Asset Management Mid-Year Outlook 2025: Alternative Routes to Resilience

This article is part of our 2025 Mid-Year Outlook: A Halftime Reset—Not A Retreat

Versatile Alternatives

Entering 2025, we highlighted a diverse opportunity set across private equity, private credit, real estate, infrastructure and hedge funds. We also emphasized the need for prudent capital deployment amid an evolving macroeconomic and policy landscape. Our private market investment views broadly remain intact.

We caution against over-indexing on a single market environment, but we believe investors can gradually recalibrate to fundamental changes that may have longer-term implications. As tariff-driven uncertainty alters dealmaking trajectories and redefines opportunity sets, we see greater opportunities for versatile alternative strategies while maintaining a long-term mindset, rather than attempting to time the market's ups and downs. Ongoing innovations in private markets are providing new tools and optionality for investors in need of liquidity or rebalancing.

Private equity pressures persist

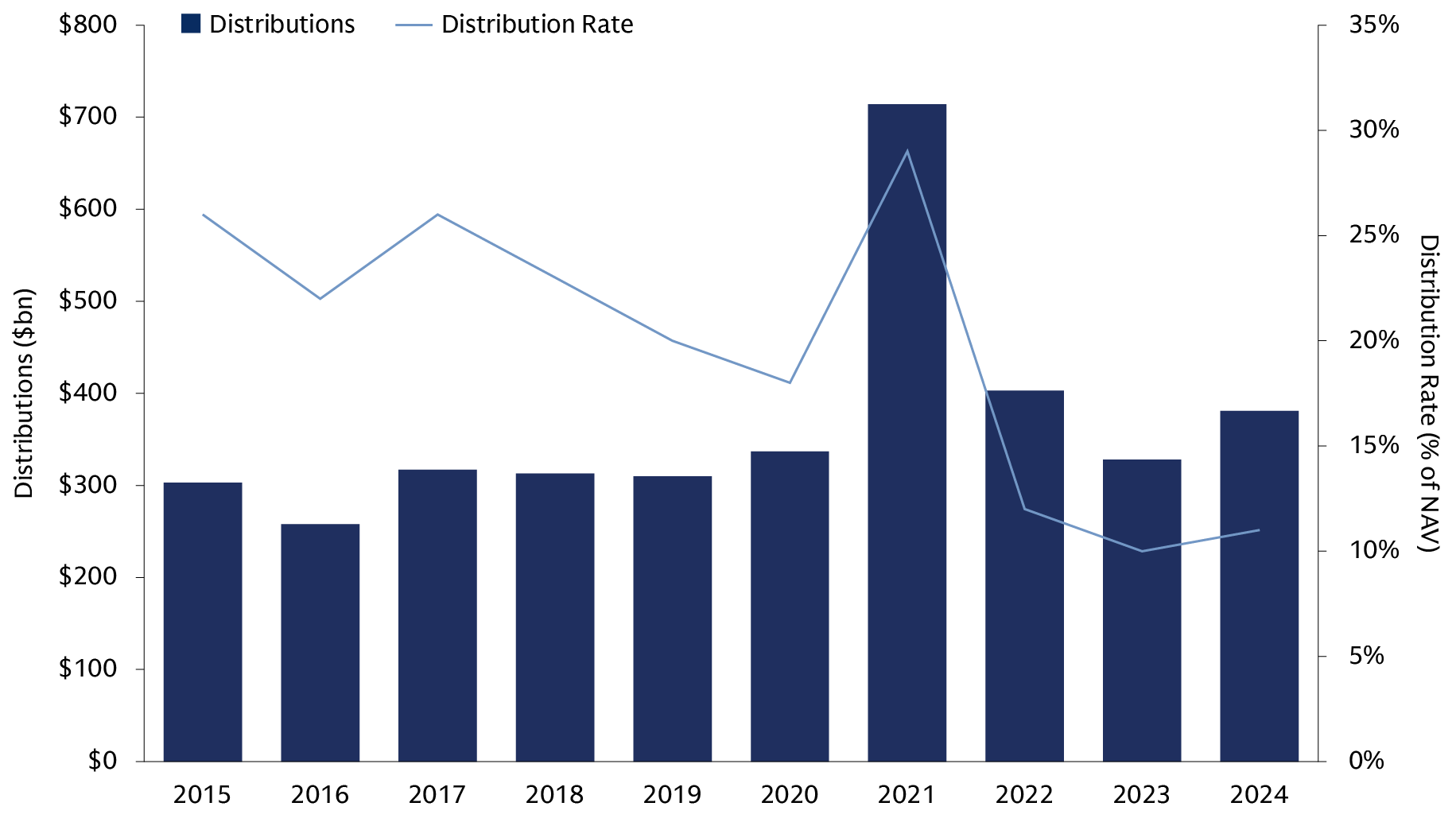

Policy uncertainty and market volatility hindered private equity dealmaking in 1H 2025, shifting investor focus to a potential rebound later this year. Reduced exit activity is driving demand for liquidity solutions in secondary and credit markets. Near-term downside risks for companies are increasing due to higher inflation and growth headwinds, creating a narrow margin of error for business operational planning. Valuations are on balance elevated for both entries and exits, and interest coverage ratios remain depressed despite a downtick in rates and refinancings. The potential for a “harder-for-longer” macro environment could extend holding periods or force general partners (GPs) to accept lower returns. Extended hold periods, combined with mounting pressure for GPs to return capital, has led GPs to explore alternative monetization strategies, such as continuation vehicles and flexible, hybrid capital. On the other hand, we believe the complex environment creates both opportunities for transformational change—which, in our view, private equity is structurally set up to drive. GPs with strong value creation skills and disciplined deployment strategies are well-positioned to navigate these conditions.

