Asset Management Mid-Year Outlook 2024

Cutting Through Complexity

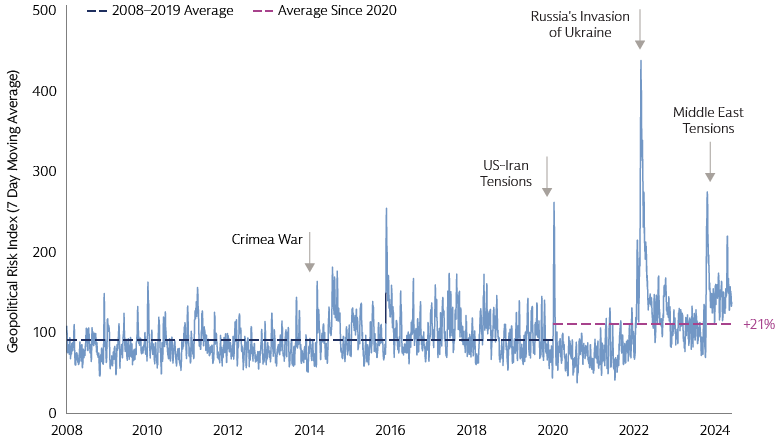

At a macro level, inflation persistence means central banks are pivoting to rate cuts at a slower pace than anticipated six months ago. In our view, evolving expectations on the exact timing and pace of policy shifts underscores the need for a dynamic investment approach in the months ahead. As the macroeconomic cycle adjusts, the world remains in an era of profound geopolitical change. Conflict escalation in the Middle East and Ukraine remain major risks. The buildup and eventual fallout of key political elections globally are heightening market volatility. These uncertainties are playing out as secular megatrends—from artificial intelligence (AI) to sustainability—accelerate and reshape economies and industries.

Understanding the nuances of these forces and how they interconnect can enable companies and investors to potentially capitalize on the opportunities they create. We have synthesized views from across our investment teams to cut through some of this complexity and help you navigate the remainder of 2024.

