Asset Management Mid-Year Outlook 2025: Broader Equity Horizons and Income Generation

This article is part of our 2025 Mid-Year Outlook: A Halftime Reset—Not A Retreat

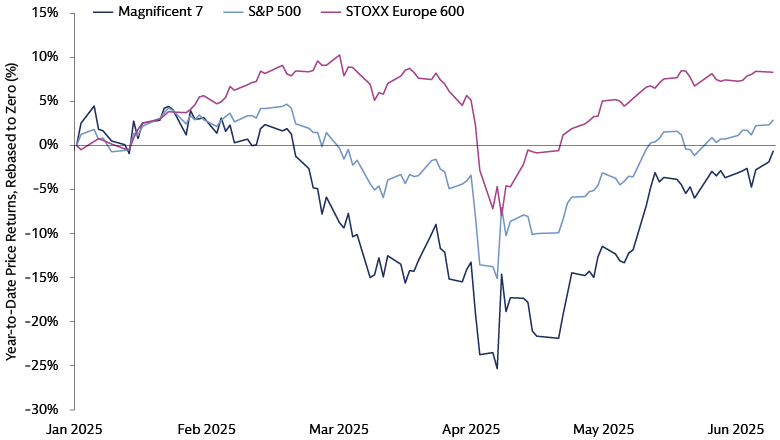

Equities: Keep on Broadening

Broadening equity market exposure beyond US mega-caps demonstrated an effective strategy for maximizing financial returns in the first half of 2025. We continue to see merit in adopting diversified equity exposures going forward, particularly given tariffs, US debt dynamics, challenges such as the high concentration of the US market, and risks associated with the unknown future returns from substantial AI capital expenditure (capex).

We believe going down the market cap spectrum, seeking out strong businesses in the US and non-US developed and emerging markets, and digging deeper into differentiated, long-term themes can help capture a wider range of potential opportunities.

Source: Bloomberg. As of June 10, 2025. Past performance does not predict future returns and does not guarantee future results, which may vary.

US equity markets have experienced considerable tariff-driven volatility so far in 2025. Despite this challenge, we maintain strong confidence in the US equity market, which is underpinned by technology innovation. Our investment approach to US equities across the market cap spectrum involves identifying companies that we believe should be able to outperform against a backdrop of tariff-related uncertainty.

We are focusing our investments on companies with the following characteristics:

- High gross margins: Companies with high gross margins are generally better insulated from the negative impacts of tariffs. High margins are often indicators of competitive differentiation, pricing power, and an ability to absorb increased costs without significantly impacting profitability.

- Strong balance sheets: A robust balance sheet provides a company with the financial flexibility to invest counter-cyclically, potentially buy back more of its own shares, and maintain low financial leverage. Balance sheet resilience is crucial in navigating economic uncertainties and potential downturns.

- Durable end-markets: Companies with durable end-markets typically experience lower cyclicality and benefit from secular growth tailwinds, such as digitization. Such companies are generally less dependent on capital markets for funding and better positioned to weather economic fluctuations.

Magnificent 7 moves out-of-sync, tech cycle rolls on

The Magnificent 7 possess a differentiated advantage: their capacity to finance substantial capex and their presence in resilient, enduring markets. However, the companies in this group are not all the same, and we expect the drivers of future performance to diverge as AI evolves. The potential for competition within the group is also evident, as demonstrated by Alphabet's stock price volatility after Apple announced its ambitions for AI-driven search.5 In the short term, the Magnificent 7 may benefit from their lower relative valuations than over the past two years, reduced investor positioning and renewed enthusiasm for AI following strong 1Q earnings reports.

Beyond the Magnificent 7, we believe the AI and broader tech landscape offers extensive opportunities. The tech industry is transitioning from a focus on AI infrastructure development led by Nvidia and hyperscalers (large-scale cloud service providers with the capability to rapidly scale their computing resources to meet the demands of AI training and deployment) to a more competitive environment in which companies like DeepSeek are beginning to emerge. There is also increased competition in semiconductors, where Nvidia's monopoly is weakening as Application-Specific Integrated Circuits gain traction thanks to their greater efficiency than the graphics processing units that Nvidia makes and the ability to customize them.