Source: MSCI. As of December 31, 2024.

In growth equity, we are observing rising demand for capital as venture-backed companies require additional private funding to support their transition from venture-backed startups to independent, self-sustaining enterprises. This trend is fueled, in part, by the fact that some venture-backed companies are still growing into their valuations, while many others are strategically choosing to remain private for an extended period. As these companies increasingly utilize M&A—often of other startups—to boost growth, it further amplifies the demand for private capital at scale. The confluence of increasing demand, rationalizing supply, and more realistic valuation expectations is creating increasingly favorable investment terms for growth equity investors.

Growing appetite for evolving credit strategies

We continue to expect strong investor demand for private credit, driven by its attractive risk-adjusted returns and diversification benefits. Early indicators suggest credit markets may be starting to reprice risk, evidenced by a widening of spreads on new-issue syndicated loans and M&A-related loans in 1Q 2025. Private credit defaults remained muted in 1H 2025, and meaningfully lower than syndicated markets when including distressed exchanges. Although the median company has continued to post strong fundamentals, a growing share of companies are facing cash flow issues, and a potential recession increases their vulnerability. Deals recently financed or refinanced may be susceptible to downside risk, as their pricing offered limited protection against increasing macroeconomic and business risks.

With corporate credit issuance closely related to M&A activity, many investors are seeking to expand private credit allocations into areas with less exposure to M&A—including real asset credit, directly-originated investment-grade credit, and asset finance. Lenders are also increasingly expanding their purview beyond the US, with markets such as Europe and Asia being less penetrated and presenting potential diversification benefits, including exposure in different currencies.