Macroeconomy: A Longer Path to Normalization

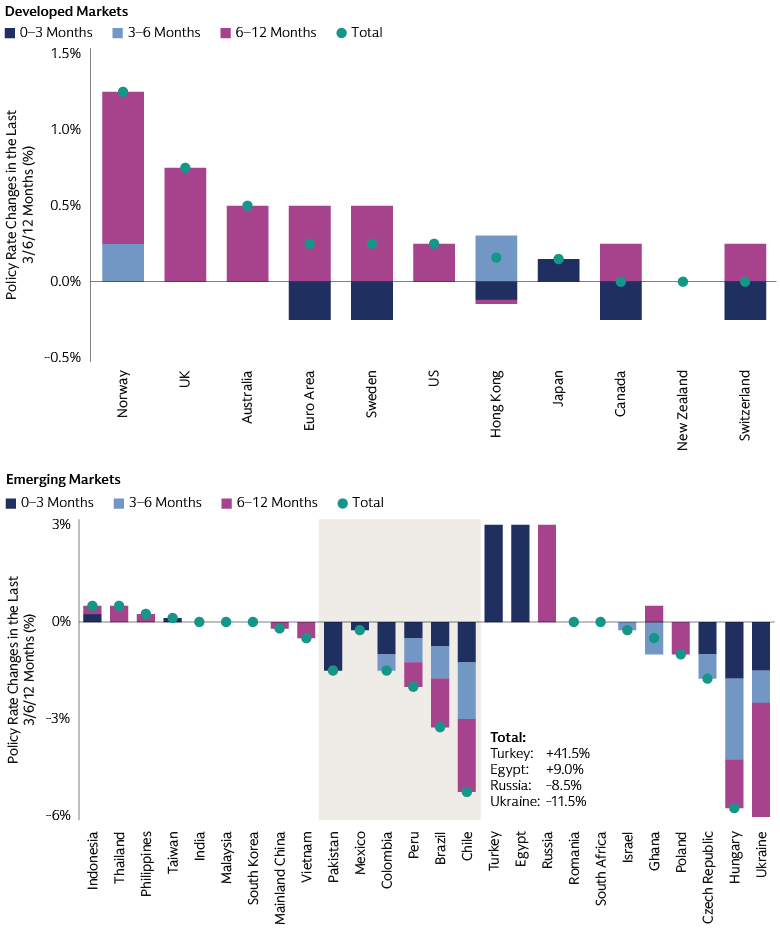

Major central banks lifted interest rates at the fastest pace in decades after the pandemic. The path to normalization is likely to be a longer one. While the inflation emergency is behind major economies, inflation is proving persistent due to pandemic-related quirks or catch-up effects in categories where prices adjust gradually. The result is that central banks are pivoting to rate cuts at a slower pace than anticipated at the start of 2024.

In the US, policymakers and investors are contending with last mile complexities. Resilience in the economy, corporate earnings, and labor markets coincided with upside surprises in inflation throughout the first quarter. Inflation prints for April and May were a step in the right direction, but not enough to fully offset inflation strength earlier in the year and the solid string of jobs data.1 Overall, despite a bumpy first half, we expect US disinflation to continue and rates to be lowered before year-end. However, the exact timing remains uncertain due to the need for economic data to reaffirm confidence in labor market rebalancing and the disinflation path. Beyond that, the US election—and potential fiscal shifts—could point to higher US rates for longer.

The European Central Bank (ECB)—which has historically embarked on cutting cycles after the Fed—lowered rates in June,2 motivated by sufficient inflation progress since the last rate hike in September 2023. We expect rate reductions to be gradual over the coming quarters. We remain watchful of wage trends and services inflation, as well as any tightening in financial conditions caused by political uncertainty, which may pose downside risks to growth and alter the pace and scope of the ECB's rate cutting cycle. In the UK, recent inflation strength has pushed back the Bank of England’s (BoE) first rate cut in this cycle; and the potential for a summer cut depends on signals from indicators of inflation persistence such as wage growth and services prices. In Japan, we anticipate further, albeit limited, rate hikes as the Bank of Japan (BoJ) persists with gradual rate normalization, with longer-run inflation expectations continuing to rise to more sustainable levels.

Emerging market (EM) cutting cycles have been underway for almost a year. EM disinflation, which has allowed an earlier start to policy easing, has broadly remained intact. Countries in Asia, Central and Eastern Europe and Latin America have made good progress on cooling inflation, though there are also notable outliers, including Argentina and Turkey. More recently, EM cutting cycles have become vulnerable to shifting US rate expectations, as well as concerns over the credibility of policymaking (e.g., Brazil) and election-related sentiment (e.g., Mexico). As a result, market expectations on the speed and extent of EM policy easing have been pared back compared with just a few months ago. In some cases, the market is now pricing in rate hikes. China’s economy continues to diverge, with policymakers set to maintain an easing bias as the economy and property market recovers.

Source: Goldman Sachs Global Investment Research. As of June 14, 2024.

Investment Considerations

Stay Focused on Fixed Income

In an environment of steady growth, slowing inflation, and broadly robust corporate fundamentals, we see opportunities to build well-diversified fixed income portfolios with the potential to capture attractive levels of income. However, we believe the environment remains one in which active security selection is critical. We remain vigilant of downside surprises in economic activity and headwinds to business investment due to election-related uncertainties, and tactical in adjusting our positioning in response to market driven opportunities. Uncertainty underscores the defensive role of government bonds and perceived safe-haven currencies like the US dollar. Elsewhere, we see value in attractive income provided by spread sectors like corporate and securitized credit.

In government bond markets, we believe adopting a dynamic strategy in managing duration is essential given divergent timelines, paces, and directions of central bank policies. In the US, we are positioned for a steepening of the forward Treasury yield curve. This exposure may safeguard against downward growth risks and allow investors to capitalize on the start to Fed rate cuts or growing term premium driven by a steady supply of US Treasuries. Our position on European rates is broadly neutral. While the ECB has shown an easing bias and political uncertainties could dampen growth, we are also alert to strength in services inflation. We favor UK rates as the BoE is on course to ease policy, absent significant upside data surprises. Conversely, in Japan, we are mindful that continued strength in wages and a hawkish leaning BoJ increases the likelihood of further tightening. In the EM sovereign credit space, investors have potential opportunities to capture attractive carry and identify bonds with potential for total return due to possible rating upgrades to investment grade. While we have reduced our overall exposure to EM local bonds, we are focused on markets like Chile, Czechia, and Hungary, which appear poised for continued monetary easing, and continue to monitor country-specific factors given unfolding divergence in central bank policy paths.