In the next phase of AI development, we expect greater focus on data security, specific AI applications, and the enabling technologies—the "picks and shovels"—that are supporting the rise of AI. Within the US, companies specializing in data cleaning and fine-tuning for Large Language Models look particularly attractive, in our view. We also believe that AI is becoming an increasingly important tool for investors to systematically extract information from large, complex and unstructured datasets and to inform investment decisions.

Agentic AI focuses on autonomous systems ("AI agents") that learn, adapt, and collaborate to solve complex problems with minimal human intervention. We view this as a paradigm shift towards AI systems that can independently pursue goals, learn from experience, and adapt to changing circumstances without constant human oversight. This contrasts with traditional AI, which often requires specific instructions and data sets for each task. In our view, Agentic AI represents the next major tech wave, with AI agents taking the lead on basic research and processing, as seen in call centers. New investment opportunities may emerge as companies can scale their workforce, improve productivity, and achieve higher return on investment. We believe incumbent software application companies with large customer bases have an opportunity to leverage existing data to offer relevant, out-of-the-box functionality, speeding adoption, enable efficient AI agent control, and potentially increase cross-selling success.

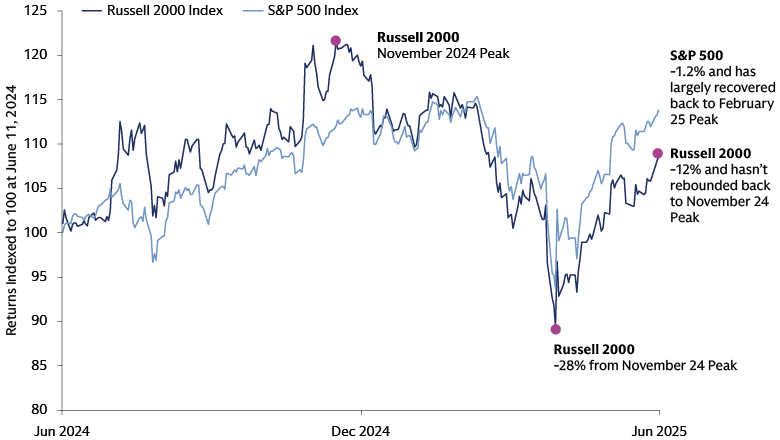

Small caps, big rebound?

After a strong start to the year, US small caps lagged the S&P 500 in 1H 2025 as growth concerns from tariffs and the Federal Reserve’s (the Fed) wait-and-see approach to policy moves weighed on performance. We remain constructive on the asset class, underpinned by solid fundamentals, attractive valuations relative to large caps, and strong earnings estimates. However, higher earnings and performance variability in small caps makes active management crucial for capturing quality earnings. Potential changes in tax policy and deregulation could disproportionately benefit smaller, domestically focused companies in the second half of 2025; 77% of Russell 2000 revenues are generated from the US versus 58% in the S&P 500.

Source: Goldman Sachs Asset Management. As of June 11, 2025. Past performance does not predict future returns and does not guarantee future results, which may vary.

Our experience from the 2018 trade war has given us the "muscle memory" to ensure that the companies we invest in have US-centric exposures in both revenues and supply chains. Our focus remains on resilient companies with key differentiators and pricing power. From a valuation standpoint, excluding unprofitable companies, US small caps are currently trading at a steep discount to US large caps. While they are just starting to move higher from all-time relative lows, their relative valuations are still well below their historical average, which we believe represents an attractive entry point for investors.

We believe investing in US small caps and staying invested in the face of market uncertainty can prove rewarding over the long term. Missing just a few of the best trading days can have a considerable negative impact on overall returns, so a consistent investment approach is key. Given small-cap stocks tend to be less researched than large companies, active stock pickers have more opportunities to exploit inefficiencies and capitalize on insights based on quantitative analysis of the full universe, complementing traditional fundamental analysis.

Outside the US, international small-cap stocks, particularly in Europe and Japan, showed strong performance in the first half of 2025 and continued to offer diversification benefits due to their low correlation with major equity asset classes. These stocks are currently trading at a discount relative to international large-cap stocks, despite historically trading at a premium. We believe a diverse universe of small-cap companies across numerous countries presents significant opportunities for active investors who possess the scale and ability to leverage data sets and advanced techniques like AI, especially given the inefficiencies arising from the under-researched nature of these stocks compared to their US large-cap counterparts.