Infrastructure: Thematic opportunities in the mid-market

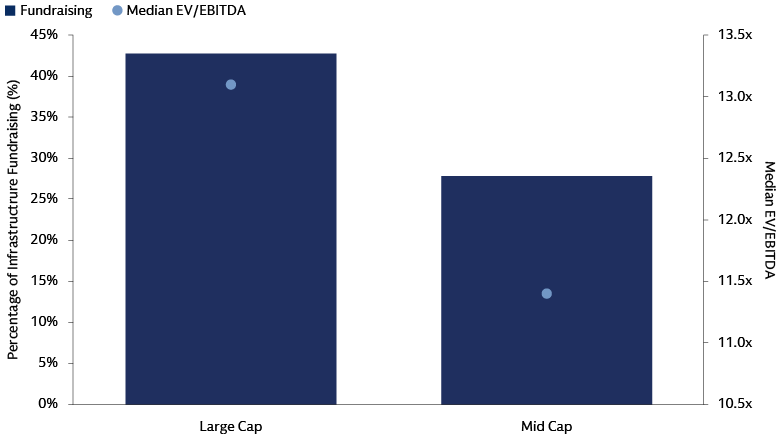

While sustained near-term inflationary pressures could benefit certain infrastructure assets, the implications of heightened geopolitical uncertainty remain hard to gauge. Limited improvement in the interest rate environment may further strain core returns, making fundamental asset growth increasingly crucial for generating attractive upside. We believe the middle market is poised to benefit from a landscape reshaped by evolving fundraising trends, offering a compelling mix of potential value creation through systematic operational improvements and a broader range of exit strategies. We anticipate that thematic investment opportunities, such as digital infrastructure assets, will remain a key focus; however, given elevated valuations in some sectors, careful and discerning asset selection is essential. Greater need for private infrastructure is becoming more appreciated in Europe, as governments reallocate budgets; however, the implementation of public spending is likely to be gradual.

Source: Preqin (fundraising), EDHEC (valuations). As of December 2024. EV/EBITDA median over the past 5 years. Fundraising for 2022-2024. Large cap defined as fund size >$8bn; midcap defined as fund size $2-$8bn.

Positive signs for CRE

After a challenging few years, underlying fundamentals in many commercial real estate (CRE) sectors exhibit positive trends. The outlook for existing assets is improving as construction levels decline from recent highs. Moreover, positive signals within real estate today stem from long-term secular trends such as demographic shifts, technological innovation, and a focus on sustainability. A healthier valuation environment is anticipated to mitigate further downside risk and stimulate transaction activity from its currently subdued levels; a rebound in transactions would aid in establishing "fair value." While the adjustment process may be challenging for some assets, it is viewed as a necessary step towards broader market recovery and increased confidence in the asset class. Current conditions potentially offer opportunities to acquire select assets at attractive prices and enhance net operating income through proactive management and accretive capital programs, alongside the scope to develop, redevelop, or reposition assets to meet evolving spatial demands.

Hedge funds in a new market regime

Entering the second half of 2025, markets are characterized by diminished returns and increased volatility, leading to significant performance divergence across equity markets. This highlights the importance of well-diversified portfolios in this new market regime, in which hedge funds have performed especially well. Since the end of quantitative easing (QE), hedge funds have outperformed a standard 60/40 equity-fixed income portfolio, both year-to-date and over the past three and a half years.15 We believe the current environment will continue to favor alpha generation for hedge funds while strengthening the value of diversification these investments tend to provide. High correlations between equities and fixed income reinforce the value of including hedge funds for both returns and diversification. However, diversifying across hedge fund styles and selecting skilled managers remains critical as performance dispersion among managers remains wide.

While multi-strategy hedge funds continue to be popular, casting a wide net and allocating to a broader set of managers is important to enhance diversification benefits and reduce outcome uncertainty. Due to more onerous terms, deleveraging risks, and increased competition, multi-strategy hedge funds have experienced a decline in alpha. Although they were top performers over the past five years, their performance has dropped to the middle of the pack over the past three years, with quantitative equity strategies leading (5% annualized return).16 This broader approach, including both platform and specialized hedge funds, accessed through funds, separately managed accounts (SMAs), and co-investments, is seen as the optimal strategy for success in hedge funds today. In addition, we believe liquid alternatives offer a transparent and cost-effective approach to capture the risk and return profile of the broader hedge fund universe. A multi-strategy approach can provide access to a range of dynamic trading strategies across all the major hedge fund styles, packaged in a liquid and accessible solution.