Despite the overall credit landscape appearing stable, dispersion is evident across sectors and regions. For instance, A-rated issuers with higher debt levels have seen a more significant drop in interest coverage ratios compared to BBB-rated issuers with lower leverage. Across credit, we favor issuers in sectors with the potential to demonstrate resilience throughout the economic cycle. Bonds issued by banks are appealing, in our view, due to their spread premium, although recent performance has reduced their valuation appeal. Sectors adapting to decarbonization and digitization, such as telecoms with broadband and 5G services, and tech firms focusing on cybersecurity and data protection, also offer potential opportunities. We continue to believe the EM corporate bond market offers an attractive mix of yield, diversification for existing corporate or EM exposures, and resilience to macroeconomic challenges. Our analysis suggests EM corporate fundamentals remain healthy, with net leverage at near-decade lows. Credit rating trends are positive, and default activity is projected to decrease in 2024, reversing the trend of the past three years. Additionally, the technical environment is favorable due to the limited new supply. We maintain a positive view on securitized credit, including commercial mortgage-backed securities (CMBS) and collateralized loan obligations (CLOs). We think there is potential for further spread tightening in the latter half of the year, supported by strong fundamentals, especially for securities at the top of the capital structure. Importantly, recent economic data remain supportive of a 'soft-landing' scenario, which is favorable for sustaining cash flows from underlying loans.

Broaden Your Equity Horizons

In public equity markets, inflationary pressures and higher interest rates have enabled the strongest business models to demonstrate their margin resilience over recent quarters. First quarter earnings seasons in the US were generally better-than-expected based on our analysis.3 Most of the earnings growth of the S&P 500 continues to be driven by the “Magnificent 7”, though performance dispersion within the group has widened. The second half of 2024 may present investors with opportunities to broaden their equity horizons beyond the largest names. We see a new layer of AI beneficiaries emerging that are simultaneously backed by fundamentals and complementary to the Magnificent 7, including companies enhancing AI by harnessing the power of data. Scrutiny of AI strategies, returns on investments, and profitability is likely to heighten as corporate AI spending grows. This underscores the need for careful security selection and active management.

After a multi-year period of underperformance relative to large caps, we believe US small caps are poised for a rebound. Our view is based on the attractive absolute and relative valuations, the improving US macroeconomic outlook and the prospect of US interest rate cuts before year-end. US policy easing cycles have historically provided a tailwind to the asset class.4 With a higher share of floating debt and higher debt burdens, smaller companies may see a more instantaneous and stronger top-line impact from expected rate reductions in the second half of 2024. Small caps also offer diversification away from concentration risk within the S&P 500.

Outside the US, we believe Europe’s improving growth and inflation mix, combined with better corporate earnings dynamics and modest valuations, bodes well for European equities. Rate reductions in Europe have materialized ahead of the US, and that, combined with moderating wage growth and inflation, should improve margins for companies, in our view, including European small caps that have been vulnerable to higher interest rates. In Japan, we expect strong equity market performance to continue being driven by structural changes; notably a shift to an inflationary environment after decades of deflation. Continued corporate reforms are resulting in Japanese companies being more proactive and public on their plans for capital efficiency.5

Evolving Private Market Opportunities

Private market opportunities continue to evolve, with multiple avenues for investors to potentially enhance risk-adjusted returns and add diversification to traditional investment exposures. In private equity, higher capital costs have changed the calculus for dealmakers. We believe operational value creation levers are poised to become the main determinants of success in this new regime. Prudence in deploying capital—for both new investments and supporting existing companies—should also become an even more critical factor to investment outcomes. With limited partners (LPs) seeking liquidity from existing holdings, in some cases as a prerequisite to new commitments, general partners (GPs) may increasingly turn to continuation vehicles and structured solutions to provide liquidity while value accrues. Secondaries continue to present opportunities, as both LPs and GPs seek deal and fund structures that offer both liquidity and opportunities to extend hold times.