European equities: Durability, defense and data-driven insights

The trend of investors, particularly European investors, reallocating their assets towards Europe is partly being driven by concerns surrounding high US valuations, market concentration, and doubts about continued US economic exceptionalism. This has been reflected in increased fund flows into European stocks year-to-date,6 coupled with the relatively strong performance of European stock markets.

However, this isn’t just about US concerns—Europe looks appealing, and many investment opportunities are emerging across sectors in the region. Our primary focus is on identifying companies whose business are most likely to generate resilient earnings and high returns on capital. This involves pinpointing businesses aligned with long-term structural trends, those committed to socially and environmentally responsible operational practices, innovators with distinctive qualities, and those demonstrating consistency in earnings.

We’ve recently explored how European fiscal transformation is creating additional investment opportunities in areas like defense, energy and infrastructure. Identifying companies with strong ties to defense spending through supply chain analysis, earnings calls, and revenue data is key to our investment approach. Europe's equity market, which has high financial and industrial sector weightings, offers useful diversification for portfolios allocated to US equities.

The European market is also less concentrated. Information about European stocks is less abundant, and diffuses more slowly than in the US, with fewer news reports, lower research analyst coverage and more limited and fragmented information sources. Linkages between European companies are also significantly more dispersed and less obvious than in the US. We believe active investors using data and technology, including AI tools to turn big data into smart data, can capitalize on these nuances and inefficiencies to identify undervalued or overvalued stocks.

Japanese equities: Growth and governance in focus

We expect Japan’s macroeconomic environment, characterized by moderately rising inflation, stable monetary policy and increased fiscal support, to lead to resilient economic and equity market performance. Corporate capex and consumer spending are projected to remain robust through 2025 and beyond, which means earnings growth should be the main market driver. A weaker Japanese yen is an advantage to exporters and supportive of corporate earnings, in our view, and inbound tourism is also supporting domestic companies. However, identifying businesses less susceptible to FX fluctuations is crucial.

Despite Japanese equities’ recent gains, valuations do not appear excessive, remaining close to their 20-year average. There are still some compelling opportunities to be found, albeit with more moderate upside potential. Corporate governance reforms are unlocking shareholder value, driven by regulatory urgency and the public disclosure of companies' action plans. In our view, domestic investors and corporations will likely continue to support Japanese equities, with corporations remaining the largest buyers and steady retail inflows providing additional support. A potential return of foreign investors could further strengthen the asset class.

We believe Japan's significant weighting in international equity indices, coupled with language barriers hindering information flow, also presents a compelling opportunity for systematic investors. This is especially true for those able to swiftly analyze vast amounts of data in both English and Japanese—including tens of thousands of earnings calls, hundreds of thousands of analyst reports, millions of news articles, and millions of patents annually—to gain a competitive edge in the market.

Indian equities: Still a stronger-for-longer growth story

Indian equities experienced less volatility than other Asian markets after the US announced its reciprocal tariffs in April, signaling confidence in India's domestic resilience. We maintain our positive long-term outlook on Indian equities, with a focus on companies benefiting from domestic growth and those with higher pricing power and export-oriented businesses. Expectations of mid-teens earnings growth over the next 3–5 years are being driven by private capex and increased discretionary spending.7 We believe India remains a compelling investment destination offering growth and earnings visibility. We believe a strong, stable and business-friendly government underpins India’s stronger-for-longer economic growth story, along with favorable demographics; the country has one of the youngest populations in the world with a median age of ~28 years—ten years younger than the US population.8

Three key questions

1. What role can active ETFs play in increasing equity market performance predictability amid volatility?

The start of 2025 saw a surge of interest in US-domiciled options-based ETFs from investors who want to remain invested in equities while seeking greater predictability in whipsawing markets. Derivative-income ETFs, which are designed to generate income from a portfolio of assets with the use of options contracts, took in a record $15.7 billion in net new money in the first quarter, rising to $26.5 billion at the end of May.9 Derivative-income ETFs, also known as covered-call or buy-write strategies, seek to provide an additional source of potential return in the form of distributions through periods of market volatility. By actively managing the call option overlay strategy, a manager can also adapt to a changing market environment by dynamically adjusting the options coverage ratio. Defined-outcome or buffer ETFs also make use of an actively managed options strategy, but with a different objective: they seek to deliver an outcome within a pre-defined range over a set period, providing investors with an equity-based hedge against portfolio volatility that can complement other defensive strategies.

