US government shutdown.

We expect the ECB to hold rates steady for the foreseeable future. Meanwhile, the BoE could resume cuts in December, driven by improved inflation, a relatively weak labor market, and potential tax hikes. However, we recognize that political and fiscal uncertainty have increased the risk to this view.

Japan presents a different picture. Inflation, consistently above target for 41 months, coupled with robust growth, will prompt the BoJ to hike rates in our view. This outlook is reinforced by recent political changes and a shift towards looser fiscal policy. Across other G10 economies, easing cycles are at varying stages. Sweden's easing cycle is likely complete if its economy improves as expected. Upside inflation surprises could pause rate cuts in Australia. Norway's monetary easing pace may continue, and a return to negative rates by the Swiss Central Bank appears less probable for now. Conversely, New Zealand rates could fall further due to recent poor GDP data. We anticipate continued easing across several emerging market economies, supported by a subdued US dollar and lower oil prices, which reduce inflation risks.

The carry opportunity

We believe the fixed income landscape in 2026 offers investors numerous opportunities to secure relatively high income streams across various asset classes. This includes the securitized space, where we are positive due to attractive carry, strong relative value, and a robust technical backdrop. We are constructive on AAA-rated tranches of Collateralized Loan Obligations (CLOs) based on carry and structure, and valuations among the BBB-rated cohort are also appealing. However, active security selection within the securitized space remains crucial. With this in mind, we are wary of mezzanine tranches within Commercial Mortgage-Backed Securities (CMBS) due to valuation pressures.

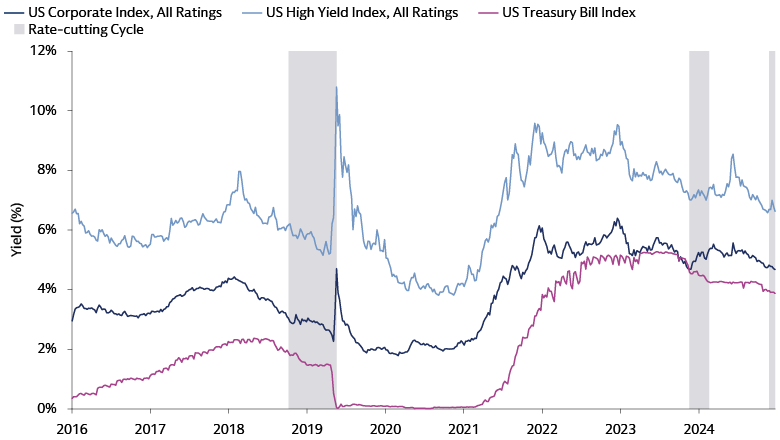

Elsewhere, high yield credit could be another avenue for income in 2026. Credit fundamentals for high yield issuers continue to defy tariff-related fears, as evidenced by strong credit metrics like interest coverage ratios and contained default rates. The positive secular shift in the high yield ratings mix over the past decade has also enhanced the asset class's resilience during occasional macro shocks. Favorable market dynamics, including firm investor demand and easing financial conditions, should continue to support primary market activity. The recent increase in M&A activity may also be supportive. Strategic buyers, focused on long-term operational integration and expansion, rather than financial returns, may be more willing to make deals with credit-friendly financing structures that can drive price appreciation for high-yield issuers.

Source: Goldman Sachs Asset Management, Macrobond. As of October 20, 2025. Past performance does not predict future returns and does not guarantee future results, which may vary.

We also see value in certain segments of the investment grade space, particularly the banking sector, which we think offers an attractive income generation story. Emerging market debt could potentially remain a strong source of income and alpha, given the asset class’s high level of differentiation, ongoing US dollar softness and the continued resilience of underlying sovereign and corporate issuers.