Private credit continues to expand, and remains valued by borrowers as a flexible, timely solution to finance capital needs. While yields on senior secured loans are still attractive compared with recent years, competitive pressure to deploy capital has driven spreads tighter in 2024. To compensate, some lenders are looking to refinance existing packages at more attractive terms to extend duration (i.e., sacrificing current yield for a higher multiple of invested capital). The structure of private credit deals may evolve, too. For instance, companies may seek to push down interest costs further by including equity kickers to compensate for a lower spread. We believe those with scale and flexibility to lend throughout the capital stack, as well as a deep book of existing borrowers, are best positioned. Semi-liquid vehicles represent a new source of competition, with pressure to deploy capital inflows relatively quickly potentially contributing to spread tightening. Overall, while we do not anticipate widespread distress, persistent elevated rates will likely test some fully levered companies and certain business models over the coming quarters. Underwriting, structuring discipline, robust sourcing pipelines and experience should become a greater determinant of ultimate outcomes, in our view.

Infrastructure dealmaking has decelerated broadly in recent quarters, with higher rates proving a continued headwind, but there are pockets of strength. Energy transition projects continue to attract capital. Digital assets also remain popular, with investors seeing compelling opportunities to develop platforms as demand increases and regulatory frameworks evolve. In real estate, diverging views on the timing and magnitude of US rate cuts is keeping some investors on the sidelines. Lingering risks in the US—including upcoming elections, regulatory uncertainty, and rising insurance costs—complicate the outlook. Many investors remain focused on the highest quality assets, while distressed sales have seen a small uptick as valuations have continued to fall. We expect demographics, technology, and the drive towards sustainability to shape global real estate demand in the years ahead, with economic and capital market dislocations creating new opportunities over time.

Three Key Questions

1. Is the shift to higher interest rates posing challenges to bond issuers?

Our view: As we near the one-year mark since the Fed funds rate peaked, our analysis suggests the core financial health of the median US investment-grade company remains robust. Interest coverage ratios, despite a downward trend, are still near or just below historical averages. Sustained economic and earnings growth may enable resilient companies to adjust to a higher rate environment. Higher rates may also encourage a more conservative approach to capital management among corporates, which could bolster credit metrics. While the shift to higher interest rates appears generally manageable, it does pose challenges for some. We believe navigating the new landscape of higher rates and structural shifts demand an active, fundamental approach to bond selection.

2. Can small caps finally outperform?

Our view: We think small caps are a coiled spring amid an improving economic backdrop, with lower rates on the horizon across developed markets. US small caps have historically generated strong returns following the dissipation of extreme mega-cap concentration, as well as in US election years.6 In our view, the best way to access the asset class is to be differentiated with high active share to capture outsized opportunities for returns, and be selective, using a disciplined, fundamental approach to avoid unprofitable companies.

3. What is “normal” for private equity?

Our view: Some private equity investors are questioning what a “normal” environment will look like going forward. While the breakneck pace of activity in 2021/22 was likely an anomaly, fueled by historically low rates and easy access to capital, a prolonged return to pre-pandemic trendlines might not be the most likely path forward either. Evergreen structures, combined with the rise of continuation vehicles, are enabling longer hold times for assets. These developments suggest that the size, scope, and nature of deals is likely to continue evolving, defying attempts to define “normal.”

Geopolitics and Elections: Roadmaps for Resilience

When geopolitics is unstable, investors have historically gravitated to the most fundamental assets: commodities, which have historically exhibited hedging properties against geopolitical and financial shocks. The value of oil as a hedge against geopolitical supply disruptions has risen so far in 2024. The price of gold hit a record high in May, driven by emerging market central bank purchases, which have tripled since Russia’s invasion of Ukraine.7 Beyond commodity exposure, we believe elevated geopolitical risk and potential for conflict escalation underscores the importance of being proactive and preparing entire portfolios for unexpected events. Balancing allocations with a diverse set of return drivers across asset classes can act as a first line of defense. Incorporating hedging strategies alongside long-term portfolio construction decisions can also help to capture opportunities and potentially reduce vulnerability to large event shocks.