2. What is the case for separating China from EM equity exposures?

We believe the strategic case for separating China allocations from the rest of EM is compelling for two key reasons. First, an EM ex-China allocation can provide diversified sources of alpha across markets with positive economic growth trajectories and stronger fundamentals than China. As AI continues to advance, markets that play pivotal roles in manufacturing leading-edge semiconductors, such as Taiwan and South Korea, may benefit from a durable demand cycle. There are also transformational stories to consider. For example, we observe that countries in the Middle East are transforming their economies with reforms to diversify away from commodities by developing their financial services and telecommunications sectors. Second, we believe segments of China’s equity market continue to offer potential alpha opportunities. We’re continuing to find potential opportunities in China in areas like advanced manufacturing (NEV batteries, robotics) and technology innovation (AI ecosystem), resilient consumption (premium products, e-commerce and logistics) and among defensive companies with more stable free cash flows and shareholder returns. In our view, investors may want to consider a standalone allocation to enable an in-depth assessment of these opportunities and greater flexibility to implement tactical views amid market volatility.

3. How can investors leverage an exponentially growing volume of data to maintain an edge?

We believe AI is becoming an increasingly important tool for investors to systematically extract information from the large, complex, and unstructured datasets, like text, audio and images. Examples of new AI tools in action include AI models programmed to analyze tonal sentiment during earnings calls. In other words, signals detecting not just what management is saying, but how management is saying it. A confident tone from management, for example, can implicitly signal a positive outlook for their company. Combining data-driven insights with fundamental analysis and active risk management allows active managers to understand the attractiveness of each investment opportunity with a more comprehensive view. To effectively deploy AI and machine learning tools, practitioners should consider the use cases such that the underlying datasets justify the need for more robust data analysis techniques. Crucially, leveraging AI effectively requires the intellectual capital to not simply use technology, but an ability to understand the data, why to use it, and how. Finally, we expect investors who have access to resources and the infrastructure in place to harness data—including the compute power and processing capabilities to train large language models—will have a competitive advantage in the years ahead.

Bonds: Unlocking Income and Returns

In Landing on Bonds, we identified opportunities to position for divergent central bank easing cycles, capture income across corporate and securitized credit, and adopt a dynamic approach to rotate across securities, sectors, and regions. While we continue to see merit in these themes, our fixed income investment playbook prioritizes a disciplined investment process that seeks to deliver consistent returns over time, rather than market timing.

Importantly, we are investors, not forecasters. While we closely monitor the evolving investment environment—including trade policies, inflation and growth risks, and fiscal positions—the investment exposures in our clients' portfolios are grounded in our fundamental process rather than specific macro, market, or policy outcomes. This approach has been crucial and increasingly relevant throughout the 2020s when the only certainty has been uncertainty. Considering this, we highlight key areas and strategies to unlock investment potential. These strategies were effective in the first half of 2025, and we continue to see merit in them for the second half of the year.

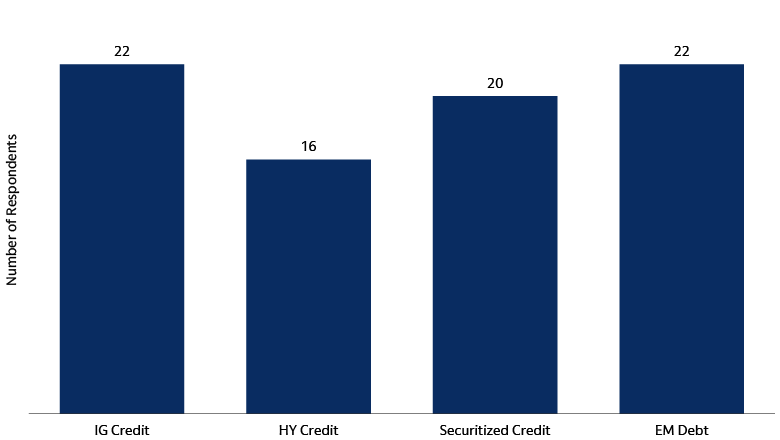

Optimizing income potential

Fixed income sector spreads have generally tightened relative to year-to-date highs reached following the April 2 ‘Liberation Day.’ The agency mortgage-backed securities (MBS) market is an exception, challenged by higher rate volatility. However, spreads remain wider relative to the tight levels reached in February.