We view recent credit events, such as fraud allegations and bankruptcies involving First Brands, Tricolor, and Cantor Group, as isolated, idiosyncratic occurrences, not indicators of rising systemic credit risk or challenges to the banking sector's resilience. The US banking sector remains sound, as reaffirmed by robust 3Q 2025 earnings, which highlighted overall benign asset quality trends. More broadly, positive momentum in earnings and revenue, coupled with resilient credit metrics and conservative balance sheet management, suggests a mid-cycle backdrop for US investment grade credit, rather than a late-cycle turn. This is supported by stable leverage and disciplined capital spending, showing few signs of over-investment outside of a few areas. The high yield market broadly mirrors this strength, exhibiting improved credit quality, shorter duration, and higher capital structure seniority for outstanding bonds compared to historical trends.17

Close monitoring for signs of late-cycle behaviors is warranted in 2026. We are alert to the potential for US deregulation or reduced policy uncertainty to lead to increased shareholder payouts and debt-funded M&A. We are closely monitoring whether buyback activity expands beyond a few sectors and begins to pressure leverage ratios, potentially resulting in credit rating downgrades. So far, share buybacks have been concentrated within specific sectors—notably technology, healthcare, and financials—that tend to be higher rated; meanwhile, BBB-rated companies have acted more cautiously. Management teams are prioritizing maintaining credit ratings when pursuing M&A, and in the high-yield market, strategic M&A activity may even enhance credit fundamentals. Certain sectors warrant caution. For instance, elevated capex needs for grid modernization, renewables, and data center power demand are outpacing operating cash flow for most utility issuers, informing our cautious outlook on the sector. We are also watching the pace of hyperscaler capex closely given potential risk that this turns into too much investment in the future, pressuring the return on assets.

Three Questions on Bonds

Looking ahead to 2026, here are three key questions concerning AI-related debt issuance, AI’s impact on the US economy, and European growth prospects.

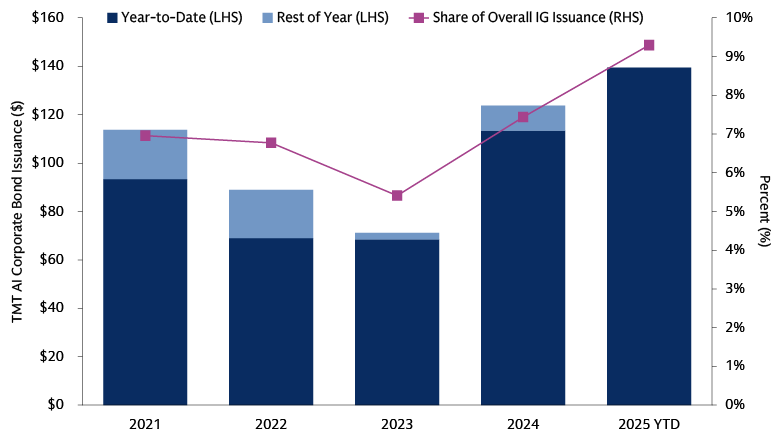

1. Should corporate bond investors be concerned about risks to credit fundamentals from AI-related debt issuance?

Hyperscalers have largely financed AI capex from cash flows since 2022, but recently this trend has shifted as capital spending continues to rise and returns to shareholders via buybacks and dividends remain constant. These three uses have consumed ~95% of operating cash flows over the last 12 months vs ~80% in 2019. This increase has left some hyperscalers in the position of needing to access capital, both public and private. In 2025, through the end of October, the 5 hyperscalers issued about ~$90 billion in credit markets, which compares with gross investment grade issuance of ~$1.5 trillion over the same period.18

As AI evolves from infrastructure to application, capex is projected to rapidly ascend. This may lead to further use of debt, depending on the pace of earnings growth and whether issuers opt to reduce buybacks. This is not an immediate concern for corporate bond investors, in our view, due to AI-investing companies' robust financial health (high cash flow, low leverage) and diversified financing sources (cash flow, private markets, securitized, public credit) spreading risk, unlike the dot-com bubble. Moreover, hyperscalers' scale and existing substantial cash flow reduces economic sensitivity. However, we are mindful of hyperscalers’ ability to ultimately earn a return on investment and interconnectedness within the AI ecosystem. Ultimately, we believe increased debt reliance warrants close monitoring through 2026, as rising AI-related debt could pressure credit metrics and widen spreads.