Politics remains in focus. The first six months of 2024 was especially active for EMs. In Taiwan, a third consecutive win for the Democratic Progressive Party suggests policy changes may be limited, but cross-strait tensions with China are likely to stay elevated. Election results in India, Mexico and South Africa were sources of market volatility. In India—which held the world’s largest election—Prime Minister Modi secured a third term. However, Modi’s Bhartiya Janata Party (BJP) failed to secure a majority and relied on alliance partners to form a government. We expect India’s macroeconomic strength to continue and do not anticipate a reversal of key structural reforms witnessed over the last decade. Mexico’s governing party candidate Claudia Sheinbaum won the presidential election by a very wide margin, outperforming pre-election predictions. This led to a negative reaction in Mexican assets, including the Mexican peso, as the Morena coalition’s large majority could allow constitutional amendments without opposition support. In South Africa, the implications of a transition to a coalition government are likely to be closely monitored in the months ahead given the surprising underperformance of the African National Congress (ANC).

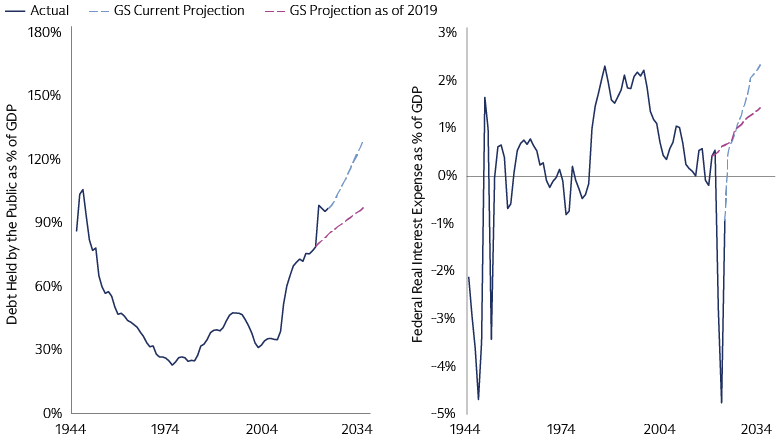

Elections in developed markets are in focus as we enter the second half of 2024. In the UK, the Labour party secured a significant majority on July 4. Labour’s manifesto policies imply relatively limited changes to fiscal policy.8 The new government is expected to set out further details of its policy agenda—including spending and taxation—in the weeks and months ahead. We expect investors to remain focused on disinflation progress and the potential for BoE rate cuts. In France, elections at the start of July resulted in a hung parliament, with the left-leaning coalition unexpectedly gaining the most seats. Political uncertainty and the potential for volatility in French assets remains elevated in the near term. The process of government formation could extend well into the summer. The US election takes place in November, and we are monitoring the impact of policy—including fiscal and trade—on regions, industries, and companies. On the fiscal front, former President Trump entered office in 2017 with a smaller, but growing, structural deficit which allowed for tax cuts. President Biden entered office four years ago with a large deficit, but also with low interest rates and a political environment that supported further fiscal measures. Neither of those conditions exist now. This does not rule out the possibility that the winner of the election will pursue policies next year that add further to the deficit. The risks of US trade and international policy shifts are also likely to increase as the US election approaches. Outcomes will have varied impacts on growth and asset market performance in other countries, including Europe and China. We expect market participants to focus on the possibility of increased tariffs becoming policy, and the risks those tariffs create to growth and profitability. Overall, we believe it is important for investors to avoid trying to time markets or take calls on binary policy outcomes.

Source: Goldman Sachs Asset Management, Caldara, Dario and Matteo Iacoviello. As of April 8, 2024. Data downloaded from https://www.matteoiacoviello.com/gpr.html. Daily data. For illustrative purposes. Past performance does not predict future returns and does not guarantee future results, which may vary.