In our view, downside growth risks suggest a high bar for spreads to revisit or push below recent history tights, but a low bar for spreads to widen on downside economic data surprises or policy disruptions. As a result, our fixed income investment team favors moderate exposure to fixed income spread sectors in aggregate, with a preference for high yield and securitized credit over investment grade credit. The latter two asset classes benefit from higher income potential alongside firm underlying fundamentals. The high yield market is structurally higher quality today than in the past, while securitized credit sectors exhibit stable fundamentals across the four key segments of the market—collateralized loan obligations (CLOs), residential mortgage-backed securities (RMBS), commercial mortgage-backed securities (CMBS), and asset-backed securities (ABS). We also see value in balancing our spread sector exposure with US Treasuries in a multi-sector fixed income portfolio since we believe US rates retain their ability to shield portfolios in the event of renewed downside growth risks or equity market volatility.

Across investment grade credit, we continue to find attractive income opportunities in bonds issued by banks with sound capital positions as well as bonds issued by BBB-rated issuers who continue to demonstrate financial discipline. We are also positioned for the credit curve to steepen to optimize for carry and roll potential. More broadly, our exposures are rooted in rigorous bottom-up analysis that considers the potential impact of US tariffs or weaker growth. Our proprietary, digitalized research tools enable us to add structure and organization to our analysis, allowing us to formulate views faster. For example, we use specific tags to assess exposure of issuers to tariff risks, other changes in US policy or China, alongside other credit metrics. This enables us to aggregate views for comprehensive analysis on tariff sensitivity within credit sectors. Our analysis suggests that under a benign scenario of below-trend US growth and around half of the tariff cost being passed through to consumers but moderate impact on foreign sales, around 98% of the US investment grade corporate credit index has minimal risk to credit ratings, with only 1.7% at risk of being downgraded to high yield, primarily reflecting companies in the consumer cyclical, media, electric utilities and energy sectors.10 In a stress scenario whereby the US economy enters recession and foreign demand declines, the fallen angel rate could rise to around 3%, though we expect the volume of fallen angels to remain below the levels observed during COVID.

Source: Based on a survey conducted by Goldman Sachs Asset Management at the 2025 EMEA Investment Forum. The results reflect aggregated responses from 80 investment professionals in attendance. As of May 22, 2025.

Unlocking securitized credit opportunities

The securitized credit opportunity set is a diverse set of sub-sectors, each with its compelling segments. Many of the assets we invest in within this opportunity set are floating rate with low duration. This can allow them to outperform in a higher-for-longer rate environment. Interestingly, despite their income potential, these assets account for a relatively modest share in traditional benchmarks, making up around 11% and 25% of the Bloomberg Global Aggregate Index and the Bloomberg US Aggregate Index, respectively, with a heavy skew towards agency RMBS.11

We have over 30 years of experience as established investors in this asset class and our global reach enables us to tap into opportunities across regions from the US to the UK, the Euro area, and Australia. This knowledge and experience is crucial when it comes to analyzing the underlying collateral and securities structures to unlock income and return potential.

Recently, we've shifted towards higher quality securities while maintaining a focus on diversification across geographies and sub-sectors. We see value in AAA-rated CLOs with high credit enhancement levels that provide strong structural protection.12 In the CMBS space, our fixed income investment team favors single-asset single-borrower (SASB) securities linked to high-quality, well-located office buildings, often referred to as "trophy properties". We believe these properties tend to have strong tenant profiles, long lease terms, and are situated in prime areas, making them more resilient to economic fluctuations, including tariff-related headwinds. In the ABS market, we favor the highest-rated tranches that have a short weighted average life, reducing exposure to interest rate risk.

Sectors like prime auto loans, made to borrowers with high credit scores, and credit card receivables, look appealing, in our view. Across RMBS, we see value in mezzanine tranches of credit risk transfer securities which can provide higher yields compared to senior tranches but with increased risk, making active security selection imperative. Additionally, we see value in AAA-rated non-qualified mortgages. Despite not meeting the standard criteria set by the Consumer Financial Protection Bureau (CFPB) for qualified mortgages, these can still be of high quality and receive AAA ratings, indicating a low risk of default. AAA-rated non-qualified mortgages provide strong credit quality and income potential.