Source: Goldman Sachs Global Investment Research, Bloomberg. As of 2Q 2025. See “AI capex turns to credit” Top of Mind: AI: in a bubble? Chart reflects constituents of the US TMT AI Basket (Ticker: GSTMTAIP) developed by Goldman Sachs Global Bank & Markets, which consists of companies that are pursuing AI or can help enable new technologies.

2. Can AI-fueled growth compensate for underlying economic and labor market weakness?

Slowing consumer spending and a stagnant housing market have raised questions about the state of the US economy, while weakness in the US labor market has added to concerns. This has been counterbalanced by the AI capex boom driving business and investment activity. As we approach 2026, this uneasy equilibrium remains intact, with growth based on long-term transformative investments potentially masking the true nature of the underlying real economy.

Whether there is some fragility to the AI-fueled parts of this growth, or whether it can continue to compensate for weaker parts of the economy, is a key question top of mind as we look to 2026. Risks skew several ways. Continued AI adoption and a relatively stable market should provide a solid platform for growth. However, a marked reversal and broad unwind of AI-related investments or significant labor market weakness could be the precursor to a hard landing for the economy. Getting this call right will be a key factor for investors in 2026.

3. Can European growth prospects get the better of multifaceted headwinds?

Europe’s growth story, following Germany’s significant fiscal expansion announced earlier this year, faces a mix of challenges and supportive factors. On the downside, we believe ongoing political uncertainty in France is already affecting soft data, and its continuation could put a handbrake on investment in the country. We are cognizant that potential flashpoints may lie ahead that could derail growth, particularly with the National Assembly fractured over fiscal policy and a presidential election on the horizon in early 2027. Questions also hang over how much impact Germany’s fiscal expansion will have on the economy, given early data suggests it has so far had an underwhelming effect. In addition, the eurozone is continuing to come under pressure from Chinese exporters, whose competitiveness is crowding out their European tech and manufacturing parts. This is exacerbated by China’s use of rare earth export controls, weighing on EU manufacturing further.

However, we believe several potential tailwinds leave the weighting of risks relatively balanced. The upcoming impulse will still provide a catalyst for growth, the strong tourism sector should also be additive, while household balance sheets are providing resilient despite uncertainty. Overall, with recent data releases on growth and inflation tending to surprise on the upside, we expect the ECB to hold rates steady for the foreseeable future.

1 Goldman Sachs Global Investment Research. As of October 8, 2025.

2 Goldman Sachs Global Investment Research. As of September 2025.

3 Goldman Sachs Global Investment Research. As of October 16, 2026.

4 National Retail Federation. As of July 30, 2025.

5 Goldman Sachs Asset Management, MSCI, FactSet. As of November 7, 2025.

6 Goldman Sachs Asset Management, Bloomberg. As of September 2025.

7 Goldman Sachs Global Investment Research. As of September 2025.

8 Goldman Sachs Global Investment Research, Ministry of Internal Affairs and Communications, BoJ, JCER. As of November 7, 2025.

9 Prime Minister’s Office of Japan. October 24, 2025.

10 Goldman Sachs Global Investment Research, Japan Securities Dealers Association. As of August 2025.

11 Goldman Sachs Asset Management, MSCI, TOPIX, Bloomberg. As of October 29, 2025.

12 Bloomberg. As of November 11, 2025.

13 Bank for International Settlements. As of December 2024.

14 US Census Bureau, Government of India. As of July 2025.

15 US International Trade Commission. As of May 2024.

16 TSMC. Company statement. As of March 4, 2025.

17 Goldman Sachs Global Investment Research. As of October 8, 2025.

18 Bank of America. As of November 2025.