Investment Considerations

Hedge Funds and Liquid Alts

Hedge funds have taken advantage of continued market dispersion across asset classes, sectors and regions in recent months. As we head further into a world where rates remain elevated, with potential for flare-ups of market volatility and geopolitical shocks, the market environment provides hedge funds with a strong opportunity set for alpha. Identifying macro dislocations, relative value discrepancies between securities, or event-driven opportunities as capital markets activity recovers, may help to capture upside and limit downside risk. While some investors may focus on gaining exposure to this opportunity set and achieving diversification through private markets, liquid alternatives enable these objectives through public markets. Liquid alternatives are not limited to equity investments. They can be cross-asset strategies implemented through long / short exposures that rely on derivatives. We favor a systematic approach to investing in liquid alternatives, with a focus on investments that are cost efficient and can provide a high degree of transparency and daily liquidity. This approach can be a complement to equity and fixed income allocations and enhance portfolio diversification.

Emerging Market Opportunities

Uncertain geopolitics in this active political year add opportunities and complexities for emerging market investors. Certain countries continue to have advantageous macroeconomic and geopolitical positions heading into the second half of 2024. India stands out for its macroeconomic stability and cross-sector reforms, as well as being a beneficiary of global supply chain realignment—tailwinds that may counterbalance investor concerns around high equity market valuations. Despite potential uncertainty around trade emanating from the US election, Latin America has a significant long-term opportunity to benefit from near-shoring dynamics. Brazil and Mexico stand to be among the beneficiaries given relatively young population profiles, and large endowments of natural resources and key minerals to support the transition to a low carbon-economy. Opportunities continue to evolve in the Middle East, with equity and debt capital markets maturing, and economic diversification continuing via investments through sovereign wealth funds.

We see a wide range of potential opportunities that can provide diversification to developed market allocations. In the equity market, we believe it is critical to be highly selective and focus on domestic-orientated companies that are exposed to long-term secular growth themes that can do well over the full market cycle independent of market events. The EM corporate bond market is also a diverse and, in our view, an underappreciated area of the fixed income universe with attractive yields and exposure to secular megatrends. Private sector corporates tend to demonstrate lower sensitivity to political events, making them potentially attractive in an active election cycle. Strong global demand for products and US-dollar revenue streams also enhances the resilience of select EM corporates to macroeconomic volatility. Overall, we believe investors need to be nimble and liquid when investing in emerging markets, and experience investing through multiple business and election cycles can help to manage risk. Creative approaches to portfolio construction, such as single country equity allocations or strategies to carveout China exposures, can also provide opportunities and help to manage risk.

Security: Supply Chains, Resources and Defense

We believe the theme of security is set on an irreversible course as governments and corporations focus on ensuring long-term supply chain, resource, and national security. Given advancements in AI, attempts by major economies to strengthen technology supply chains are likely to receive bipartisan support, regardless of election outcomes. Developed markets are accelerating their transition to clean energy to increase energy independence and reduce reliance on fossil fuels. Wars in Ukraine and the Middle East continue to highlight the importance of national security, and we expect geopolitics—more than domestic politics—to drive defense spending in the years ahead. From an investor’s perspective, we believe in playing this secular long-term trend in a holistic way. Investing across the three security themes outlined above offers a broad universe to look for stock ideas, and the ability to construct a well-diversified portfolio with balanced exposure across sectors.

Three Key Questions

1. Are investment theses predicated on the continuation of existing policies?

Our view: While prudent investments are never predicated on a single factor, many investors are contemplating how potential policy removals, additions, or alterations can change underwriting assumptions. This can potentially be easier to navigate in the US, where many policies related to supply chains and energy resources have a bottom-up nature that target specific markets, as opposed to in Europe where top-down regulations can fundamentally change the landscape.

2. What might the US election mean for the Inflation Reduction Act?

Our view: The US election creates some uncertainty around sustainable investing. Projects funded by the Inflation Reduction Act (IRA), the signature US climate policy, may see more support if the Democrats win, or receive a different level of support under a Republican administration. Wholesale repeal seems unlikely regardless of who holds office. Despite potential post-US election policy shifts, we continue to expect strong growth in climate-related and low-carbon investment opportunities, driven by improved pricing for solar generation and energy efficiency.