Overall, we believe securitized credit presents a compelling opportunity set for investors seeking attractive income potential through dedicated securitized credit allocations or through multi-sector fixed income portfolios.

Source: Bloomberg, Goldman Sachs Asset Management. Market value as of April 30, 2025. The Bloomberg Global Aggregate Index covers the most liquid portion of the global investment grade fixed-rate bond market, including government, credit and collateralized securities. The Bloomberg US Aggregate Index covers the US investment grade fixed rate bond market, with index components for government and corporate securities, mortgage pass-through securities, and asset-backed securities. Past performance does not predict future returns and does not guarantee future results, which may vary.

Dynamic rates views based on policy divergence

We entered 2025 anticipating relative value opportunities in global interest rates, reflecting divergence in central bank policies. While the initial tariff shock presented challenges, these opportunities are now resurfacing. For example, we believe that market pricing currently underestimates the extent of future easing by the Bank of England, creating a favorable environment to overweight UK rates, both on a directional and relative value basis. Conversely, we anticipate that Japanese Government Bond yields will rise across the curve, reflecting Japan's hotter inflation landscape. Opportunities are also identified in smaller G10 markets, including Scandinavia, where inflation momentum has slowed, as well as in New Zealand and Canada, where market expectations for monetary easing appear insufficient given the backdrop of weak growth and decelerating inflation, as confirmed by our current activity and inflation pressure indicators.

Recognizing the complexities of the investment environment, we see opportunities to complement active interest rate views with systematic strategies driven by various disaggregated factors influencing asset prices and returns. These data-informed strategies are grounded in a deep understanding of market structure and fundamental return drivers. These drivers encompass macro factors like inflation dynamics, statistical relationships such as mean reversion, market dynamics including new issuance activity, and security-level characteristics, notably curve steepness, which can generate carry and roll opportunities.

The signals generated by these systematic strategies stimulate investment discussions, helping to mitigate behavioral biases through their objective derivation. They also broaden the scope of investment perspectives, potentially enhancing security selection skills. Collectively, these efforts aim to achieve a higher information ratio and establish more resilient and diversified interest rate exposures. For example, our auction and month-end systematic strategy has contributed to directional rate view performance this year, demonstrating resilience amidst high-rate volatility. Similarly, our country signals systematic strategy aided in resisting a rise in European rates driven by fiscal expansion news, focusing instead on mean-reversion dynamics at the long-end of the curve. This model also guided us to counter the rally in US rates following the April tariff shock, a strategy that proved successful given subsequent volatility in US rates related to fiscal developments and auction demand.

Risk management is a central pillar in our decision-making process for systematic strategies. It's important to note that while we systematize data analysis, we do not automate our investment decision-making.

Three key questions

1. Will tariffs cause a one-time boost to US inflation, or will the reacceleration prove more persistent?

As of May, US CPI and PPI inflation data show limited evidence of tariff-related price pressures.13 However, we expect the impact of tariffs to continue unfolding, raising consumer prices in the coming months. The key question for investors is whether this reacceleration represents a one-time boost or proves more persistent, as seen in 2021 and 2022. Based on signals from key drivers of inflation, we believe a temporary rather than persistent inflation overshoot is more likely:

- Inflation expectations: While short-term consumer inflation expectations have risen, long-term expectations remain anchored.14

- Labor market pressures: The labor market is less tight than in 2022, despite curtailed migration, as indicated by perceptions of job security. This has kept wage growth expectations in check, curtailing the risk of a wage-price spiral.

- Domestic demand: Unlike the reopening era, household spending is not being boosted by universal, sizeable fiscal transfers or pent-up savings. Below-potential growth and a modest rise in unemployment may alleviate core goods and services inflation, with the breadth of price rises being narrower than observed in 2022.

- Supply chains: Although supplier delivery times have increased, supply chain stress remains far below pandemic peaks.