Alternative risk premia: Potential resilience in rising and falling markets

Alternative risk premia (ARP) strategies are designed to capitalize on volatility, dispersion, carry and trends. They can be constructed offensively to generate uncorrelated alpha over time, or defensively to provide tail risk hedging during challenging market environments. Different techniques offer unique advantages and limitations depending on market cycles and risk environments. For instance, different defensive strategies (i.e., calls on front-end interest rates, currency options, VIX call replication, intraday trend following) exhibit varying degrees of resilience during market downturns. Therefore, we believe a dynamic and diversified approach using a blend of defensive ARP strategies is crucial to help provide effective downside mitigation across a range of potential sell-off scenarios. We contend that the efficacy of each strategy is contingent upon its thoughtful structuring in view of the total portfolio, tailored to specific portfolio construction objectives and prevailing market environments.

Three key questions

1. How do private market investors solve for the denominator effect, enabling consistent commitments over the market cycle, while staying close to target allocation?

The first step for investors is to assess their approach to private market allocation targets. Establish ranges for target allocations that insulate the portfolio from day-to-day public market gyrations. When an allocation threshold is breached, allowing a grace period of a few quarters can help to address short-term market fluctuations and provide sufficient time to assess potential approaches if the allocation does not come back within range. Some investors have already learned this lesson during the Global Financial Crisis and implemented these changes in their governance structures, which helped them to weather the COVID-era market drawdown and volatility. To be prepared for contingencies, investors estimate how much of public market returns their private markets may capture on an accounting basis, as well as some reasonable stress scenarios of how much portfolio value may fluctuate in the near term. A stress test can also estimate cash flows, recognizing that contributions and distributions tend to move together.

2. How can secondaries help unlock liquidity?

Private secondary fundraising continued with strong momentum YTD amid the broad weakness in the primary markets, with capital closed year-to-date already exceeding 60% of the annual total in 2024.17 Recent headlines suggest more closes will be reported soon. Bifurcation remains in the secondary market, with year-to-date fundraising dominated by mega funds. While capital continues to flow to the strategy, demand is still likely to outstrip supply as a multitude of idiosyncratic factors could compel limited partners (LPs) to seek meaningful adjustments to private market exposure through the secondary market amid a confluence of pressures from evolving policy and market uncertainty. Additionally, as hold times extend, we observe that GPs are increasingly leading secondary transactions to help provide liquidity to investors while staying invested in high-quality assets. We believe the current environment presents compelling opportunities in the secondaries market. Providing liquidity when it's scarce can become an advantage and potentially lead to attractive risk-adjusted returns.

3. PIK your battles: Why is it important to draw distinctions between PIK loans?

Loans with “payment-in-kind” (PIK) features, whereby a portion of the coupon payment to the principal instead of settling it in cash, have been a popular avenue to deal with elevated interest rates. PIK is typically less favorable when a cash-pay loan converts to PIK due to unforeseen financial difficulties, which can be either short-term or long-term. Such deals saw an average annualized EBITDA decrease of 21% after the initial investment. However, we believe PIK can be a sound strategy when prudently incorporated from the start, particularly in leveraged buyouts (LBOs) during high-interest rate periods, as it allows companies to conserve cash or reinvest more.

Megatrends and Disruption

We had anticipated disruption from all angles in 2025. Tariffs, fiscal developments and unusual dollar dynamics have provided multiple challenges for investors to navigate. Amid macro and market disruption, destabilization in geopolitics, supply chain shifts and the rise of AI remain prominent themes. In our view, thoughtful exposure to these trends across public and private markets can be an important anchor for portfolios in today's complex environment. We believe the underlying drivers supporting long-term investment in security (at the supply chain, resource, and national level) and sustainability are fundamentally sound. Identifying opportunities at their intersections represents another proactive path to potential portfolio resilience, long-term growth, and value creation. Our focus remains on cutting through the noise to find signals of actual change.

Security still front and center

We believe long-term drivers supporting investment in economic security remain strong. These drivers include:

- Supply Chain Security: Companies are investing in localizing and vertically integrating supply chains to reduce operational fragility and geopolitical risk, regardless of government incentives. This is driven by boardroom-level mandates focused on survivability.