3. How should investors think about healthcare in an election year?

Our view: In the US, healthcare has so far featured less prominently versus prior election cycles. Rising medical costs due to inflation may receive more attention ahead of November’s vote. Private equity acquisitions in healthcare could face increased scrutiny due to concerns of monopolies being created in certain markets, which are then optimized for profits, rather than patient care. As a result, we favor investments that are insulated from reimbursement and “stroke of the pen” risk. More broadly, we remain focused on beneficiaries of long-term growth themes, such as robotics-assisted surgery and anti-obesity drugs, which continue to create investment opportunities.

Tailwinds and Headwinds: Investing in Megatrends

Beyond the near-term path of inflation, rates, and election results, we remain focused on longer-term paradigm shifts, including five key structural forces: decarbonization, digitization, deglobalization, destabilization in geopolitics, and demographic aging. Active investment strategies, a focus on diversification and risk management may become increasingly important to help navigate these contours and deliver alpha. Investors who stay in their silos and focus on a single theme may miss out on opportunities and underestimate risks.

The drive to decarbonize is unlocking a wide range of investment opportunities across equities, fixed income, and alternatives. The economic viability of clean-energy technologies continues to improve, driven by growing affordability and greater efficiency of solar power and battery storage. Meanwhile, the most immediate and tangible impact on reducing carbon emissions can be achieved by helping high emitters that are restructuring their business models and repositioning themselves for a greener economy across developed and emerging markets. Over the coming quarters, we expect more investors to track decarbonization at a granular level and use more complete metrics to quantify real-world impact of individual assets. Beyond decarbonization, inclusive growth opportunities are evolving too, improving accessibility and affordability of education, financial inclusion, and healthcare.

Digitization and technology advancements, notably generative AI, are long-term drivers of opportunity in our view. We believe more investors will consider dedicated allocations to technology going forward due to the pace of disruption and potential wealth creation opportunities. While investors can choose to capitalize on the latest developments by deploying capital directly into AI-related opportunities, they can similarly benefit from evaluating how AI breakthroughs are helping to enhance investment management processes and investment decision-making. As a wider range of companies across sectors look to integrate generative AI into their firmwide strategies, we believe corporate management teams should evaluate ways generative AI can be used as a tool for true strategic differentiation, not just efficiency gains.

Given the potential economic and financial implications of deglobalization and destabilization in geopolitics— combined with decarbonization and disruptive tech—investors will need to combine macroeconomic and geopolitical expertise with thoughtful strategies. The interplay of these forces could play out in various ways. A major challenge and opportunity is to understand the profound interdependencies of these megatrends and map out their investment implications. Lastly, aging demographics is just one factor influencing economic and social outcomes across economies, but these dynamics can play a critical role in shaping public policy, inflation, and investment decisions over long-run time horizons.

Source: Goldman Sachs Global Investment Research (GIR). As of June 1, 2024. GIR assumes a baseline nominal interest rate of 3.75%, nominal growth rate of 4%, and a starting effective interest rate on the debt of 2.57% as is currently the case. GIR assumes that recessions occur once per decade on average and result in a 5pp cumulative increase in the primary deficit. GIR assumes that interest rates increase by 1bp for everyone 1pp increase in the debt-to-GDP ratio.

Investment Considerations

Artificial Intelligence: Data is the Differentiator

The advent and rapid adoption of generative AI is creating opportunities across asset classes and industries. Investors will need clear strategies to find the next generation of AI winners and to understand and apply the technology themselves. A combination of investing in and with artificial intelligence—two distinct but interrelated approaches—may drive long-term outperformance, but the journey is likely to be complex and continuously evolving. As AI models become more sophisticated and complex, the reliance on high-quality data sets is among the highest priorities. The differentiating factor will be the meticulous management of data, including where the data originates, storage infrastructure, cleansing protocols, and measures in place to keep it secure. Companies’ limits within the context of generative AI capabilities are likely to be determined by the quality of datasets. Adequate infrastructure and the intellectual capital to understand the economic rationale and conviction behind AI models will also be key.