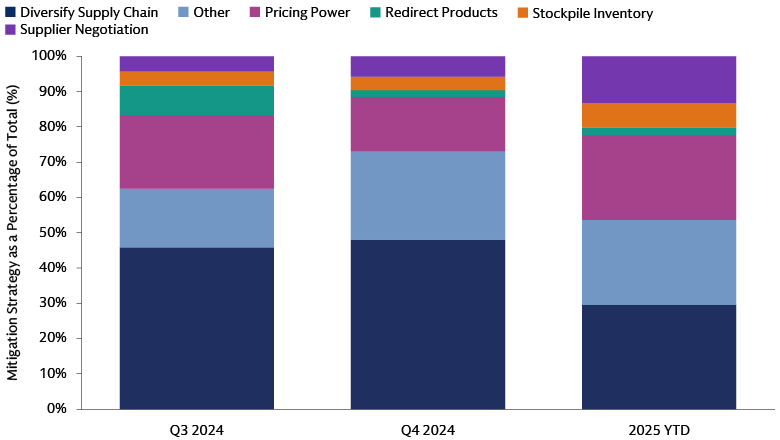

- Company pricing power: Commentary from company management teams during the 1Q earnings season suggests that companies are using various strategies to address tariff-driven rises in input costs. These strategies include supply chain diversification, cost reductions, and stockpiling inventory, rather than solely exercising pricing power to pass on costs to consumers, though some passthrough is anticipated.

We would become more concerned about the risk of persistent tariff-driven inflation if country-specific tariffs rise back to prohibitive rates causing shortages, if tariff escalation continues into 2026, or if tariff revenue is used to provide broad-based stimulus checks for consumers.

Source: AlphaWise, Morgan Stanley Research. As of May 2025.

2. Will the easing cycle extend?

Seven G10 central banks delivered rate cuts in the first half of 2025. We expect ongoing monetary easing in Europe, driven by tariff-related growth risks and disinflation. Central banks in the Euro area, Canada and New Zealand are nearing neutral rates, suggesting a more cautious approach to easing actions ahead. In the UK, the Bank of England is still above neutral and expected to cut towards it—a policy trajectory we are positioned for. Upside risks to US inflation suggest the Fed will proceed cautiously until evidence of labor market weakness becomes clearer. We anticipate a couple of rate cuts later this year if hard data weakens in the coming months, though risks are skewed towards fewer and later cuts. The Bank of Japan is likely to remain an outlier, resuming rate hikes if tariff tensions continue to ease and global financial conditions remain stable, responding to the hottest inflation regime since the early 1990s. Overall, we expect easing paths to extend but with divergence in pace and destination, presenting relative value interest rate opportunities.

3. Will fiscal dynamics unsettle bond markets?

Uncertainty regarding government debt levels, deficit spending, and the credibility of fiscal policy has intensified. In the US, rising long-end yields and a plateauing dollar signal heightened investor sensitivity to US fiscal risks and policy. Higher rates and quantitative tightening mean refinancing low-yield debt at higher costs, compounding deficits versus prior cycles. US debt-to-GDP has surged and is projected to climb further. While no immediate fiscal crisis is foreseen due to US Treasury liquidity and dollar reserve status, risks remain. An economic slowdown, policy error, or rate hike could highlight fiscal unsustainability. Bond market volatility in April—when the 30-year US Treasury yield topped 5%, and the Japanese equivalent reached a record high—has demonstrated the importance of understanding technical dynamics and the risk of sudden deleveraging of popular investment strategies. That episode highlighted the importance of diversified exposure and de-risking swiftly amid acute uncertainty but also the benefits of pausing once you have de-risked to assess potential for market stabilization.

For more of our Mid-Year Outlook: A Halftime Reset—Not A Retreat investment views explore Alternative Routes to Resilience.

5 Bloomberg. As of May 7, 2025

6 EPFR, Goldman Sachs Global Investment Research. As of June, 6. 2025.

7 Goldman Sachs Global Investment Research. As of May 31, 2025.

8 Pew Research, Census Bureau. As of December 31, 2024.

9 Morningstar. As of May 31, 2025. Ex funds of funds and feeder funds.

10 Goldman Sachs Asset Management. Based on Bloomberg US Aggregate Corporate Index. As of April 22, 2025.

11 Bloomberg, Goldman Sachs Asset Management. As of April 2025.

12 This structuring provides a level of protection for investors in the higher-rated tranches. Specifically, the credit enhancement level indicates the extent to which underlying assets could potentially default before the highest-rated tranches are affected.

13 Bureau of Labor Statistics. As of June 11, 2025.

14 US Federal Reserve. As of April 16, 2025.