- Resource Security: Control of energy, water, and critical minerals is crucial. Companies enabling resource independence and efficiency are well-positioned. Private capital (infrastructure funds, industrial REITs) may step in to finance projects if government responses are weak.

- National Security: Elevated geopolitical tensions require sustained investment in cybersecurity and defense modernization. Private sector investment in cybersecurity, AI, and dual-use technologies can supplement government R&D.

In the first half of 2025 we saw a wave of corporate investment across economic security sectors in the US, replacing direct government investment. This is important to highlight given the Trump administration’s focus on cutting fiscal spending programs previously passed by the Biden administration. We have finally started to see increased fiscal spending in Europe necessary to facilitate investment in defense, supply chains, and resource security. This will help enable us to increasingly allocate to companies outside of the US and in Europe as spending on defense and infrastructure ramps up following decades of underinvestment. Geopolitical uncertainty is driving volatility in markets but also reinforces our view of the importance of maintaining a long-term focus, especially given how early we are in this theme. We believe focusing on high-quality businesses and maintaining discipline will generate alpha versus the broad market. We are focused on taking advantage of market volatility in companies where our long-term thesis has not changed.

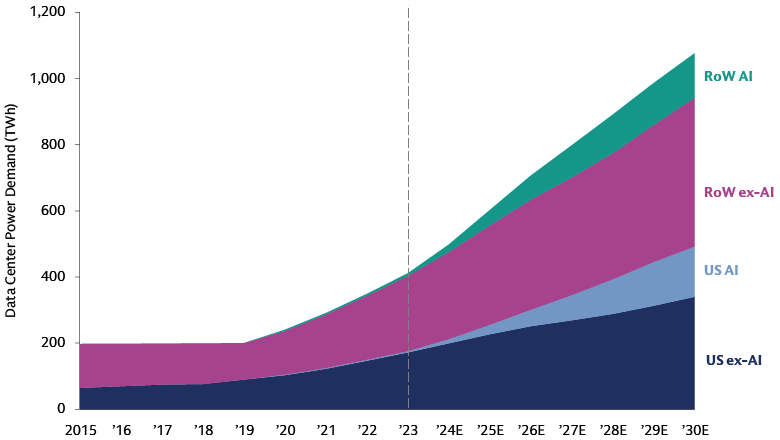

Power demand, aging grids and energy storage

AI, clean energy transition, robust economic growth and industrial reshoring continue to drive strong increases in demand for power and electricity. Globally, we continue to see 160% data center power demand growth (AI + non-AI) in 2030 vs 2023—the equivalent of adding another top 10 power-consumer country.18 Solutions that help data centers optimize energy consumption are helping to improve energy efficiency and ultimately support grid stability and sustainability. We believe companies providing installation and maintenance services will be critical to ensuring the reliability, efficiency, and safety of the electric power grid as capacity grows. Increased climate transition-oriented private credit will be needed to scale energy solutions across countries and use cases, in our view. Shifting energy cost landscapes, particularly in the US, where reliance on foreign-sourced materials for renewables, could pose challenges.

Source: Cisco, IEA, Masanet et al. (2020), Goldman Sachs Global Investment Research. As of June 4, 2025.

Spain’s blackout: A wake-up call for grid investment?

On April 28, Spain’s domestic power demand fell sharply by approximately 60%. A sudden disconnection of 10 gigawatts (GW) of solar and 3 GW of nuclear power within seconds triggered a grid collapse and blackout. This event emphasizes broader challenges, the need for solutions, and potential investment opportunities related to renewable energy integration that are applicable beyond Spain.19

Since the start of the year, Spanish power demand has increased by +4%.20 This is a major inflection point: power demand has been declining since 2008. Rising power demand is driven by factors such as data centers (volatile and highly energy-intensive), electrification of transportation, and increased use of digital technologies.