Advancing Sustainable Growth

The world remains, in our view, in the early innings of a multi-decade shift toward sustainable, inclusive growth. The vast amount of investment needed on the journey makes green, social and sustainability (GSS) bonds increasingly important. In the first quarter of 2024, GSS bond issuance totaled $272 billion. This is expected to grow to a record $1 trillion in 2024.9 Green bond issuance alone totaled $195 billion in the first three months of the year—the strongest first quarter on record. Looking ahead, we expect green bond issuance to grow in Asia and the Middle East, driven by the rise of sustainable projects, such as green buildings and the need for climate change adaptation measures. Currently, GSS bonds make up only 5% of emerging market sovereign external debt, with the corporate bond market reflecting a similar trend. As green bonds and the broader GSS bond market matures, we expect more investors to diversify existing EM fixed income allocations toward this segment.

China Comeback?

China’s economic headwinds persist and conditions in the property sector look likely to determine the overall rate of recovery. High debt levels, geopolitical trade tensions, and aging demographics may mean a recovery in this cycle is more challenging and likely longer drawn. China’s policymakers have not sat on the sidelines. The intensity, acceleration, and scope of fiscal, monetary and property policy measures increased in the first half of 2024. Chinese equities rallied in response, helped by better-than-expected economic growth. More investors may review their tactical stance on Chinese equities in the months ahead, particularly as Chinese stocks still trade at historically high discounts to global equity peers. We remain focused on the long-term fundamentals of Chinese companies and see opportunities in the areas of advanced manufacturing and technology innovation, which is broad based and benefiting healthcare and IT sectors. A focus on businesses with more stable free cash flows and shareholder returns may prove rewarding over the coming quarters. Recently announced US tariffs on Chinese electric vehicles, solar cells, and lithium-ion batteries—areas identified by China policymakers as drivers of high-quality growth—highlight the importance of monitoring international trade policy and seeking to avoid companies that may get caught in the crosshairs of geopolitics.

Three Key Questions

1. What are the potential market implications of rising sovereign debt levels?

Our view: The level of US sovereign debt is on an upward trajectory, and there is little political momentum for deficit reduction. Higher debt levels in the US and in some other advanced economies may have modest near-term impacts on markets, while long-term effects are difficult to measure. However, we believe shifts in debt burdens should be closely monitored due to potential knock-on effects to fiscal and monetary policy. The flow of bond supply is also worth watching as growing debts and deficits may lead to more sovereign bond issuance, impacting term premia.

2. How will AI shape real estate and infrastructure?

Our view: The rise of AI is already impacting real estate and infrastructure. From a real estate perspective, the location of data center assets is critical given affordable and reliable power is a necessity for AI’s evolution. From an infrastructure standpoint, generating and delivering efficient energy will be vital in the coming years to support AI’s expected growth curves. Investors with the resources and expertise to assess both halves of the supply and demand equation look best positioned.

3. What opportunities are emerging at the intersection of AI and sustainability?

Our view: As AI touches an expanding scope of business activities, rising power demand and the prospect of higher data center emissions will drive debate around decarbonization. We expect greater demand for energy efficiency solutions, with AI models potentially playing a key role. AI tools also have the potential to help democratize quality education and foster innovations in healthcare, leading to increased accessibility and affordability. We predict greater use of AI by investors to separate noise from value and accelerate progress across a range of sustainable investing objectives.

1. US Bureau of Labor Statistics. As of June 12, 2024.

2. European Central Bank. As of June 6, 2024.

3. Goldman Sachs Asset Management, Company Information. As of June 2024.

4. Goldman Sachs Asset Management. As of December 29, 2023. Past performance does not guarantee future results, which may vary.

5. Tokyo Stock Exchange, Goldman Sachs Global Investment Research. As of May 16, 2024

6. Goldman Sachs Global Investment Research. As of May 29, 2024.

7. Goldman Sachs Global Investment Research. As of May 2, 2024.

8. Goldman Sachs Global Investment Research. As of July 5, 2024.

9. Climate Bonds Initiative. As of June 20, 2024.