Asset Management Outlook 2025: Disruption from All Angles

This article is part of our 2025 Outlook: Reasons to Recalibrate.

Disruption from All Angles

Economies may be moving towards a better balance, but disruption is likely to keep coming from multiple directions in 2025. Our focus remains on cutting through the noise to find signals of actual change. There are several key structural forces that stand out in this era: these include decarbonization, digitization, deglobalization, destabilization in geopolitics, and demographic aging. Mapping their long-term implications, identifying opportunities at their intersection, and strategically allocating capital across public and private markets can drive positive financial and real-world impact.

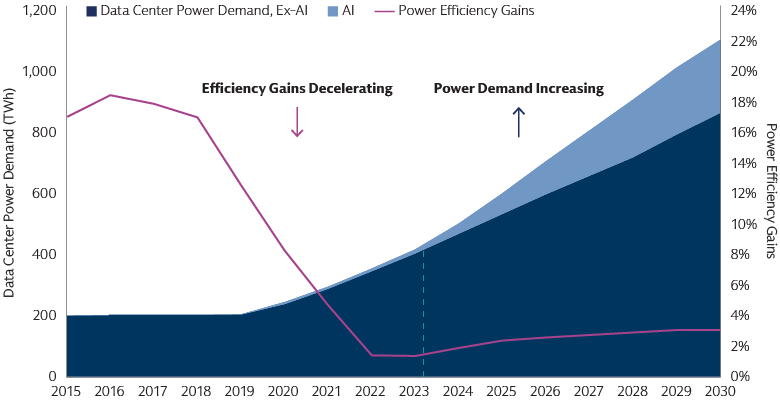

Power demand inflection point

Artificial intelligence, the clean energy transition, robust economic growth and industrial reshoring are driving strong increases in demand for power and electricity. We expect the appetite for power to grow in 2025 and intensify in years ahead. The electrification of transport, heatwaves increasing the need for air conditioning and a deceleration in the pace of data center energy efficiency gains will add to demand growth. AI may put pressure on the energy system (a ChatGPT search consumes around 6-10x the power as a traditional Google search)1 but it may also help find solutions to make data centers and the grid more efficient. Sharp increases in energy demand could accelerate the shift to renewable sources of power, but may also lead utilities to ramp up their use of readily available fossil fuels in the short term.

Source: Masanet et al. (2020), IEA, Cisco, Goldman Sachs Global Investment Research. As of April 28, 2024.

Major economies, including the US, Europe and Japan, are focusing on semiconductor reshoring, but they are also looking to build the power infrastructure required to be net exporters of “intelligence” rather than sending their data to another provider or country to help train their AI models. Rising power demand is creating investment opportunities in utilities, renewable generation and industrials whose investment and products will be needed to support growth. Wind, solar, nuclear and gas will all be part of the power equation. Hybrid solutions that help maintain grid resiliency and efficiency will be essential in minimizing outages. Utility-scale energy storage reduces the likelihood of brownouts and enables more renewable power to be used on the grid. Growing energy use by data centers is also spurring demand for resource and land efficiency solutions, including clean water and infrastructure.

Security to stay front and center

After a mega-election year, post-election policy shifts by governments in major economies may disrupt some areas of the global economy in 2025. However, we do not expect leaders to compromise on security. Security at the supply chain, resource, and national levels is a vital precondition for sustainable growth. Policy tailwinds in this area are likely to remain in place and, in some cases, strengthen. For instance, while a second Trump presidency creates uncertainty about the future of the Inflation Reduction Act (IRA), we expect efforts to solve for affordable, reliable, and sustainable energy to remain a key priority for corporate management teams. At the same time, we expect security threats to grow in magnitude and complexity, driving the need for new defense and cybersecurity solutions. Advances in AI and the likelihood that geopolitical tensions remain elevated mean attempts by the US government to strengthen the country’s technology supply chains are likely to receive bipartisan support.

In Europe, the recently unveiled “Draghi Plan” includes a set of recommendations to promote private investment, boost Europe's competitiveness, close its productivity gap with the US and China and enhance its economic security by reducing its dependencies. For example, as 2022’s energy crisis demonstrated, securing a supply of critical resources from key trade partners is vital for the region. High energy costs in Europe remain an obstacle to growth, while a lack of generation and grid capacity could impede the spread of digital tech and the electrification of transport. About half of the €800 billion extra annual investments posited in the Draghi Plan would be in clean energy and electric mobility.2 If implemented, the plan would provide significant tailwinds for EU electrification compounders and power utilities.

We believe in playing the long-term theme of security in a holistic way. Supply chain, resource and national security themes in developed economies provide a broad universe of investment ideas to choose from, and the ability to construct a well-diversified portfolio with balanced exposure across sectors.

Sustainability: A sharper focus on financial returns

We are seeing investors begin to re-focus on financial materiality once again, going back to basics by concentrating on financial returns. As we move away from simplistic industry exclusions and narrow tilts towards lower-emission stocks, we believe that a broadening of the investable universe will lead to both greater real-world impact and heightened performance benefits. We believe there will be a growing push to link sustainability with stock performance and quantifiable real-world impact.

Investors increasingly realize that decarbonizing the real economy will require capital to be channeled into sectors with higher emissions, such as energy companies, utilities and producers of cement, chemicals and steel. This represents a considerable shift in mindset from the early days of sustainable investing, when many investors focused on carbon-light sectors that were viewed as more positive for the environment. This evolution can be seen in the growth of forward-looking “transition” and “improver” strategies, which tend to invest more in companies expected to improve the sustainability of their operations and products. Understanding the decarbonization challenges facing heavy-emitting sectors including oil & gas, aerospace & defense and metals & mining can help investors identify corporations making real progress and companies providing the solutions they need.

Three Key Questions

1. What are the potential impacts of the US election on sustainable investing?

While uncertainty regarding sustainability policy, and the Inflation Reduction Act in particular, may be elevated following the US elections, we expect the underlying commercial drivers of sustainable investment opportunities to remain resilient, regardless of the political backdrop and direction of near-term policy priorities. For instance, the fundamentals of clean tech continue to improve (higher quality solutions, lower cost curves). We also see growing corporate and investor interest in decarbonization broadly, greater demand power resources driven by AI growth, and an accelerated need to prepare for and respond to climate related hazards. We continue to focus on financially-material drivers of investment opportunity and risk.

2. What can investors do to integrate biodiversity risks and opportunities into their processes?

Climate change is increasingly disrupting the balance of biodiversity, and focus on nature from governments, corporate leaders and investors is on the rise. The wide variety of terminology and approaches in the biodiversity market make it difficult for investors to navigate. Based on our own experience and engagement, we think investors should begin by clarifying their objectives and then select tools that make it possible to assess companies and identify opportunities to make biodiversity investing actionable.

3. What are investment implications of increasingly interrelated forces of AI, geopolitics, and the energy transition?

These forces could interact in various ways. For example, AI may strain the energy system, but it may also help find solutions to make data centers and the grid more efficient. For investors, the challenge is to understand these interdependencies and map out their investment implications. Investors who stay in their silos and focus on a single theme could be missing out on opportunities and underestimate the risks. More specifically, we see opportunities to leverage the power of AI in investing to open the door to future alpha generation—but we believe this requires an intuitive data strategy and human expertise.

For more of our 2025 investment views explore A New Equilibrium, Landing on Bonds, Broader Equity Horizons and Exploring Alternative Paths and the potential sources of attractive returns they could create.

1 Goldman Sachs GIR. As of April 28, 2024.

2 European Commission, Goldman Sachs GIR. As of October 14, 2024.