Many existing power grids are aging and lack the capacity and technology to handle the increasing penetration of renewable energy sources and growing demand. Modernizing the grid with new transmission lines, smart grid technologies, and advanced control systems is necessary to improve reliability and efficiency.

To address intermittency of renewables, we believe investment in energy storage solutions like batteries is crucial. Energy storage can store excess power generated during periods of high renewable output and release it when output is low, helping to stabilize the grid and ensure a consistent power supply.

Sustainability: A sharper focus on financial returns

We believe sustainable investing is entering a new phase in which performance will be a key driver of market growth. The key question for investors is how to achieve this. Understanding past performance drivers is crucial for building next generation approaches that integrate a clear thesis, thoughtful portfolio construction, and a more nuanced view of how different tools and asset classes fit in a holistic portfolio solution. From a public market perspective, we believe quantitative equity solutions allow investors to carefully mitigate unintended tilts and biases, utilize curated data to generate investment insights, and leverage diversifying shorter-term alpha sources to potentially enhance returns and mitigate short-term performance volatility as longer-term themes play out. Against the broad backdrop of challenging performance, there is a very select but identifiable cohort of fundamental sustainable equity managers with a demonstrated track record of performance across market cycles. We believe investors should also pay more attention to fixed income solutions as an efficient way to increase sustainability exposure with limited impact on a portfolio’s overall financial characteristics.

Three key questions

1. Will renewable energy deployment advance in the US despite policy headwinds?

We expect renewable energy deployment to continue advancing, driven by economic advantages and faster deployment speeds. Enabling public policy can accelerate this transition, but even without incentives, renewables are price-competitive with natural gas. Rising natural gas turbine prices and order backlogs extending to 2030 contrast sharply with renewables' shorter deployment timelines. Estimates suggest renewables will continue to grow faster than gas power in the US electricity market. We believe this economic competitiveness and faster deployment will continue to fuel renewable energy growth despite potential policy challenges.

2. How might policy support in Asia lead to potential investment opportunities?

We expect policy support in the Asia-Pacific region, particularly Japan's US$1 trillion (~150 billion JPY) Green Transformation Policy (GX40), to create solid sustainable investment opportunities. Japan is aiming for renewable energy to account for 50% of its electricity mix by 2040, with nuclear power taking up another 20%.21 Market mechanisms, including GX Transition Sovereign bonds, carbon pricing (starting FY 2028), and an Emissions Trading System, support this, along with Japan's US$14 billion (~2 trillion JPY) Green Innovation Fund which will allocate capital to tech startups and broader innovation. These initiatives, combined with strong government, corporate, and financial institution alignment on sustainability, present significant investment opportunities in APAC's decarbonization efforts.

3. How will financial institutions begin to factor climate-related physical risk and adaptation?

Financial institutions are increasingly factoring climate-related physical risk and adaptation into their strategies, driven by negative outcomes and perceived escalating risks across multiple sectors in the economy. Adaptation finance opportunities could reach $1.3 trillion annually by 2035, with green bonds as a key vehicle.22 While adaptation investment is still in its early stages, growing investor interest signifies a shift towards incorporating climate resilience into financial decision-making, potentially mirroring the growth trajectory seen in biodiversity-focused interest and investments.

For more of our Mid-Year Outlook: A Halftime Reset—Not A Retreat investment views explore Broader Equity Horizons and Income Generation.

15 Pivotal Path, MSCI and Barclays. As of December 31, 2024. “60-40”: 60% MSCI World NR USD + 40% Bloomberg Barclays Global Aggregate TR USD. Hedge Fund returns net of Manager Fees.

16 PivotalPath. Data through November 2024.

17 Preqin. As of June 15, 2025.

18 Goldman Sachs Global Investment Research. As of June 4, 2025.

19 Goldman Sachs, Global Investment Research. As of May 1, 2025.

20 Entsoe, Goldman Sachs Global Investment Research. As of May 1, 2025.

21 Reuters. As of December 17, 2024.

22 European Centre for Development Policy Management. As of January 15, 2025